Bitcoin, the world's first cryptocurrency, launched the crypto revolution in 2009. Since then, developers have continued to build on its foundation to create the burgeoning web3 world we know today.

While Bitcoin is still one of the most successful cryptocurrencies, its lack of interoperability has posed a challenge. The solution? Wrapped Bitcoin (wBTC).

This guide will show you what wrapped Bitcoin is, and how wrapped tokens allow BTC holders to benefit from other cryptocurrencies and networks.

What is Wrapped Bitcoin?

Wrapped Bitcoin is an ERC-20 cryptocurrency token that runs on the Ethereum blockchain and is intended to be backed 1:1 by Bitcoin. To attempt to keep the prices of wBTC and BTC stable, for every wBTC token issued, there should be an equivalent amount of Bitcoin held in reserve by a custodian.

You can think of wrapped tokens like a modifier that allows you to use a cryptocurrency from one blockchain on another chain that does not traditionally support such crypto assets.

The custodians that issue wBTC include centralized exchanges (CEX), decentralized exchanges (DEX), or a group of decentralized organizations (such as a DAO) that manage the token's supply and attempt to ensure that the Bitcoin backing the token remains matches the amount of wBTC issued.

“Wrapping” Bitcoin – that is, exchanging your BTC for wBTC – allows you to enjoy the benefits of Bitcoin while benefiting from the features offered by the Ethereum network and its DeFi ecosystem.

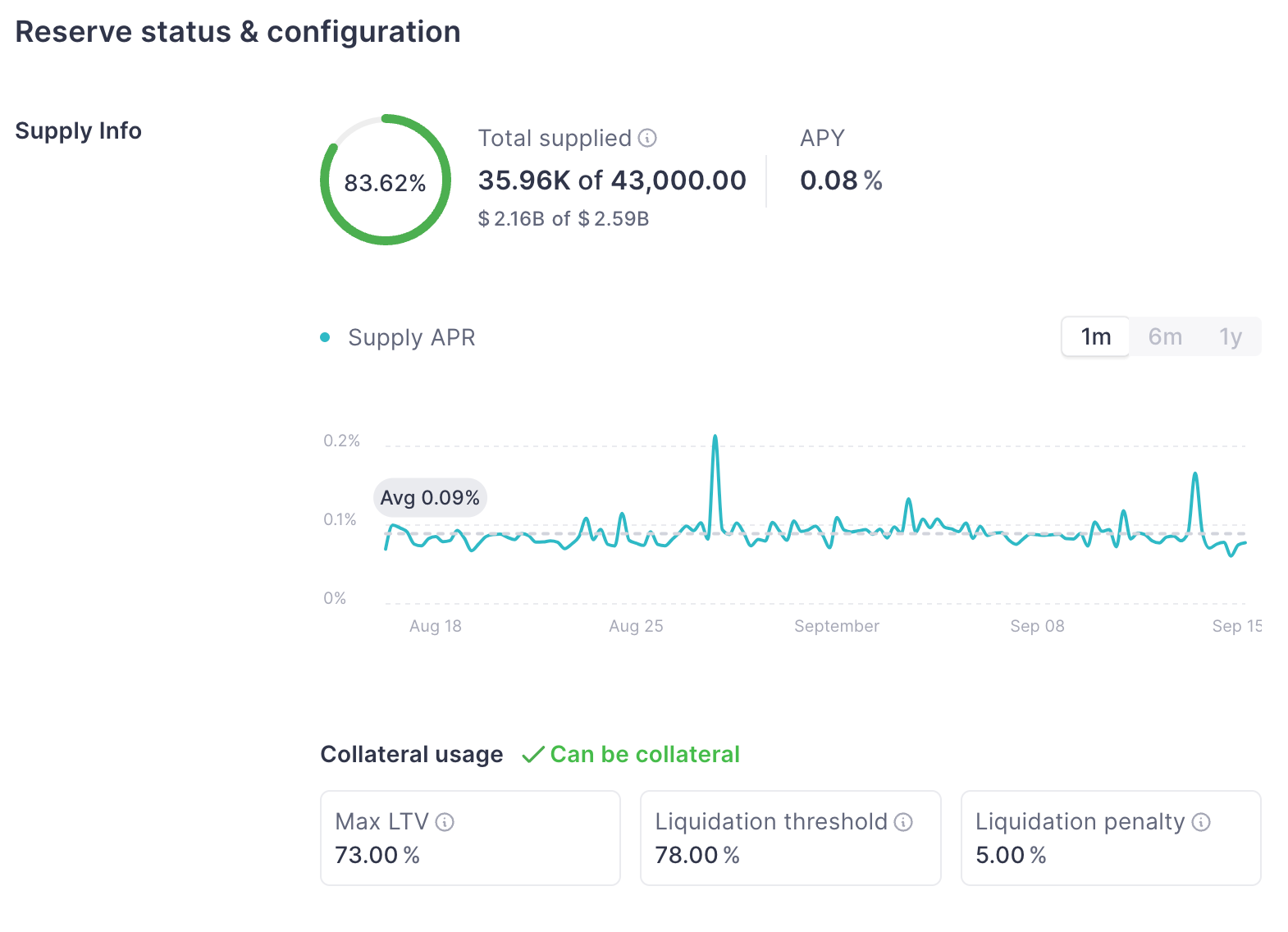

Wrapped Bitcoin can be traded on various cryptocurrency exchanges and used as collateral for loans and other financial transactions. Wrapping BTC has become a popular way for Bitcoin holders to access the world of DeFi and participate in Ethereum-based applications.

Why was Wrapped Bitcoin created?

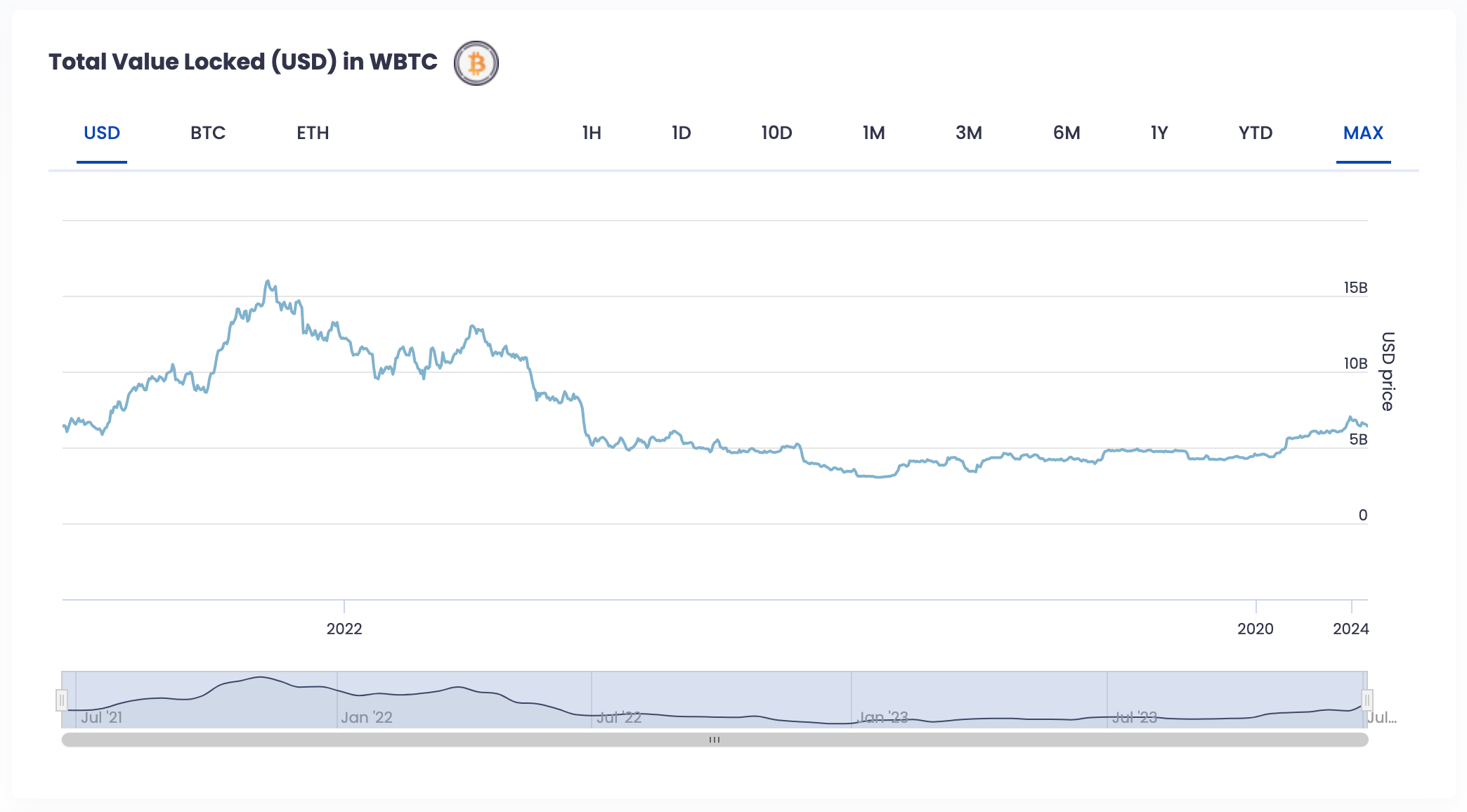

The Bitcoin wrapped token was launched in January 2019 with the aim of creating a cryptocurrency that could bring the liquidity and functionality of Bitcoin to the Ethereum ecosystem.

Before wBTC, there was no way to take advantage of smart contracts and decentralized applications (dApps) with Bitcoin, as it can't natively run on the Ethereum network. However, with the introduction of wrapped Bitcoin tokens, users can now access Ethereum's smart contracts and dApps by leveraging BTC in a form that is compatible with the Ethereum blockchain.

Who created Wrapped Bitcoin?

Wrapped Bitcoin was created by a collection of companies in the crypto industry, including BitGo and Kyber Network.

- BitGo is a digital asset custodian and security company and provides the custodial services for the Bitcoin tokens that back wBTC

- Kyber Network is a decentralized exchange platform and provides liquidity by allowing users to trade it for other ERC-20 tokens

How does Wrapped Bitcoin work?

Wrapped Bitcoin works by creating a bridge between the Bitcoin and Ethereum blockchains. When someone wants to convert their Bitcoin to wBTC, they first send their Bitcoin to a custodian, who should hold the Bitcoin in reserve.

The custodian will then mint an equal amount of wBTC ERC-20 tokens and send them to the user's cryptocurrency wallet. This process is called wrapping.

When someone wants to convert their Wrapped BTC back to Bitcoin, they initiate a “redemption request” with the custodian. The custodian then burns the wBTC tokens and sends the equivalent amount of Bitcoin to the user's crypto wallet.

The process of minting and burning wBTC is overseen by custodians, who are responsible for holding the Bitcoin reserves that back the wBTC tokens.

What's the difference between Bitcoin and Wrapped Bitcoin?

While Bitcoin (BTC) is the original cryptocurrency used for peer-to-peer transactions, Wrapped Bitcoin (wBTC) is an ERC-20 token representing BTC on the Ethereum network. wBTC allows Bitcoin holders to access Ethereum’s decentralized finance (DeFi) applications while maintaining BTC’s value.

Another key difference between Bitcoin and Wrapped Bitcoin is the level of decentralization.

Bitcoin is fully decentralized and operates on a trustless, peer-to-peer network. Wrapped BTC, on the other hand, relies on a group of custodians to hold the Bitcoin reserves that back the wBTC tokens. However, since custodians represent a central point of control, they also present potential vulnerabilities (more on that below).

What are the benefits of Wrapped Bitcoin (wBTC)?

Wrapped Bitcoin (wBTC) offers several advantages, particularly for users who want to leverage the power of BTC within the Ethereum DeFi ecosystem:

1) Access to Decentralized Finance (DeFi)

By wrapping Bitcoin into an ERC-20 token, users can utilize wBTC in various DeFi protocols on Ethereum. This opens up a wide range of decentralized financial services like lending and borrowing, yield farming, and staking, which are typically unavailable to native Bitcoin holders.

2) Improved liquidity on Ethereum

wBTC enhances liquidity within Ethereum's ecosystem by allowing Bitcoin's significant market value to be used in Ethereum-based applications. This increased liquidity helps strengthen DeFi protocols and allows for larger-scale financial activities.

3) Cross-chain interoperability

wBTC bridges Bitcoin and Ethereum, enabling users to seamlessly transfer value between the two largest blockchain networks. This interoperability allows Bitcoin holders to access Ethereum's vast range of applications without selling BTC.

4) Increased transaction speed

wBTC transactions on the Ethereum network can be faster and more cost-effective than native Bitcoin transactions, especially after the Ethereum Merge to Proof-of-Stake (PoS). Users benefit from Ethereum’s scalability solutions and transaction throughput, which are intended to handle congestion better than the Bitcoin network.

What are the risks associated with Wrapped Bitcoin (wBTC)?

Like any cryptocurrency, Wrapped Bitcoin is not immune to risk factors that can affect any digital asset:

1) Price volatility

The value of wBTC is pegged to Bitcoin's, meaning that fluctuations in Bitcoin’s price directly affect wBTC’s value. Any significant market movements in BTC will reflect on wBTC, making it vulnerable to the inherent volatility of cryptocurrency markets.

2) Custodian risks

wBTC is backed by actual Bitcoin, which is held in reserve by a custodian. If they misuse or lose control of these reserves, the peg between wBTC and BTC could be jeopardized, thus affecting the confidence of holders in the token’s value.

3) Security and insolvency

Custodians holding the BTC reserves are exposed to risks like hacks, security breaches, or even insolvency. In the event of failure, there could be a complete loss of the underlying asset (BTC), putting wBTC holders at significant financial risk.

4) Regulatory hurdles

The legal status of wBTC, like other cryptocurrencies, is subject to evolving regulations. Changes in government policies or enforcement actions could impact the ability to "HODL", trade, or even issue wBTC, creating legal uncertainties that could affect its liquidity and market value.

Frequently asked questions (FAQs) about wBTC tokens

Are there are other wrapped Bitcoin tokens besides wBTC?

Yes, there are other variations of wrapped Bitcoin in addition to wBTC. Other wrapped Bitcoin assets include:

How many wrapped Bitcoins are there?

At the time of writing, there are over 153,000 wBTC wrapped tokens in circulation, compared to Bitcoin's circulating supply of 19.7 million bitcoins.

Note: Cryptocurrency circulation figures are subject to change.

What is the goal of wrapping Bitcoin tokens?

The goal of Wrapped Bitcoin is to bring the advantages of Bitcoin to the Ethereum ecosystem. The creators of Wrapped BTC recognized that while Bitcoin is the most well-known and widely-used cryptocurrency, it's limited in its functionality compared to other blockchain networks like Ethereum.

Will wBTc's price always equal the price of BTC?

It is impossible to predict the future price of wBTC (or any cryptocurrency). But if a wBTC custodian maintains a 1:1 backing or BTC to wBTC, then the price of wBTC issued by that custodian should equal BTC's price.

However, it is possible the price of wBTC fluctuates in the future, either because a custodian does not maintain a 1:1 backing or for another reason.

For live Bitcoin price and market metrics, view our Bitcoin Price page.

Which blockchains support wrapped tokens?

There are a number of blockchains that support wrapped crypto assets, in addition to Bitcoin. Some of these include:

How to wrap Bitcoin?

To wrap Bitcoin, you can send your BTC tokens to a centralized exchange that will hold your BTC and send you an equal amount of wBTC tokens in exchange. If you prefer decentralized finance (DeFi), you can use an option like Keep Network to mint wBTC tokens directly using a smart contract.

How to buy Wrapped Bitcoin (wBTC) and BTC

You can buy Wrapped Bitcoin (wBTC) and Bitcoin (BTC) via MoonPay or through any of our partner wallet applications with a credit card, bank transfer, Apple Pay, Google Pay, and many other payment methods. Just enter the amount of wBTC or BTC you wish to purchase and follow the steps to complete your order.

Users can also top up in euros, pounds, or dollars and transact with MoonPay Balance to buy cryptocurrencies like BTC and wBTC. Once funded, use your balance for faster, cheaper transactions and higher approval rates. When you're ready to withdraw, enjoy zero-fee transfers straight to your bank account.

How to sell Bitcoin

MoonPay makes it easy to sell Bitcoin when you decide it's time to cash out your crypto.

Simply enter the amount of BTC you'd like to sell and enter the details where you want to receive your funds.

We're always adding more cryptocurrencies like Wrapped Bitcoin (wBTC) to sell, so check back soon.

Swap Wrapped Bitcoin for more crypto

Want to exchange WBTC for other cryptocurrencies like Ethereum and Bitcoin? MoonPay allows you to swap crypto cross-chain with competitive rates, directly from your non-custodial wallet.

.png?w=3840&q=90)

.png?w=3840&q=90)