Decentralized Finance (DeFi) has been key in leading technological innovations in the Web3 space.

Between February 2021 and 2022, the DeFi market grew by over 47% with total value locked (TVL) surpassing $230 billion. As of December 2023, however, DeFi TVL sits at about $47 billion.

For DeFi users, yield farming can be used to generate additional revenues while also helping contribute to an active DeFi ecosystem.

But what is yield farming and how does it work?

This article explains the benefits and risks of yield farming so you can determine if yield farming is right for you as a way to start generating revenue from your tokens.

Disclaimer: Yield farming may also introduce additional risk so you should consider whether yield farming is appropriate for you before taking any action. The following is for informational purposes only and should not be construed as financial advice.

What is yield farming?

Yield farming is the process in which crypto token holders can earn rewards by providing liquidity to DeFi platforms. By locking their crypto tokens in yield farming protocols, yield farmers can generate additional revenue from their principal investment.

How does yield farming work?

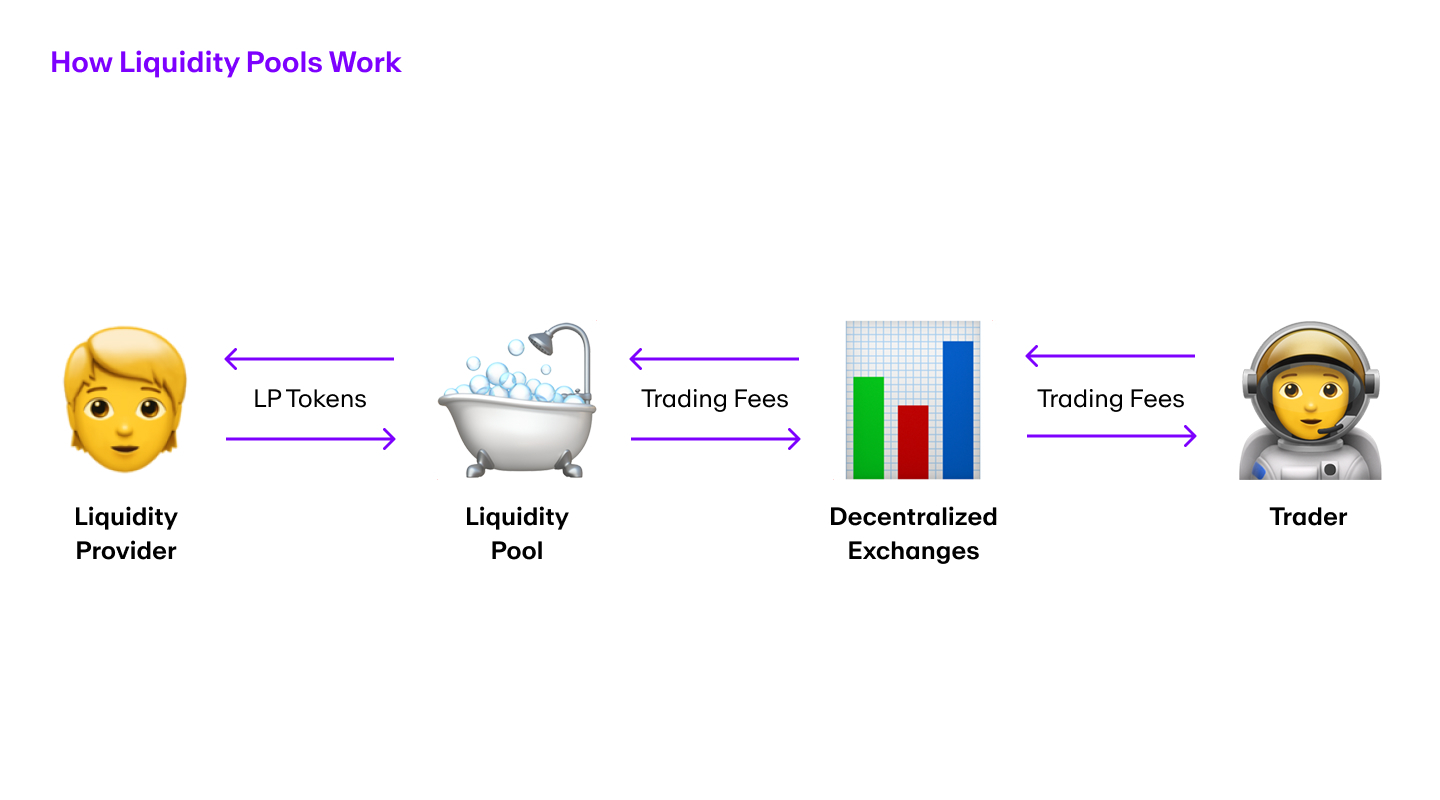

Though it may sound complicated, yield farming works by liquidity providers depositing tokens into a liquidity pool.

Supplying liquidity

A yield farmer can earn rewards by providing liquidity to a decentralized application (dApp), such as a decentralized exchange (DEX).

When liquidity providers deposit equal amounts of tokens into a decentralized exchange liquidity pool, they get a proportionate amount of liquidity provider (LP) tokens.

Liquidity provider tokens entitle liquidity providers to a portion of transaction fees that decentralized crypto exchanges charge for trading against a liquidity pool.

What can yield farmers do with LP tokens?

Liquidity providers can stake their acquired LP tokens to earn additional rewards, participate in certain initial DEX offerings (IDOs), and even lend their digital tokens to borrowers and generate revenue through smart contract-enabled lending-borrowing platforms.

How are yield farming returns calculated?

Yield farmers calculate their estimated returns from yield farming with two market metrics: Annual Percentage Yield (APY) and Annual Percentage Rate (APR).

APY factors in compounding interest, thereby calculating profit reinvestment that generates more returns. APR, however, does not.

That being said, APY and APR merely help in making projections that may not always correspond with actual returns. Moreover, they are remnants of legacy finance metrics that calculate annualized returns over the course of a year.

Given the speed of innovations in decentralized finance, APY and APR have become outdated for calculating returns. Perhaps it is time for the DeFi sector to design a unique metric that can better predict daily or weekly returns.

Can yield farming be profitable?

Yield farming can be very rewarding for investors if they properly invest their capital and other resources. Users need to track monthly and quarterly metrics of an underlying DeFi platform and follow proper investment advice to generate profitable returns from a volatile investment.

It is best for novice yield farmers to invest in a trustworthy liquidity pool, even if the interest rates aren't very high. Given the volatility of crypto markets, it's also best to participate in liquidity mining platforms where risks won't outweigh rewards.

While crypto yield farming can be profitable, it is still a capital-intensive and high-risk venture. Thus, it is necessary that you identify risks of yield farming before investing.

What are the risks of yield farming?

Yield farmers face a number of risks when investing in crypto markets, including the five mentioned below.

Price volatility

During turbulent market conditions, cryptocurrency prices can swing significantly over short durations.

Thus, token holders might suffer a loss if the price of their locked tokens depreciates during a bear market. Moreover, volatility risks may be compounded because yield farmers cannot liquidate their locked assets before the completion of the vesting period.

View our Bitcoin Price and Ethereum Price pages for live price and market data for these leading cryptocurrencies.

Impermanent loss

When token prices keep changing during a volatile market, yield farming can lead to something called “impermanent loss”. As the prices of a token pair fluctuate in the liquidity pool, the ratio keeps readjusting to stabilize the total value.

If a token's value falls due to readjustment, investors may suffer an impermanent loss. However, this loss only becomes a permanent one once users withdraw their funds from a liquidity pool on a decentralized exchange at the depreciated value.

Smart contract hacks

The smart contracts of yield farming platforms may contain bugs or faulty coding, making them susceptible to hacks. Ill-intentioned hackers can exploit such security vulnerabilities in smart contracts to drain user funds.

In December 2021, for example, smart contract bugs led to the theft of $31 million from a DeFi yield farming protocol.

Read our articles How to spot and avoid crypto scams and Crypto security basics: Staying safe in Web3 to learn all about the most common scams and how to spot them.

Fraud

Rug pulls (a scam in which project developers disappear with investors' money) are one of the most common ways of yield farmers losing their investments. In 2021 alone, losses from DeFi rug pulls totaled $2.8 billion.

In a rug pull, malicious developers hype up a DeFi project on social media and rake in liquidity by selling tokens to potential investors. They then deliberately tweak the smart contract code to remove the token vesting period, enabling scammers to “pull away” investor funds and disappear with their money.

Regulatory uncertainties

Crypto yield farming platforms are also exposed to risks accompanying an uncertain regulatory environment, which may put certain DeFi investments in limbo. There is an extensive history of regulatory risk, such as the Securities and Exchange Commission (SEC) listing certain assets as securities, thereby bringing them under their jurisdiction. The New York Attorney General has also banned some yield farming platforms, with several other states issuing cease and desist orders.

Popular yield farming protocols

Despite a bearish market, DeFi's TVL surpassed $38 billion in 2023. Though this figure is down from $112 billion in TVL in 2022, investors continue to provide liquidity into yield farming platforms.

Here's a list of some of the most popular platforms:

MakerDAO

MakerDAO is a smart contract-enabled decentralized lending-borrowing platform where users can deposit collateral to mint an algorithmic stablecoin, DAI. This stablecoin is usable across more than 400 dApps and DeFi platforms.

MakerDAO has its own native token called Maker (MKR) which also functions as a governance token. Running on Ethereum, MakerDAO has the highest TVL of $4.7 billion, down from $14.5 billion in 2022.

Aave

Aave is a multi-chain yield farming platform for lending and borrowing assets with dynamic and algorithmically controlled interest rates. Users can act as liquidity provider to Aave's liquidity pools to earn yield. They can also stake digital assets to participate in the protocol's governance. Owners of AAVE, the platform's governance token, can vote for protocol upgrades and other improvement proposals.

Aave is another common platform to yield farm, with $4.6 billion TVL, down from nearly $9 billion in 2022.

Uniswap

Uniswap is a leading DeFi trading protocol where users can exchange tokens and participate in liquidity mining. Users supply liquidity to pools in a 50:50 ratio against which traders execute their trades. In return, investors earn a few percentage points of the trading fees, as well as UNI governance tokens.

Uniswap is one of the most popular yield farming protocols, with $3.2 billion TVL in 2023.

Curve

Curve is a yield farming platform where users can perform trustless token swaps across stablecoin liquidity pools. Curve uses its own Automated Market Maker (AMM) algorithm that allows trading liquidity with low slippage across low-risk stablecoin pools. The protocol runs on the Curve DAO Token (CRV), with which users can make decisions via governance voting power.

Curve is a top protocol to earn passive income on deposited assets, with $2.2 billion TVL in 2023.

InstaDapp

InstaDapp is a yield farming protocol that allows developers to build custom DeFi infrastructure and monetize them for higher returns. It comes with a simple Javascript code that frees developers from worrying about auditing their contract code. Non-developers can also manage their portfolios by opting for lucrative yield farming strategy options through the Instadapp Lite feature.

InstaDapp is a promising platform for users of varying experience levels to earn passive income , with $1.79 billion TVL in 2023.

Convex

Convex is a yield farming platform where liquidity providers from Curve can deposit their LP tokens to earn rewards. These rewards include boosted CRV tokens as well as CVX tokens. Users can stake these tokens to earn additional interest from the protocol.

Convex is a widely-used protocol to earn yield on liquidity deposits, with $1.82 billion TVL in 2023.

Compound

Compound is a yield farming protocol where users can lend and borrow assets for the money market. By participating in the platform, users get rewards in the form of Compound (COMP). COMP tokens function as governance tokens that allow holders to participate in protocol governance. The Compound ecosystem runs on Ethereum, with algorithmically-controlled interest based on the supply-demand ratio.

Compound is one of the most used platforms for lending crypto assets, with $1.5 billion TVL in 2023.

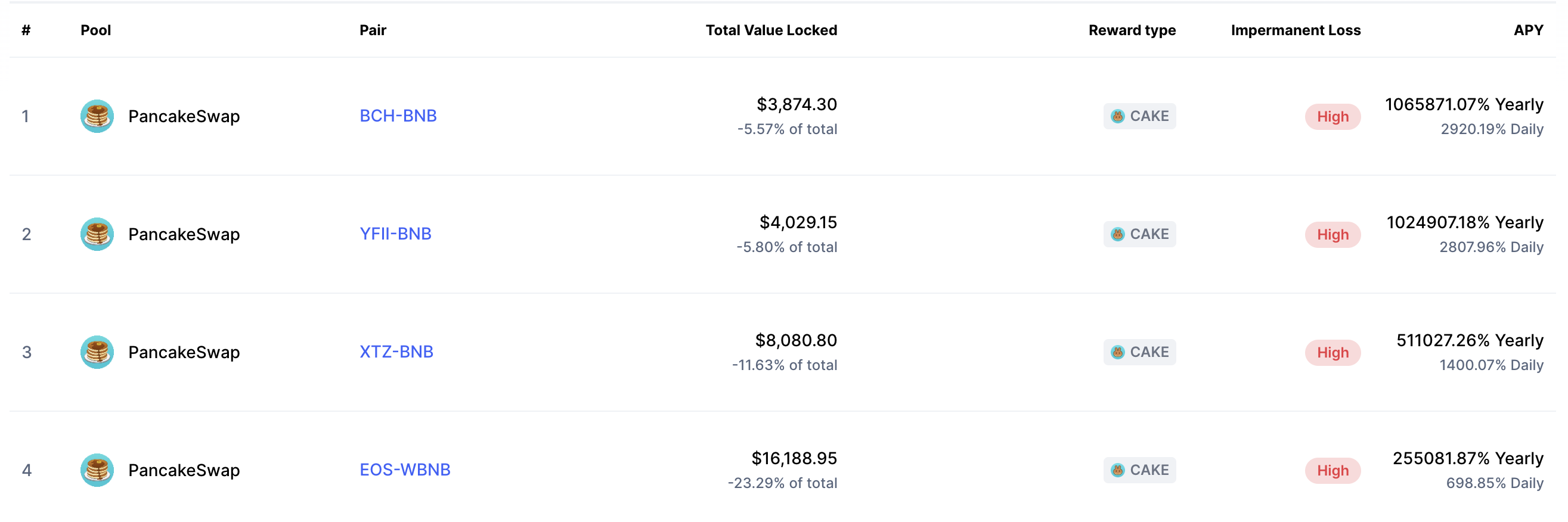

PancakeSwap

PancakeSwap is a yield farming protocol running on the Binance Smart Chain. Although it was inspired by Uniswap, PancakeSwap has expanded features, including an NFT marketplace and in-platform games like lotteries. Leveraging an Automated Market Maker (AMM), the PankcakeSwap runs on the CAKE governance token that provides users with governance rights.

PancakeSwap is another common platform to yield farm, with $1.3 billion TVL in 2023.

Balancer

Balancer provides flexibility to liquidity providers since they can create customized liquidity pools with unequal token allocations. Through customizable and flexible staking, Balancer opens up a new way for liquidity providers to contribute to DeFi. Users who provide liquidity get a portion of the trading fees from the protocol.

Balancer has $690 million TVL in 2023.

Yearn

Yearn is a DeFi aggregation protocol that automates access to liquidity pools across platforms like Aave and Compound. Yearn uses an algorithm to locate a yield farming protocol offering maximum returns and suggests it to users. Upon depositing funds, Yearn issues yTokens that keep rebalancing the principal amount to maximize profits.

Yearn has $320 million TVL in 2023.

Start yield farming with MoonPay

By investing in different yield farming platforms, you can earn interest and grow your crypto portfolio.

To get started on your yield farming journey, simply buy crypto via MoonPay using a card, mobile payment method like Google Pay, or bank transfer. MoonPay's widget offers a fast and easy way to buy Bitcoin, Ethereum, and more than 50 other cryptocurrencies.

MoonPay also makes it easy to sell crypto when you decide it's time to cash out. Simply enter the amount of the token you'd like to sell and enter the details where you want to receive your funds.

.png?w=3840&q=90)