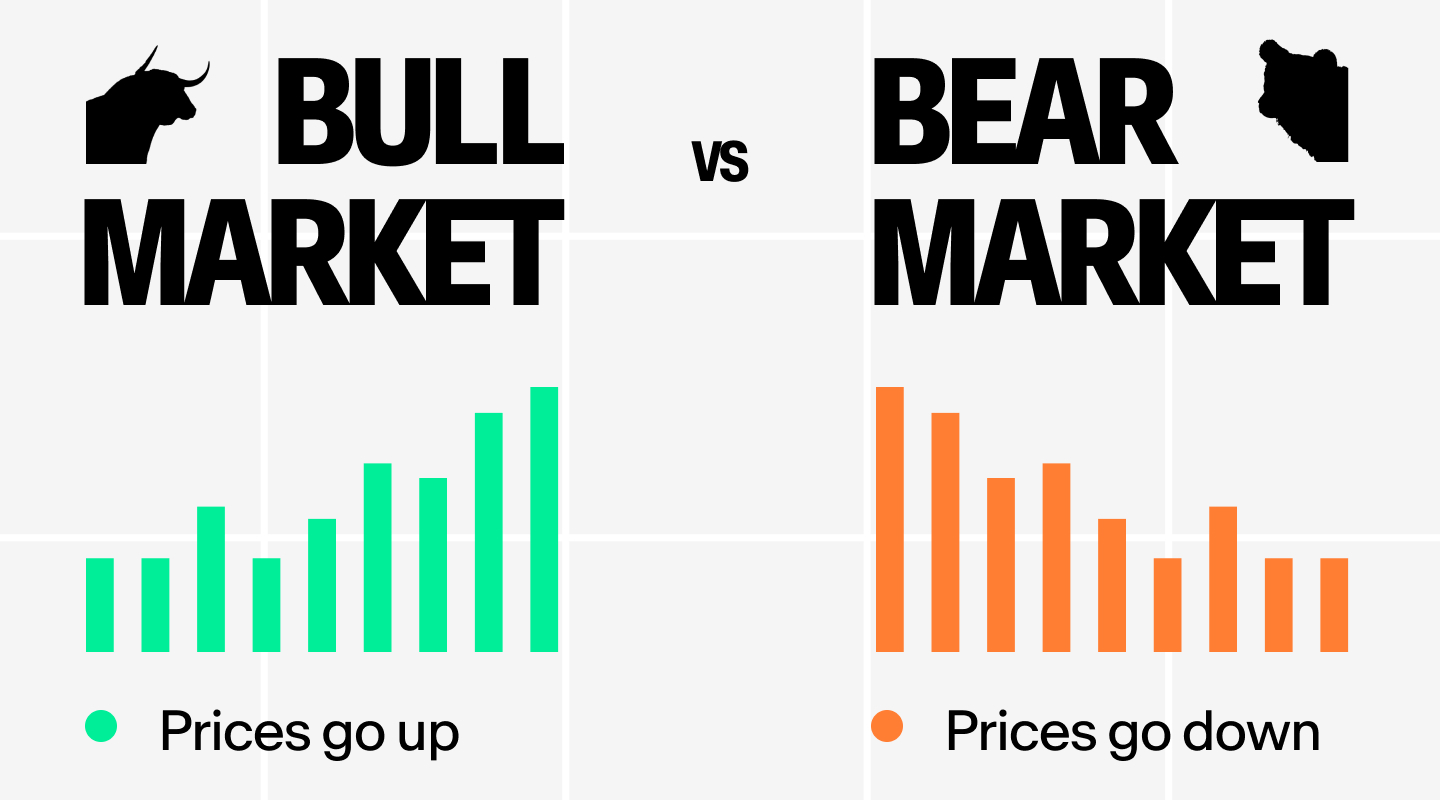

Bull and bear markets are terms that refer to markets generally and, in respect of cryptocurrencies, the state of the broader cryptocurrency market.

Given the market’s constant volatility and daily fluctuations, these terms are used to describe more sustained periods of predominantly upward or downward movement. Large fluctuations (at least 20%) in either direction are indicative of shifts in the market.

In this article, we will discuss what bull and bear markets are, how they got their names, and how to identify them.

What is a bull market?

A bull market is a type of market in which prices of cryptocurrencies are generally increasing. Bull markets are typically characterized by optimism and high investor confidence. In traditional markets, a bull market is usually characterized by prices of shares generally increasing.

Many people think high asset prices signal a bull market, but other factors must be considered. For example, when analysts talk about a “bull market,” they might be referring to high levels of trading volume, strong earnings growth, or widespread optimism among investors.

So, how do you precisely characterize a bull market in the cryptocurrency space, what’s often referred to as a “crypto bull run”?

There is no precise answer to this. According to Forbes, however, a market is said to have entered the bull run when asset prices rise by 20% or more and continue to grow for weeks.

Since crypto markets are far more volatile than traditional finance markets, this 20% figure may be low in some cases.

Why a bull?

Bulls are known to attack by thrusting their horns upwards. It’s how the term “bullish” came about: to describe an attitude or outlook that favors an increase in prices.

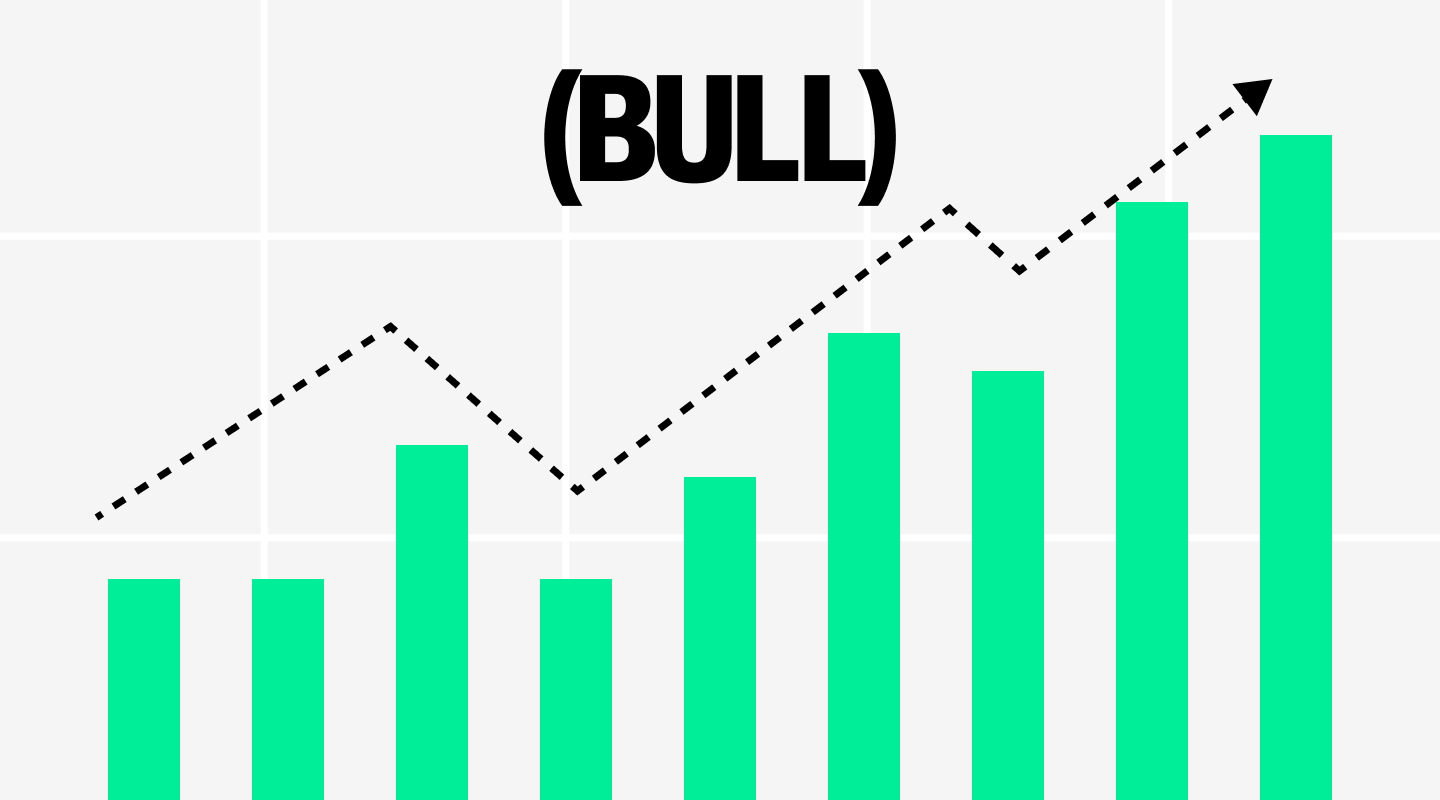

What is a bullish trend, and how do you spot it?

In its broadest sense, a bullish trend is when an asset’s price consistently goes up over time.

There are different ways to spot a bullish trend. One way is to look at price charts and identify patterns such as “higher lows” and “higher highs”.

- Higher lows are when an asset's price consistently makes new lows, but each low is higher than the last.

- Higher highs are when an asset’s price consistently makes new highs, and each high is higher than the last.

Another way to identify a bullish trend is to look at moving averages. A moving average is a technical indicator that shows the average price of an asset over a certain period.

Generally, when the moving average line is sloping upwards, it indicates a bullish trend. When the moving average line is sloping downwards, it indicates a bearish trend.

What causes a bull market?

There is no single factor that can cause a bull market.

In traditional markets, a bull market is typically the result of a combination of positive economic indicators such as low unemployment rates, strong corporate earnings, and increasing consumer confidence.

In cryptocurrency markets, some news events could trigger a bull run. For example, Bitcoin’s price surged in late 2020, coinciding with PayPal’s announcement of the addition of $50 million worth of BTC to its balance sheet.

What is a bear market

A bear market is a type of market in which prices are generally declining. Bear markets are typically characterized by pessimism and low investor confidence. In traditional markets, a bear market is usually characterized by prices of shares generally decreasing.

Some signals of a bear market include decreasing trading volumes, weak earnings growth, and widespread pessimism among investors.

So how do you characterize a bear market in the cryptocurrency space, what’s often referred to as a “crypto bear run”?

Again, there is no concrete answer to this. Generally, however, when asset prices drop by 20% or more and continue to decline for weeks, it is indicative of a bear market.

Why a bear?

Bears are known to attack by swiping their claws downward. This is also how the term “bearish” came about: to describe an attitude or outlook that favors a decrease in prices.

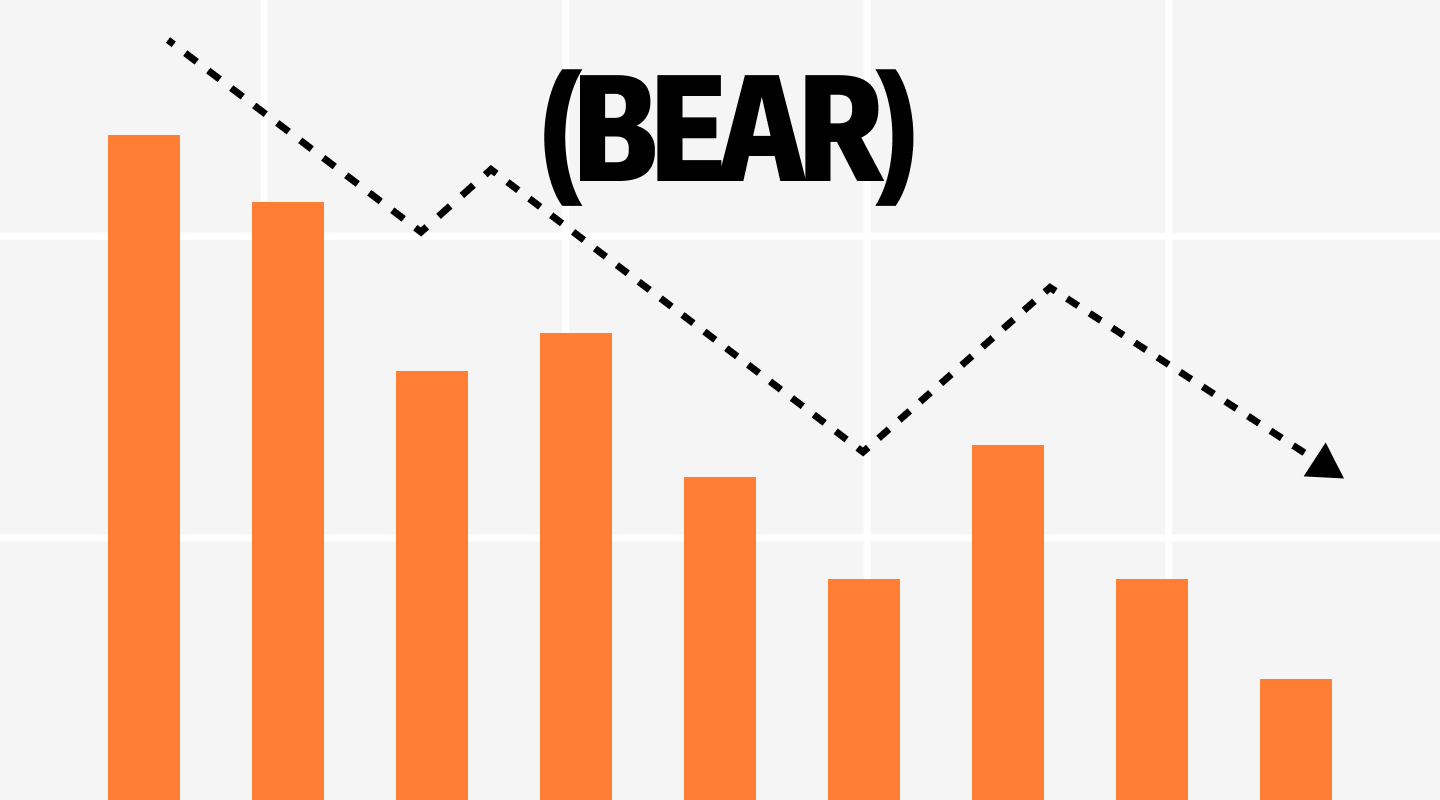

What is a bearish trend, and how do you spot it?

Generally speaking, a bearish trend is when the price of an asset falls over a continuous period.

Unlike in a bullish market, which will have higher lows and higher highs, in a bearish market, you get “lower highs” and “lower lows”.

- Lower highs mean the prices are going up, but each time the price reaches a new high, it is lower than the last one.

- Lower lows mean the prices are decreasing and hitting new lows each time.

You can also spot a bearish trend by studying moving averages. When the line is sloping downwards, it typically indicates that the market is in a bearish phase.

What causes a bear market?

There is no single factor that causes a bear market, but some of the most common causes in traditional markets include an economic recession, weak corporate earnings, and reduced consumer confidence.

In the crypto space, bear markets can be triggered by news events such as regulatory uncertainty, ICO scams, and major hacks. For instance, Bitcoin’s price plummeted after the Mt. Gox hack in 2014.

What kind of investor are you?

As you would have guessed by now, there are two kinds of investors:

- Bullish investors (a.k.a. Bulls)

- Bearish investors (a.k.a. Bears)

So, how do you find out which one you are?

A bullish investor profits from rising prices by buying low and selling high. Such an investor believes that the market will rise in value over time. They are usually optimistic and have faith in the assets they’re holding, regardless of short-term price movements.

A bearish investor tries to profit from the declining market by short selling. Such an investor believes that the market will decline in value over time. They are usually pessimistic and have little faith in an asset’s future potential.

Many investors tend to adopt a combination of bull and bear strategies, depending on market conditions. This makes them more flexible and better equipped to take advantage of any opportunities that come their way.

Ultimately, investors should decide what works best for them based on their risk tolerance and investment objectives.

Bear and bull markets conclusion

Bull markets and bear markets are common terms in both traditional finance and cryptocurrency circles. Understanding what they mean and when they apply can help investors make better decisions.

Of course, there is no surefire way to predict which direction the market will take. The best approach is to stay informed, conduct thorough research, and be aware of risks.

View our Bitcoin Price and Ethereum Price pages for live price and market data for these leading cryptocurrencies.

Begin your crypto journey with MoonPay

Now you know the basics of bull and bear markets, it's time to experience crypto for yourself.

To get started, simply buy cryptocurrency via MoonPay using your credit card or any other preferred payment method.

MoonPay's widget offers a fast and easy way to buy Bitcoin, Ethereum, and more than 100 other cryptocurrencies.

MoonPay also makes it easy to sell crypto when you decide it's time to cash out. Simply enter the amount of the token you'd like to sell and enter the details where you want to receive your funds.

.png?w=3840&q=90)