People generally understand that crypto wallets are used to store cryptocurrencies and execute transactions on a blockchain network.

But technically crypto wallets don’t store crypto per se. Instead, a digital wallet generates an address that locates the user’s digital assets on the blockchain.

There are different wallet types available in the market and every wallet has a corresponding public key and private key.

A public key is like a bank account number, shareable with everyone. It is required for transferring money into a user’s wallet.

On the other hand, a private key is like a password with which users can access their funds or sign a crypto transaction. It is imperative to keep a private key safe.

Wallets are either custodial or non-custodial, depending on who controls or has access to private keys. But what else differentiates these two wallet types and how can one determine which is most suitable for their needs?

This article provides all the information you need to make an educated decision about the wallet type that's best for you.

What is a custodial wallet?

A custodial wallet is a wallet in which a third party (usually a crypto exchange) is responsible for managing your private keys. Instead of having custodial access to your funds, a service provider gets complete control of your money.

Users rely on custodial wallets because managing private keys is not an easy task. Losing your private key means losing access to your funds forever. If you’re considering a custodial wallet, it’s important to choose a trusted and reliable service provider that will keep your private keys and funds safe.

Custodial crypto wallets compliant with existing regulatory regimes are usually safer than non-compliant wallets. Users can also opt for custodial wallets that offer insurance coverage for theft or misuse of funds.

What is a non-custodial wallet?

A non-custodial wallet is a wallet in which you are responsible for storing and managing your private keys. Instead of third parties like crypto exchanges having custodial access, you have full control over your digital assets.

Users with non-custodial wallets essentially become their own banks with round-the-clock access to their funds. These non-custodial wallets are ideal for experienced traders ready to shoulder the great responsibility of storing their keys safely.

Many in the crypto industry believe in the maxim: “not your keys, not your coins”. If investors and traders lose access to their private key, they lose all of their crypto assets. Since it's extremely difficult to retrieve a lost private key for non-custodial wallets, users need to be extra careful.

Although users are taking the risk of losing their funds into their own hands, non-custodial crypto wallets offer better protection against a data breach than custodial wallets. Some non-custodial wallets require internet connectivity to operate, however, so offline hardware wallets are usually the safest option in this regard.

Custodial vs non-custodial wallets

The main difference between custodial and non-custodial wallets is that custodial wallets give a third party the permission to hold your private keys, whereas non-custodial wallets give you sovereign control of your private keys.

Private key ownership

For custodial crypto wallets, the wallet provider is tasked with securely storing the user’s private key. Therefore, users do not have full control over their assets. Instead, the custodian directly handles the funds, and in some cases may misuse them.

For non-custodial crypto wallets, no third party is involved and users manage their own private keys. Thus, without interference from any kind of intermediaries, users alone can access the assets stored in their crypto wallets.

Security

Users must consider security as the most important criterion when choosing a crypto wallet. Since a custodial wallet stores a user’s keys in centralized servers, they are more prone to attacks and hacks from malicious actors. The $90 million Liquid exchange hack, for example, demonstrated the vulnerability of exchange-hosted custodial wallets.

Since non-custodial wallet users store their keys (ideally off-chain), it's extremely difficult for hackers to steal their funds. Non-custodial crypto wallets therefore offer better security compared to custodial wallets. Using a hardware wallet that functions offline can further reduce security vulnerabilities.

Read our article How to spot and avoid crypto scams to learn all about the most common scams and how to spot them.

Transaction time and cost

With a custodial wallet, every transaction requires approval from the central exchange. Consequently, there could be a delay in the transaction going through. The transaction history is also not recorded on the underlying blockchain in real-time, and transaction costs are typically higher due to the involvement of custodians and other intermediaries.

Non-custodial wallet users directly authenticate transactions without involving centralized entities, so they’re usually faster. Moreover, the transaction history appears on the blockchain in real-time. Transaction costs are also cheaper because there are few or no commission-seeking intermediaries.

Funds backup and recovery

Custodial wallet users can rely on the custodian to retrieve their password in the case of loss. For instance, a custodial crypto exchange should recover a user’s funds since it holds custodial rights over the user’s private key. Thus, users can typically contact customer support to help get their assets back.

With non-custodial wallets, however, users need to be extra careful since losing one’s private key means losing all their assets. To protect their cryptocurrency, users need to safely store their recovery phrase (also called a seed phrase), a 12, 18, or 24 character mnemonic phrase used to regain access to one crypto wallet.

Creating a new account

Account creation for custodial wallets may be a lengthier process. Users need to complete Know Your Customer (KYC) and Anti Money Laundering (AML) forms for security and regulatory compliance. This can be a lengthy and time-consuming process.

Non-custodial wallets, on the other hand, do not require KYC / AML. Thus, creating a non-custodial wallet may be faster to set up.

Offline accessibility

Custodial wallets require an internet connection to reach centralized servers and access blockchain data. Thus, custodial crypto wallets can only operate online, making them vulnerable to cyber attacks.

Non-custodial wallets are more flexible because they can usually operate both online and offline. A non-custodial crypto wallet can function from a web browser or a mobile application. A hardware wallet is the safest, however, because users can sign transactions offline, thereby protecting keys from malicious hackers.

Feature | Custodial wallets | Non-custodial wallets |

Private keys | A central custodian controls the private keys | The wallet owner controls the private keys |

Private key access | Private keys are stored on third-party servers | Only the owner can access their private keys |

Convenience | More convenient, can be accessed from any device using an app or website | Less convenient, login requires 12 or 24-word seed phrase |

Suitability | Suitable for beginners | Suitable for experienced users |

KYC-AML | Users are required to get KYC/AML verified before using their wallets | Users are not required to get KYC/AML verified |

Funds accessibility | The custodian or wallet service provider has access to the user's funds | Only the user has access to their funds |

Withdrawals | The custodian or wallet service provider approves withdrawals on behalf of users | The users need to use their private keys to sign withdrawals |

Compatible applications | The wallet is not compatible with decentralized applications | The wallet is compatible with dApps, DeFi protocols, DEXs, and other Web3 applications |

Seed phrase | No seed phrase is needed, recovery is done through the service provider | The users receive a seed phrase, which must be stored safely in case they lose their private keys |

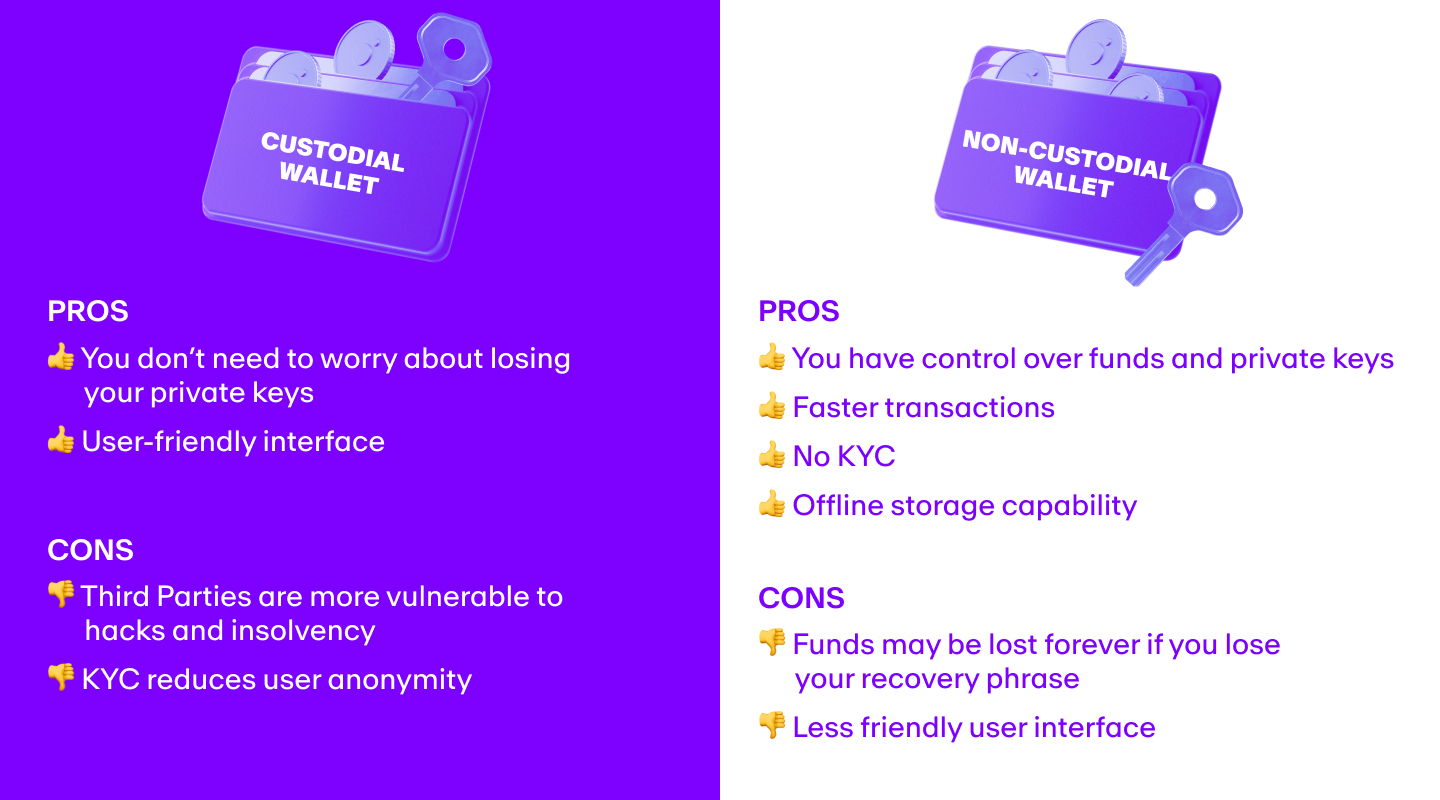

Custodial pros and cons

Pros

Custodial wallet holders enjoy peace of mind because they don’t need to worry about losing their private key. If users lose any sensitive data, they can contact customer support and regain access to their funds.

Thus, with custodial wallets, users can usually take advantage of backup facilities at any time to help avoid financial loss.

Custodial wallets also usually have a more user-friendly interface so novices can navigate them quite easily.

Cons

With custodial wallets, users have to completely rely on a third party custodian for storing their private key. If the third party does not have strong security measures, the user is at risk of losing their funds.

A liquidity crisis like the one at Celsius could also jeopardize investor funds. And since custodial wallets cannot operate offline, they are more prone to hacks and online theft.

Non-custodial pros and cons

Pros

Non-custodial crypto wallet holders have sovereign control over their private keys, and therefore control their funds completely. They don’t need to trust a third party exchange to properly manage their assets.

Moreover, offline non-custodial wallets, or “cold wallets”, are protected from online hackers. Non-custodial wallets also usually process transactions immediately at negligible costs.

Cons

Users need to be extra responsible with non-custodial wallets because losing one’s private keys means losing their funds forever. Apart from the seed phrase, there is no way to restore an account if a user loses their password. Sometimes the user interface of non-custodial wallets can also seem a bit overwhelming for new users.

Which wallet type is suitable for crypto users?

New users purchasing crypto may get lost in the weeds of the custodial vs non-custodial wallets debate.

As the aforementioned sections demonstrate, both custodial and non-custodial wallets have their own advantages and disadvantages. Each wallet type is suitable for different users with specific needs. Blockchain users can either delegate storage and private key management to a third party or become the sole custodian of their private keys.

Some examples of custodial wallets are Binance, Free Wallet, BitMex, and Bitgo.

Examples of non-custodial wallets include Metamask, BitPay, Trust Wallet, Ledger Nano X, Trezor One, Zengo, Edge, Electrum, Exodus, Wasabi, and Phantom.

Frequently Asked Questions about Wallets (FAQs)

What is the main difference between custodial and non-custodial wallets?

With a custodial wallet, a third party stores and manages a user’s private keys. With a non-custodial wallet, the user must store and manage their private keys on their own.

What is a private key?

A private key is a cryptographically generated string of characters that acts as a password to manage user funds and create a backup wallet on a new device. The private key helps to prove asset ownership, create digital signatures, and execute transactions on the blockchain.

Are custodial wallets safe to use?

Yes, custodial wallets are safe to use but users need to do their own research before choosing one. It is better to select custodial wallets that comply with regulations and offer robust security and insurance coverage.

Are non-custodial wallets safe for users?

Yes, non-custodial wallets are usually safe for users, but it’s the user’s responsibility to keep their private keys safe and have a proper backup.

Is MoonPay custodial or non-custodial?

MoonPay is non-custodial. Blockchain users can buy crypto on MoonPay with their credit/debit cards, Apple Pay, Google Pay, bank transfer, and other local payment methods.

Start your crypto journey with MoonPay

Now you know the basics of custodial vs non-custodial wallets, it’s time to explore them for yourself.

To get started, simply buy cryptocurrency via MoonPay or through any of our partner wallet applications with a credit card, bank transfer, Apple Pay, Google Pay, and many other payment methods. MoonPay's widget offers a fast and easy way to buy Bitcoin, Ethereum, and more than 50 other cryptocurrencies.

MoonPay also makes it easy to sell crypto when you decide it's time to cash out. Simply enter the amount of the token you'd like to sell and enter the details where you want to receive your funds.

You can also kick off your crypto journey by topping up your wallet in euros, pounds, or dollars and use your MoonPay Balance for buying Bitcoin (BTC), Ethereum (ETH), and more tokens. Use your balance to enjoy lower transaction fees, quicker processing times, and better approval rates. Plus, withdraw to your bank account with zero fees when you're ready to cash out.

.png?w=3840&q=90)