Hyperliquid is available to users globally except those located in the United States and Ontario, Canada.

Since its inception, Decentralized finance (DeFi) has been evolving from a technical experiment into a vibrant financial alternative for users around the world, with over $140 billion in DeFi TVL (total value locked). As more crypto traders seek advanced tools to manage their portfolios, the infrastructure behind decentralized exchanges (DEXs) continues to innovate.

Among emerging platforms, Hyperliquid is establishing itself as a potential frontrunner with its unique approach to perpetual trading. The platform offers ultra-fast execution, innovative technology, and the seamless experience you get with centralized exchanges, all while keeping user assets under self-custody.

This comprehensive guide breaks down what Hyperliquid is, how it works, and why it might be an ideal fit for your trading needs in the expanding sector of decentralized exchanges and perpetual derivatives.

What is Hyperliquid?

Hyperliquid is a decentralized exchange (DEX) and Layer-1 blockchain built for perpetual futures (perps) and spot trading. The platform was engineered to solve persistent pain points found on legacy DEXs, like slow execution speeds, high transaction costs, liquidity challenges, and user experience limitations.

Through the combination of a lightning-fast orderbook, gas-free trading experience, and a secure settlement framework, Hyperliquid bridges the gap between high-speed centralized trading and permissionless DeFi. The platform’s goal is to empower crypto traders with all the tools and advantages previously only found on major centralized exchanges, without the custodial risks inherent to CEXs.

Who Created Hyperliquid?

Hyperliquid was founded by Harvard classmates Jeff Yan, iliensinc, and a team of seasoned developers, quantitative finance professionals, and blockchain industry veterans committed to advancing the technical possibilities of DeFi.

Other team members bring experience from Caltech and MIT, further reinforcing the project’s strong technical foundation. Collectively, the team has prior work histories at leading companies such as Airtable, Citadel, Hudson River Trading, and Nuro, giving them expertise in software engineering, finance, and large-scale systems.

How Does Hyperliquid Work?

Hyperliquid’s unique approach relies on a hybrid on-chain/off-chain architecture, delivering the best of both speed and transparency. In practice, users experience highly responsive trading, zero gas fees on trades, and the confidence of on-chain settlement that’s visible and verifiable on public blockchains.

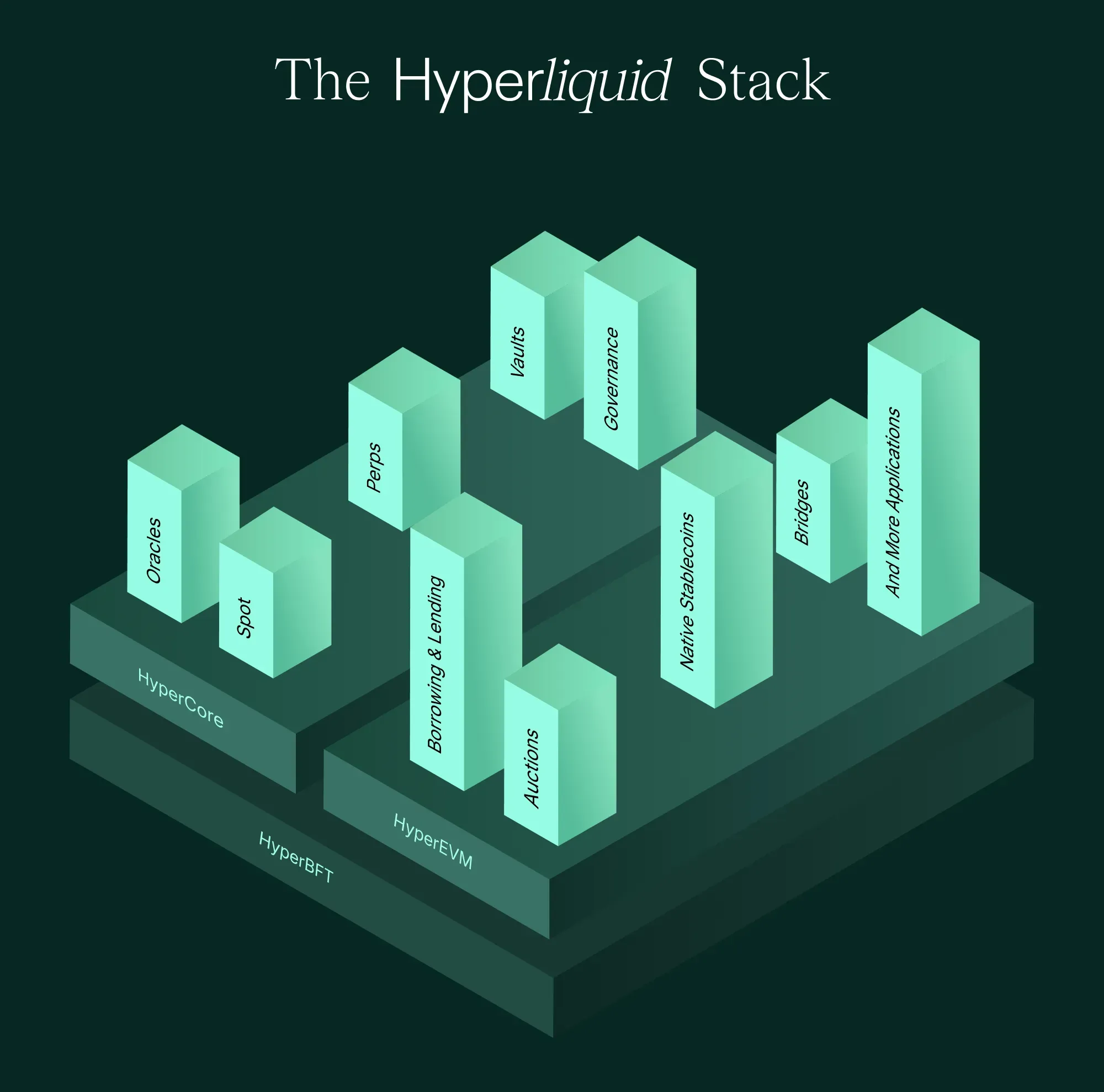

Core Technology Behind Hyperliquid

Hyperliquid is powered by HyperCore, a custom-built Layer 1 blockchain and off-chain matching engine working in tandem. HyperCore is designed from the ground up for high-performance trading, allowing the platform to process hundreds of thousands of transactions per second, without compromises on user control or transparency.

Orders are matched off-chain by HyperCore’s matching engine, ensuring fast, reliable execution, while all trades and balances are recorded and settled on-chain.

Smart Contract Power: HyperEVM

Alongside HyperCore, Hyperliquid features HyperEVM, a fully EVM (Ethereum Virtual Machine)-compatible environment secured by the same HyperBFT consensus. The HyperEVM isn’t a separate chain, but interacts natively with HyperCore’s order books by enabling developers to deploy smart contracts that connect directly to the platform’s spot and perpetual trading infrastructure. This gives builders access to deep liquidity and allows for innovative applications, such as permissionless token launches, DeFi protocols, and new on-chain financial tools.

For builders, HyperEVM means the ability to use standard Solidity tooling and tap into Hyperliquid’s liquid on-chain order book system with no bridging risk or permission requirements. Community-developed apps and directories, like HypurrCo and Hyperliquid.wiki, are already live, and more resources can be found in the developer documentation and onboarding FAQ.

How Trading is Executed on the Hyperliquid Blockchain

When you trade on Hyperliquid, you interact directly with HyperCore’s permissionless, Proof-of-Stake network. There are no gas fees required for trading, as the network uses efficient message passing between nodes.

Trades are matched in real time off-chain, and once matched, they are finalized and recorded on the Hyperliquid L1 chain. The result is high throughput and low latency, all while users maintain full custody of their assets.

Off-Chain vs On-Chain Models in DeFi

Most decentralized exchanges either run fully on-chain or are only partially decentralized. While this maximizes transparency and decentralization, it can lead to slower execution, higher trading fees, and more slippage.

In contrast, Hyperliquid leverages its own Layer-1 and a proprietary matching engine to deliver fast performance without sacrificing transparency. Off-chain matching combined with on-chain settlement means that Hyperliquid users get the best aspects of both worlds: instant trading, ample liquidity, and true self-custody, with all trades and balances always visible and verifiable on-chain.

Why Use Hyperliquid? Use Cases and Benefits

Hyperliquid offers more than just your typical decentralized perpetual exchange. It addresses both the everyday needs and advanced preferences of modern DeFi traders, developers, and liquidity providers. Some common perks include:

Frictionless Perpetual Trading

Hyperliquid's main purpose is to enable trading. Users can open, close, and manage long or short positions on perpetual contracts without complex procedures or trade delays. The Hyperliquid platform's streamlined trading experience is a major advantage for active traders seeking to move confidently in high-pressure crypto markets.

High Frequency Trades

The hybrid order-matching technology behind Hyperliquid provides millisecond (0.07 seconds) level execution, allowing traders to compete on an even playing field with high-frequency trading professionals. Trades are processed instantly, minimizing slippage and missed opportunities.

Self-Custody

Users maintain full control of their funds at all times when interacting directly from a non-custodial wallet. With Hyperliquid, there is no need to transfer assets to a centralized exchange or third-party custodian. Self-custody helps to reduce counterparty and other centralization risks while remaining in line with core DeFi principles of asset ownership.

Cost Savings

Trading on Hyperliquid eliminates per-trade gas fees, helping users maximize profits and making frequent trading strategies practical even for those with smaller portfolios.

Open and Permissionless

Anyone around the globe can participate in Hyperliquid by simply connecting a compatible crypto wallet. There are no account sign-ups or barriers to entry, making the platform accessible to a truly global audience.*

*Hyperliquid is not available for users in the United States or Ontario, Canada.

What is the Hype Token (HYPE)?

The HYPE token is the backbone of the Hyperliquid Layer-1 blockchain and DeFi protocol, supporting the platform’s ecosystem in several ways:

- Trading: HYPE tokens can be used directly for trading and settling transactions on the Hyperliquid platform, through both perpetual futures trading and spot trading.

- Governance: Holders may participate in governance via voting on protocol changes, new feature proposals, or community initiatives via the Hyper Foundation.

- Fee Reductions: Frequent traders and liquidity providers may use HYPE tokens for reduced trading fees, exclusive rewards, or loyalty incentives.

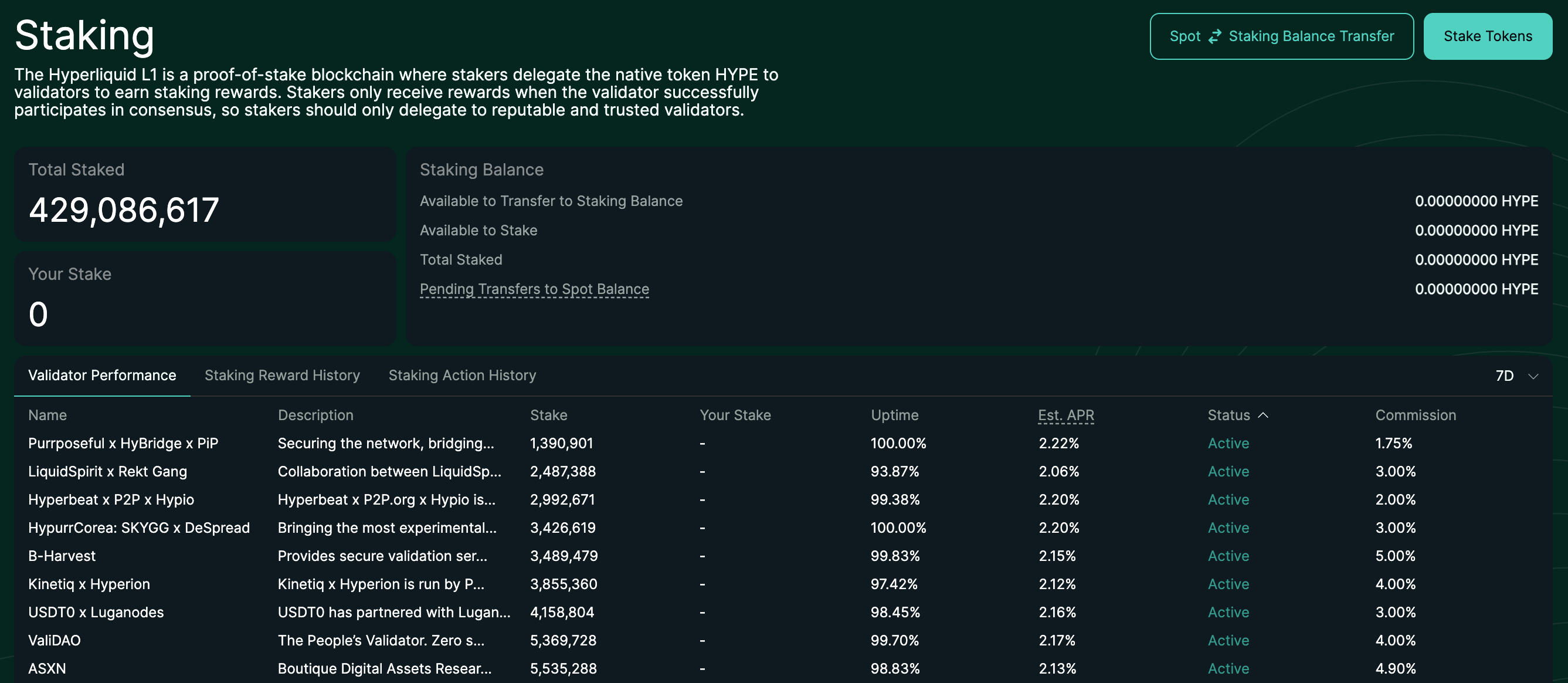

- Staking: Stakers can delegate their HYPE tokens on the Hyperliquid L1 blockchain to validators to earn staking rewards. Rewards are only distributed when a validator successfully participates in network consensus.

Note: Always review the proper documentation and tokenomics before purchasing or staking HYPE. Token use cases are subject to change with ecosystem development.

What Are the Limitations of Hyperliquid?

No DeFi protocol is perfect. While Hyperliquid offers a major leap forward in user experience and technical efficiency, users should consider its potential limitations:

Centralization Due to Hybrid Model

Since Hyperliquid’s order matching occurs off-chain while settlements are finalized on-chain, users are required to place a certain level of trust in the off-chain matching engine to report trades accurately and fairly. Such a model is less decentralized than a fully on-chain DEX, leading to centralization concerns among certain users.

Platform Maturity

Even in a nascent industry, Hyperqliquid remains a newer entrant in the DeFi perpetuals landscape. The platform has simply not been through every possible market scenario or stress-test that more established protocols have already faced, meaning Hyperliquid is still proving its long-term viability.

Liquidity for Certain Trading Pairs

While leading trading pairs generally benefit from deep liquidity, less popular assets might see lower volumes. Low volume means low liquidity, which could affect order fills and pricing for those searching for niche trading markets.

Smart Contract and Operational Risk

Despite ongoing code reviews and audits, all DeFi protocols face some risk from potential smart contract vulnerabilities and unexpected operational issues. Users should remain aware of this inherent risk in decentralized trading.

Regulatory Uncertainty

Like many DeFi platforms, Hyperliquid operates in a rapidly evolving regulatory environment. Region-specific rules and regulations may impact future platform access or introduce new compliance requirements for users in some jurisdictions.

Tip: Always weigh the benefits of any DeFi platform with its risks, and never deposit or trade more than you can afford to lose.

Hyperliquid vs Other Decentralized Exchanges and Perpetuals Protocols

Hyperliquid blends the speed normally reserved for centralized exchanges with the trust-minimized, transparent nature of DeFi, putting it ahead of many legacy DEXs that struggle with latency, high fees, or UX friction.

Let's compare Hyperliquid with other leading DeFi perpetuals platforms in key areas:

Protocol | Speed | Liquidity | User Experience | Decentralization | Fees | Notable Features |

Hyperliquid | Instant | Deep | Intuitive, modern | Hybrid (on/off) | Very low | Gasless trading, CEX-like feel |

dYdX | High | Deep | Advanced UI | Hybrid (StarkEx L2) | Low | Layer-2 scaling, orderbook trading |

GMX | Moderate | Good | Simple, clean | On-chain | Low | Decentralized liquidity pools |

Level Finance | Moderate | Good | Simple, functional | On-chain | Low | Risk tranching, yield options |

Kwenta | High | Niche pairs | Functional, professional | On-chain (Optimism/Synthetix) | Variable | Synthetix liquidity & oracles |

Always check live stats for the latest data for mentioned platforms.

How to Start Trading on Hyperliquid: A Step-by-Step Guide

Trading on Hyperliquid is designed to be beginner-friendly and non-custodial. Here is a step-by-step guide to start using the platform:

1. Set Up a Crypto Wallet

Begin by downloading a crypto wallet such as MetaMask, Rabby, Trust Wallet, or any supported wallet extension or mobile application. If you're creating a new wallet, you should safely store your seed phrase offline and choose a strong, unique password to keep your funds secure and always accessible.

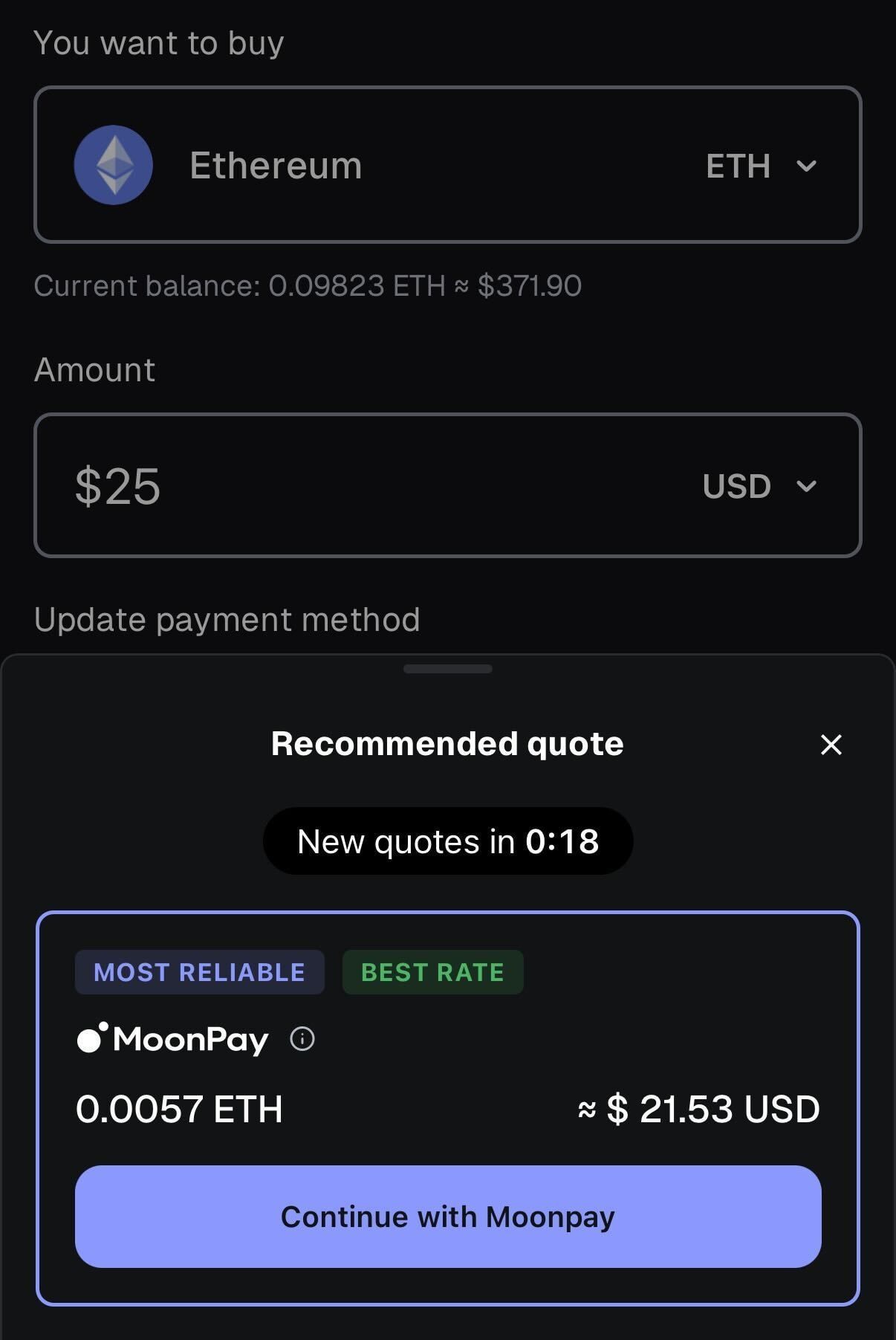

2. Fund Your Wallet with Supported Crypto

Next, purchase USDC (Arbitrum) and Ethereum (Arbitrum), the main tokens required to trade on Hyperliquid. You can easily use a fiat on-ramp service like MoonPay to buy USDC, ETH, and other cryptocurrency directly in your wallet using a bank card, Apple Pay, and many more preferred payment methods.

Note: USDC (Arbitrum) is not available to MoonPay customers in New York or Canada.

If you already hold USDC or Ethereum in another wallet, simply swap or transfer it to your connected wallet. If you have USDC or ETH but on a different blockchain network, you can swap or bridge to the Arbitrum network directly in MetaMask and other wallets.

Note: You’ll need to have Ethereum (Arbitrum) to cover the initial gas fee when depositing into Hyperliquid.

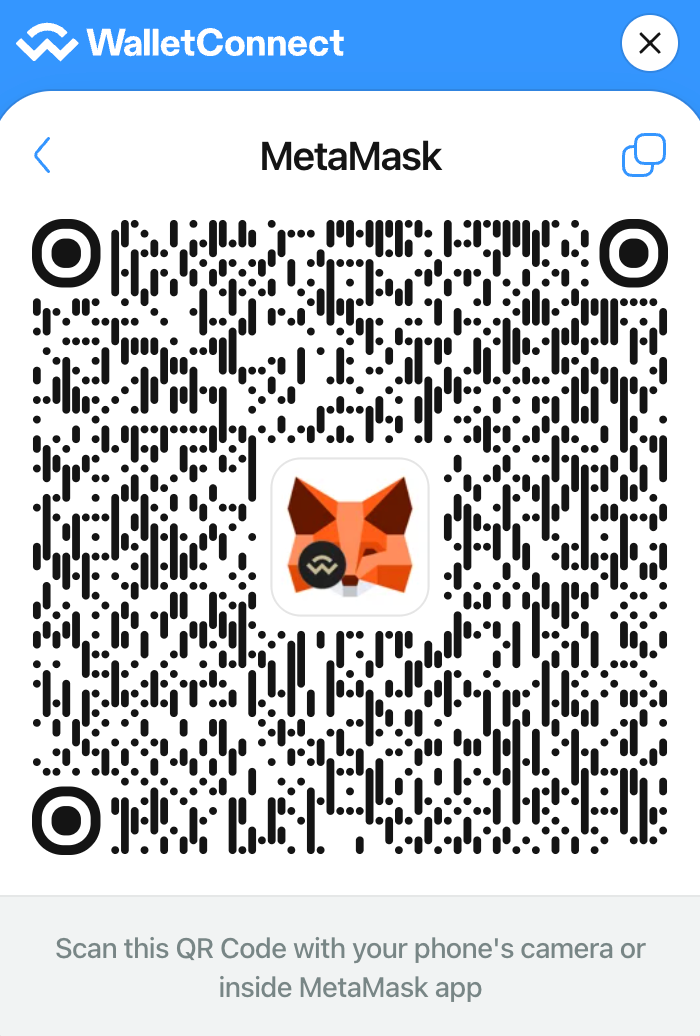

3. Connect Your Wallet to Hyperliquid

Navigate to the official Hyperliquid application and choose the option to connect your wallet. You can connect via WalletConnect to scan a QR code from your mobile phone, or connect via desktop browser extension for wallets like MetaMask and Trust Wallet.

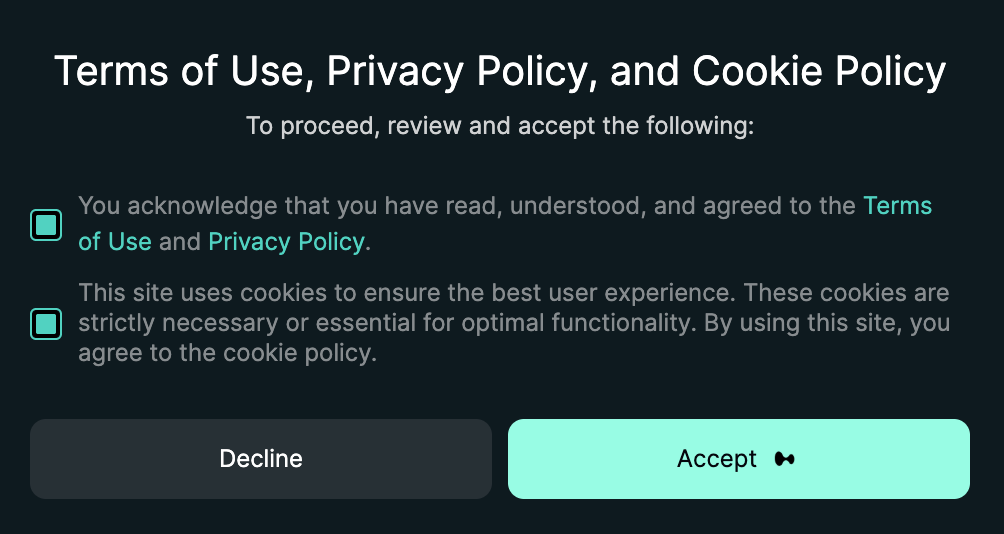

Next, approve the connection in your wallet interface and confirm you are on the correct blockchain network as required by the platform. You will also have to confirm the terms of use of the Hyperliquid platform to continue.

4. Deposit Funds into Hyperliquid on the Arbitrum Network

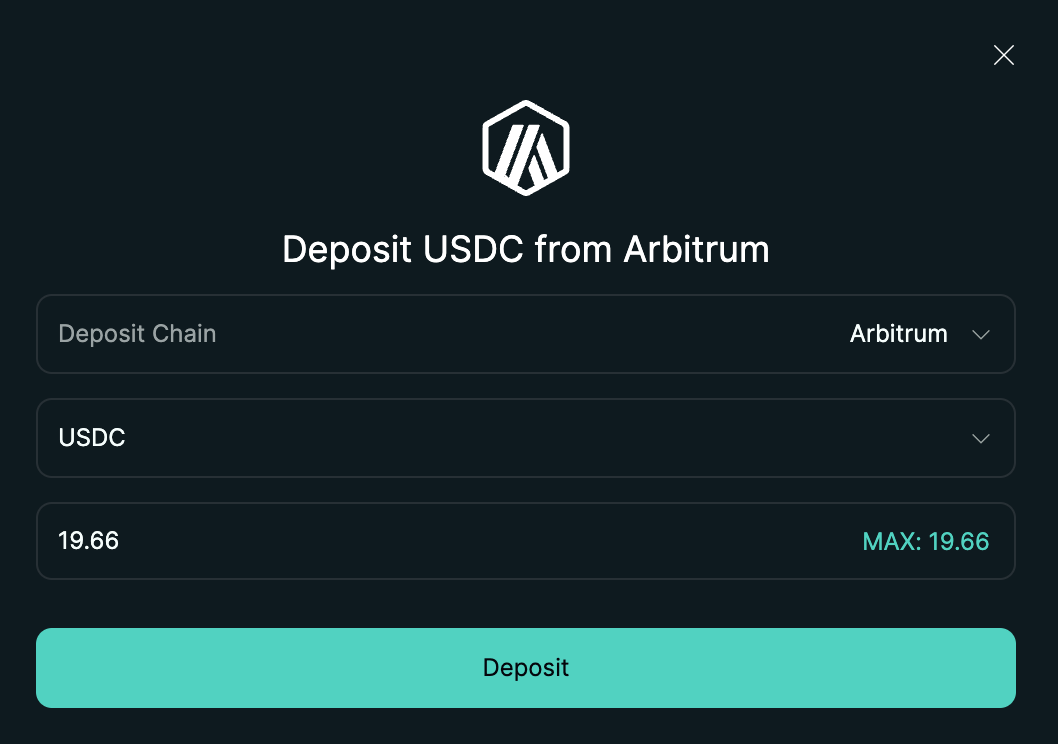

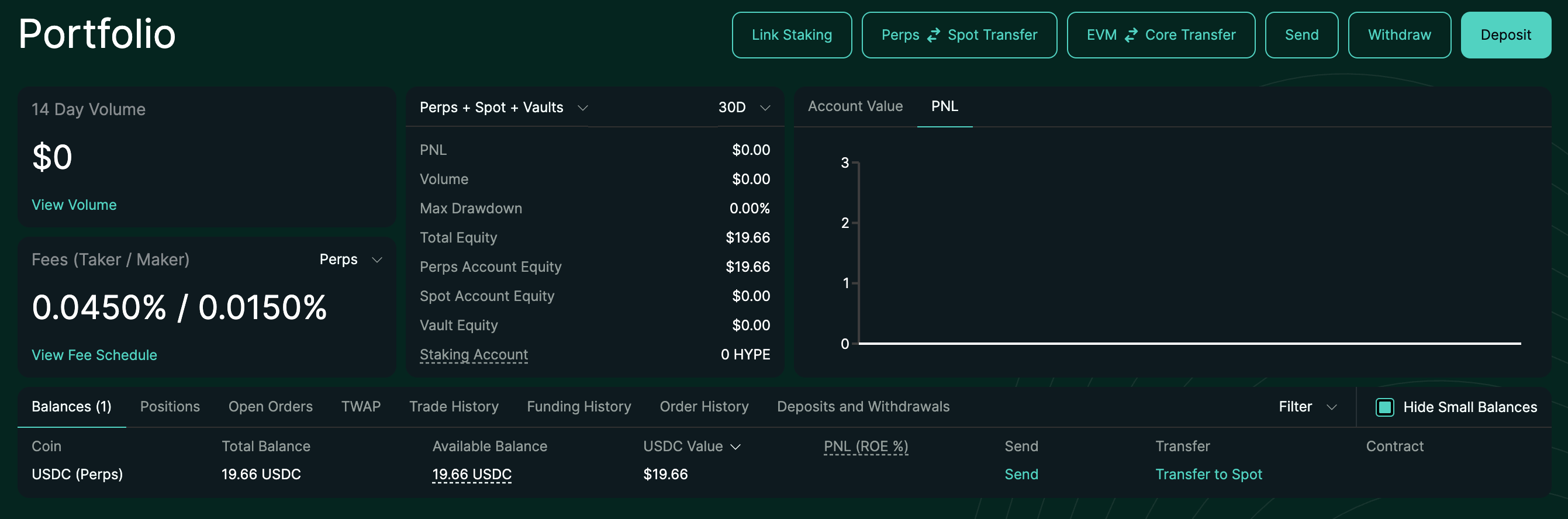

Once your wallet is connected, you'll need to deposit assets like USDC (Arbitrum) from your wallet into Hyperliquid’s smart contract. Head to the Portfolio tab, and then click the Deposit button.

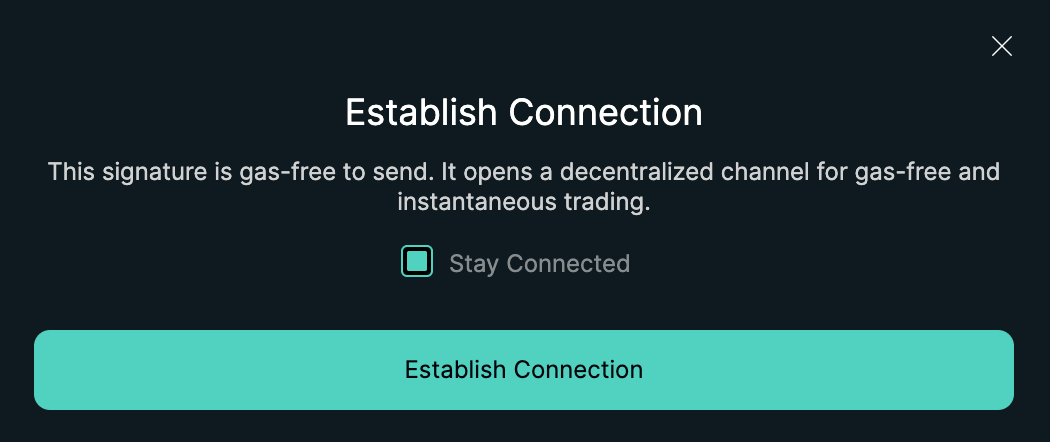

This will prompt a signature in your wallet that you'll need to sign in order to establish a connection with the Hyperliquid protocol. Be sure to confirm this transaction within your wallet (this signature is gas-free).

After you've confirmed the signature to Establish Connection, you can deposit assets into Hyperliquid. The default asset is USDC (Arbitrum), which can be deposited into your Perps balance in just a few clicks.

While Hyperliquid itself is a gas-free platform for trades, be sure that you have enough Ethereum on Arbitrum in your wallet to cover the gas fees associated with the USDC deposit transaction.

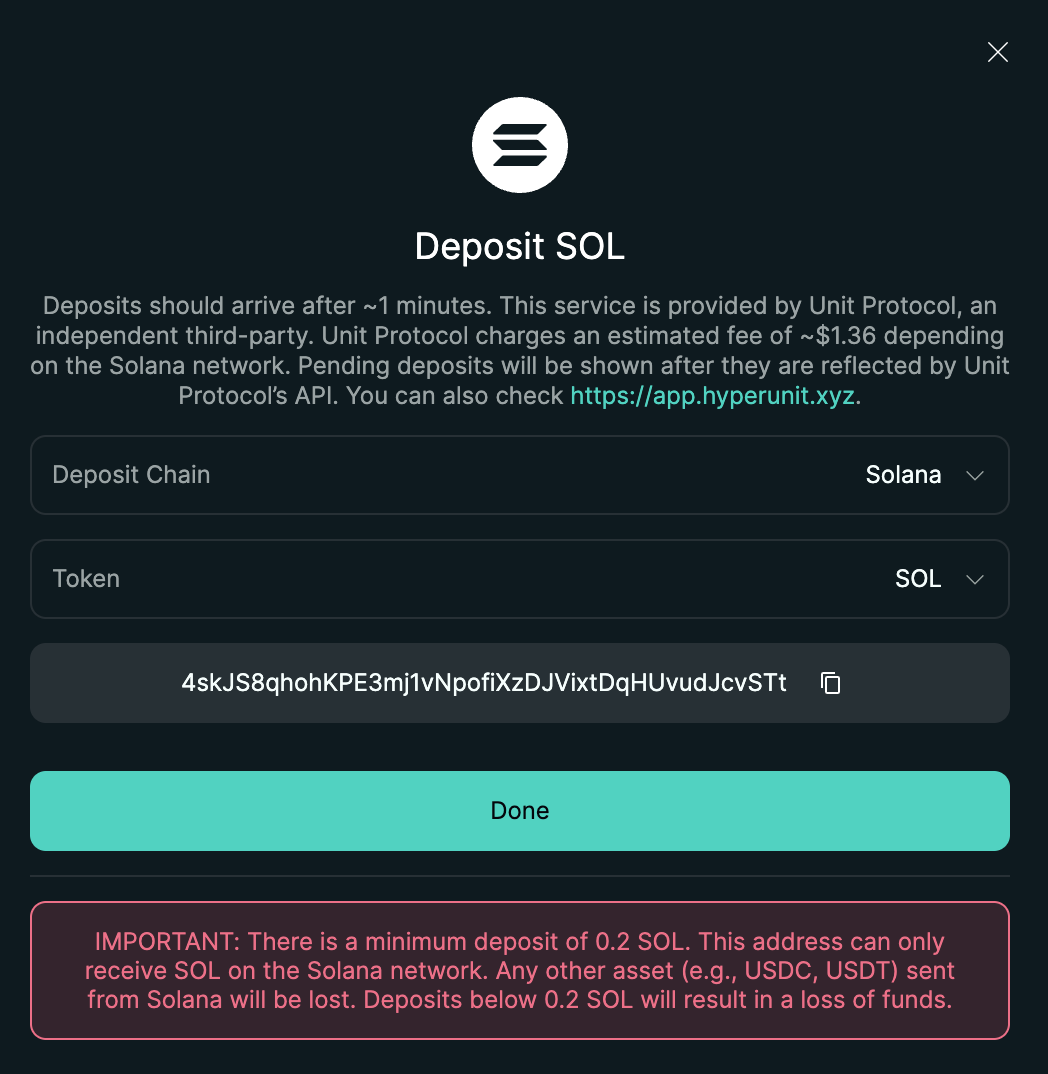

However, if you choose to deposit assets like Bitcoin, Ethereum, Solana, and other tokens, you'll need to manually copy and paste the wallet address into your wallet to send tokens. This will also incur an additional fee of a few dollars on top of any gas fees, since the service is provided by a third party.

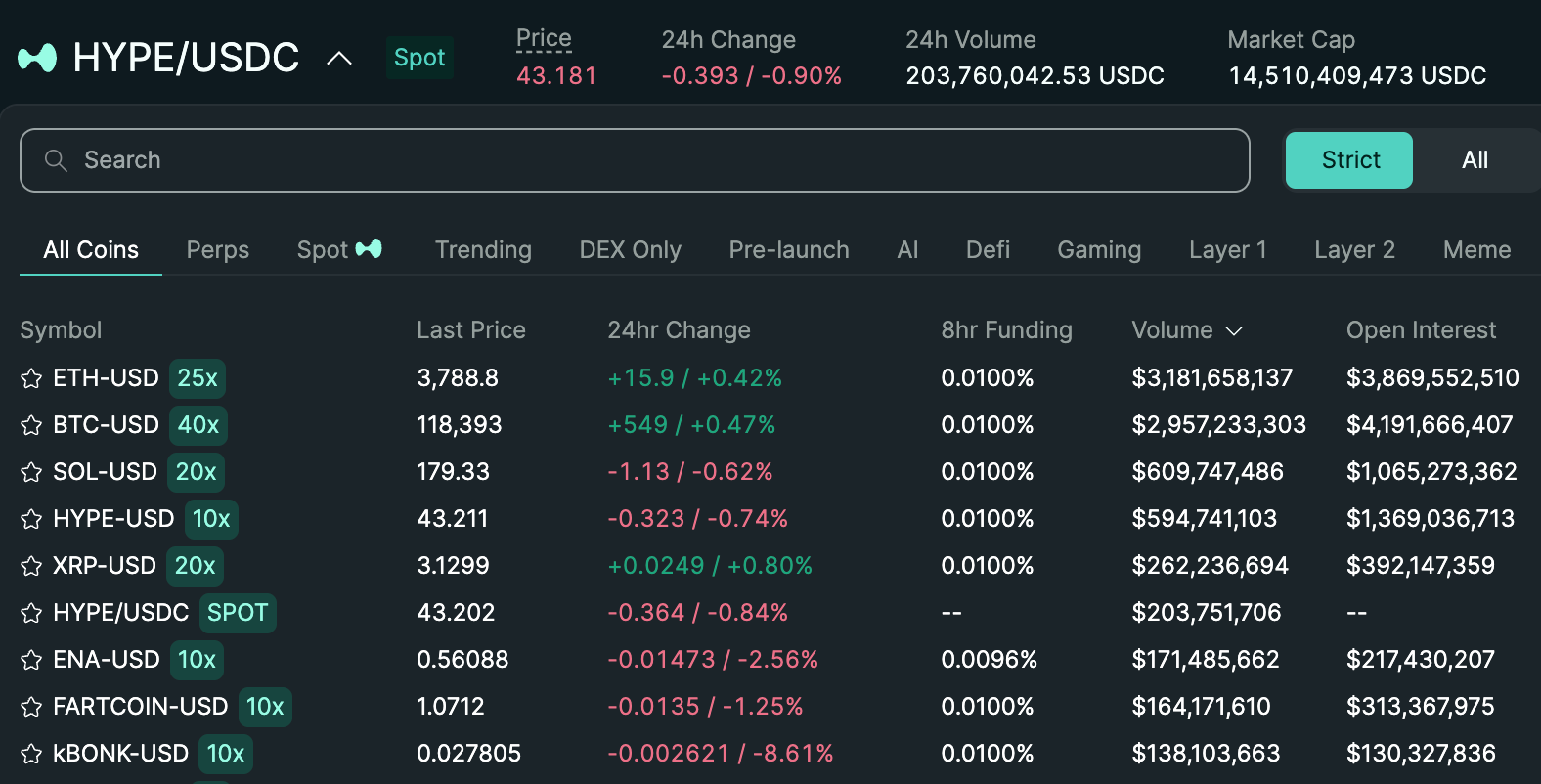

5. Execute Trades

With your assets now available within Hyperliquid, go to the markets section and select the trading pair or contract you wish to trade, such as BTC or ETH perpetuals. Decide on the type of trade you wish to place (market order or limit order), the trading amount, and if applicable, the level of leverage. Then, submit your trade to experience instant, gasless execution.

6. Manage Your Positions

Track your open positions and monitor your performance in the Hyperliquid Portfolio dashboard. You’ll have the flexibility to adjust your margin, close positions, and transfer tokens between your Perps and Spot balances, all directly from the user interface.

7. Explore DeFi tools

You can also take advantage of advanced trading tools like staking and vaults to grow your portfolio.

Staking on Hyperliquid allows users to delegate HYPE tokens to validators on the Hyperliquid L1 blockchain to earn rewards, with payouts depending on the validator’s successful participation in network consensus.

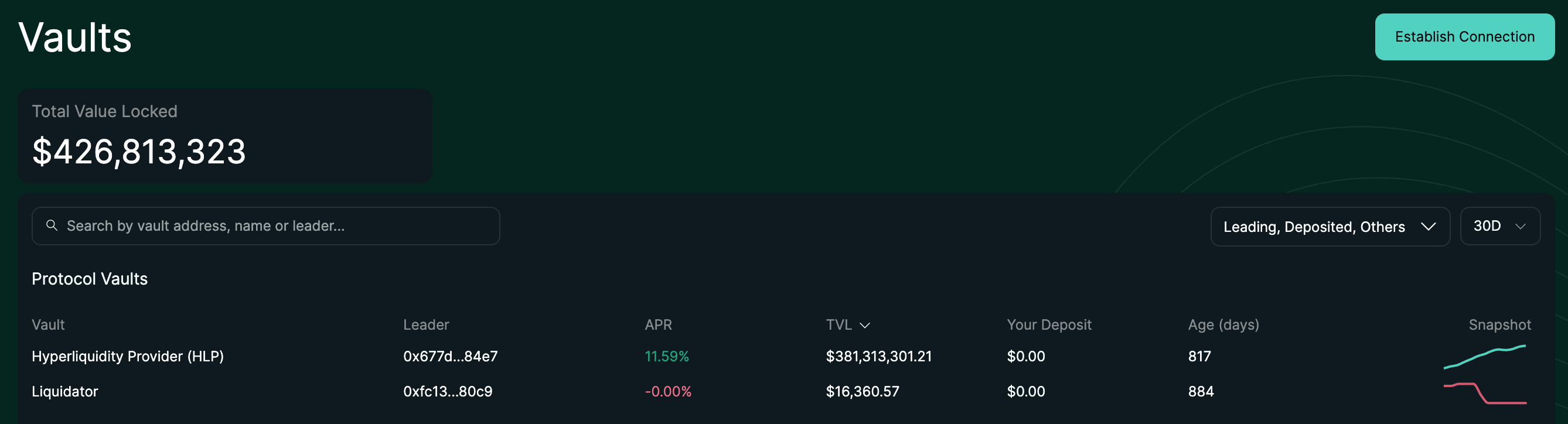

Vaults on Hyperliquid let anyone deposit funds into advanced market making and trading strategies managed by traders or automated systems, sharing in profits while the vault owner typically earns a fee.

Always review each vault’s risks before depositing assets.

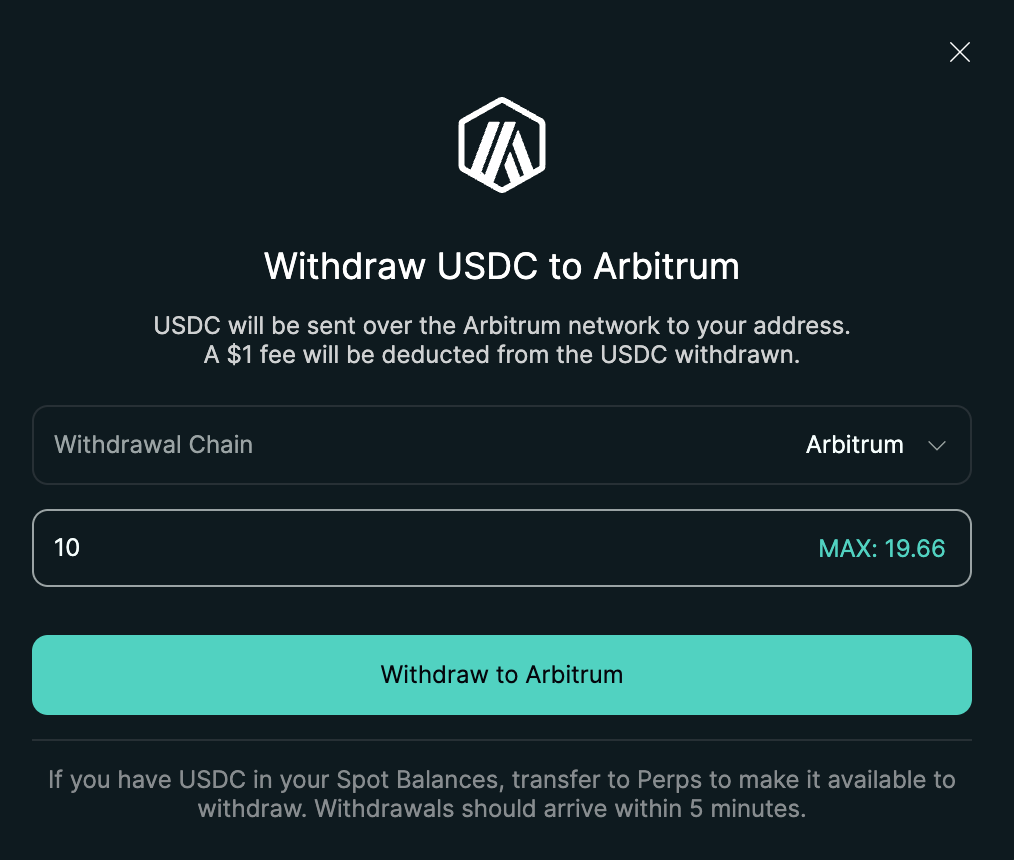

8. Withdraw Funds

When you’re ready to move your assets out, access the withdrawal function on Hyperliquid and follow the on-screen steps to send funds back to your non-custodial wallet. Throughout the withdrawal process, you maintain full control of your assets.

Hyperliquid FAQs

Is Hyperliquid Safe to Use?

While no DeFi platform can be deemed 100% safe to use, Hyperliquid is designed with security in mind. Users keep self-custody of their funds, trades are settled on audited smart contracts, and you connect directly with your own Web3 wallet. The platform undergoes regular protocol updates, has an active bug bounty program, and encourages third-party audits to help protect users.

What Types of Assets Can I Trade on Hyperliquid?

Hyperliquid supports a wide range of popular perpetual trading pairs, including digital assets like BTC, ETH, and others. The platform may also offer selected spot pairs like BTC-USD, ETH-USD, SOL-USD, HYPE-USD, and more. It’s best to check the live marketplace within the app for the most up-to-date list of available trading options.

Are There Fees for Deposits and Withdrawals?

While trading on Hyperliquid is gasless, depositing or withdrawing funds may involve standard blockchain network fees, depending on congestion and the asset you are moving.

To optimize trades for low fees, always review current network conditions and fee structures before making transfers.

Is Customer Support Available?

Hyperliquid offers assistance and resources through its foundation website, Zendesk, and official community channels like X (Twitter).

Can I Use Hyperliquid Directly in My Crypto Wallet?

Yes, you can use Hyperliquid in certain crypto wallets like Phantom. To begin trading perpetual futures contracts in your Phantom Wallet, just click on Perps on your wallet homescreen. Then, fund your perps account with Solana (SOL) and select the perpetual contract from a list of token options like ETH-USD, BTC-USD, SOL-USD, and more.

.png?w=3840&q=90)

.png?w=3840&q=90)