Crypto volatility exists for just about every token you can think of, from Bitcoin (BTC) to Shiba Inu (SHIB). Just as cryptocurrencies can experience euphoric rises, they can also see their price plunge overnight and without warning.

To combat these price swings, fiat-backed stablecoins have emerged as a way for investors to remain in the crypto ecosystem holding a token that historically has lower volatility than most other tokens.

Many stablecoins are pegged to a real-world asset—fiat-backed stablecoins are pegged to underlying fiat currency—as an attempt to offer resistance against the fluctuations (both up and down) to which other coins are susceptible.

Both USDC (USDC) and Tether (USDT) are pegged to the US Dollar and have emerged as the two most popular fiat-backed stablecoins, appearing in most major cryptocurrency exchanges, wallets, and decentralized applications.

If you're considering which stablecoin is a better fit for your needs, it helps to understand how each one functions in the crypto market.

Learn more in this article about the differences between USDC and USDT.

What is a fiat-backed stablecoin?

A fiat-backed stablecoin is a cryptocurrency whose value is pegged to a fiat currency and may be backed by a basket of external assets, such as cash, government bonds, or other assets, in an attempt to keep the price of the crypto asset stable.

For a long time, Bitcoin and early cryptocurrencies could only be exchanged for other crypto tokens or traditional fiat currencies. If you wanted to swap tokens, there was no way to move into a fiat-backed asset without exiting the cryptocurrency ecosystem altogether.

This is where stablecoins stepped in.

Through fiat-backed stablecoins, many crypto traders can actually remain in the cryptocurrency ecosystem by holding a digital currency that is historically less volatile than many other tokens and can be exchanged 24 hours a day without having to directly convert to fiat currency.

What is USDT (Tether)?

USDT is a fiat-backed stablecoin first issued by Hong Kong-based Tether Limited in 2014 in order to bridge the gap between cryptocurrency and fiat currency.

When it was launched, Tether gave users access to a platform-agnostic, blockchain-based, and fiat-backed stablecoin that was pegged to the US Dollar that held many of the technical advantages of cryptocurrencies like Bitcoin and Ethereum, but was designed to have less volatility than crypto assets.

Tether tapped into the best of both worlds, and created a permissionless way to send a new type of crypto asset to anyone with speed, transparency, and low cost. This paved the way for other stablecoins, opening up the use case of cryptocurrencies to remittances, payments, and more.

Upon its release, hundreds of cryptocurrency trading pairs began listing against USDT, giving the coin a first-mover advantage in the fiat-backed stablecoin market.

As of time of publication, there are more than 112 billion USDT tokens circulating on most major blockchains, including Bitcoin (BTC), Ethereum (ETH), Eos (EOS), Algorand (ALGO), Tron (TRX), and more.

Up-to-date Tether price, circulation, and market cap information is available here.

Tether is the one of the crypto market's most popular trading pairs by volume, and can be used on crypto exchanges to buy or swap for hundreds of other cryptocurrencies. USDT stablecoins allow anyone to transact cheaply and quickly, and potentially generate interest on decentralized finance protocols, including yield farming, staking, and liquidity pools.*

However, Tether is not a MICA-compliant issuer, so trading USDT in Europe involves more risk and presents less safeguards than other MiCA-compliant stablecoins. Because there is no MiCA-compliant issuer, USDT may present higher risk in Europe relating to redemption, transparency and disclosures. Additionally, there may be very few options to sell USDT in Europe. MoonPay encourages its European customers to only trade stablecoins with issuers authorised under MiCA.

*These decentralized finance protocols also present a risk of loss and you should do your own research before making any decisions on whether to participate.

USDT also gives merchants a way to accept cryptocurrency payments denominated in a fiat currency, instead of more volatile cryptocurrencies.

USDT volume and market cap

USDT has consistently stayed in the top 5 of all cryptocurrencies in terms of market cap and trade volume, often exceeding the daily trading volume of Bitcoin.

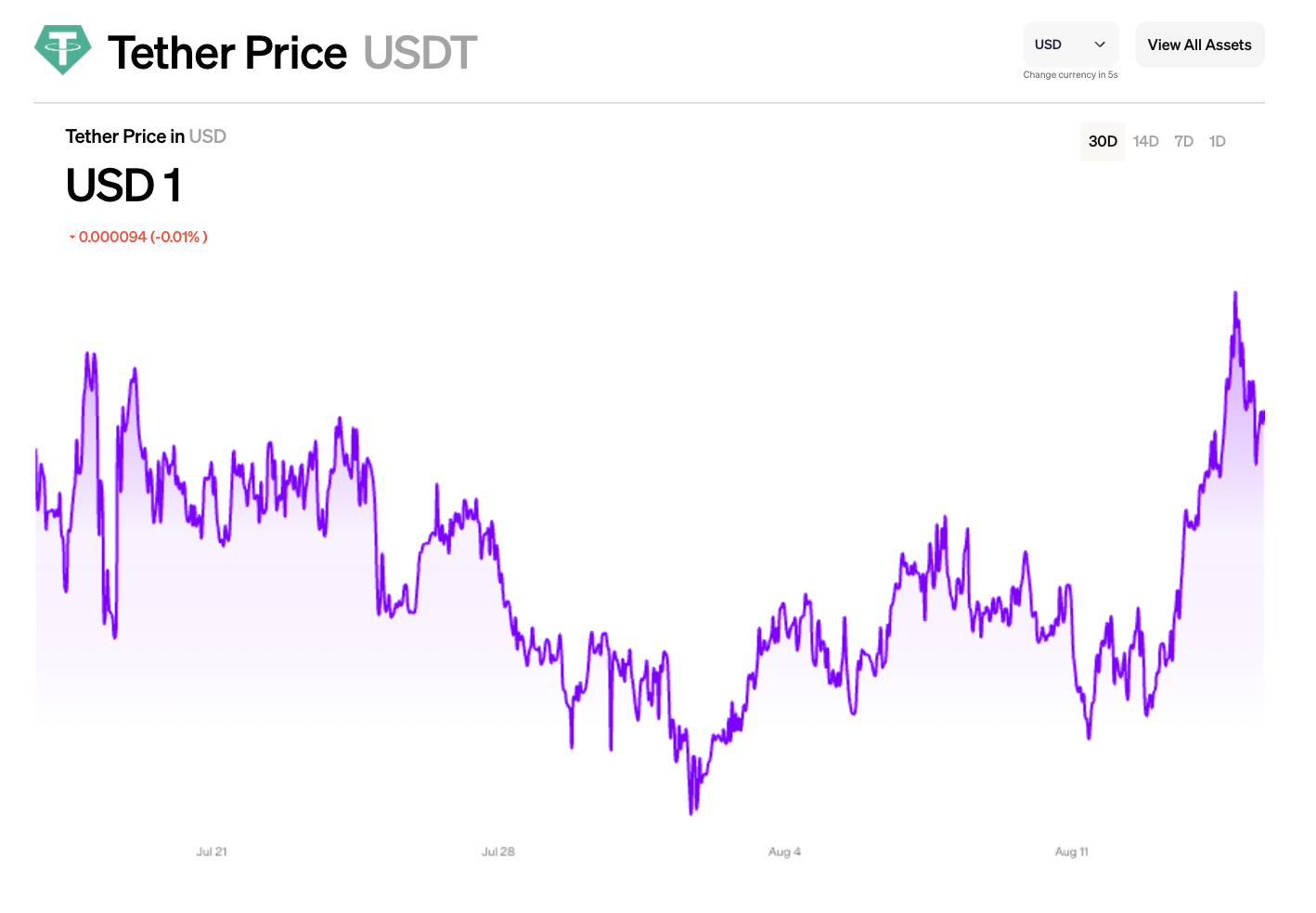

USDT stability

USDT has been designed to be pegged to the US dollar and Tether Limited claims that USDT is fully backed by its reserves, as an attempt to maintain USDT's value at $1.

While there can occasionally be slight fluctuations in price of a few cents, the market has historically corrected itself to return the USDT price to about $1.00.

What is USDC?

USDC is a fiat-backed stablecoin pegged to the US dollar on the Ethereum blockchain, created by Circle and Coinbase in 2018. Like USDT or any other fiat-backed stablecoin pegged to USD, its goal is to have a steady price of $1.

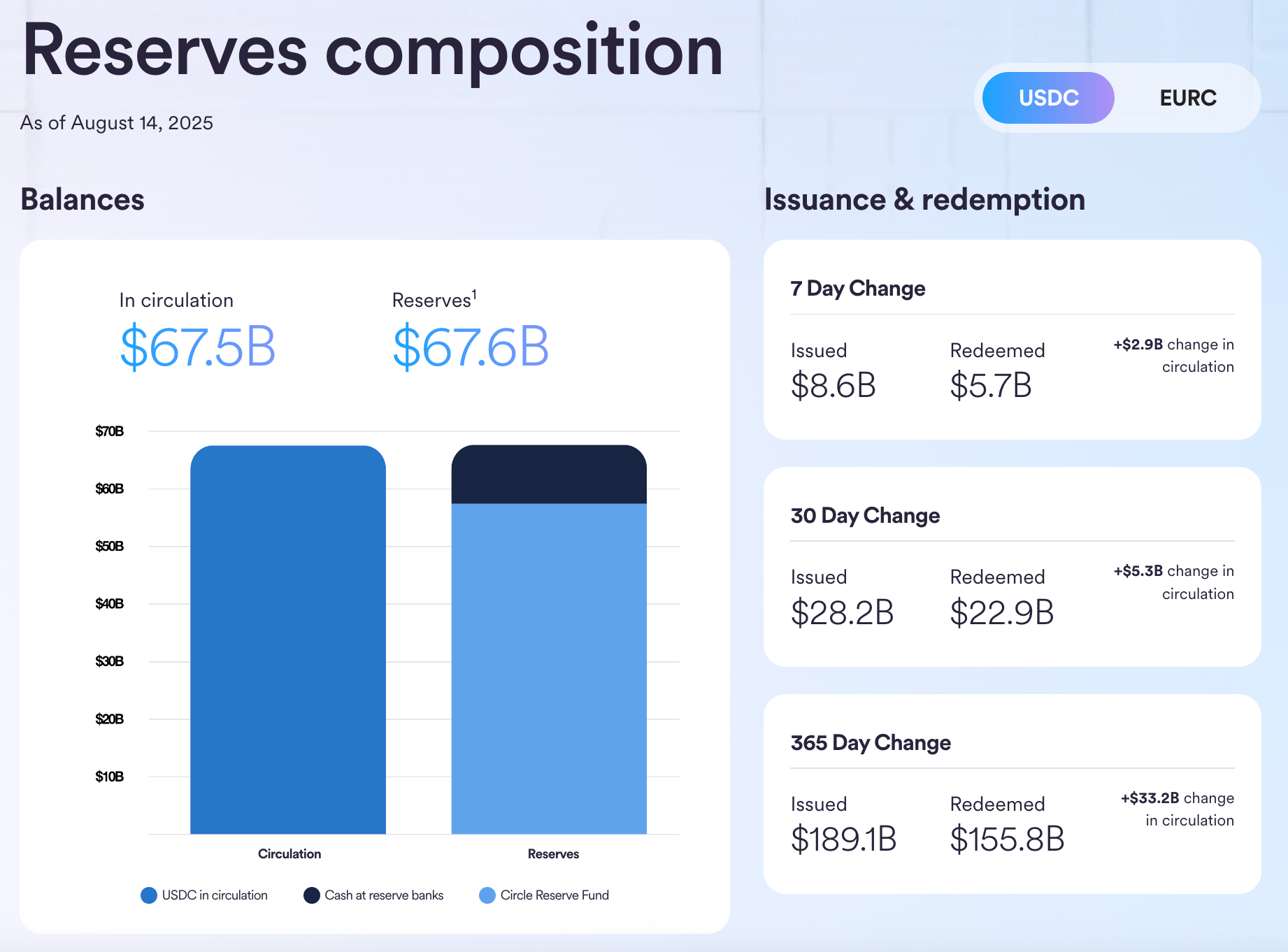

As with USDT, Circle tries to maintain a stable value and price of $1 by asserting that USDC is fully backed by its reserves.

Previously, the USDC token was called USD Coin and governed by the Centre Consortium, made up of a group of crypto-based companies including Circle and Coinbase. However, in 2023, Centre announced that they would be shutting down. As a result, Coinbase took an equity stake in Circle, and Circle itself took full control over the USD stablecoin, including issuance and governance.

Circle oversees the technical and financial standards for USDC stablecoins and claims to provide transparency around a true 1-to-1 backing. This means that for every USDC created, $1 of USD is held in reserve in the form of US Dollars and other cash equivalents.

As of time of publication, there is a circulating supply of over 32 billion USDC, with an equal dollar amount in reserves.

Up-to-date USDC price, circulation, and market cap information is available here.

Only approved regulated financial institutions that meet Circle's membership framework can issue USDC tokens, which allows for the sustainable growth of the USDC ecosystem.

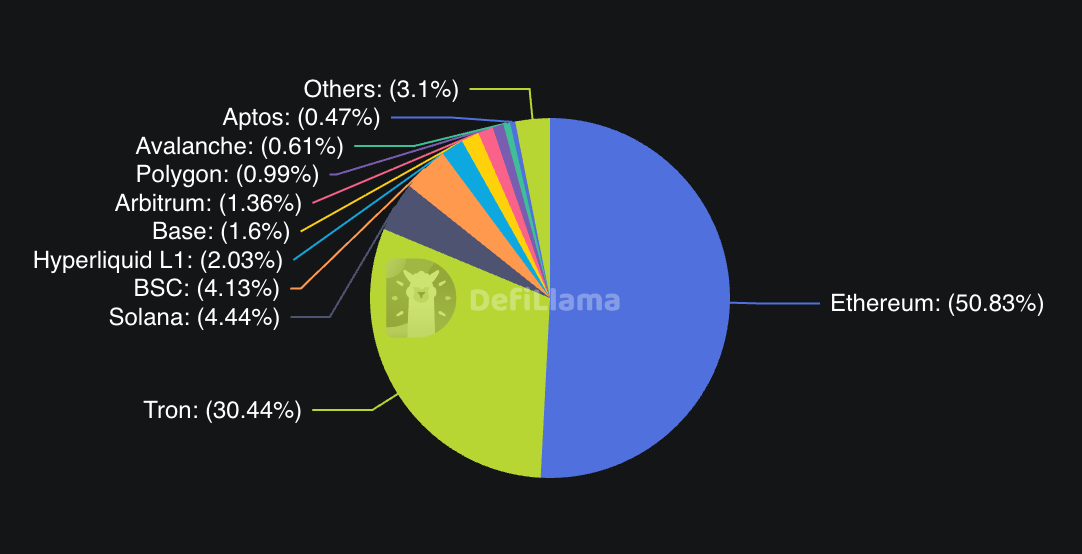

USDC is available on most major exchanges and cryptocurrency providers. Like USDT, USDC can be sent and received by any wallet or exchange that is ERC-20 (Ethereum) compatible, along with many other blockchains such as Algorand, Stellar, Binance Smart Chain, Hedera, Tron, Solana, and more.

Circle Internet Financial Europe SAS is a French electronic money institution that has complied with the requirements of MiCA, so USDC is a fully MiCA-compliant stablecoin. USDC is therefore obligated to comply with a number of requirements related to transparency, redemption, and disclosures, that may make it more appropriate for European customers.

The UK also plans on regulating fiat-backed stablecoins in the near future.

USDC volume and market cap

USDC often ranks in the top 10 of all cryptocurrencies in terms of market cap and daily trading volume, usually behind that of USDT.

.png)

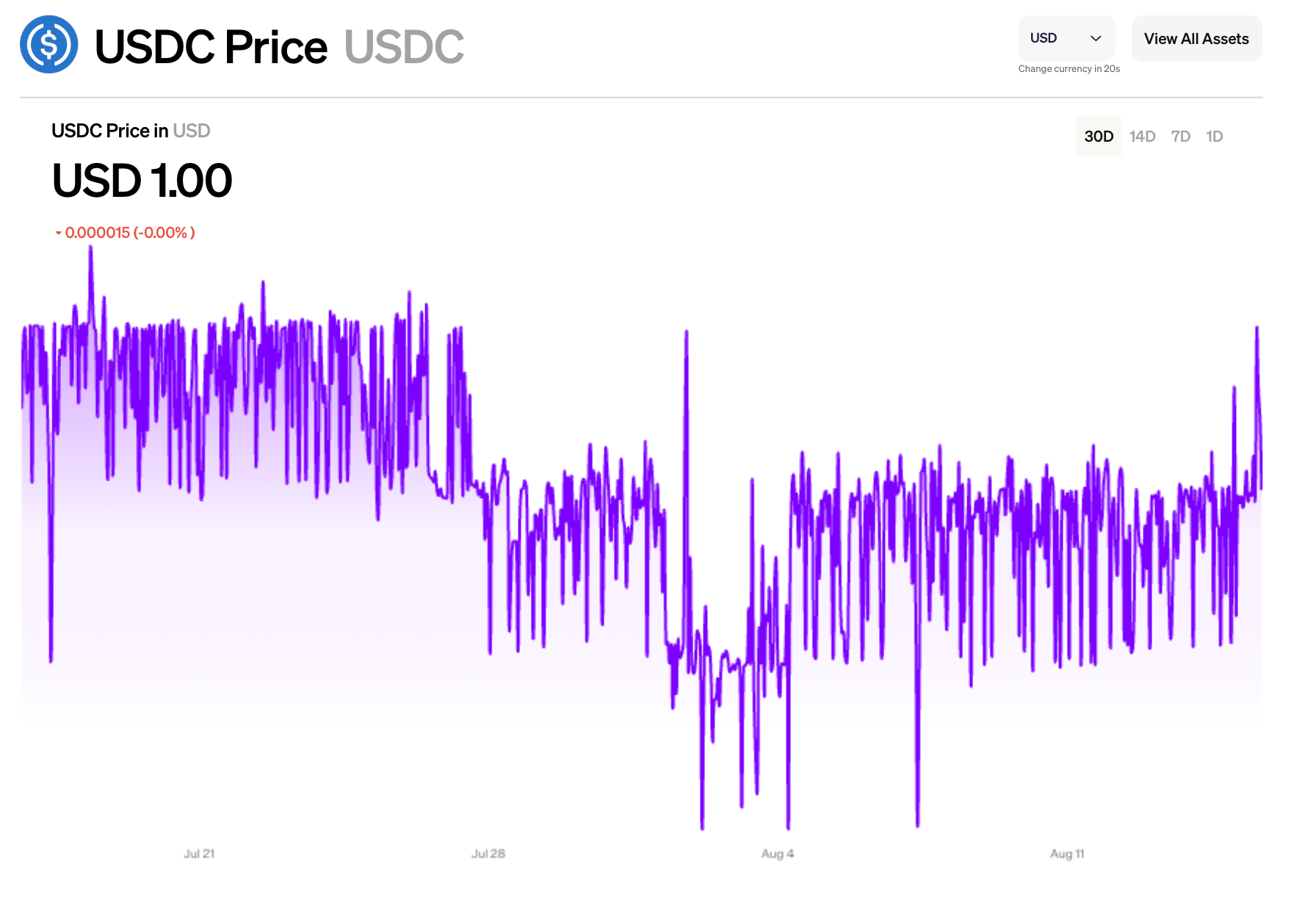

USDC stability

As mentioned above, Circle tries to maintain a stable value and price of $1 for USDC by backing it 1:1 with a reserve of assets. There can be slight fluctuations with any fiat-backed stablecoin and usually these are quickly corrected, bringing the price back to $1.

In March, 2023, however, the value of USDC ‘de-pegged' and fell to just below $0.90 after the failure of Silicon Valley Bank. (This USDC de-pegging event also caused the price of USDT to temporarily increase above $1.)

USDT vs USDC: Main differences

Although USDT is used more frequently for trading and payments, USDC is viewed by some as a safer stablecoin. This is because Circle has its reserves attested to by an independent auditor monthly, while Tether's attestations occur quarterly.

Feature | USDT (Tether) | USDC (formerly USD Coin) |

Issuer | Tether Limited | Circle |

Year Launched | 2014 | 2018 |

Price Peg | 1 USDT = 1 US Dollar | 1 USDC = 1 US Dollar |

Blockchains Supported | 10+ | 10+ |

MiCA/Regulatory | Not compliant | MiCA-compliant |

Reserves/Audits | Mixed, daily updates | 1:1, monthly audits |

Transparency | Lower | Higher |

Trading Volume | Highest | High |

Usage | Trading, global | DeFi, compliance |

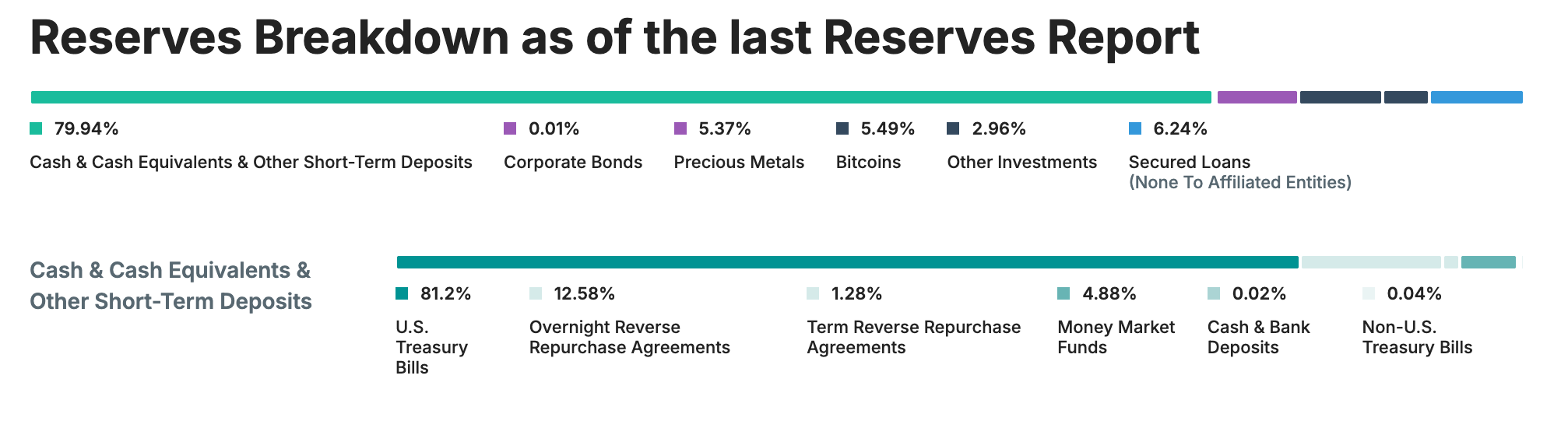

Additionally, Circle's reserves for USDC appear to consist of only U.S. Treasury securities and cash. Tether's reserves for USDT appear to consist of U.S. Treasury securities, short-term repurchase agreements, money market funds, cash, non-U.S. Treasury bills, corporate bonds, precious metals, bitcoins, ‘other investments', and secured loans.

Trading pairs

Both USDT and USDC are popular choices to be used as swapping pairs on DeFi (decentralized finance) protocols. With USDT's 4-year head start, they have long been the most widely-used stablecoin with the highest consistent trading volume. USDC has since closed the gap somewhat, and is now available for use on many of the same blockchains as Tether.

Safety and transparency

In the past, USDT received some scrutiny due to Tether's hesitance to release complete and frequent updates on how the coin is backed. On the other hand, USDC's parent company Circle has consistently released regularly audited reports on their reserves.

Although they eventually released a breakdown of their reserves in March, 2021, Tether fought to prevent their reserve composition from going public, even going so far as asking the New York Supreme Court to block the state Attorney General from releasing documents to CoinDesk after the latter filed a Freedom of Information Law (FOIL) request.

Since then, Tether has taken steps to become more transparent by publishing the contents of their reserves and providing daily updates. While this is a good start, there are still some, such as the Commodity Futures Trading commission, calling on Tether to perform a full audit. One former Tether auditing firm was even fined $1 million by the SEC for what they considered "sloppy accounting work".

USDC, on the other hand, has historically provided more information about its reserves. Circle releases monthly audits into their reserves by accounting firm Grant Thornton LLP. They also pledged to only own US dollars and short term treasury bills.

“There's a reason why USDC is regulated and supervised by banking regulators under the same laws that supervise the balances you hold on PayPal or with Apple or with Square,” Circle CEO Jeremy Allaire told the Brookings Institute. “Those things have applied to us since day one. And those statutes exist so that people have confidence in these electronic payment systems. And I think that's really important.”

Stablecoin regulation

In recent years, the Biden administration published reports calling for greater regulation of stablecoins, and the Treasury Department has been pressuring Congress to pass legislation requiring stablecoin issuers to become insured depository institutions (similar to a bank).

The markets in crypto assets regulation (MiCA) came into force in the European Union on June 30, 2023, and its rules on fiat-backed stablecoins (referred to as electronic money tokens) have started to apply on June 30, 2024. USDC complies with MiCA. USDT does not comply with MiCA. MoonPay generally encourages its European customers to trade stablecoins with issuers who are authorised under MiCA and comply with MiCA’s requirements and USDC may therefore be more appropriate for European customers.

Since stablecoin regulatory compliance is an ongoing process, it's vital that issuers take the precautionary steps necessary to not be caught off guard once more laws are passed.

Recent developments in USDT, USDC, and other stablecoins

The stablecoin market has rapidly evolved in the last few years. Here are the most important updates and trends for USDT, USDC, and global stablecoin regulations:

Key developments

Regulation and MiCA compliance

Europe’s MiCA (Markets in Crypto-Assets) regulation requires stablecoins to meet certain compliance standards. USDC is the only top-ten stablecoin to achieve fully MiCA-compliant status, while USDT is not authorized under these rules. Circle’s USDC and EURC are now uniquely positioned to serve the EU, with many European platforms increasingly favoring MiCA-compliant options.

USDC governance changes

In 2023, Centre Consortium (the joint governance body by Circle and Coinbase) dissolved, with Circle taking full control over USDC issuance and policy. This act simplified the governance structure, making Circle the clear decision-maker for all USDC operations and regulatory compliance.

Transparency & attestation improvements

Both Tether (USDT) and Circle (USDC) increased the frequency and detail of their reserve disclosures. Tether began publishing daily breakdowns (not audits), while Circle continues monthly audits by a major accounting firm.

Expanded blockchain support

Both stablecoins now operate on a vast range of networks. USDT and USDC can be held on Ethereum, Solana, Polygon, Tron, Base, Arbitrum, Optimism, and more, making them among the most portable stablecoins for on-chain transactions.

Pro tip: You can purchase both USDT and USDC on multiple blockchains via MoonPay, in supported jurisdictions.

Emergence of institutional stablecoins

New, regulated entrants like PayPal USD (PYUSD) and “tokenized deposit” stablecoins are being launched by major fintechs and banks, increasing competition and regulatory pressure on legacy stablecoins like USDT and USDC.

USDT or USDC: Which should you use?

There is no definitive answer when it comes to using USDT vs USDC.

If you're interested in participating in a specific blockchain or DeFi protocol, then you'll need to make sure the stablecoin you select is supported on that network. USDC and USDT can both be used for lending, staking, and providing liquidity for trading pairs, though the returns and functionality for each may vary.

%20(1)-3.png)

Both stablecoins have their own use cases within different DeFi ecosystems. For example, if you want to access Solana DeFi trading on MoonPay, then USDC (SOL) is the right choice. Just hold USDC in your MoonPay Solana Account to quickly trade for any supported Solana token with low fees.

FAQs about USDC and USDT stablecoins

Which is safer: USDT or USDC?

While no stablecoin can be deemed 100% safe, USDC generally offers greater transparency and regulatory compliance, with regular audits and 1:1 USD cash reserves. USDT is more widely-used and has a higher market cap, but its reserves and transparency have been historically more controversial. For European users, USDC’s MiCA compliance adds an extra layer of protection.

How can I generate revenue with USDT and USDC?

DeFi has become so popular because it offers a number of different services that allow a holder of certain tokens, including fiat-backed stablecoins, to generate additional revenue from crypto holdings. One such option is to earn interest by lending your tokens on a variety of platforms.

You'll have complete control when choosing where to invest your money compared to doing so with a standard bank. If you're interested in the metrics at a given time, DefiLlama has several convenient tools where you can view the yield rankings and current APY for different stablecoins.

Of course, there are always risks associated with any potential staking or lending returns, and it's important to do your own research to understand each platform and financial instrument.

Can I use USDT and USDC on the same networks?

Yes, both USDT and USDC are available on blockchain networks like Ethereum (ERC-20), Tron (TRC-20), Solana (SPL), Polygon, and other major chains. Always check the correct token standard and network before buying, sending, or receiving stablecoin tokens.

Are there other USD stablecoins?

With multi-billion-dollar market capitalizations, USDT and USDC are the most popular stablecoins used today. But they are not the only ones.

For example, there is Dai (DAI), an Ethereum-based stablecoin alternative, PayPal USD (PYUSD), a stablecoin created by the payment provider giant, as well as many other USD stablecoins that function across a range of blockchains. Just like every other crypto asset, stablecoins are designed to function on a specific blockchain network.

Just like USDT and USDC, DAI attempts to maintain a price equal to $1, but that doesn't mean it is completely interchangeable—the stablecoin you choose to purchase will depend on which blockchain and applications you wish to interact with.

Can I swap USDT for USDC?

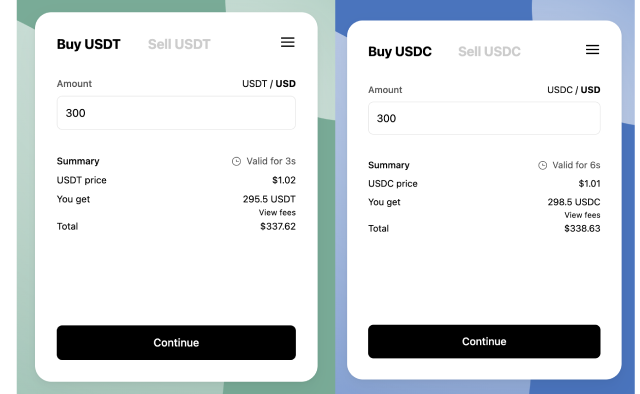

There are many crypto exchanges and applications that allow you to convert USDC to USDT and vice versa. When researching exchange platforms, you should make sure that they support the coins you want to trade, and pay attention to conversion rates and fees.

MoonPay makes it easy to swap crypto assets like USDT and USDC, along with many other trading pair combinations.

How can I buy USDT and USDC stablecoins with fiat currency?

MoonPay Balance is an easy way to purchase USDC and USDT using fiat currency. To begin, top up your wallet in euros, pounds, or dollars and use your MoonPay Balance for buying cryptocurrencies like USDC and USDT. Once funded, use your balance for faster, cheaper transactions and higher approval rates. When you're ready to withdraw, enjoy zero-fee transfers straight to your bank account.

Is USDT a more widely-used stablecoin than USDC?

Both USDT and USDC have seen popular adoption across cryptocurrency exchanges, wallets, on-ramps, and other applications. However, USDT generally has a much higher market capitalization, circulating supply, and trading volume than USDC.

Can I use stablecoins for daily transactions?

Fiat-backed stablecoins like USDT and USDC are often supported by merchants that accept crypto payments. Exact coverage will depend on the specific merchant, but fiat-backed stablecoins provide a convenient way to transact cryptocurrencies with less price volatility than many other digital assets.

How do regulations affect which stablecoin I should use?

The question of stablecoins has long been a hot button issue among regulators, as covered above. The SEC and US regulators, for example, have had stablecoins like USDT and USDC in their crosshairs for years, so it's important to pay attention to web3 and traditional news sources for breaking developments regarding stablecoin regulatory compliance.

In Europe, the MiCA regulation governs stablecoins. USDC complies with MiCA, while USDT does not.

Can USDT or USDC “depeg” from $1?

Both USDC and USDT have experienced brief “depegging” events. However, speedy issuer action typically restores the peg, though risk remains, especially if reserves are compromised or regulatory action occurs.

Always do your own research before buying, holding, or using stablecoins in DeFi or other crypto applications. Even stablecoins carry risks, including loss of peg and regulatory changes, so only use reputable platforms and never invest more than you can afford to lose.

How to buy USDT and USDC

You can buy USDT and USDC via MoonPay or through any of our partner wallet applications with a credit card, bank transfer, Apple Pay, Google Pay, and many other payment methods.

Just enter the amount of USDT or USDC you wish to purchase and follow the steps to complete your order. MoonPay makes it easy to buy USDC and USDT, and send to any custodial or non-custodial crypto wallet.

Where to sell USDC and USDT

MoonPay makes it easy to sell USDT and USDC for fiat currency when you decide it's time to cash out your crypto.

Simply enter the amount of USDC or USDT you'd like to sell and enter the details where you want to receive your funds.

Alternatively, if you have USDC (SOL) in your MoonPay Account, you can use it to trade for Solana SPL tokens like Solana (SOL), Bonk (BONK), OFFICIAL TRUMP (TRUMP), USDT (SOL), and much more.