Cryptocurrency has established its place in the financial world during the last decade, with thousands of digital assets currently on the market. Popular tokens like Bitcoin and Ethereum offer an alternative to traditional finance when it comes to trading and investment.

One of the key metrics that investors often consider when evaluating cryptocurrencies is market capitalization, also referred to as "market cap." But what is market cap, and what effect does it have on cryptocurrencies and the web3 space?

This article explains what market capitalization is, how it's calculated, why it's important, and the main factors affecting it.

Disclaimer: The following is for informational purposes only and should not be construed as financial advice.

What is market cap?

Market capitalization (or market cap) is a metric used in both traditional finance and cryptocurrency markets. It represents the total value of a specific cryptocurrency and can be calculated by multiplying the current price per token by the total number of coins in circulation.

In traditional finance, market capitalization allows you to assess a company’s size, value and potential for future growth. In cryptocurrency too, this metric helps users to understand the relative size and growth potential of cryptocurrencies like BTC and ETH.

Market caps can be broken into categories primarily based on total value, often denominated in fiat currency like US dollars or euros. Just as there are large-cap companies, mid-cap companies, and small-cap companies in the business world, there are also large-cap, mid-cap, and small-cap cryptocurrencies in the web3 world.

Classifying market caps into these categories can help differentiate between cryptocurrencies with different levels of risk and growth potential, while using different value ranges.

To put it another way, you can think of market cap as a reflection of any given cryptocurrency's popularity and significance in the crypto ecosystem at a specific time.

But how do you calculate market cap in crypto?

How to calculate market cap

Calculating market cap is a simple process, and is based on the following formula:

Market Cap = Current Price per Token x Circulating Supply

Similar to how a traditional company's market cap is calculated by multiplying its stock price by the total number of shares outstanding, the market cap of a cryptocurrency is calculated by multiplying its price per token by the total number of tokens in circulation.

For example, if a cryptocurrency has a price per token of $100 and a circulating supply of 1 million tokens, its market cap would be $100 million.

If you're still confused, we'll break down these components further when we consider factors that affect this vital metric.

Why is market cap important?

Understanding market cap is essential for anyone involved in the cryptocurrency space, from traders to developers and enthusiasts.

Here are several important purposes that market capitalization serves in the world of cryptocurrency:

- Relative size: Market cap allows you to gauge the relative size of a cryptocurrency within the broader crypto marketplace. It provides a standardized method for an investor to gauge how large or small a cryptocurrency is in relation to others.

- Assess risk: Understanding the market cap of a cryptocurrency can be helpful in assessing its risk profile.

- Liquidity indicator: Market cap can be indicative of a cryptocurrency's liquidity, the ease in which a token can be traded for crypto assets or fiat money. Cryptocurrencies with higher market caps often have greater liquidity and higher trading volume, making them easier to buy and sell via cryptocurrency exchanges, wallets, and on- and off-ramps.

- Investor confidence: Many investors use market cap as one of the guiding factors to determine whether a cryptocurrency is a viable investment option. Factors like market capitalization and dominance can help identify potential investment opportunities, assess risk and gauge a token's acceptance within the crypto community.

Now that we have an understanding of what market cap is and why it's important, let's examine some of the factors that can affect a cryptocurrency's market capitalization.

Factors affecting market cap

Market cap can change over time due to various factors. Understanding them is essential for anyone looking to make informed investment decisions:

Circulating supply vs. total supply

Circulating supply

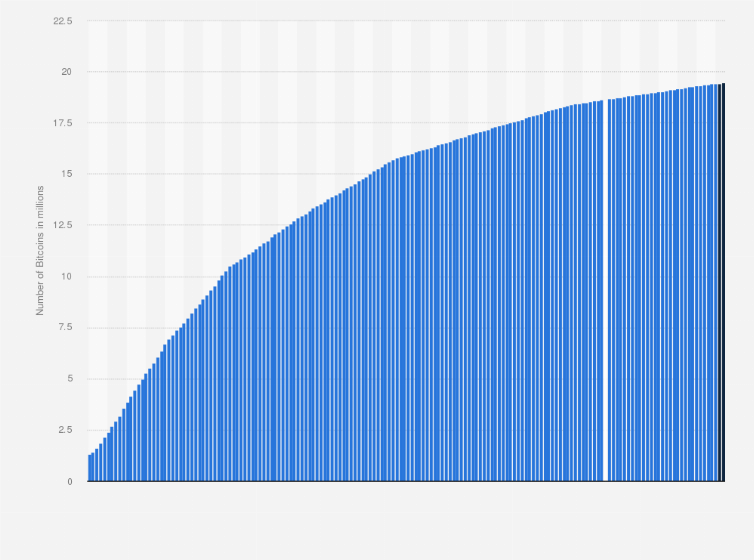

Circulating supply is the number of coins that are currently in circulation and available for trading. It excludes tokens that are held by the project's founders, locked in smart contracts, or otherwise inaccessible.

Total supply

Total supply, on the other hand, is the maximum number of cryptocurrency tokens that will ever be created or exist on the blockchain, including coins that are not in public circulation. Some cryptocurrencies, like Bitcoin, have a fixed total supply, while others may have mechanisms for creating additional tokens over time.

Price per cryptocurrency token

The price per cryptocurrency token is determined by the current market value of a single unit of the cryptocurrency in your chosen currency, such as USD or EUR.

Price fluctuations can significantly impact a cryptocurrency's market cap, as even small movements in token price can lead to substantial changes in overall market capitalization.

Generally, an increase in the price per token leads to an increase in the market capitalization of the cryptocurrency, while a decrease in the price per token will result in a decrease in market capitalization.

View our Bitcoin Price and Ethereum Price pages for live price and market data for these leading cryptocurrencies.

Market sentiment

Positive news and adoption by major institutions can boost market sentiment and drive up demand for a particular cryptocurrency. This increased demand can lead to higher prices and, subsequently, a higher market cap.

Conversely, negative news, security breaches, or regulatory crackdowns can all erode investor confidence, leading to a drop in prices and market cap.

Before investing, it's important to be vigilant about monitoring news and sentiment in the crypto space.

Trading volume

Trading volume represents the total amount of a cryptocurrency traded within a specific time frame, usually 24 hours. High trading volume is often associated with larger-cap cryptocurrencies, and indicates a liquid and active marketplace. On the other hand, a cryptocurrency with low trading volume may face challenges in maintaining a stable market cap.

It's essential to also consider the quality of trading volume, as some exchanges may engage in wash trading or other manipulative practices.

Economic factors

The status of the general economy can also affect a cryptocurrency's market capitalization.

A healthy economic environment (such as a bull market) will generally raise a cryptocurrency's market capitalization, while a depressed economy (such as a bear market) may lower the market cap of a cryptocurrency.

Market cap and investment strategies

Market cap plays a vital role in shaping investment strategies in the cryptocurrency space, allowing investors to make informed investing decisions, formulate a comprehensive strategy, and evaluate growth potential and risks linked to specific digital assets.

Understanding how it's used in investment strategy can be helpful for those looking to navigate this complex landscape.

How investors use market cap in decision making

Investors often use market cap as a starting point for evaluating cryptocurrencies, though how they use it will largely depend on their investment goals and risk tolerance.

Here's how market capitalization can influence their decision-making process:

- Risk assessment: Market cap can be key for investors to analyze the risk level of a crypto investment. For example, larger-cap cryptocurrencies may be perceived as more stable because they have an established track record and broader adoption.

- Diversification: To spread risk across their crypto portfolio, investors may choose to allocate their funds across a range of cryptocurrency size categories, including large-caps, mid-caps, and small-caps.

- Growth potential: Smaller-cap cryptocurrencies are often seen as having more significant potential for growth compared to higher cap tokens.. An investor seeking high-risk, high-reward opportunities may focus on these assets in the hope of substantial returns.

Strategies for investing based on market cap category

Cryptocurrency investment strategies can vary significantly based on a token's market cap category.

The primary market capitalization categories include large-cap, mid-cap, and small-cap. Each segment has its unique characteristics and associated investment strategies.

Let's examine them further:

Large-cap crypto

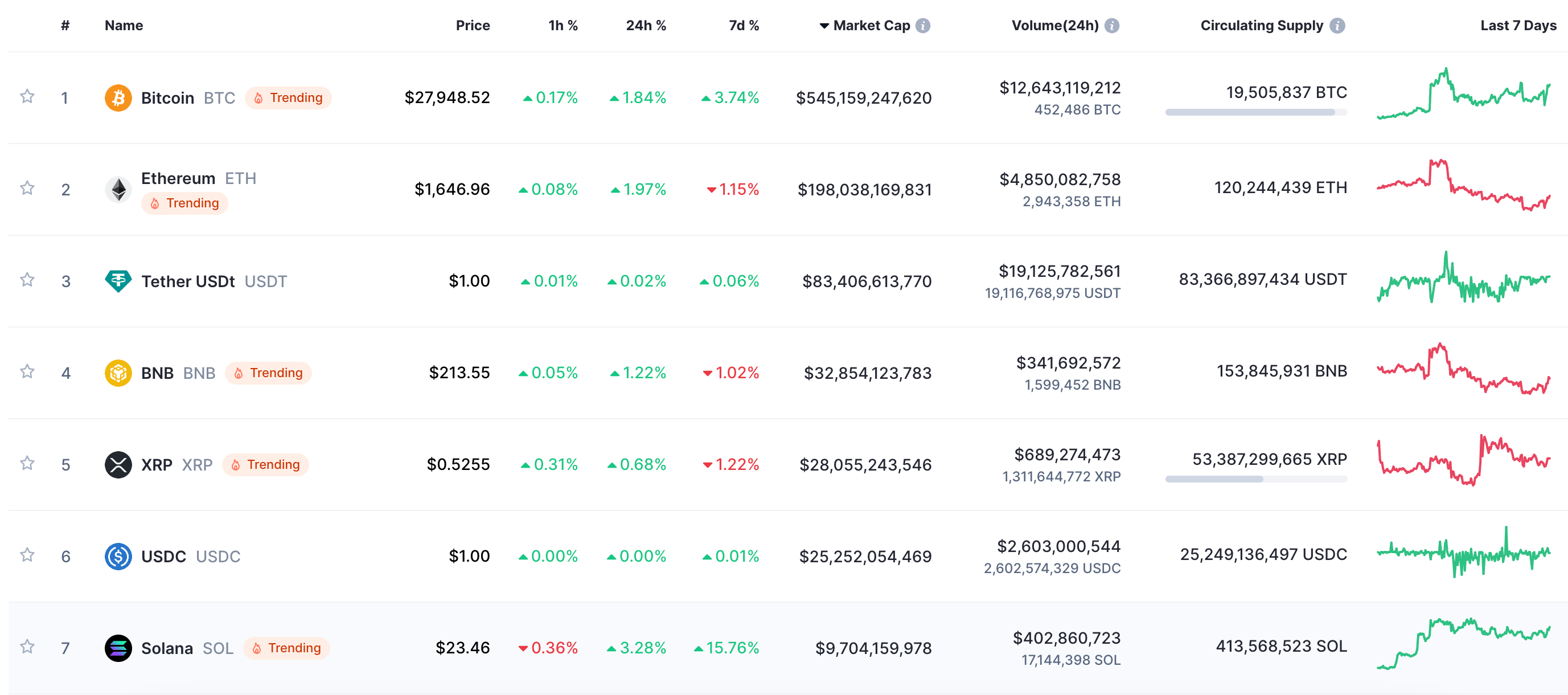

Large-cap cryptocurrencies typically have market caps above $10 billion and include well-known names such as Bitcoin (BTC), Ethereum (ETH), Tether (USDT), XRP (XRP), and USD Coin (USDC).

Investment strategies for large-cap cryptocurrencies may focus on:

- "Hodling" for the long term: Many choose to "hodl" large-cap cryptocurrencies like Bitcoin and Ethereum as long-term investments, banking on the tokens' established track records and widespread adoption.

- Stability and diversification: Investors may allocate a greater portion of their crypto portfolio to large-cap cryptocurrencies in an attempt to balance risk with exponential returns.

Large-cap crypto assets are less likely to experience extreme price volatility but may offer more modest returns compared to smaller-cap assets.

Mid-cap crypto

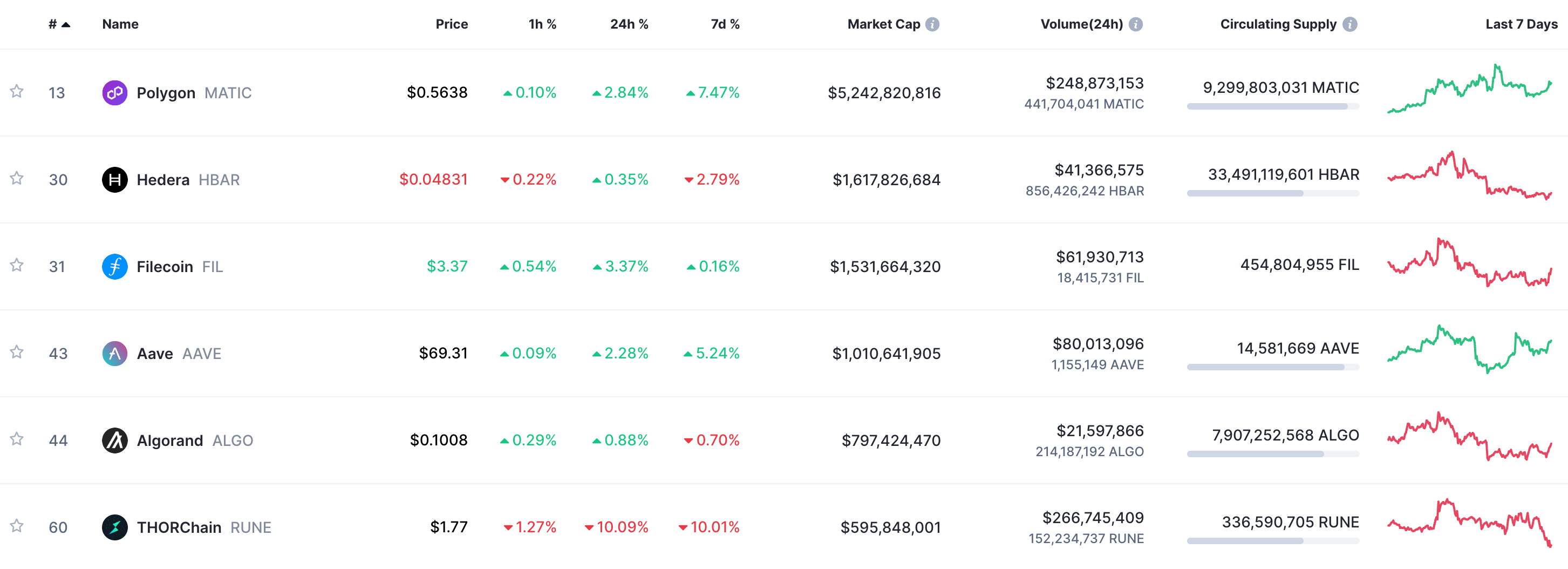

Mid-cap cryptocurrencies have market caps ranging from hundreds of millions to a few billion dollars and include tokens like Polygon (MATIC), Hedera (HBAR), Aave (AAVE), and Algorand (ALGO). The decision to invest in this size type often comes down to seeking a balance between stability and potential for future growth.

Strategies for investing in mid-cap crypto include:

- Growth potential: Mid-cap cryptocurrencies are often considered for their potential for growth. Investors often seek projects with innovative technology and strong fundamentals.

- Active research: Due diligence is crucial when investing in mid-cap cryptocurrencies. Investors may actively research and analyze these projects to identify hidden gems.

Mid-cap crypto assets may offer more significant price appreciation compared to large-caps, but come with higher risk.

Small-cap crypto

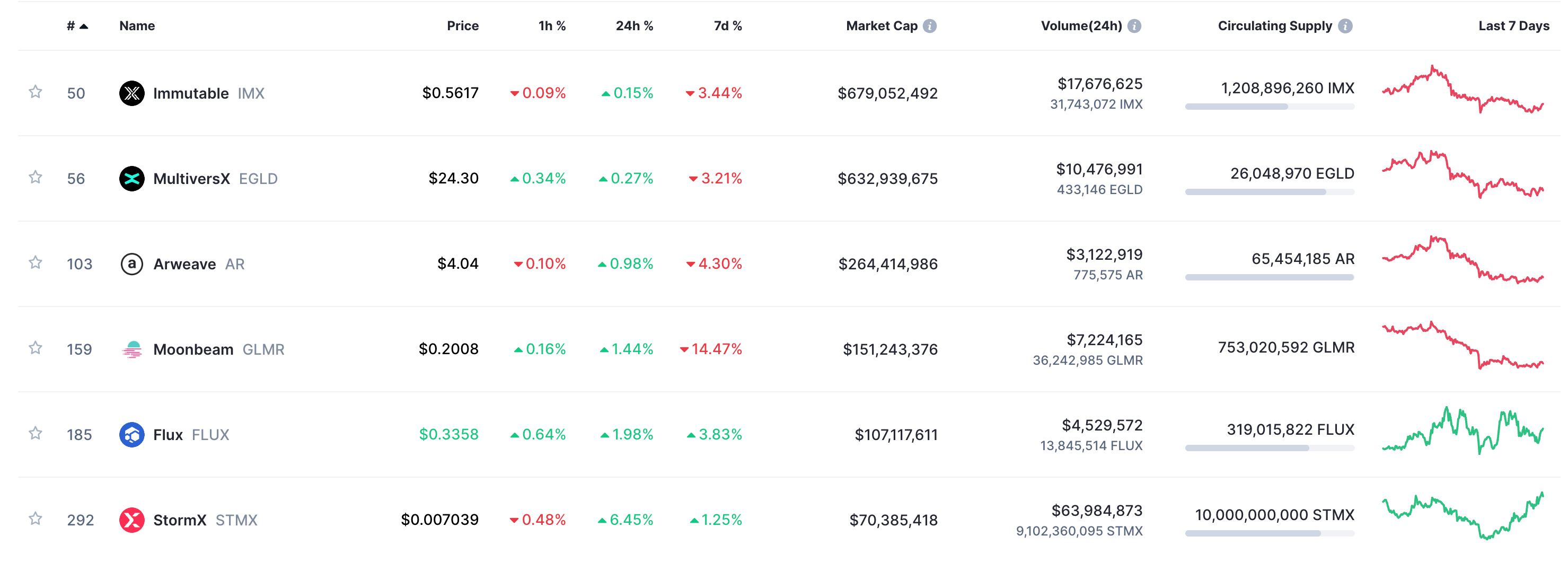

Small-cap cryptocurrencies have market caps in the tens of millions to a few hundred million dollars (maxing out at around $500 million) and include coins like Immutable (IMX) and MultiversX (EGLD). Investors in small-cap crypto are often looking for exponential growth but should be prepared for significant price volatility and potential significant risks.

Strategies for investing in small-cap crypto include:

- Speculative investments: Small-cap cryptocurrencies are often viewed as speculative investments due to their higher volatility. Investors should be prepared for significant price fluctuations.

- Early adoption: Investors may consider small-cap projects that show promise and potential returns for early adopters. These investments come with the hope of substantial gains if the project succeeds.

Small-cap crypto assets are generally considered high-risk, high-reward assets.

Diluted market cap

In addition to traditional market cap, another important concept is diluted market cap. Diluted market cap takes into account all potential coins that could be in circulation, including those that may be released in the future due to factors such as mining rewards or token unlocks.

This metric provides an alternative view of a cryptocurrency's potential, using a more conservative estimate of a crypto asset's value and factoring in future supply increases.

Risks associated with relying solely on market cap

While market cap is a valuable metric, it should not be the sole determinant for investment decisions. For example, it does not consider other factors such as a crypto project's historical performance, dev team, or competitive landscape.

Here are some risks associated with exclusively using this metric for investment decisions:

- Market volatility: Cryptocurrency markets can be highly volatile, and as a result market caps could change rapidly due to price swings.

- Market manipulation: Newer and smaller-cap cryptocurrencies can be more susceptible to price manipulation, which can artificially inflate their market caps.

- Lack of fundamental analysis: Relying strictly on market cap may not fully capture an asset’s fundamental value and can lead to neglecting critical factors such as technology, team, adoption, and competition from similar tokens.

FAQs and misconceptions about market cap

Market cap vs. fundamental value

Some may mistakenly believe that market cap provides insight into a cryptocurrency's fundamental value or the quality of its underlying technology and project. This is not true.

Rather, it is solely a reflection of the market's perception of a token's worth and does not necessarily align with the fundamental value of a cryptocurrency. For example, it is entirely possible for a large-cap cryptocurrency to lack substance, leading the token to face long-term challenges.

Market cap is based strictly on coin price and circulating supply, while fundamental value is based on other factors like financial performance. It is important to understand the difference between these two metrics and consider both when evaluating digital assets.

How can market cap fluctuate?

Market cap is highly susceptible to market dynamics, sentiment shifts, and price fluctuations, even if the total supply remains constant. It can change rapidly, both upwards and downwards, making it a somewhat volatile metric.

For example, an increase in token price will cause it to go up, while a decrease in token price will cause it to go down. Market sentiment can also impact market cap, as positive or negative news can affect investor decisions and asset prices.

What is market cap dilution?

Cryptocurrency projects may have mechanisms in place that allow for the creation of additional tokens over time. This increase in circulating supply dilutes a token's market cap and is a signal of reduced scarcity of the cryptocurrency.

Is it better to have a high market capitalization?

While a high market cap can indicate a cryptocurrency's maturity and stability, it also means that the asset may have already experienced significant growth. This could limit the potential for future returns.

On the other hand, smaller-cap cryptocurrencies may offer higher potential for growth, though they also come with greater risks.

How can market cap help diversify crypto investment portfolio?

Investors can diversify their crypto portfolios by allocating investments across different market cap categories, such as large-cap, mid-cap and small-cap cryptocurrencies, to balance risk with growth potential.

Resources where to track crypto market caps

Tracking cryptocurrency market cap is easy, thanks to numerous online resources and tools.

Here are some popular platforms where you can monitor this data:

- CoinMarketCap: CoinMarketCap provides a comprehensive overview on market capitalization, token prices, trading volume, rankings, and more for thousands of cryptocurrencies.

- CoinGecko: CoinGecko offers a user-friendly interface with market cap rankings, live and historical data, and detailed information about cryptocurrencies.

- MoonPay Price pages: MoonPay's new Price pages will allow you track the live market cap, price, supply, history, and other metrics for cryptocurrencies like Bitcoin and Ethereum.

- Cryptocurrency news websites: Leading crypto news sites like CoinDesk often include market cap data in their reports and analysis, in addition to dedicated landing pages for such metrics.

Concluding thoughts on market cap in crypto

Market capitalization is a crucial metric in the world of cryptocurrency, serving as a yardstick for evaluating the size, popularity, and relative importance of crypto assets.

While it provides valuable insights for investors and traders, it should not be the sole determinant of any investment decision. Rather, it should only be considered in conjunction with other fundamental and technical analysis factors.

It's essential to stay informed about the dynamic nature of the crypto market and be prepared for both opportunities and risks associated with investing. Understanding market cap can be a powerful skill to help navigate the market's complexities and make more informed decisions in the pursuit of financial growth and success.

Start your crypto journey

Now that you know the basics of market cap in crypto, it's time to experience it for yourself.

To get started, simply buy Bitcoin or your preferred cryptocurrency via MoonPay using your credit card or any other payment method.

.png?w=3840&q=90)