As the adoption of cryptocurrency continues to accelerate globally, millions of people worldwide are being exposed to new ways to transfer and store digital assets for the first time.

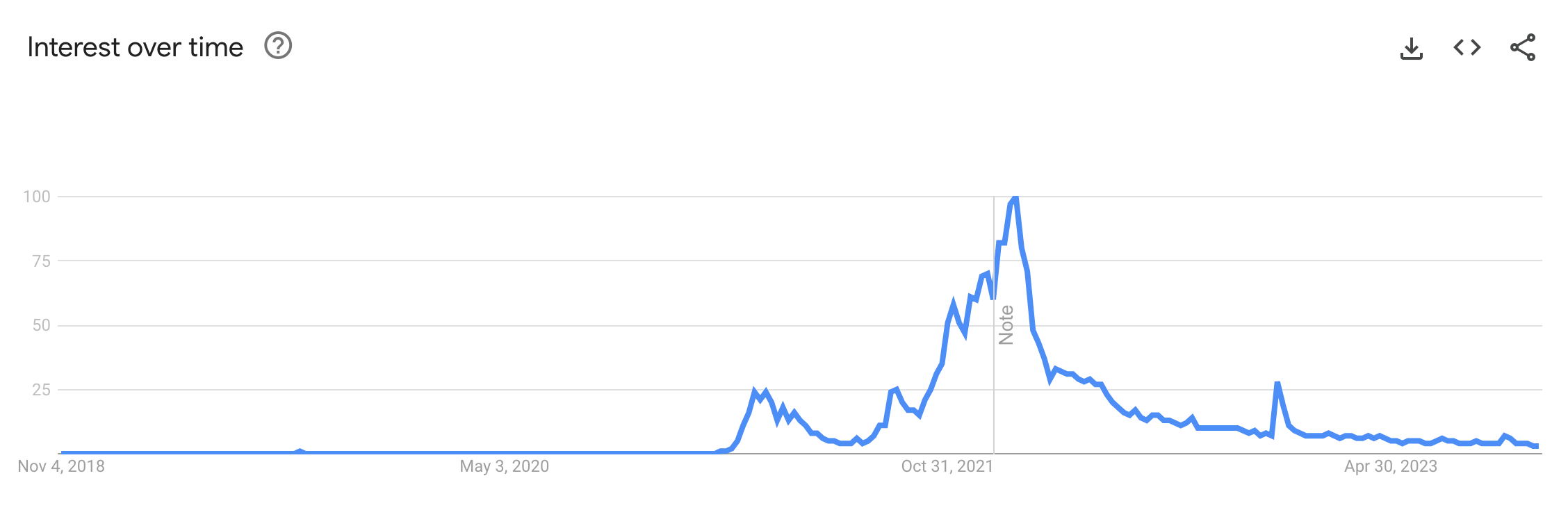

While the likes of Bitcoin, Ethereum, and even Dogecoin, lead the charge in putting blockchain technology on the map, non-fungible tokens or NFTs are also quickly becoming a household name.

In this article, we'll share what an NFT is, why they matter, and how they will continue to play a significant role in the future adoption of crypto and blockchain technology.

What are NFTs?

NFTs (non-fungible tokens) are digital assets that represent a specific unit of data stored on a digital ledger such as a blockchain network. This data can be a piece of digital art or any other form of media such as video, audio, or even text.

How are NFTs different from cryptocurrencies?

Unlike cryptocurrencies such as Bitcoin and Ethereum, which are fungible and interchangeable, NFTs are non-fungible and one of a kind based on their specific data.

For example, if you were to exchange one USD at the bank, you would ultimately still have a dollar. And if you send one Bitcoin in exchange for another Bitcoin, you will end up with the same value.

NFTs on the other hand, are designed to be unique, and therefore naturally collectible. Just like there is only one true Mona Lisa painting, there is only one of any specific NFT.

As Nofungible.com notes:

“Non-fungible tokens (or “NFT”s) are a special class of assets on the blockchain characterized by being unique and non-interchangeable with one another for equal value.

An NFT is different from a cryptocurrency in that it is defined by metadata that builds-in a role, function, and value that are unique to it. Specifically, a non-fungible token can be a video game asset, a work of art, a collectible card or image, or any other “unique” object stored and managed on a Blockchain.”

The uniqueness of NFTs makes them a reliable digital certificate of ownership for a specific item or piece of content. They can be sold, traded, or even used as a virtual currency in a variety of online games. As our founder and CEO of MoonPay, Ivan Soto-Wright shared with The National News:

“The singularity of each token makes them easy to verify and can drive certain tokens to be highly sought after…they offer a unique guarantee of authenticity as they cannot be copied, stolen or replicated. You bought it, you own it. You can sell it, too.”

For most use cases, it can be helpful to think of NFTs as a digital version of Beanie Babies or Pokémon cards, with the bonus of being able to transfer them across the world in seconds—no postage required.

How do NFTs work?

While the term 'non-fungible token' may sound complicated or intimidating, NFTs are much easier to understand when broken down into their key concepts:

Blockchain technology

The core of non-fungible tokens is blockchain technology, the same decentralized and secure distributed ledger used for most cryptocurrencies. A blockchain records all NFT transactions, ensuring transparency and immutability.

This means that every NFT has a traceable and verifiable ownership history that is stored on the blockchain, making it easy to track (and difficult to counterfeit).

Token standards

NFTs adhere to specific token standards, the most common of which is the ERC-721 standard for Ethereum-based tokens. A token standard defines the rules and functions for NFTs, ensuring that they can be created, bought, sold, and transferred consistently across any NFT marketplace, digital wallet, or other platform.

Smart contracts

Smart contracts are self-executing agreements with the terms of the contract directly written into the code. In the NFT space, smart contracts facilitate the creation, transfer, and management of NFTs.

When you buy an NFT, in essence you're acquiring a smart contract that represents ownership of the digital asset. A smart contract defines the conditions for transferring or selling the NFT, including any royalties or commissions that creators may receive upon resale.

Ownership

One of the most significant advantages of NFTs is their ability to establish and verify ownership and provenance. When you own an NFT, you essentially have a digital certificate that proves your ownership of a specific digital asset.

This certificate includes information about the item's origin, its previous owners, and the conditions for its use. This makes NFTs highly valuable in the art world, where authenticity and ownership history are paramount.

The history of non-fungible tokens (NFTs)

While there is some debate as to who rightfully claims the title of being the world's first NFT, the “Colored Coin” created in 2013, is considered by many to be the earliest concept of a non-fungible token.

As investor Andrew Steinwold shared in his excellent Medium article on the history of NFTs:

“One could argue that Colored Coins are the very first NFTs to exist. Colored Coins are made of small denominations of a bitcoin and can be as small as a single satoshi, the smallest unit of a bitcoin.”

That said, it wasn't until several years later in 2017 that NFT projects began picking up steam with the launch of both CryptoKitties and CryptoPunks. CryptoKitties, created by DapperLabs, continues to have a thriving community worldwide even today, with thousands of CryptoKitties being sold, traded, and bred daily.

CryptoPunks, created by LarvaLabs, is a series of 10,000 pixelated ‘punk' avatars that have long been one the most sought after NFT collections. At its peak in 2021, the floor price of a CryptoPunk was as high as 125 ETH, though at the time of this writing in 2023 the minimum price in which you can purchase a CryptoPunk is under 47 ETH.

More recently, additional NFT projects and artwork have gained mainstream attention. Most notably, artist Beeple selling his digital art for a record $69 million. Over the course of the last few years, hundreds of celebrities, artists, musicians, and brands have also launched their own NFTs allowing fans and collectors to own a piece of history.

NFTs and the blockchain

While there are hundreds if not thousands of blockchains in operation, the Ethereum blockchain has long been the blockchain of choice for most NFT projects. Because popular cryptocurrency wallets such as Metamask and Trust Wallet support the ERC-721 standard, it's relatively easy to purchase, send, and receive NFTs for anyone using a crypto wallet.

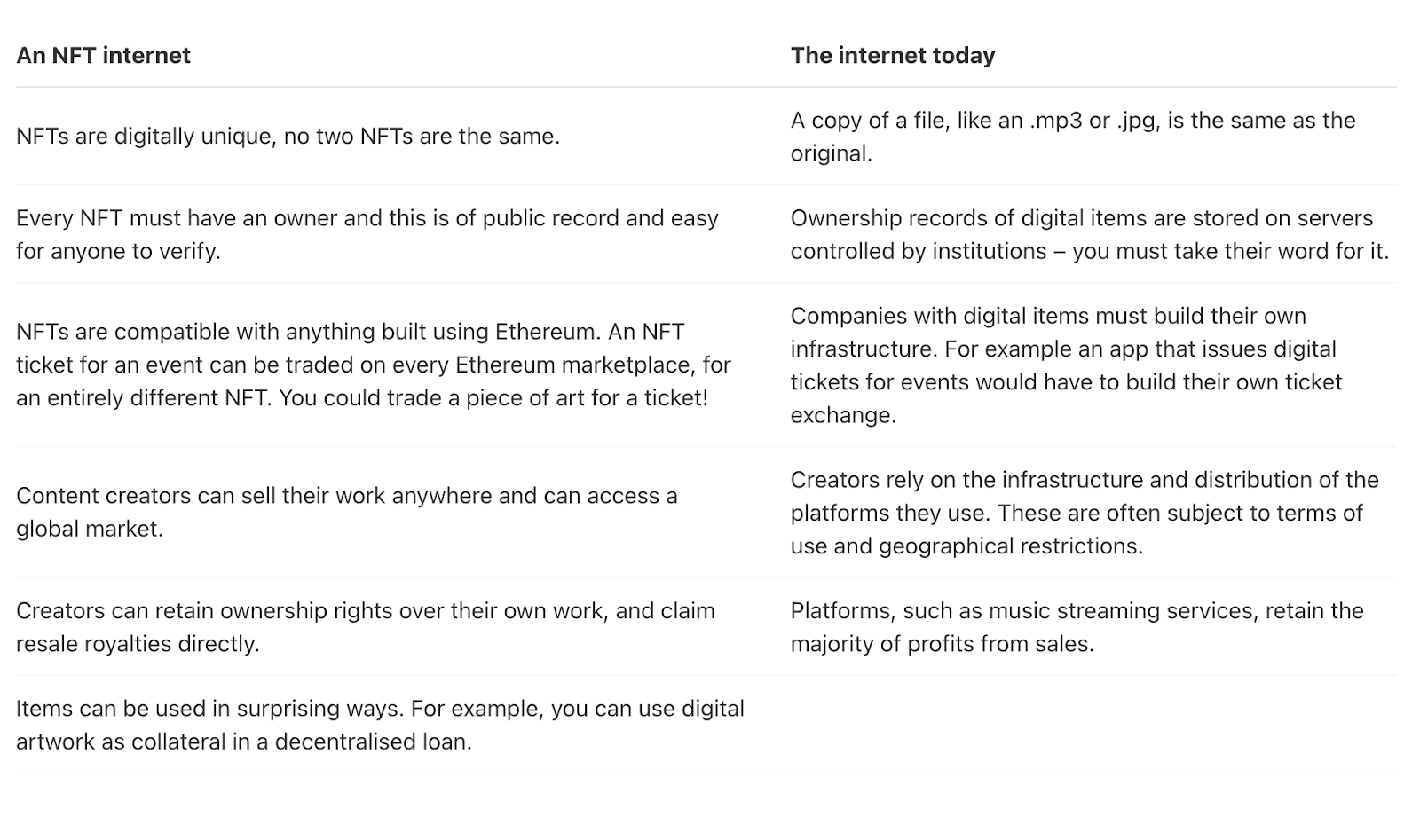

The accessibility of the Ethereum blockchain gives both technical and non technical folks the opportunity to monetize their work, defeat piracy and plagiarism, build communities, and manage royalties in a way that has never been possible before.

“As everything becomes more digital, there's a need to replicate the properties of physical items like scarcity, uniqueness, and proof of ownership,” says the Ethereum organization.

NFT use cases

Although NFTs are a relatively new innovation, we are starting to see some groundbreaking use cases for these digital files, in addition to your run of the mill generative art NFT collection clones.

Here are a few worth mentioning:

NFT digital art

NFTs have found their niche in the creative world, particularly in the digital art and music industries. Artists and musicians can tokenize their work, allowing them to sell digital copies of their creations while earning royalties and retaining ownership and control.

This has opened up new revenue streams for creators, eliminating the need for intermediaries that would otherwise take a cut of artist profits. Artists like Kings of Leon, Eminem, Snoop Dogg, Ja Rule, and 3LAU have all dabbled in releasing music via NFT digital art.

NFT gaming and virtual real estate

NFTs are also making waves in the gaming world. Players can own in-game assets, characters, or virtual land as NFTs. This ownership extends beyond the game, allowing players to trade, sell, or use these assets in other virtual environments or even sell them to other players, introducing an exciting dynamic to the traditional gaming ecosystem.

Some of the most popular NFT gaming platforms include Axie Infinity and Gods Unchained, while the Sandbox and Decentraland are two of the leading NFT virtual worlds. In all of these platforms, users can collect and trade NFTs, and potentially earn active and passive income while doing so.

NFT controversies

Although NFTs represent an exciting future of revolutionary use cases, there are still some downsides worth discussing:

Environmental concerns

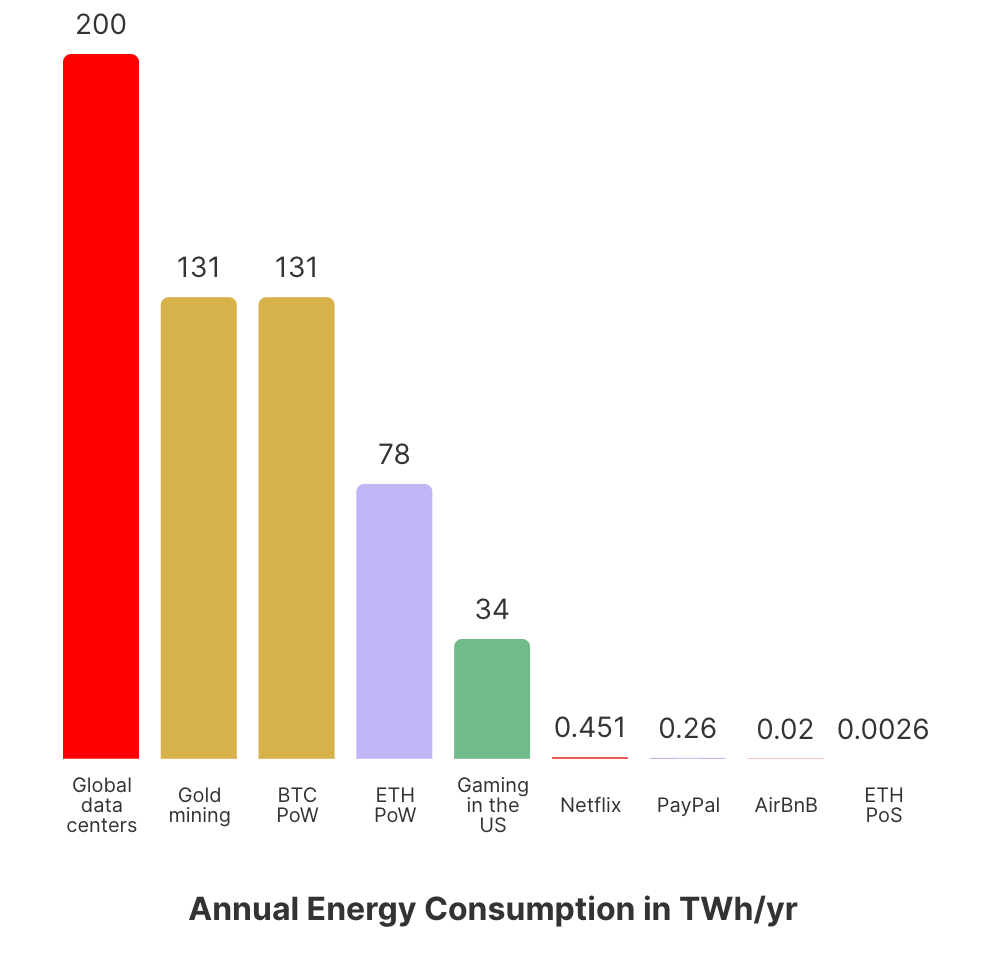

One of the most significant criticisms of NFTs is their impact on the environment. Most NFTs are built on the Ethereum blockchain, which until recently relied on a Proof of Work (PoW) consensus mechanism that consumes a substantial amount of energy.

This has led to concerns about the carbon footprint of NFTs and their contribution to climate change. Fortunately, after making the switch to Proof of Stake (PoS) in the Ethereum Merge, the Ethereum blockchain has since cut emissions by up to 99.99%.

Copyright and intellectual property

NFTs have raised questions about copyright and intellectual property rights. When a digital artist sells an NFT of their work, it doesn't necessarily transfer the copyright or intellectual property rights associated with that work. This has led to disputes and legal challenges in the NFT space, such as when Seth Green's Bored Ape was stolen during his plans to feature the NFT in a TV show.

Potential rug pulls and scams

When it comes to NFTs, rug pull and scam risks abound on multiple fronts:

There are some notable cases of new NFT collections launching in what actually was a rug pull, in which project creators tricked users into purchasing a non-existent digital asset, before making off with the stolen funds and disappearing completely.

Pro tip: Before minting or purchasing an NFT, do your research on the development team to make sure they're active and doxxed.

There are also general hacks and scams that can befall unwary users. There are several instances of users having their wallets drained of prized NFTs, as well as being scammed via offers to buy NFTs made on fraudulent peer-to-peer NFT exchanges.

Pro tip: Only purchase NFTs on official NFT marketplaces, and never from proposals in messaging apps like Discord.

The future of NFTs

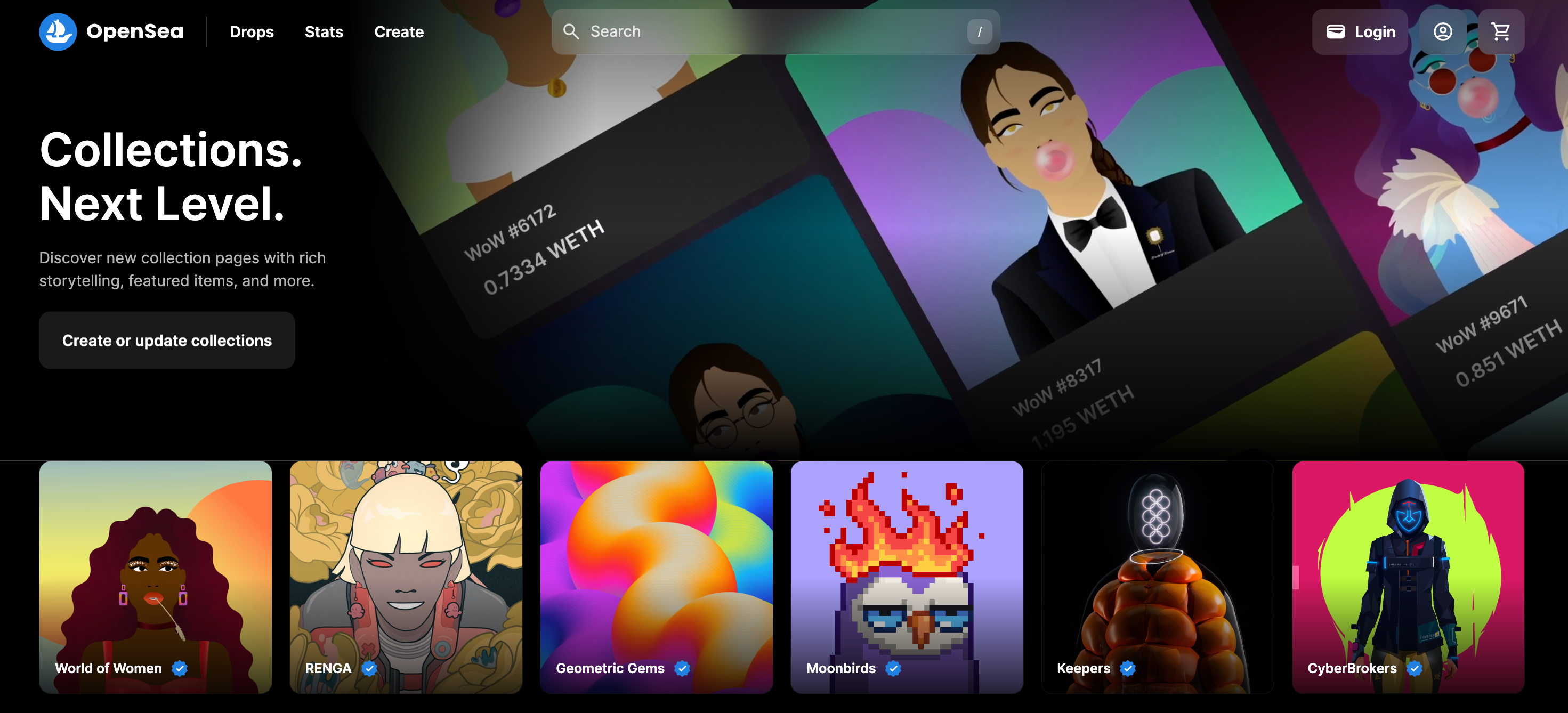

NFT marketplaces like OpenSea are leading the way to making purchasing NFTs more accessible.

As the demand for NFTs continues to grow, other marketplaces such as Rarible, Magic Eden, and LooksRare are hard at work, making NFT ownership and creation more accessible to everyone.

Even though they're a relatively new asset class, NFTs have the potential to transform every industry with limitless applications. By using blockchain technology, these simple digital assets could impact culture and ownership inside the web3 space and out.

And at MoonPay, we're committed to doing our part to help organizations on the forefront of crypto and NFT innovation to make that a reality. We're honored to play a small role in providing the payment infrastructure needed for current and future marketplaces.

NFTs aren't just ‘digital art.' They offer an entirely new way to consume, create, share, and connect.

Frequently Asked Questions about NFTs

Where can I buy NFTs?

The best place to buy NFTs is on dedicated NFT marketplace platforms, such as OpenSea. Before purchasing, be sure that you have enough of the relevant cryptocurrency in your digital wallet.

MoonPay makes it even easier to purchase digital assets using a credit card, saving you the steps of using a cryptocurrency exchange and waiting for funds to settle before transferring to your crypto wallet.

What blockchains support NFTs?

There is a wide range of digital assets that are supported on different blockchains. Some of these include:

What are the most popular NFT marketplaces?

Some of the largest NFT marketplaces that support NFTs on multiple blockchains include OpenSea, AtomicHub, Magic Eden, and Rarible.

There are also NFT marketplaces dedicated to digital assets built on a single blockchain, such as LooksRare with ETH, Solanart with SOL, Axie Marketplace with AXS, and NBA Top Shot with FLOW.

What are the most popular NFTs?

The most popular NFT collections of all-time (by trading volume) include:

Can any digital artwork be an NFT?

Digital artists can turn any of their physical and digital art into an NFT. This allows artists to tap into a larger audience pool and distribute their creations to anyone with cryptocurrency and an internet connection.

To learn more, view our NFT guide for artists

How to mint NFTs?

There are several ways to mint an NFT. The easiest way to do this is on most NFT marketplaces. You can also mint NFTs directly via smart contracts, using the smart contract address on block explorers like Etherscan.

To learn more, view our NFT minting guide

Can you stake NFTs?

Just like Proof of Stake (Pos) cryptocurrencies, some NFTs can be staked to earn rewards via passive income.

To learn more, view our NFT staking guide

How to buy NFTs

You can mint NFTs directly on a project's official website, or buy on secondary NFT marketplaces like OpenSea. Be sure you only mint, buy, and sell NFTs on legitimate, official websites only, to avoid falling prey to NFT and crypto scams.

MoonPay's NFT Checkout solution makes it easier than ever to buy NFTs directly using a credit card, with fewer roadblocks and dropout points.

We've removed excessive steps in the purchasing process, including needing to acquire the necessary crypto first and transfer between multiple exchanges and wallets.

Just choose the NFT you wish to purchase and enter your card details to complete your transaction.