Cryptocurrency has a history of price fluctuations, a characteristic present ever since the launch of Bitcoin in 2009.

For many investors, these unpredictable changes in value can present an opportunity for significant returns. However, some individuals may find the potential for losses to make crypto assets seem overly risky.

While the most popular cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) garner the majority of attention in the crypto space, one notable drawback is their susceptibility to substantial price volatility.

To address the issue of these significant value swings, stablecoins were introduced as digital assets aiming to maintain a steady price.

In this educational guide, we will delve into this category of digital currency and focus on USDT, one of the most widely used stablecoins in the current market.

What is USDT?

USDT (Tether) is a cryptocurrency that aims to maintain a 1:1 exchange rate with the US dollar, created and first issued in 2014. Unlike some other stablecoins, USDT is a fiat-backed stablecoin, meaning that it is backed by a reserve of assets.

As of 2024, USDT is still the world’s most widely used stablecoin, with a market cap of over $110 billion. Although Tether is more commonly used, some other popular stablecoins include USDC, Dai, PYUSD, and TrueUSD.

To manage the USDT supply its parent company Tether Limited, mints and removes the stablecoin from circulation according to their dollar reserves — Tether claims to maintain a 1:1 reserve ratio of USDT to the assets backing USDT. This reserve is maintained by Tether Limited as an effort to allow USDT to trade at the same value as the US dollar.

Note: Europe’s MiCA (Markets in Crypto-Assets) regulation requires stablecoins to secure authorization before serving the EU market. While USDC has obtained full MiCA approval, Tether’s USDT has not been authorized, limiting its ability to compete in a region where platforms are steadily shifting toward compliant options.

Why was the USDT (Tether) token created?

At the time USDT was launched, Bitcoin and other early cryptocurrencies could only be exchanged for other cryptocurrencies or fiat currency — there was no easy and fast way for crypto holders to trade crypto for fiat currencies (or vice versa) without altogether exiting the crypto ecosystem.

USDT was created in a bid to bridge this gap. Tether aimed to give users seamless access to a platform-agnostic, blockchain-based fiat-backed stablecoin pegged to the U.S. dollar that held many of the technical advantages of Bitcoin, Ether, and other crypto assets, without having their market volatility.

USDT introduced a less volatile option to an asset-class that historically fluctuated broadly against fiat currencies, enabling traders to quickly move into a more “stable” asset, fund USD-denominated margin accounts, and quickly complete transactions between crypto exchanges.

In creating USDT, Tether also solved one of crypto’s most elemental challenges — that the volatility of cryptocurrencies restricted their real-life utility in a fiat-denominated world.

Instead, USDT gave anyone a permissionless way to send crypto to anyone with speed, transparency, and low cost, opening up the use case of cryptocurrencies to remittance transactions, payments, and more.

Who created Tether?

USDT is issued by Tether Limited, a Hong Kong-based company founded in 2014 by early cryptocurrency proponents Brock Pierce, Reeve Collins, and Craig Sellars.

In 2021, Tether Limited settled a years-long legal dispute with the New York Attorney General, which alleged the USDT creator had historically misrepresented the amount of US dollars it held in cash reserves.

How does USDT (Tether) work?

Here is a general overview of how Tether works:

1. Issuance and redemption

When a user wants to obtain USDT, they send fiat currency to Tether Limited. In return, Tether Limited issues an equivalent amount of USDT tokens to the user.

Conversely, when a user wishes to redeem USDT for fiat currency, they send their USDT tokens to Tether Limited, which then sends back the equivalent amount in fiat.

Luckily, there are crypto on- and off-ramps like MoonPay that facilitate this process for the user, so that they don't need to do all the Tether issuance and redemption work alone.

3. Reserve transparency

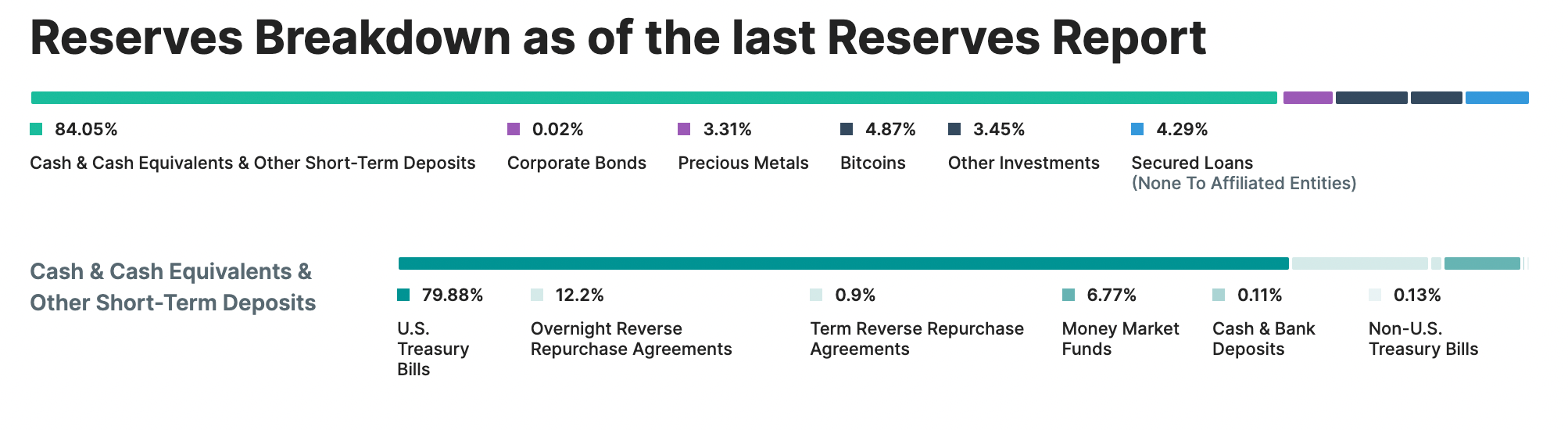

Tether Limited claims to maintain a reserve that fully backs all USDT in circulation. This reserve is intended to be a mix of cash, cash equivalents, and other assets.

In an attempt to assure users of its solvency, Tether periodically publishes reports from third-party auditors, although the extent and frequency of these audits have been subjects of debate within the crypto community for years.

2. Blockchain integration

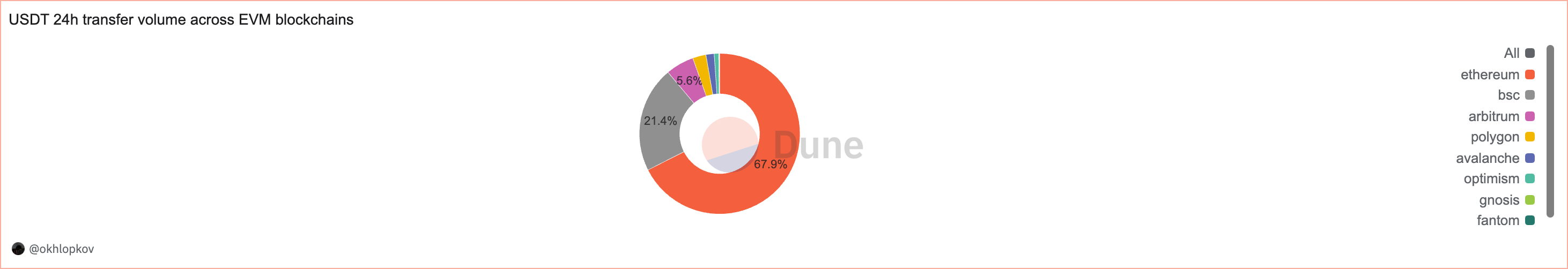

USDT tokens are issued and transacted on various blockchain platforms. This integration allows Tether to leverage the security, transparency, and immutability of these blockchains.

While USDT was originally issued on top of the Bitcoin network via the Omni Layer, it is now traded on a many different blockchain protocols including Ethereum (ETH), Solana (SOL), Tron (TRX), Eos (EOS), Algorand (ALGO), Liquid Network, and Bitcoin Cash (BCH), in addition to Bitcoin.

For instance, on the Ethereum network, USDT exists as an ERC-20 token, allowing cryptocurrency users to benefit from the robust infrastructure and wide adoption of the Ethereum blockchain.

What can USDT be used for?

Tether serves several crucial roles in the cryptocurrency market:

Staying in the crypto ecosystem

Cryptocurrency markets are notoriously volatile, with prices often experiencing rapid and unpredictable changes. Tether provides a more stable alternative that allows traders and investors to move their funds into a less volatile asset without needing to convert back to fiat currency.

Liquidity and trading

As the crypto market's most popular cross-pair, USDT can be used on exchanges to buy or trade against hundreds of cryptocurrencies including Bitcoin, Ether, and Litecoin. Additionally, the digital token can be used to earn interest via decentralized finance (DeFi) protocols such as staking pools, liquidity pools, and yield farming.

Payments

For individuals, USDT allows anyone to transact in a cheap, fast, and peer-to-peer way. By using USDT, users can bypass the hurdles of traditional payment systems, enjoying faster transaction times and lower fees.

USDT also gives merchants a way to accept cryptocurrency payments, where it is legal to do so, in a crypto asset that is pegged to USD, without the need for taking on the volatility associated with accepting payments in other cryptocurrencies.

Did you know? You can pay with USDT

What are the benefits of Tether?

Here are some key advantages of using USDT:

1. Stability

One of the primary benefits of USDT is its price stability. Unlike other cryptocurrencies that can be highly volatile, USDT maintains a stable value by being pegged to the US Dollar.

2. Liquidity

USDT's liquidity and availability on most crypto exchanges means that users can easily buy or sell USDT with minimal price slippage compared to other digital currencies.

3. Easy conversion to fiat currency

USDT can be easily converted to fiat currencies like dollars and euros. This provides a convenient bridge for users worldwide between the cryptocurrency ecosystem and traditional financial systems.

4. Low transaction fees

Using USDT for transactions, especially cross-border transfers, can be significantly cheaper than sending fiat currency. The low transaction fees associated with USDT make it a viable alternative option for international payments and remittances.

5. Fast transaction times

USDT transactions can be processed quickly, depending on the speed of the underlying blockchain networks it operates on. However, USDT transactions on Solana, for example, will be processed much quicker than ones on Ethereum, due to the networks' differing capacity.

This rapid processing time is also considerable difference from conventional payment systems, which can take days to settle some transactions (like international ones).

6. Decentralized finance (DeFi)

USDT plays a crucial role in the burgeoning decentralized finance (DeFi) sector. Many DeFi platforms use USDT as a stable asset for lending, borrowing, and liquidity provision, enabling users to participate in DeFi activities without exposure to volatile assets.

What are the risks of USDT?

Like all cryptocurrencies, USDT is susceptible to risks.

Some of these include DeFi platform or smart contract hacks, rug pulls, general crypto scams, as well as impermanent loss when using USDT in decentralized applications (dApps).

Tether, the parent company of USDT, has faced scrutiny over the years regarding their reluctance to publish consistent audits of their reserves, as well as concerns about the backing of the stablecoin itself. Although the USDT price usually remains around $1, these factors have occasionally thrown into doubt Tether's status as a stable store of value.

Before choosing to invest in a cryptocurrency like USDT, users should do their own research. This may include researching the price history of Tether (USDT), the team behind the stablecoin project, or the backing company of the Tether stablecoin and their reserves.

How can you buy USDT?

You can buy USDT (Tether) via MoonPay or through any of our partner wallet applications with a credit card, bank transfer, Apple Pay, Google Pay, and many other payment methods. Just enter the amount of USDT you wish to purchase and follow the steps to complete your order.

You can also get started by loading your wallet with euros, pounds, or dollars and using your MoonPay Balance to purchase USDT and other stablecoins. Use MoonPay Balance for faster, cheaper transactions and improved approval rates. When you're ready to withdraw, enjoy zero fees and direct transfers to your bank account.

How can you sell USDT?

MoonPay also makes it easy to sell USDT when you decide it's time to cash out. Simply enter the amount of Tether you'd like to sell and enter the details where you want to receive your funds.

Swap USDT for more tokens

Want to exchange USDT for other cryptocurrencies like Ethereum and Bitcoin? MoonPay allows you to swap crypto cross-chain with competitive rates, directly from your non-custodial wallet.

Plus, if you swap USDT for USDC (SOL), you can enjoy Solana DeFi trading on MoonPay and access thousands of SPL tokens like SOL, BONK, TRUMP, and more.

.png?w=3840&q=90)