Imagine this: you bought ETH to explore the world of DeFi, interact with decentralized applications (dApps) and even swap ETH for other altcoins. But then you realize that not all decentralized exchanges (DEXs) or protocols accept ETH.

There's an ocean of crypto projects out there and more are emerging every day. What if all you had was ETH and no way to interact with those projects?

The answer lies in wrapped tokens. In this case, wrapped Ether (wETH).

In this article, we shed light on what wETH is, how it differs from regular ETH, and its most common applications.

What is wETH?

Wrapped ETH (wETH) is an ERC-20 token that represents ETH and is pegged 1:1 to the value of ETH. It can be used to interact with DeFi protocols and applications whereas ETH, by itself, can not be used in many dApps.

Understanding the difference between a coin and a token is critical to clearly understand the role of wrapped Ether.

Coins are digital assets that have their own independent blockchain, while tokens are built on top of existing blockchain infrastructure. Coins are typically used as a form of currency, while tokens can represent virtually anything, from loyalty points to digital assets.

For example, Bitcoin (BTC) is a coin because it runs on the Bitcoin blockchain and helps validate transactions. Similarly, ETH is a coin because it runs on its native chain, the Ethereum blockchain.

One way to think about this is to compare fiat currency (legal tender) with a gift card. Both have value and both can be used as a form of payment, but they exist on different platforms. Fiat currencies exist independently while gift cards rely on someone else's payments infrastructure / ecosystem.

Why should you wrap ETH?

Ethereum was conceptualized in 2013 and developed starting in 2014. For the next three years, Ether (ETH), the native cryptocurrency of the Ethereum blockchain, was mainly used to pay for gas fees.

With the rising popularity of tokens and the ease at which they could be created, the developers of the Ethereum community saw the need for standardization. In 2017, they developed ERC-20 as a standard for smart contract-based fungible cryptocurrencies.

Since the ERC-20 standard was created after ETH, ETH itself does not conform to the ERC-20 standard. This greatly limits its usage. For instance, ETH cannot be directly used in dApps that are built for the ERC-20 standard.

This is where wETH comes in. There are three main reasons why you should wrap your ETH:

1. Use in dApps and make microtransactions

The largest fraction of crypto users (around 31%) are between 18-29, an age demographic that typically includes college students and new graduates. It’s impractical for these users to spend hundreds of dollars on transaction fees.

wETH allows beginner investors to get involved in the DeFi space and explore dApps without the hindrance of high fees.

Since wETH can also be used across other Ethereum-compatible chains and Layer-2 solutions, users can bypass the high gas fees and just learn more about the space by playing around with microtransactions.

2. Wider exposure to DeFi applications

wETH is required by some DeFi protocols in order to function properly. We'll get into more detail on this later, but essentially some protocols require you to have ERC-20 tokens in order to interact with them.

As ETH does not conform to the ERC-20 standard, it cannot be used directly with these protocols. By wrapping ETH, however, it behaves like an ERC-20 token, which allows you to use it with those protocols.

3. Faster and cheaper transactions

The transaction fee on the Ethereum network can be quite high, especially during periods of high traffic. Transactions on the Ethereum main chain can also take hours to get validated.

Users typically get around this by using wETH on Polygon, which is a Layer-2 blockchain solution built on top of Ethereum. This allows the users to perform the same operations with their ETH as they would on the Ethereum blockchain but at the fraction of the cost and blazing fast speeds of over 1,000 TPS.

How do you wrap ETH?

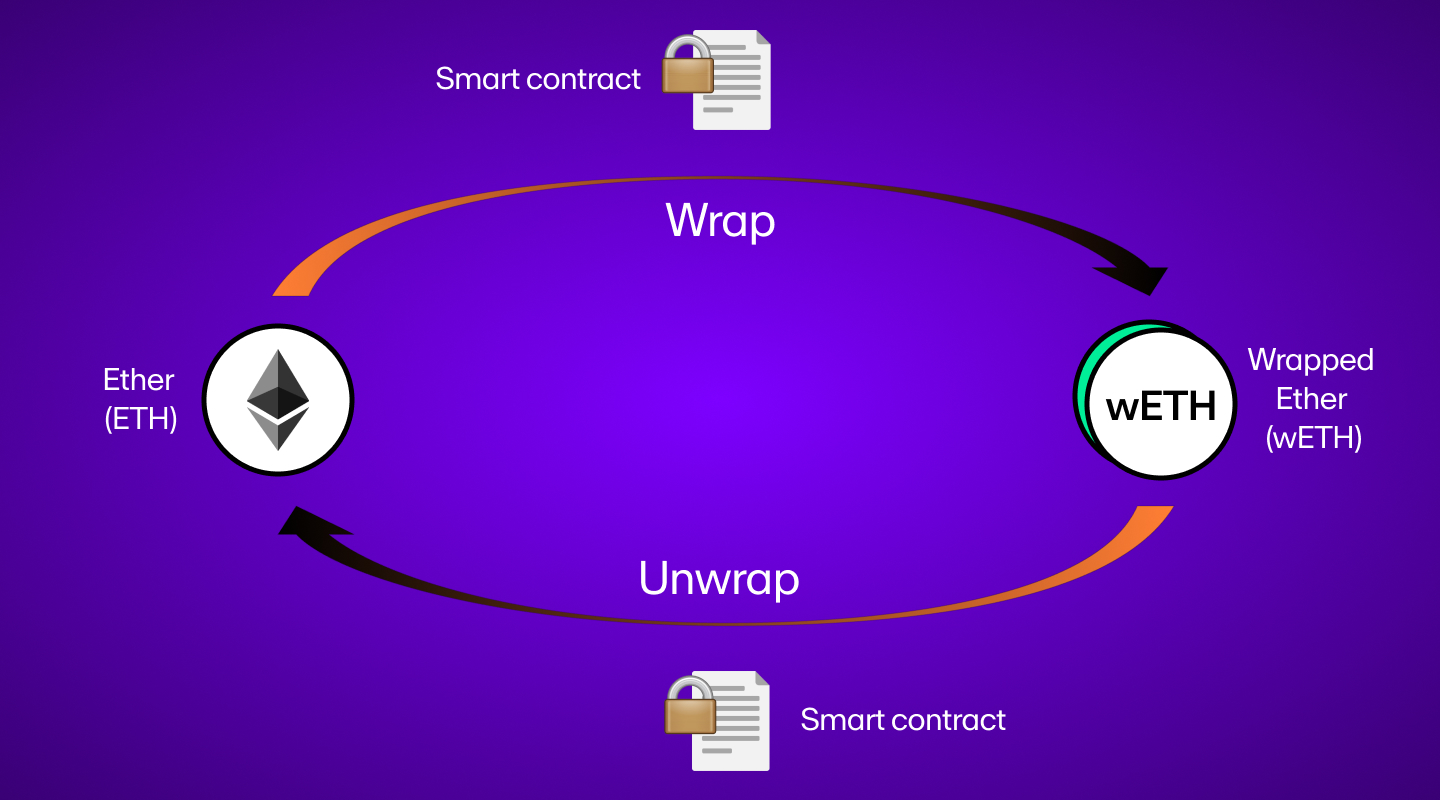

Wrapping ETH simply refers to exchanging ETH tokens for wETH tokens. You can do this by locking up your ETH in smart contracts that produce an equivalent amount of wETH.

Using MoonPay for wETH

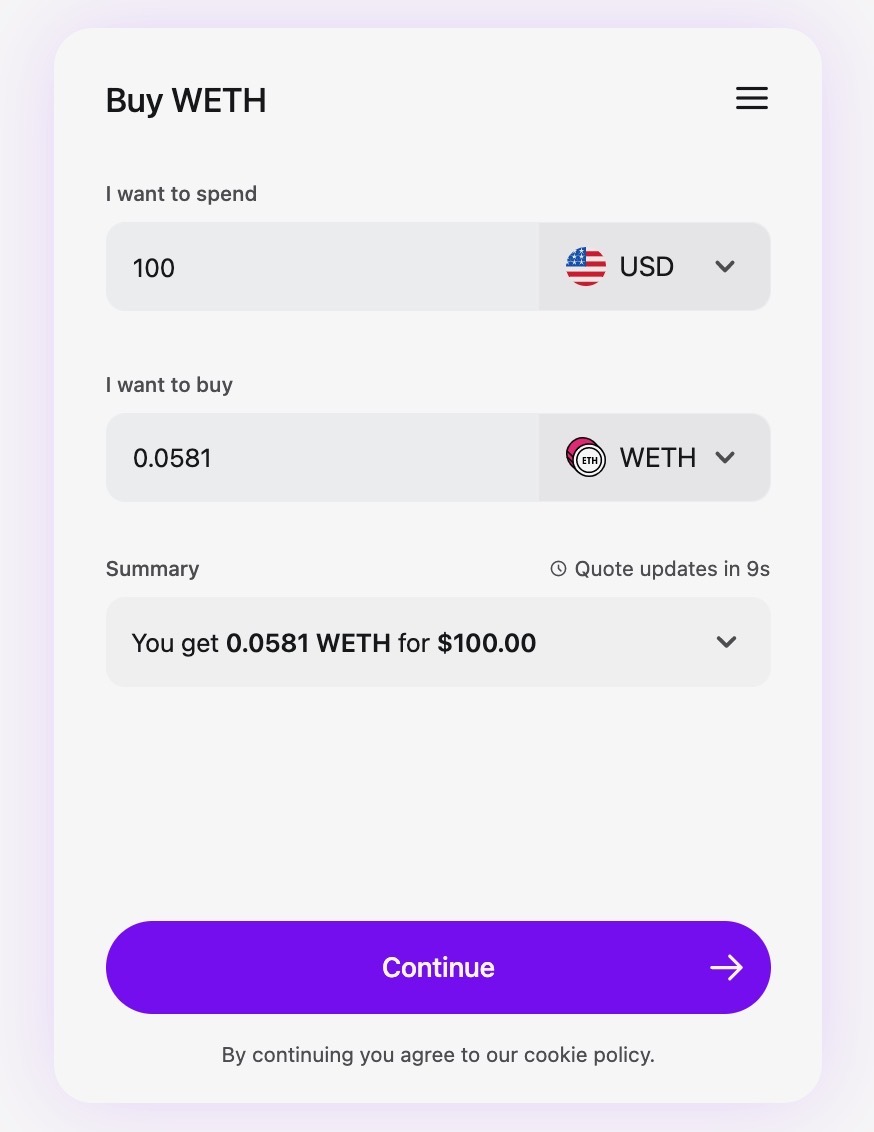

One of the simplest ways to buy wETH is through MoonPay. Here’s a breakdown of how to buy wETH using MoonPay:

- Go to MoonPay.com

- Click "Buy Crypto"

- Choose your preferred fiat currency for buying wETH

- Change the crypto from the default BTC to wETH

- Click "Continue"

- Enter your email ID and click "Continue"

- Enter the verification code sent to your email

- Enter your billing details and proceed to check out

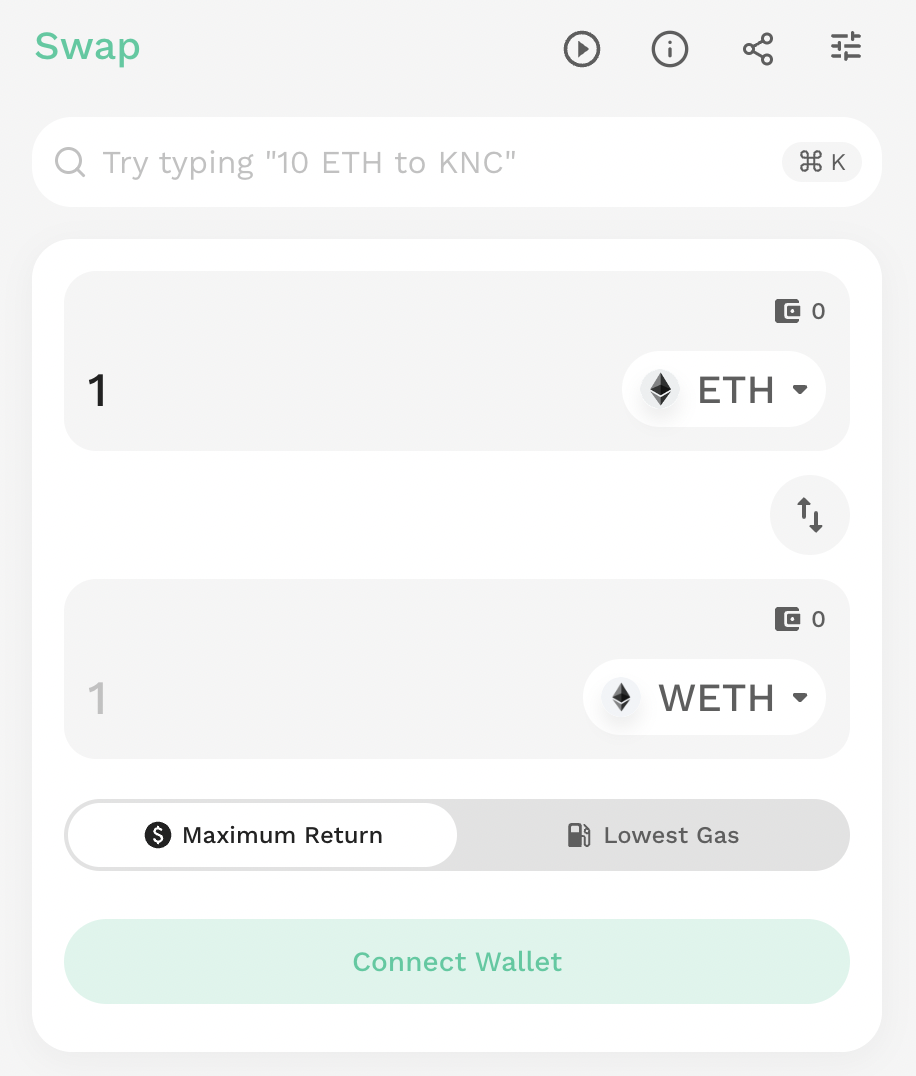

Using Uniswap for wETH

If you use a non-custodial wallet, swapping your ETH for wETH is easy on decentralized exchanges like Uniswap. Here's a breakdown of how you can wrap ETH using Uniswap:

- Go to the Uniswap app

- Connect your wallet

- Click "Select a token" and choose wETH

- Enter the amount of ETH you want to swap for wETH

- Click "Wrap"

- Review the gas fee and confirm the transaction

Using MetaMask for wETH

If you're using MetaMask, there's a dedicated dApp for swapping ETH for wETH. Here’s a breakdown of how to wrap ETH using MetaMask:

- Open your MetaMask wallet

- Click "Swap"

- Choose “wETH” under "Swap to"

- Enter the amount of ETH you wish to swap

- Click "Review Swap"

- Review transaction details and click "Swap"

How do you unwrap ETH?

Unwrapping ETH is the process of exchanging wETH back into ETH. The process is exactly the same as wrapping ETH but in reverse.

To unwrap ETH, simply head over to Uniswap or MetaMask and follow the steps mentioned above, but this time select ETH under "Select a Token" or "Swap To".

Can wETH exist on other blockchains?

The answer is yes. However, you’ll need the help of a cryptocurrency bridge.

A cryptocurrency bridge can be thought of as an intermediary that allows two different blockchain networks to communicate with each other. This communication allows for the exchange of assets between the two networks, which can be useful for users who want to take advantage of both platforms.

To get a wETH token on another chain, you first have to lock up your funds on one end of the bridge. Then, an equivalent amount of wETH tokens will be minted on the new chain. You can reclaim your locked funds by burning the wETH through the same bridge.

Unfortunately, there are a few potential disadvantages of using cryptocurrency bridges. For example, the bridge could be hacked, resulting in the loss of your tokens. Additionally, there could be a problem with the bridge's software that results in users not being able to access their crypto. Finally, the bridge could simply go out of business, leaving users unable to access their assets.

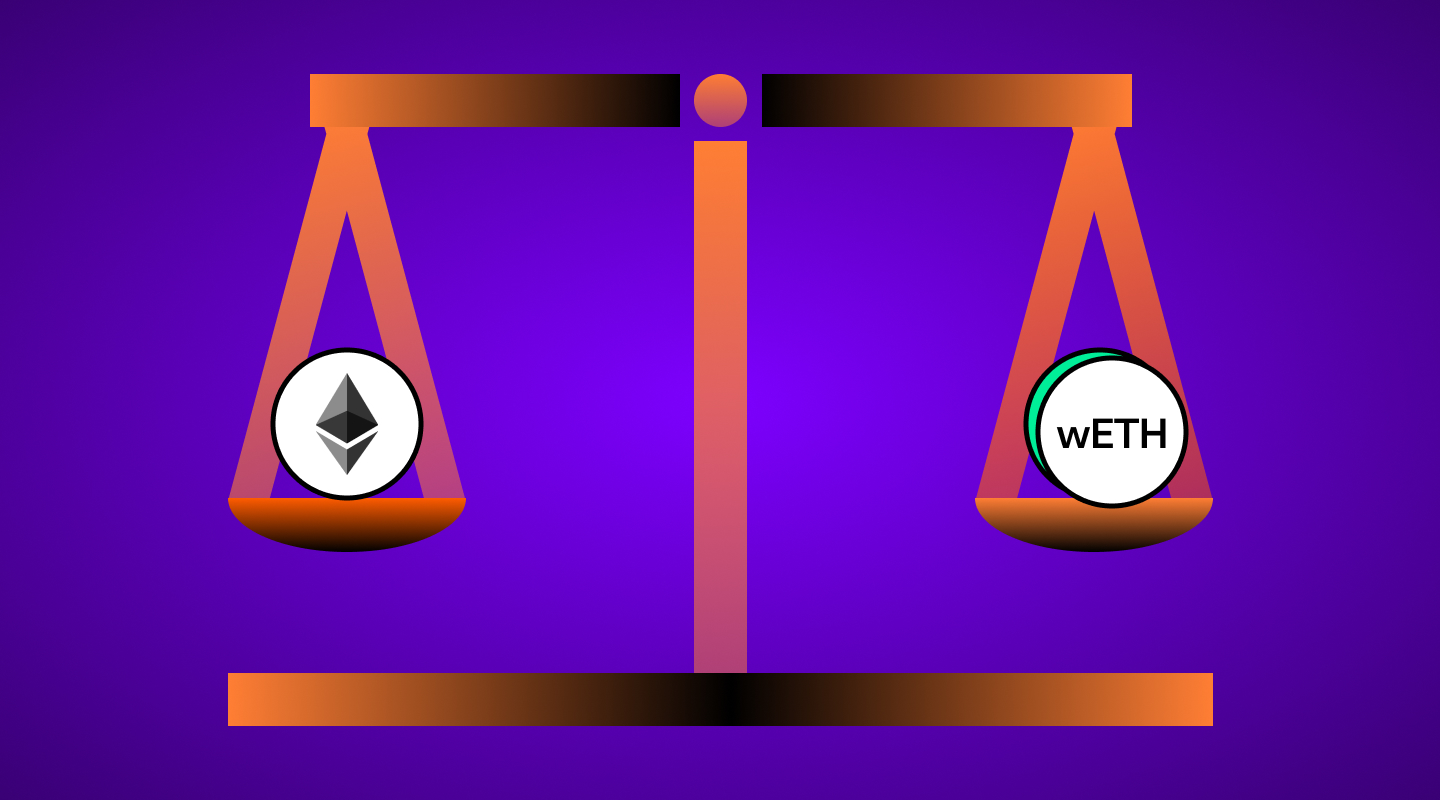

How is wETH’s price equal to ETH?

The price of wETH is backed by the actual ETH that is locked up in the smart contract in a one-to-one ratio. This means that the supply of wETH will always be less than or equal to the amount of ETH locked in the contract.

As a result, the price of wETH will always be equal to or close to the price of Ethereum, since there is a direct relationship between the two.

In the case of liquidity pools and crypto exchanges, the way wETH's price is pegged to ETH's price is similar to collateralized stablecoins - arbitrage opportunity.

Arbitrage is the act of buying and selling assets in order to take advantage of discrepancies in prices. It is simply buying an asset from one place and selling it on another platform where the price is higher. The difference in these prices (after the trading fees) will be your net profit.

So, if the price of wETH ever gets too high, people will start selling wETH in order to buy ETH at a lower price. This will drive the price of wETH down, and the price of ETH up. Similarly, if the price of ETH ever gets too low, people will start buying ETH in order to sell wETH at a higher price. This will drive the price of ETH up and the price of wETH down.

For live Ethereum price and market metrics, view our Ethereum Price page

Where can you use wETH?

wETH can be used on a wide variety of DeFi applications. Some popular examples include:

1. Uniswap

Uniswap is a decentralized exchange that allows users to trade ETH and ERC20 tokens. wETH is used as one of the main trading pairs on the platform.

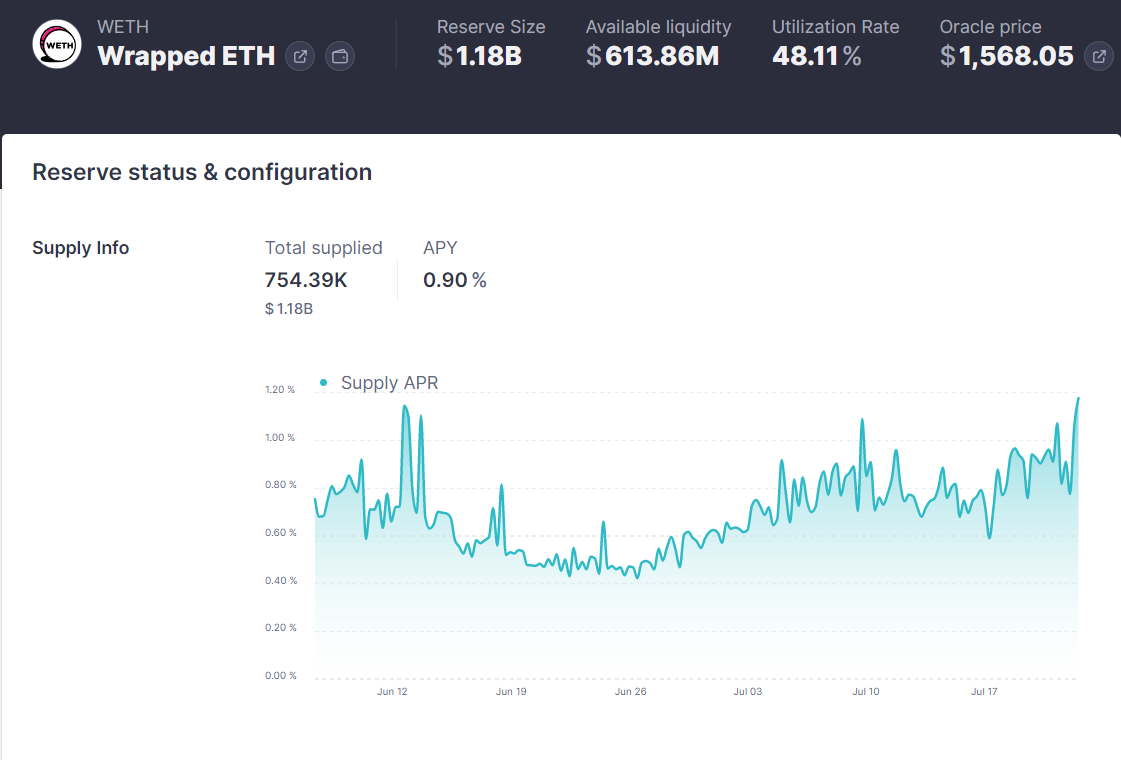

2. Aave

Aave is a decentralized lending platform that allows users to lend and borrow a variety of cryptocurrencies. wETH can be used as collateral on the platform.

3. Kyber Network

Kyber Network is a decentralized platform that pools liquidity from multiple sources to provide the end user with the best rates.

With Kyber Network, you can use a hardware wallet, like Ledger, to swap ETH to wETH. This functionality is not available in Uniswap.

What does the future of wETH look like?

wETH has been a game changer in many ways for the Ethereum community and has played a significant role in the ecosystem’s maturity and adoption. The future for wETH in the short term is certainly bright as more dApps are developed.

But this is not likely to hold true in the long run. While ETH's lack of conformity with the ERC-20 token standard was the precedent for developing wETH, the Ethereum community is actively trying to make ETH more functional.

One of the proposed ways to do this is by replacing the ERC-20 standard with a newer and improved standard: ERC-223. This is a solution to a bug in the ERC-20 standard that “burns” tokens when they are sent to a smart contract using an incorrect function.

Closing thoughts on wETH

That wraps up this article on wETH.

In summary, wETH is an ERC20 token that is pegged to the price of ETH. It is used to trade ETH on decentralized exchanges and to provide collateral on lending platforms. You can wrap ETH on other blockchains with the help of a cryptocurrency bridge.

Where can you buy Ethereum and wETH?

You can buy Ethereum (ETH) and wrapped ether (wETH) via MoonPay or through any of our partner wallet applications with a credit card, bank transfer, Apple Pay, Google Pay, and many other payment methods.

Just enter the amount of ETH or wETH you wish to purchase and follow the steps to complete your order.

You can also top up your wallet in euros, pounds, or dollars and use your MoonPay Balance for buying Wrapped Ethereum, Ether, and other tokens. Use your balance to enjoy lower transaction fees, quicker processing times, and better approval rates. Plus, withdraw to your bank account with zero fees when you're ready to cash out.

How to sell Ethereum

MoonPay makes it easy to sell Ethereum when you decide it's time to cash out your crypto.

Simply enter the amount of ETH you'd like to sell and enter the details where you want to receive your funds.

We're always adding more cryptocurrencies like wrapped Ether (wETH) to sell, so check back soon.

Swap Wrapped Ethereum for more crypto

Want to exchange Wrapped ETH for other cryptocurrencies like Ethereum and Bitcoin? MoonPay allows you to swap crypto cross-chain with competitive rates, directly from your non-custodial wallet.

.png?w=3840&q=90)

.png?w=3840&q=90)