Blockchain smart contracts, which are programs that automatically execute when certain conditions are met, are capable of completely changing the way value and information flow in our society, creating systems that give individuals more autonomy in the way they interact with products and services.

But there's a catch.

Smart contracts are only as useful as the data they’re fed. They therefore require access to trustworthy data sources.

That's where Chainlink comes in. By connecting smart contracts to external data sources, Chainlink allows for new and exciting blockchain use cases that were once thought impossible.

In this article, we explore what Chainlink is and how it works.

What is Chainlink?

Chainlink (LINK) is a decentralized oracle network that enables smart contracts to securely access off-chain data feeds, web APIs, enterprise systems, cloud services, IoT devices, payment systems, other blockchains, and more.

It essentially acts as a bridge between the blockchain and the outside world, allowing smart contracts to access external data and events.

In simple terms, Chainlink is a technology that helps smart contracts "talk" to the outside world.

History of Chainlink

Chainlink was founded by a team of individuals including Sergey Nazarov, Steve Ellis, and Ari Juels, in September 2017. The idea for Chainlink came about as the founders recognized the need for a secure and reliable way for smart contracts to access off-chain data. They thought that without this, the full potential of smart contracts would never be realized.

The team initially began working on Chainlink as a solution to this problem and eventually released the first version of the Chainlink network in May 2019.

According to Sergey Nazarov, the CEO of Chainlink, the company's goal is to create a decentralized network that provides tamper-proof inputs and outputs for complex smart contracts on any blockchain. He believes that Chainlink will be a crucial component for the mass adoption of blockchain and smart contracts by solving the "oracle problem."

The "oracle problem" explained

One of blockchain's most important use cases is allowing two or more parties to safely exchange data or value without the use of an intermediary. This is made possible by smart contracts, which are programs that automatically execute when the conditions written into the contract are met.

The problem is, smart contracts need to have a reliable, decentralized way to access real-world data like weather, news events, and prices. If the data feeding into a smart contract is incorrect or corrupted, the outcome will also be incorrect.

If smart contracts rely on a centralized source of data, it is much more likely that the data source can be manipulated or compromised. This is known as the "oracle problem."

To give a crude example, let's imagine a smart contract that is programmed to release $100 worth of Token B to an individual when the contract receives $100 worth of Token A.

The contract needs to be able to retrieve data that can accurately tell it what the prices of Token A and Token B are. Otherwise, it will either not dispense the correct amount of Token B or not dispense it at all.

How does Chainlink solve the oracle problem?

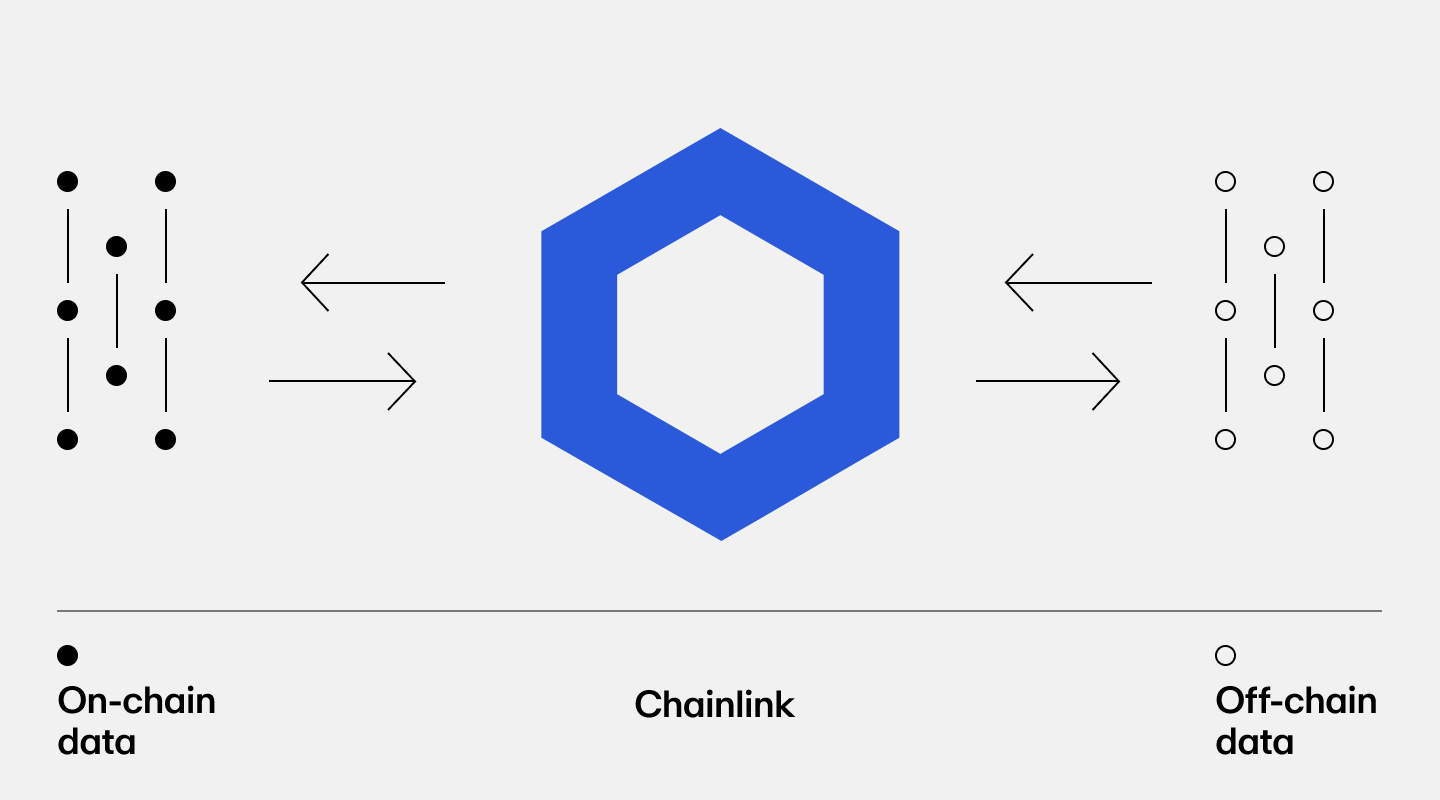

To solve the oracle problem, Chainlink created a decentralized network that acts as middleware - a bridge - between smart contracts and external data sources (a.k.a. "on-chain" data and "off-chain" data).

Instead of trusting a central authority to moderate data, Chainlink maintains an Ethereum-based, decentralized network of node operators in which participants are incentivized to verify data and feed it back to smart contracts for use.

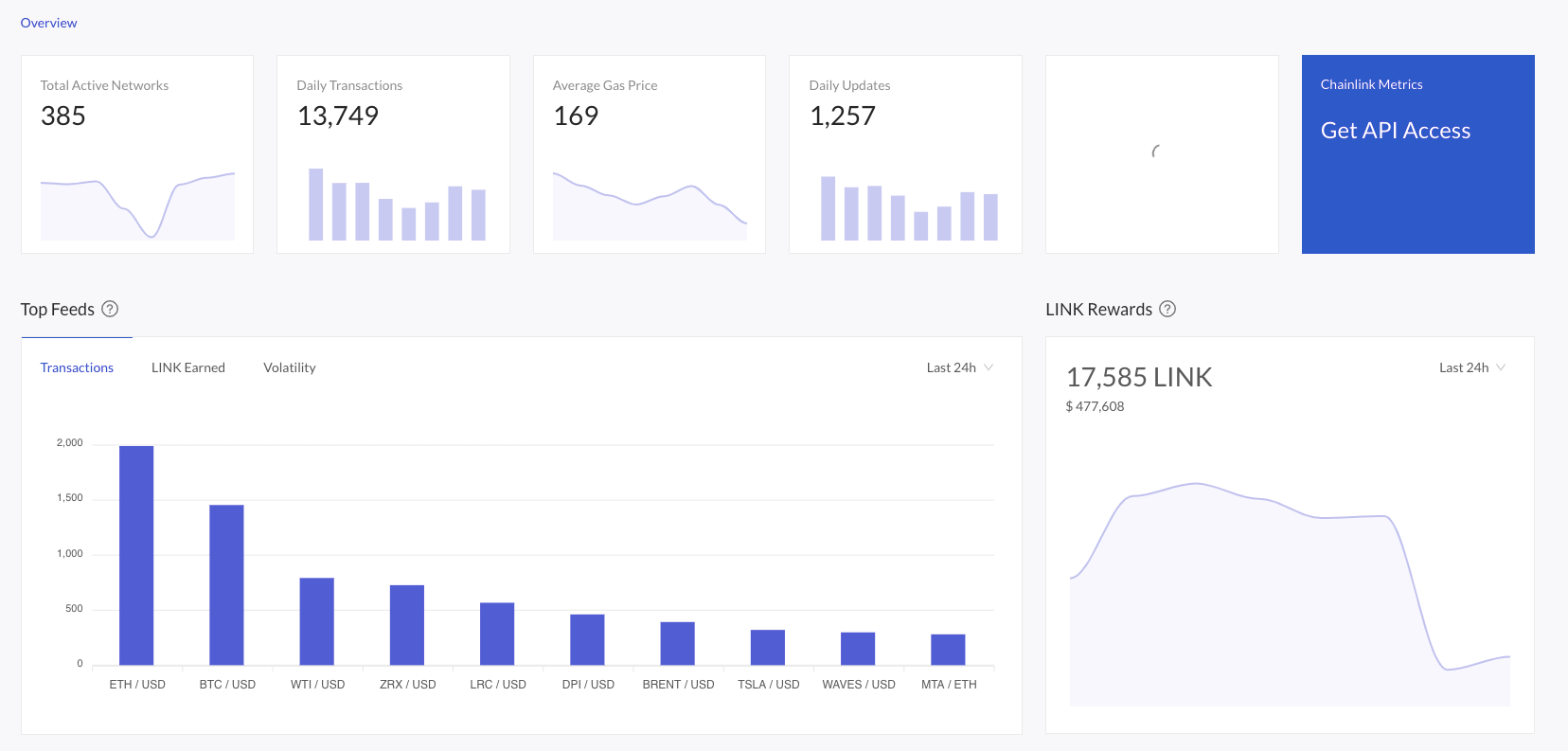

A key part of this is Chainlink's reputation system, which rates oracles based on different performance metrics like uptime, response time, and how many jobs they have successfully completed.

Smart contracts that are seeking trustless data from an off-chain source — web APIs, IoT sensors, and more — can send Chainlink a query, creating a "job" for nodes.

To be eligible to fulfill jobs and receive rewards, Chainlink nodes need to buy LINK tokens and lock them up as collateral. If nodes feed bad or incorrect data to smart contracts, they will lose a portion or all of this collateral — if they act correctly, they will have their collateral returned and earn a reward.

To give smart contracts control in this process, Chainlink allows nodes (oracles) to be selected based on their reputation and job history.

Top 5 Chainlink use cases

Stablecoins

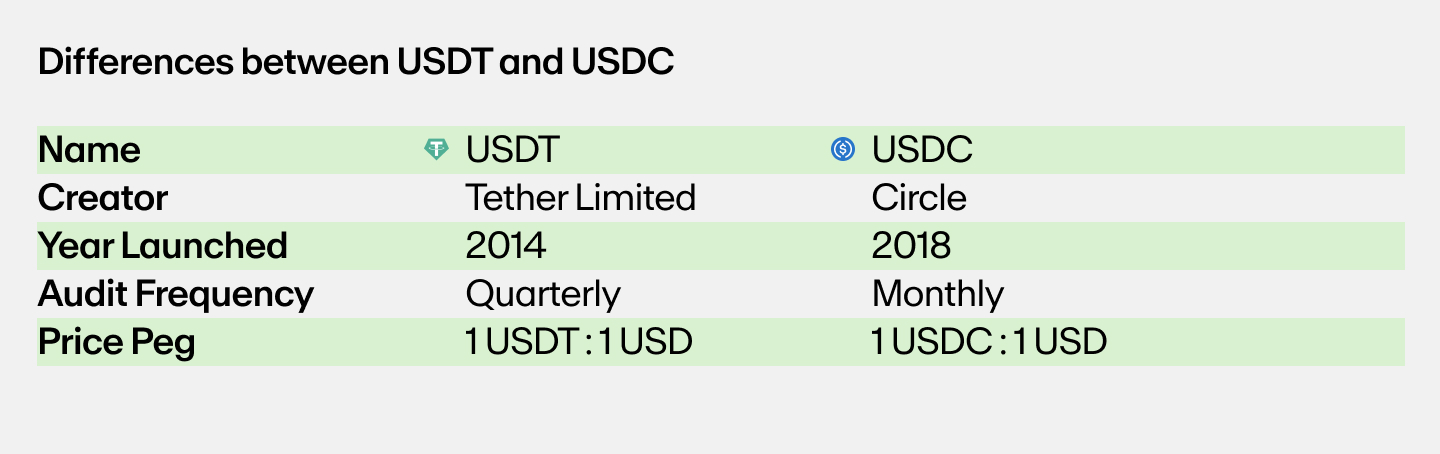

Stablecoins are cryptocurrencies that aim to hold a fixed exchange rate against other currencies and assets like the US dollar, cryptocurrencies, or precious metals. Some of the most popular stablecoins include USDT and USDC, which aim to trade at 1:1 against the US dollar, backed by dollars held in bank accounts.

In order to keep their peg, stablecoins need an accurate way to track the value of their underlying asset. The Chainlink network offers decentralized price feeds of all major assets, enabling stablecoins to maintain the integrity of their reserve ratios in real time.

On-chain reserve monitoring

Cryptocurrencies that are based on one blockchain can be ported over to other blockchains if they are "wrapped" (locked in a vault in their native blockchain and then represented with a 1:1 token that circulates on the other blockchain).

Wrapped Bitcoin (WBTC) is the most popular ported token, with tens of thousands of BTC locked in a reserve on the Bitcoin blockchain, circulating on the Ethereum blockchain as the WBTC ERC-20 token.

Chainlink actively monitors the reserves of both blockchains to make sure all the WBTC tokens stay fully collateralized at all times. This opens up the liquidity of cryptocurrencies beyond their own ecosystem.

Decentralized finance (DeFi)

Unlike traditional finance, decentralized finance (DeFi) enables anyone with an internet connection to borrow, lend, and earn interest using almost any type of asset. The global DeFi market has exploded in the last few years, with the amount of capital deposited into DeFi platforms increasing from $600m in March 2020 to over $54 billion today.

For these systems to function without central authorities that moderate collateral levels, interest rates, and currency values, they can use a decentralized oracle solution like Chainlink to access reliable market data.

Yield farming

One of the most popular buzzwords within DeFi is "yield farming" — the process of depositing crypto assets into liquidity pools and earning interest on them.

But in the past, bad actors have used price feeds as an attack vector to exploit protocols that pool together assets. If bad actors can manipulate the data feeding into the pools, they can change the outcomes of how and where the pools distribute funds.

Several DeFi protocols are using Chainlink to provide tamper-proof price feeds and track the value of deposits, ensuring users receive the correct amount of yield and remain protected from losses.

Supply chain

Supply chain was one of the earliest industries to begin experimenting with smart contract systems, using the technology to record the movement of goods on an immutable decentralized ledger where all information remains open and transparent, updated in real-time.

As goods progress through their various stages of the journey and move from one location to another, smart contracts need to interact with external data sources like APIs, IoT sensors, and data feeds. Chainlink oracles can connect smart contracts to these sources in a decentralized, tamper-proof way.

Did you know? You can pay with Chainlink

How can you buy LINK tokens?

You can buy Chainlink (LINK) via MoonPay or through any of our partner wallet applications with a credit card, bank transfer, Apple Pay, Google Pay, and many other payment methods. Just enter the amount of LINK you wish to purchase and follow the steps to complete your order.

Users can also top up in euros, pounds, or dollars and use MoonPay Balance when buying Chainlink (LINK) and other cryptocurrency. Use your balance to enjoy lower transaction fees, quicker processing times, and better approval rates.

Swap Chainlink for more crypto

Want to exchange Chainlink for other cryptocurrencies like Ethereum and Bitcoin? MoonPay allows you to swap crypto cross-chain with no processing fees (network fees apply), directly from your non-custodial wallet.

.png?w=3840&q=90)

.png?w=3840&q=90)

.png?w=3840&q=90)