What are governance tokens and how do they work?

Are governance tokens the key to the full decentralization of finance? Learn how they're empowering on-chain governance and community participation.

By Sankrit K

Table of Contents

- What are governance tokens?

- How do governance tokens work?

- Examples of Governance Tokens

- What is the difference between governance tokens and utility tokens?

- Advantages of governance tokens

- Disadvantages of governance tokens

- Governance token value

- Begin your decentralized finance (DeFi) journey

- Swap governance tokens

Just as any company or country requires decision makers to ensure that progress is being made in the right direction, so too do decentralized finance (DeFi) protocols and blockchain networks.

But how do you ensure proper (and streamlined) governance of DeFi protocols without breaking the ethos of decentralization itself?

Beyond the complex algorithms and mining procedures, there lies a pivotal component that is essential to the operation of these networks - governance tokens.

These digital assets have gained a lot of attention recently, mainly for their role in the decentralization of the decision-making process for major blockchain-based systems.

This article explores what exactly governance tokens are and how they function.

What are governance tokens?

Governance tokens are cryptocurrencies that are the key to on-chain decision-making. Unlike crypto assets such as Bitcoin that are used only as a means of payment, governance tokens incentivize community participation by giving holders voting powers for the future direction of the crypto project.

Specifically, these tokens give holders the right to vote on specific decisions made by the network, such as changes to the software code, protocol upgrades, bug fixes, feature implementation, and more. All of this gives governance token holders real power, allowing them to directly influence the development, operation, and future direction of a Defi protocol or blockchain network.

The aim of governance tokens is to create a more decentralized system that reduces risk and increases trust for all participants. They also provide an incentive for people to participate in the network and contribute towards its growth, which can lead to greater adoption of the protocol itself. This, in turn, would strengthen the network and increase its value over time.

How do governance tokens work?

Governance tokens work by providing holders with a certain weight in the voting system, depending on the number of coins they hold. Those who hold more tokens have greater governance power and more influence in how the network operates, meaning their votes are weighted more heavily than those who hold fewer coins.

This is in contrast to a democratic system, where everyone has an equal vote regardless of how many assets they own.

Once users cast their votes, a consensus mechanism is used to assess the collective opinion of all token holders and decide which changes should be implemented. This means that any proposed changes to the network must receive approval from a certain percentage of token holders before it is approved. Votes are tallied and enacted automatically via smart contracts so that no tampering by malicious actors can occur.

This system ensures that no single user or entity has too much control over the network and its operations, encouraging an increased level of decentralization.

Here's what a typical on-chain governance system with a governance token may look like:

- One token = one vote

- The proposal is accepted if at least 51% of participating tokens vote in favor

- Funds from the community treasury are allocated to the proposal's implementation if passed

Note that such a setup is not universal. Instead, each protocol is free to use its own tokenomics and voting process.

Examples of Governance Tokens

While any decentralized autonomous organization (DAO) or crypto platform can create their own governance token, there are a few that dominate the market.

Here are some of the top governance tokens:

Maker (MKR)

Maker is the governance token of the MakerDAO protocol, a decentralized autonomous organization (DAO) and lending platform built on the Ethereum blockchain. MKR holders can vote on changes to the platform, including setting interest rates and collateral requirements.

Compound (COMP)

Compound is a decentralized lending and borrowing platform that uses the COMP token for governance. COMP governance token holders can propose and vote on changes to the protocol, including changes to interest rates and asset listings.

Uniswap (UNI)

Uniswap is a decentralized exchange (DEX) that allows users to trade cryptocurrencies without the need for an intermediary. UNI governance token holders can submit and vote on proposals that decide how the platform is governed, including changes to parameters such as trading fees.

Aave (AAVE)

Aave is a decentralized lending and borrowing platform that uses the AAVE token for governance. AAVE governance token holders can vote on proposals related to the development and governance of the protocol.

Yearn.finance (YFI)

Yearn.finance is a decentralized finance (DeFi) platform that provides yield farming strategies to users. YFI is the governance token of the Yearn.finance protocol and enables holders to vote on proposals related to the platform's development and operation.

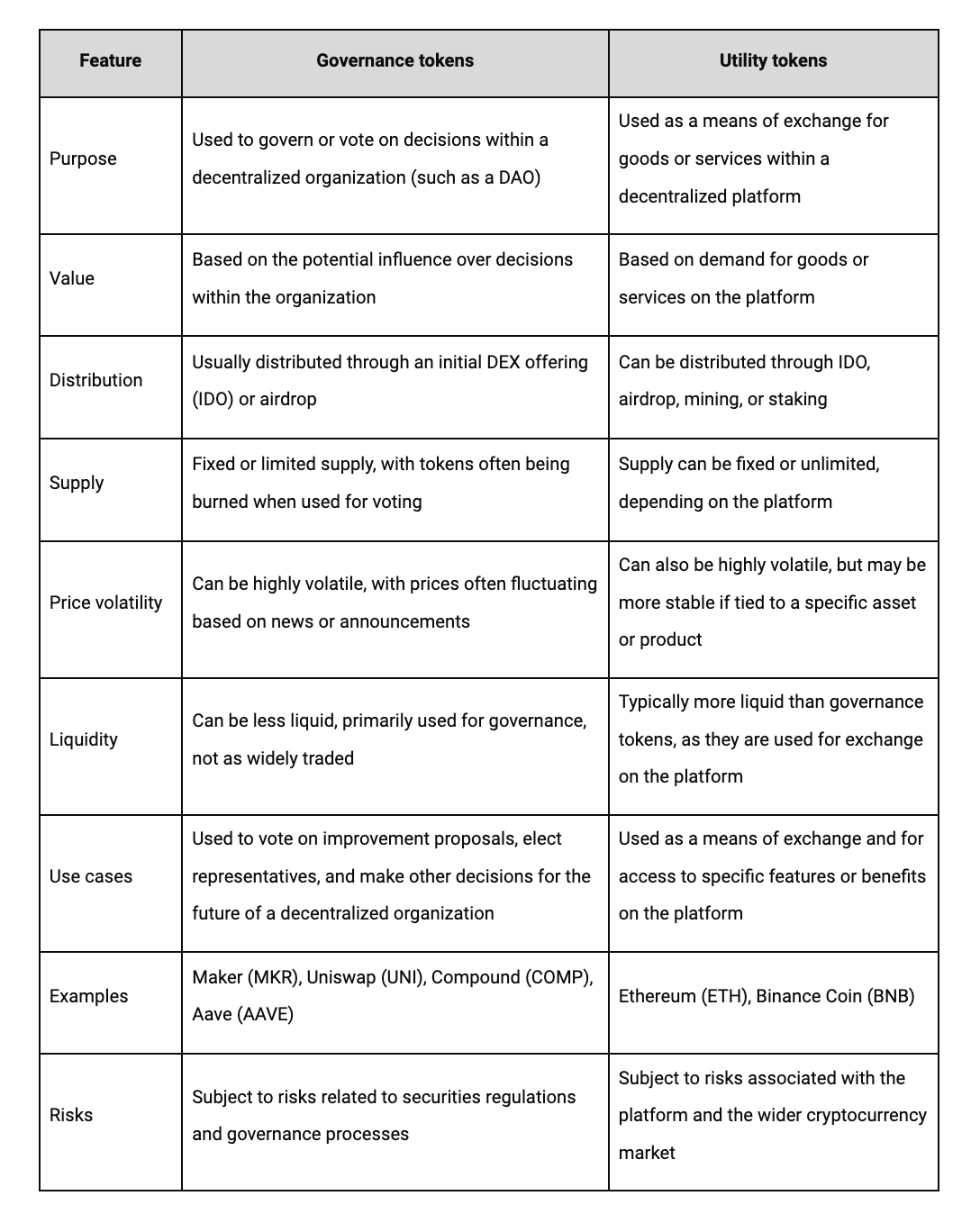

What is the difference between governance tokens and utility tokens?

Although they may seem similar, governance tokens and utility tokens are not exactly the same thing.

- Governance tokens are typically held by users who have skin in the game in order to influence the decision-making process of the DeFi project or blockchain network.

- Utility tokens can be held by anyone, and their purpose is to provide access to a particular service or product.

Let's compare governance tokens and utility tokens further:

Note that some cryptocurrencies can be both governance tokens and utility tokens. In a way, governance tokens are also utility tokens as they allow access to the DeFi project's voting process.

Advantages of governance tokens

- Decentralized decision-making: Allow users to make decisions pertaining to a protocol or blockchain network without having to rely on centralized entities. By protecting from centralized governance, they help prevent any one entity from gaining too much control over the ecosystem.

- Decentralized funding: Token holders can use their governance tokens to vote on proposals for the development of the underlying protocol, and these funds are then allocated directly from the token holders themselves. This helps ensure that projects are funded by those who actually use and benefit from them.

- Community engagement: Incentivize community engagement and participation. Community members are more likely to take an active interest in the network and its success if they have voting rights and a direct say in the project's future.

- Transparent governance: Governance tokens can provide a transparent and auditable record of decisions within a network. This helps to increase trust and accountability with community members.

- Flexibility and agility: Allow for more flexibility and agility in the decision-making process. The decentralized nature of governance protocols means that decisions can be made quickly and efficiently without the need for bureaucratic processes.

- Incentivizing contributions: Governance tokens can also be used to incentivize contributions to the network. For example, community members may be rewarded for providing liquidity or contributing to the development of the ecosystem.

Disadvantages of governance tokens

- Low voter turnout: Low voter turnout is a serious concern in the case of on-chain governance. While a governance token provides a mechanism for greater voting power and decentralized decision-making within an organization, it is still up to the token holders to participate in the governance process.If voter turnout is low, decisions may be made by a small group of individuals, which can lead to a less democratic outcome, as we will see next.

- Concentration of voting power: Concentration of voting power may occur if there are whales in the project, which are token holders who hold a disproportionate amount of voting power. This can lead to a situation where decisions are made by a small group of individuals rather than the wider community.

- Manipulation: Governance tokens are susceptible to manipulation by those with a large number of tokens. For example, a token holder with a large amount of tokens may attempt to influence the outcome of a vote in their favor.

- Slow decision-making: Decentralized governance can lead to slower implementation of decisions. This is because proposed changes may need to be voted on by the token holders, which can take time.

- Lack of accountability: Governance tokens can provide a transparent and auditable record of decision-making, but they do not provide any mechanism for holding token holders accountable. This could lead to decisions being made without any repercussions, which could ultimately be damaging to the DeFi project and network.

Governance token value

Governance tokens are valuable to crypto projects and community members because of three main reasons:

- They help bootstrap growth

- They help to align incentives between users and DeFi protocols

- They protect blockchain protocols through network effects

Bootstrap growth

When a new blockchain project is launched, it needs to attract users and investors to grow. Governance tokens can help bootstrap this growth by incentivizing people to use the crypto platform.

For instance, a project might offer governance tokens as a reward for users who serve as liquidity providers to a liquidity pool or for developers who contribute code to the project.

By offering governance tokens, the crypto project can attract early adopters who are willing to contribute their time, money, or resources to help it grow.

Align incentives

Blockchain projects rely on a community of users to maintain and improve the platform. However, users may have different goals and incentives.

For example, a user who holds a lot of a particular cryptocurrency may want to see the price of that cryptocurrency go up, while another user who uses the platform for a specific purpose may want to see it become more efficient.

Governance tokens can help align these incentives by giving users voting powers in the project's decision-making process. By allowing users to vote on proposals, the project can ensure that decisions are made in the best interest of the community as a whole.

Protect the protocol

A blockchain project is only valuable if it has a strong network effect. The network effect refers to the concept that a platform becomes more valuable as more people use it.

Governance tokens can help protect DeFi protocols by creating a feedback loop between the platform's value and the value of the governance token itself. This creates a self-reinforcing cycle that can help protect the platform from attacks by malicious actors, as well as external competition.

Begin your decentralized finance (DeFi) journey

Using governance tokens like AAVE, COMP, and DOT allows you to participate in a decentralized organization by voting on key decisions pertaining to the project's future.

To get started on your decentralized governance journey, simply buy crypto via MoonPay using your credit card, bank transfer, or any other preferred payment method. MoonPay's widget offers a fast and easy way to buy Bitcoin, Ethereum, and more than 50 other cryptocurrencies.

MoonPay also makes it easy to sell crypto when you decide it's time to cash out. Simply enter the amount of the token you'd like to sell and enter the details where you want to receive your funds.

Swap governance tokens

Want to exchange governance coins like AAVE and COMP for other cryptocurrencies like Ethereum and Bitcoin? MoonPay allows you to swap crypto cross-chain with competitive rates, directly from your non-custodial wallet.