Disclaimer: The following is for informational purposes only and should not be construed as financial advice.

Gold has dominated investment markets for centuries. But over the past decade, Bitcoin's rising popularity has demonstrated how a blockchain-based distributed network can store value intrinsically while enabling efficient, borderless transactions.

The world's first cryptocurrency has been called “digital gold”, and although it’s been tested in bear markets, investors have been adopting Bitcoin as a speculative hedge against inflation, recession, and socio-economic disasters.

But why has Bitcoin been called digital gold, and how does this cryptocurrency compare to tangible, real-world gold that glitters and glistens?

This article examines the similarities and differences between Bitcoin and gold using metrics such as regulation, utility, liquidity, and volatility.

Before diving into the details, though, it's necessary to understand how each of these commodities fare as financial instruments.

Bitcoin in brief

Introduced in 2009, Bitcoin is a digital-native crypto asset and the largest by market capitalization. In less than a decade, Bitcoin established itself as a viable unit of exchange.

Bitcoin was created by a person or a team of people under the pseudonym Satoshi Nakomoto, who described the new technology as an electronic peer-to-peer cash system. This gave rise to the crypto industry: a new era of finance and investing in which people could finally take control of their assets and break free from centralized entities.

Unlike regular fiat currencies, Bitcoin is created, stored, and traded on a distributed ledger called the blockchain. At its core, a blockchain is a decentralized database spread across a network of nodes around the world.

This network is immutable, meaning that whenever a transaction takes place on the blockchain, this new information along with the information in the previous block is merged to form a fixed chain. The network has a set of participants called miners who verify these transactions. Whenever a transaction is successfully verified by a miner, a Bitcoin is created and rewarded to that miner. The miner is then free to sell, trade, or simply HODL their coin.

No single person, company, organization, or country can control the Bitcoin network and anyone can become a part of it. This means that Bitcoin, as a product of this network, also cannot be controlled by central banks or other government authorities.

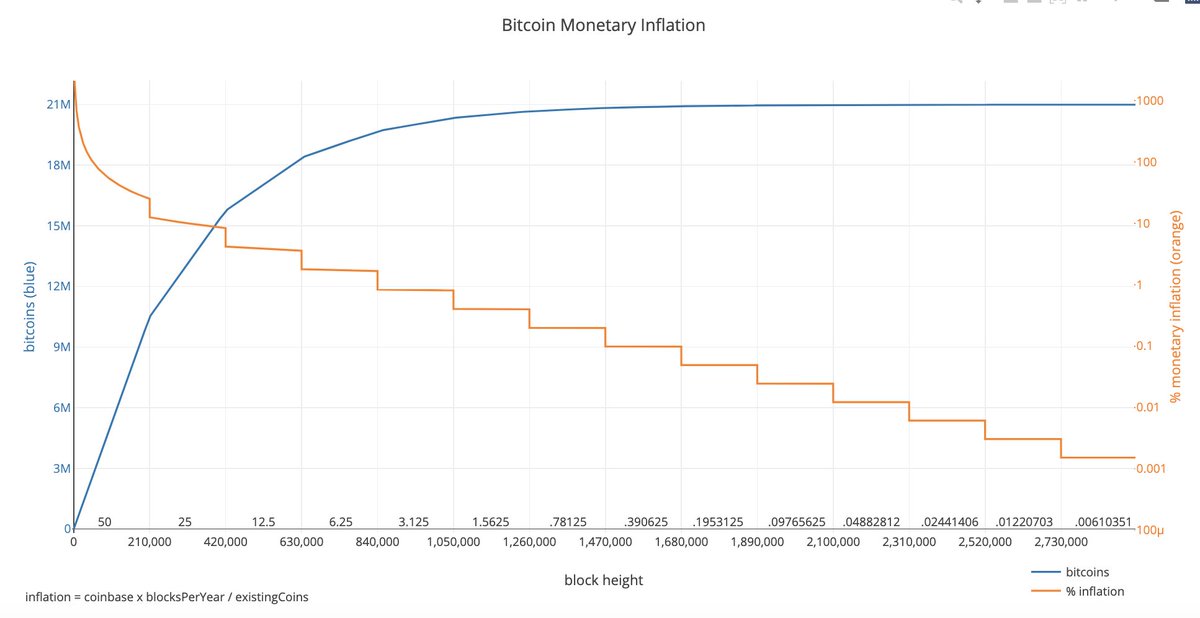

Bitcoin has a maximum total supply of 21 million coins, out of which about 19 million are currently in circulation. The production of new coins also halves approximately every four years, with total production estimated to finish in 2140.

The inherent value of Bitcoin is thus a function of this scarcity, along with other things such as utility and acceptability.

Gold in brief

With a rich history that dates back to the dawn of civilization, gold is one of the most coveted precious metals and is used across the world for a wide variety of purposes.

In the modern economy, gold has long been established as one of the most reliable investment vehicles. Investors buy gold as a portfolio hedge and to diversify risk, since overall gold has maintained a remarkably consistent market performance compared to other assets. This makes it one of the most sought after investments of all time.

In the wake of the COVID-19 pandemic, many investors turned to gold to protect their portfolios against plummeting market conditions. As a result, gold’s price skyrocketed to over $2,000 in mid-2020.

Key differences between Bitcoin and Gold

Regulations

The key difference between Bitcoin and gold lies in the regulatory infrastructure surrounding them. Gold is a widely accepted and well-regulated means of investment, storage, and value exchange across the globe.

There are government-certified brokers and dealers for buying and selling gold. This significantly reduces the chances of fraud or scams, and it is almost impossible to create undetectable counterfeit gold.

Bitcoin, however, is not recognized and regulated in some countries due to its inherent decentralized nature. The laws and regulations applicable to owning, buying, selling, mining, and trading Bitcoin vary from country to country, and investors could face regulatory friction depending on where they live.

With the popularity of cryptocurrencies rising each day, countries are slowly taking measures to recognize and regulate them. In 2021, for example, El Salvador made Bitcoin legal tender. And in 2022, India made it a taxable asset.

Utility

Another area in which Bitcoin and gold differ is utility—these assets have vastly different use-cases in the real world.

Historically, gold has been used as both a currency and as raw material for the production of jewelry. It has also found use in luxury items, electronics, and dentistry.

Bitcoin, on the other hand, has little use in the real world but more applications in finance. Like gold, it is used for investment purposes, but unlike gold it’s also used as a digital currency to make payments across the globe.

Bitcoin also has applications in decentralized finance (DeFi), an alternate financial system built purely on digital assets. Within DeFi, Bitcoin can be used for decentralized lending, borrowing, staking, and yield farming.

Liquidity

The liquidity of an asset is a measure of how easily it can be exchanged for fiat currency. In this regard, generally both Bitcoin and Gold are liquid.

Investors can easily convert their Bitcoin to fiat money on platforms like MoonPay, but some crypto exchanges have upper limits so users may find it difficult to liquidate all of their Bitcoin at once.

Gold, on the other hand, is easier to liquidate, since it is an asset that users can seamlessly move in and out of. The fact that physical gold is sold around the world and can be used as collateral to obtain loans also makes it better in terms of liquidity.

Volatility

Both gold and Bitcoin are volatile assets. Bitcoin, however, can have far more price fluctuations than gold in a single day. Between April and May of 2022, for example, the price of Bitcoin fell from a high of $43,236 to a low of $30,574.

This was a result of market trends and the media effect in which news prompts users to panic buy or sell, causing waves of fluctuations.

On the other hand, during the same time period, the price of gold hardly moved from $1930/oz at the beginning of April 2022 to $1911/oz at the beginning of May–a change of less than one percent.

The historical data clearly shows Bitcoin has a higher rate of volatility compared to gold and therefore could present greater risk to investors.

For live Bitcoin price and market metrics, view our Bitcoin Price page

Rarity

Rarity is a key factor when it comes to choosing one financial instrument over another, since scarcer assets are usually more valuable to the investor.

As mentioned earlier, Bitcoin's total supply is limited to 21 million, 90% of which is already in circulation. But, in the case of gold, the scope for production is not limited. Data from the World Gold Council shows that mining companies have extracted close to 190,000 metric tons of gold so far, while an additional 3,300 is produced every year.

Gold mining could eventually become economically unsustainable. However, as long as there is demand for gold, in practice, it will have unlimited supply until the extraction rate surpasses the replenishment rate.

For Bitcoin, however, this isn’t the case. Its supply is absolutely finite and cannot be inflated under any circumstances. Moreover, the number of Bitcoins produced is halved roughly every four years.

Bitcoin vs gold as inflation hedges

The scarcity of gold has long maintained its position as a hedge against inflation. With Bitcoin emerging as another scarce asset, however, it’s possible Bitcoin may serve as an additional option to hedge against inflation. This is one of the reasons why Bitcoin has been called digital gold.

Global economies increase their currency reserves by buying government bonds to lower the rates of interest. This inadvertently leads to rising inflation. In March 2022, inflation in the US rose to about 8.4%—the highest since 1982. This signifies that a dollar during this time had 8.5% less purchasing power than it had a year prior.

Hedge investments help protect against such declines in purchasing power by outperforming inflation. Gold, for instance, has historically performed well during inflationary periods by increasing in value as the dollar declined. Bitcoin, with its scarcity, could also potentially serve as a hedge investment under certain market conditions.

However, investing in Bitcoin and other cryptocurrencies involves a great deal of risk, so you should research carefully and evaluate all possibilities before making any investment decisions.

Which is a better investment: Bitcoin or Gold?

Both Bitcoin and gold come with their fair share of benefits and risks. Bitcoin is a riskier asset because of its lack of regulatory infrastructure and higher volatility, but of course this also means that it can bring a higher return on investment.

The decision to invest in either of these assets comes down to the individual investor’s goals and appetite for risk. For those with a slightly higher risk tolerance, Bitcoin would make for a great addition to their portfolio.

For risk-averse investors, however, gold is the better option. With less volatility and risk, gold is more suitable for people seeking a stable value appreciation.

How to buy Bitcoin

You can buy Bitcoin (BTC) via MoonPay or through any of our partner wallet applications with a credit card, bank transfer, Apple Pay, Google Pay, and many other payment methods. Just enter the amount of BTC you wish to purchase and follow the steps to complete your order.

You can also top up in euros, pounds, or dollars and use your MoonPay Balance to purchase cryptocurrencies like Bitcoin. Once funded, use your balance for faster, cheaper transactions and higher approval rates. When you're ready to withdraw, enjoy zero-fee BTC transfers straight to your bank account.

How to sell Bitcoin

MoonPay makes it easy to sell Bitcoin when you decide it's time to cash out your crypto.

Simply enter the amount of BTC you'd like to sell and enter the details where you want to receive your funds.

Swap Bitcoin for more crypto

Want to exchange Bitcoin for other cryptocurrencies like Ethereum and Wrapped Bitcoin? MoonPay allows you to swap crypto cross-chain with competitive rates, directly from your non-custodial wallet.

.png?w=3840&q=90)

.png?w=3840&q=90)

.png?w=3840&q=90)