The GENIUS Act was passed in July 2025 and represents the United States’ first federal framework for stablecoins.

Short for Guiding and Establishing National Innovation for U.S. Stablecoins, the Act outlines clear standards for digital dollars used in payments, settlement, and global value transfer.

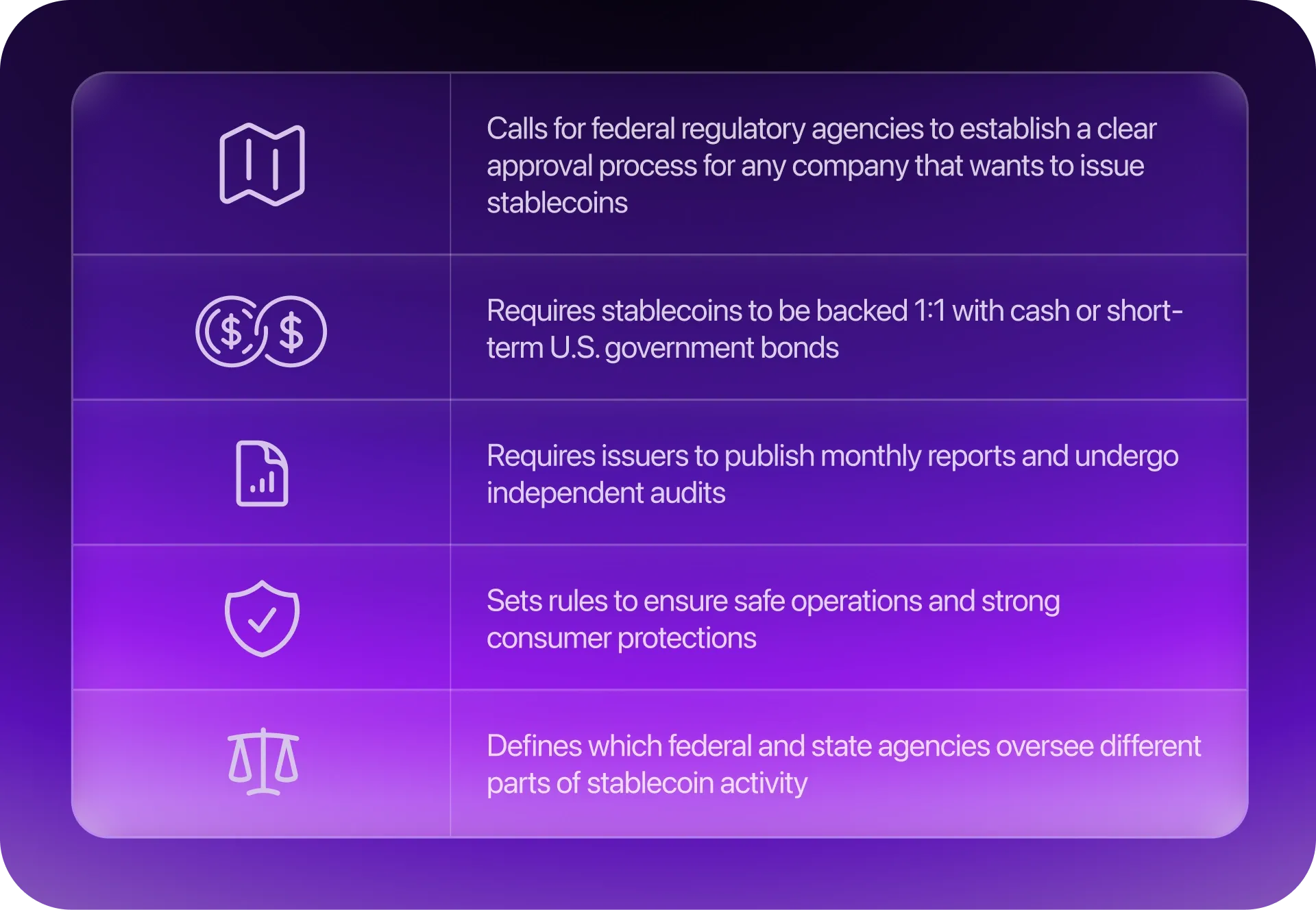

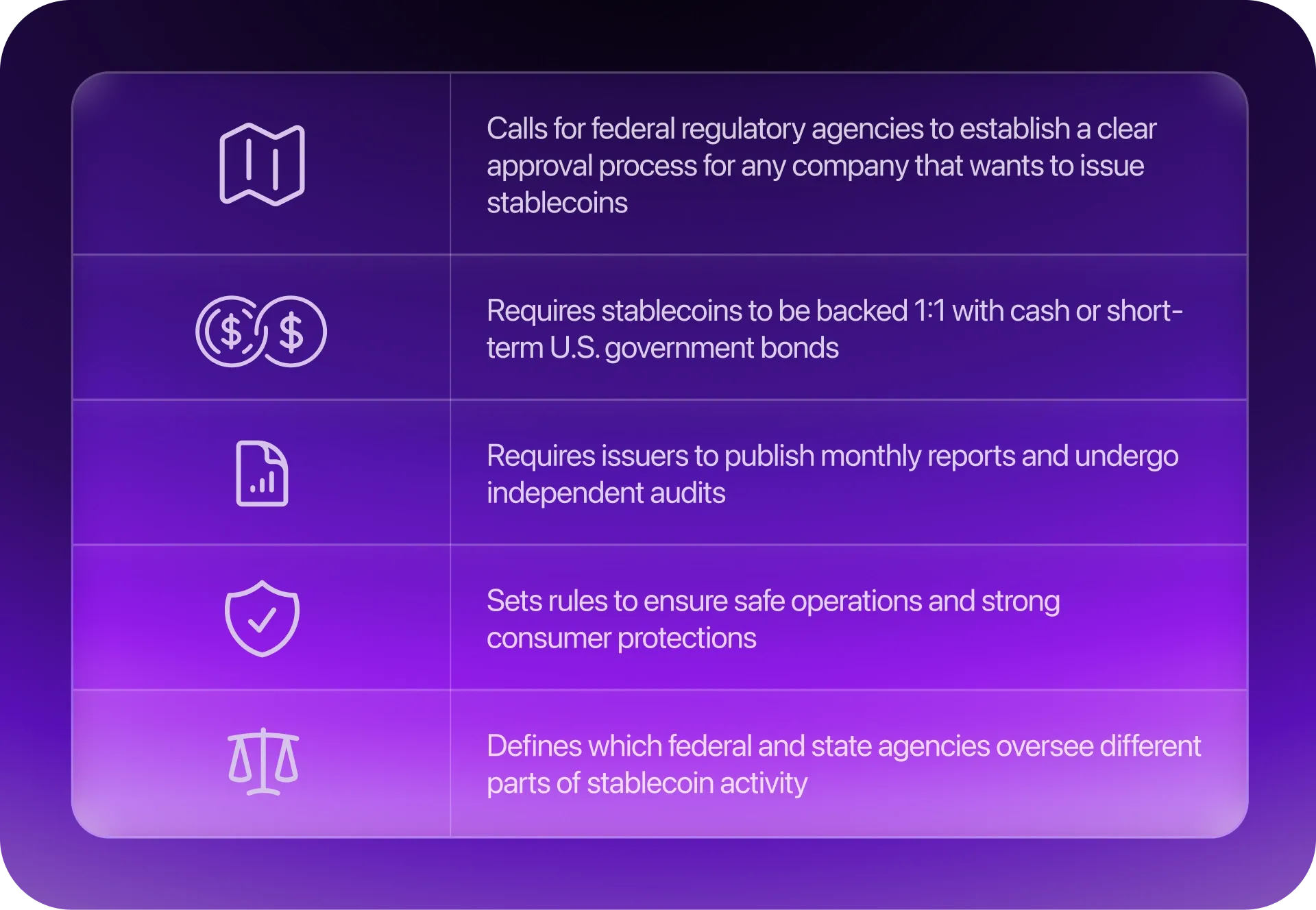

Key provisions of the GENIUS Act

The goal of the GENIUS Act is to support innovation while ensuring that stablecoins remain trustworthy and clearly regulated. To do that, the Act:

By July 2028, these requirements will fully take effect. Any stablecoin available to U.S. consumers must come from a federally-approved issuer such as a bank, credit union, or specially licensed non-bank provider (such as a state or federal trust charter holder).

Stablecoins that do not meet these standards will not be permitted to be listed by digital asset service providers, as defined in the Act.

Why GENIUS matters

With stablecoins now under clear rules, the path is open for traditional banks and financial institutions to safely enter the digital asset space. Clearer regulation will make stablecoins more trusted, which may accelerate wider adoption of digital payments and crypto-linked services across finance.

At the same time, the framework aims to protect consumers from risks associated with unstable or poorly backed stablecoins, reducing chances of de-pegging, collapses, or misleading marketing.

Stablecoins today

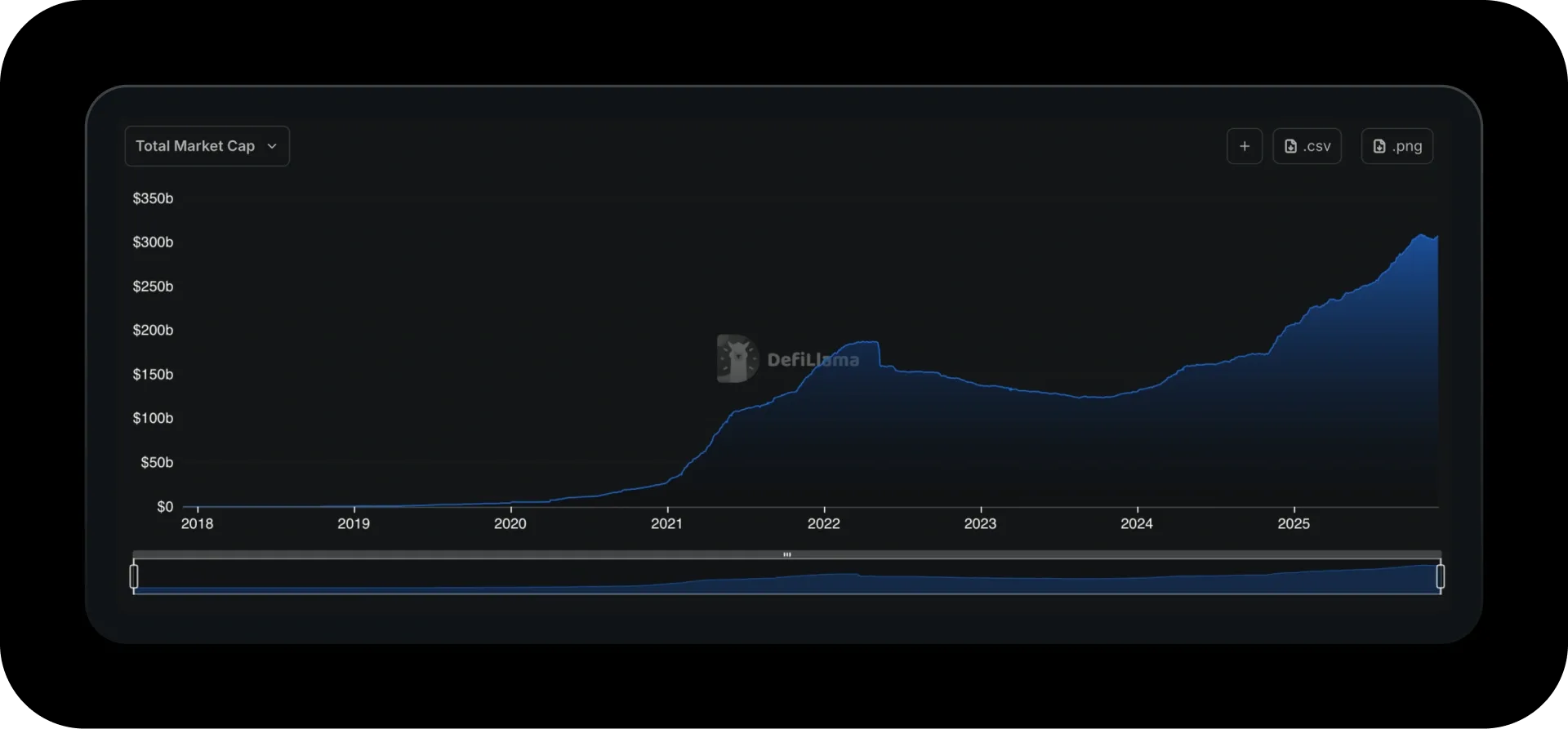

Ten years ago, stablecoins were a small experiment designed to bring the stability of the dollar to the blockchain. Today, that experiment has grown into a global economic force. With a total supply of more than $300 billion, stablecoins now move trillions of dollars every year, operating at a scale that rivals major credit card networks.

Stablecoin total market cap by year

Source: DefiLlama

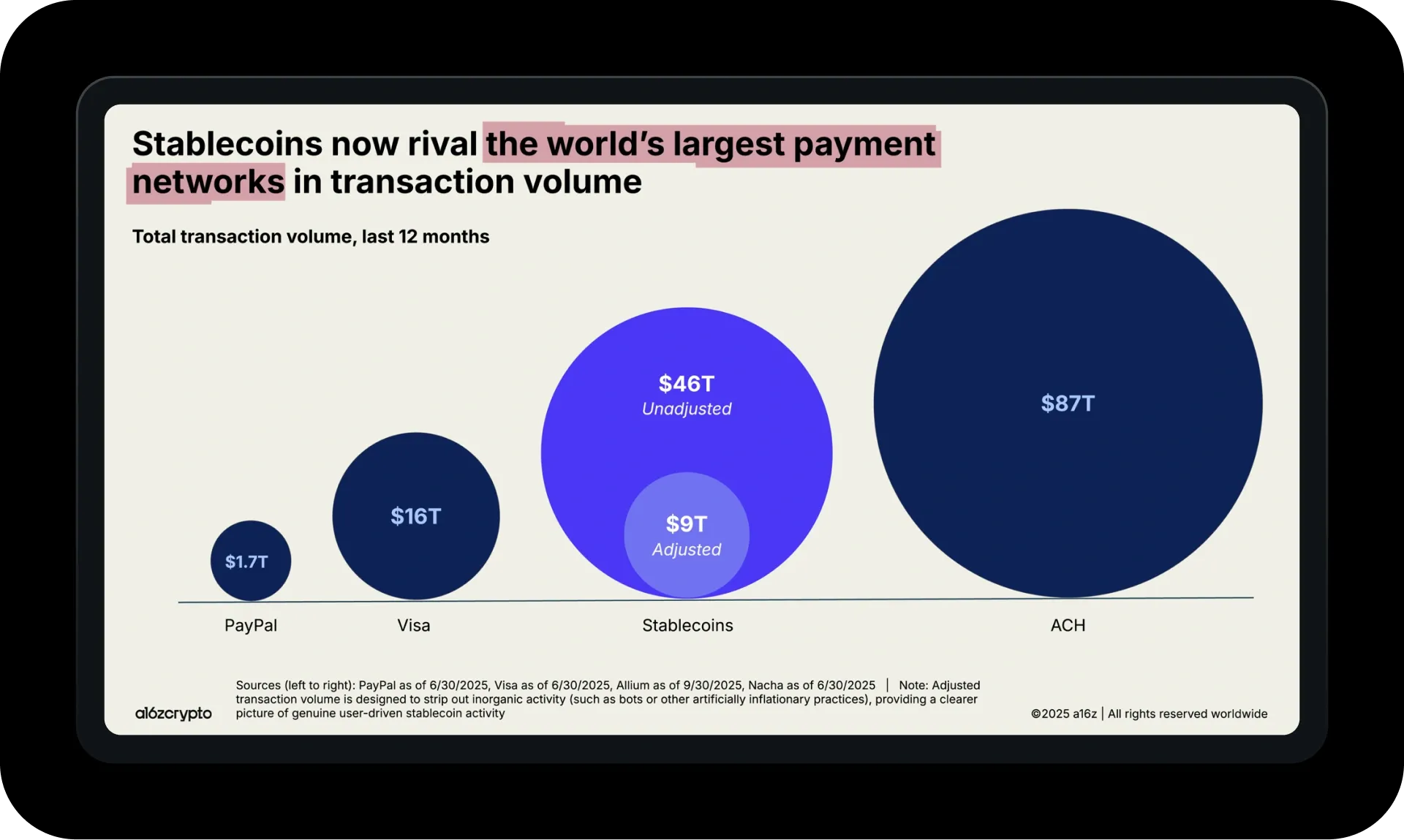

In the last year, stablecoins processed $46 trillion in total transaction volume, nearly three times Visa’s annual throughput.

Source: a16zcrypto

What’s next

The GENIUS Act became law once it was signed by the President. Regulators and issuers are now beginning the work of setting up the compliance, reporting, and oversight systems required under the law. This includes meeting new standards for licensing, public disclosures, reserve management, and consumer protection.

For now, the focus is on putting these rules into practice. As agencies release guidance and issuers update their operations, it will become easier to see how the stablecoin market adjusts to the new regulatory framework.