ACH

By Geoffrey Lyons

ACH is a payment processing network used to move money in bulk between banks.

Think of it like a school bus for money. Instead of sending each kid (or dollar) individually, it fills up with passengers one by one and then drops everyone off at once.

Sign up to our weekly MoonPay Minute newsletter

What problem did ACH solve?

In order to process a large number of transactions, banks need to be able to clear and settle payments.

Clearing When banks confirm the details of a payment, such as who’s sending money to whom. |

Settling When banks move money between accounts and officially complete a transaction. |

While clearing and settling may seem straightforward, consider a company that needs to process payroll for thousands of employees. Many banks would need to be able to coordinate these payments. Here’s where ACH comes in:

- The computer-based Automated Clearing House system was established in the early 1970s to replace the cumbersome, paper-based system of checks.

- That old system relied on physically moving checks between banks and tallying everything by hand, which was slow and prone to error.

- ACH disrupted this by introducing electronic batch processing that moved funds more quickly. Its key innovations were automation and centralization.

The incredible bulk

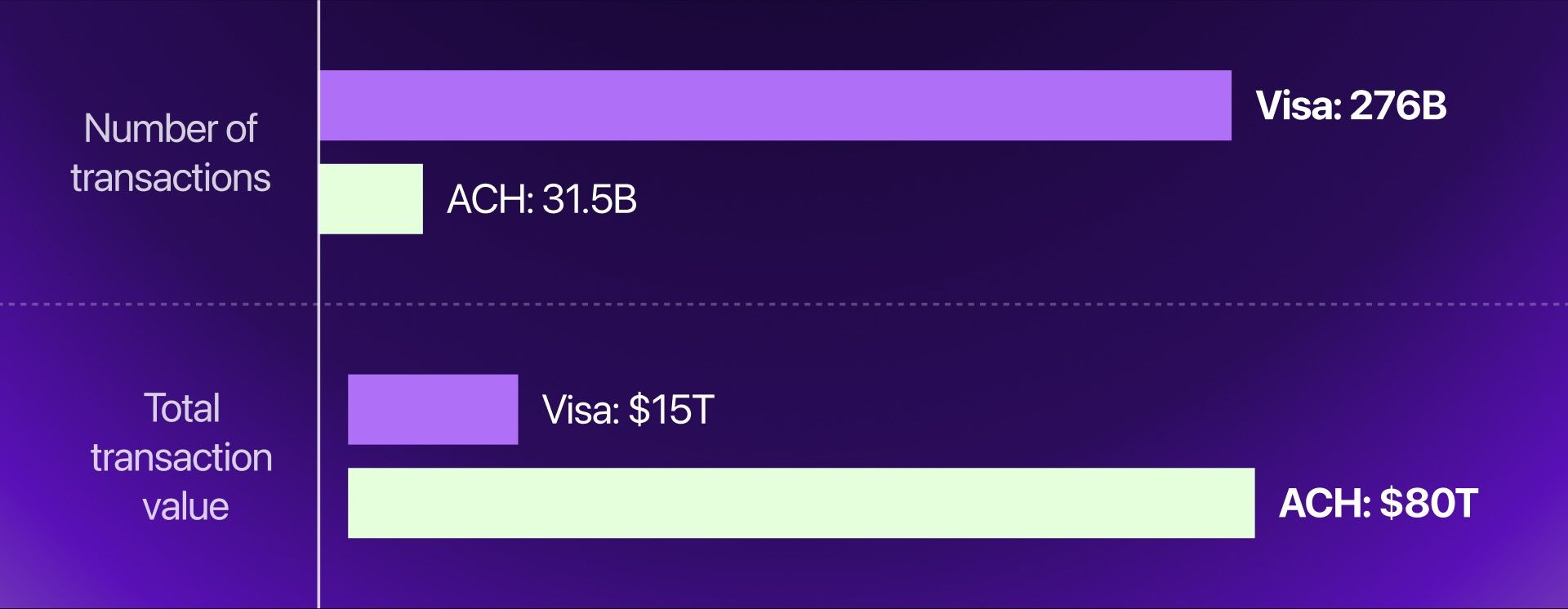

One way to visualize how ACH is commonly used for bulk transactions is to compare it to the Visa network. While ACH is much smaller than Visa in terms of the total number of transactions processed, it’s roughly 5x larger if we compare total dollar volume moved.

Why blockchain is better

ACH’s ability to batch transactions is impressive, but blockchain is the batching king.

ACH batching | Blockchain batching | Why it matters | |

Speed | Batches processed in 1-3 business days. | Batches processed in seconds. | Much faster settlement and can operate outside business hours. |

Cost | Fees usually $0.20 to $1.50 per transaction. | Fees can be fractions of a cent. | Drastically lower costs for high-volume sends. |

Scalability | Batches are limited by central capacity, meaning there’s fixed daily throughput. | Batches scale with block space (the amount of data that can be handled in one go), so there can be more payments per block. | More efficient for batching since there are no central bottlenecks limiting volume. |

Finality | Batches can fail partway through or be reversed later. | Batches are atomic, meaning everything is settled at once or not at all. | All payments in a batch are final. For things like payroll, this creates more certainty. |

Subscribe to our newsletter!

Did you like this article? Sign up to our weekly MoonPay Minute newsletter to get similar content delivered directly to your inbox.