Supply and inflation are issues faced by every cryptocurrency project. While some like Bitcoin have deflationary mechanisms built into the infrastructure itself, others are burned with a potentially unlimited supply and the prospect of token inflation over time.

Coin burning is one common strategy that has emerged to influence tokenomics and counteract some of these downsides, while attempting to increase its scarcity and value.

But what exactly is coin burning, and why do projects choose to implement it?

In this guide, we’ll explain what coin burning is, how it works, why projects use it, and explore real-world examples of how token burns affect crypto ecosystems.

What is coin burning?

Coin burning refers to the process of intentionally removing a certain number of coins or tokens from circulation. Also known as burning tokens, this is irreversible and typically achieved by sending the coins to a public wallet address where they cannot be retrieved or spent.

Once coins are sent to this 'burn address', they are effectively rendered unusable, thus reducing the total supply of the cryptocurrency.

The concept of a crypto coin burn is similar to a stock buyback in traditional finance, where a company buys back shares to reduce the total number of shares available on the market. Similarly, a crypto coin burn aims to decrease the total supply of a cryptocurrency, with the aim to potentially increase its value.

However, such an outcome of price appreciation is never guaranteed for cryptocurrency or stocks.

How does token burning work?

Coin burning works by removing tokens from the circulating supply and sending them to a specific cryptocurrency wallet. But there is more than one way to go about it.

Mechanisms for coin destruction

Coin burning can be achieved through manual or automatic means:

- Manual burning involves a project team or designated authority that burns coins at a specified interval or based on certain conditions.

- Automatic burning utilizes smart contracts that automate the process, burning coins based on predefined triggers, such as transaction volume or time intervals.

Method | How It Works | Advantages | Drawbacks |

Manual Burn | Tokens are destroyed by project teams at specific times or milestones. | Flexible and easy to execute. | Requires trust in the team; risk of manipulation. |

Automatic Burn | Smart contracts trigger burns automatically based on rules ( volume, time, fees, etc.). | Transparent and verifiable on-chain. | Less flexibility; may require complex coding. |

Automatic token burning is generally seen as the more transparent and reliable option, as it operates without human intervention. Manual burning, while flexible, might raise concerns about governance, centralization, and trust, since it's reliant on human discretion.

Impact on token supply

The primary impact of token burning is on token supply. Reducing the total number of coins in circulation allows projects to influence market dynamics such as price and market capitalization.

The aim of burning tokens is to increase scarcity with a supply-demand imbalance that may increase the token's value over time, although this is never a guaranteed outcome.

Why is token burning important?

Coin burning exists for several reasons, often tied to the fundamental economics (tokenomics) of a cryptocurrency project:

Supply control

One of the most common reasons for burning crypto is to control inflation and the overall supply of tokens. With a limited supply, the hope is to increase the value of the remaining coins, and create a healthier ecosystem.

Increase scarcity

Reducing the circulating supply creates scarcity, which can potentially contribute to price appreciation. While this strategy attempts to attract investors, there are many factors that affect the price of a token, such as market dynamics and the health of the overall crypto ecosystem.

Align incentives with token holders

Token burns can also be used to align the incentives of project owners with those of coin holders. When project teams are responsible for reducing supply, they can potentially increase the overall value of the tokens held by their community, thus fostering a sense of shared success and aligned goals.

Other coin burn reasons

- Rewarding holders: Some projects burn coins as part of a buyback program, buying coins from the market and burning them to return value to holders and the community.

- Maintaining network security: Certain consensus mechanisms like Proof of Burn (PoB) use coin burning as an alternative method to validate transactions and secure the network.

- Eliminate unused or lost tokens: Coin burning can also clear out old or unused tokens, streamlining the network and ensuring greater resource efficiency.

What is Proof of Burn (PoB)?

Proof of Burn (PoB) is a consensus mechanism where users "burn" a portion of their tokens to gain the right to validate transactions on the blockchain. This concept involves a trade-off, where validators sacrifice part of their holdings to earn the opportunity to secure the network and receive rewards. PoB is seen as an alternative to Proof of Work (PoW), providing a potentially energy-efficient means of blockchain validation.

The concept behind Proof of Burn is that by destroying a certain number of tokens, validators demonstrate a vested interest in the success of the blockchain network. The burned tokens represent the validators' commitment to the network and grant them the ability to validate transactions, create new blocks, and earn rewards.

The amount of tokens burned can determine the level of participation or influence a validator has within the network. Generally, the more tokens a participant burns, the greater their power and responsibility in the consensus process. Similar to Proof-of-Stake (PoS), PoB creates a system where validators are incentivized to support the network's long-term health, as they have invested their own resources into it.

Benefits of coin burning

Coin burning has several potential benefits that may contribute to the stability and growth of crypto projects:

Market stability

Token burns contribute to a more stable supply, which in turn promotes market stability. With fewer coins in circulation, the potential for large-scale price fluctuations can be reduced, leading to a more predictable market environment.

Although such stability is never certain, burning coins may help to differentiate a project from more volatile cryptocurrencies with no capped maximum supply, such as meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB).

Price support

With coin burning, the reduction in circulating supply can lead to price support, helping to stabilize the token's value over time. This strategy can create a healthier ecosystem by trying to attract users looking for assets with a controlled supply.

Rewarding token holders

Token burning may reward long-term holders by reducing supply and potentially increasing token value. This can be part of a broader strategy to retain and engage a dedicated community of holders.

Building trust and confidence

Consistent and transparent coin burning practices can build trust within the crypto community. When a project demonstrates its commitment to managing supply and promoting token value, it may gain credibility among its community members by aligning their incentives.

Encouraging long-term commitment

With the prospect of value appreciation through coin burning, projects may attempt to encourage long-term investment. This shift away from short-term speculation could help to stabilize the cryptocurrency and foster a more sustainable ecosystem.

Risks of coin burning

Despite its potential benefits, token burning has faced criticism and controversies due to a range of concerns:

Lack of transparency

A common criticism is the lack of transparency in burning crypto. If projects don't clearly communicate their burning strategies or burn schedules, it can lead to mistrust among its community.

Manipulation and speculation

Token burning, particularly when done manually, can open the door to potential market manipulation and speculative trading. This creates a potential risk for investors and can undermine the stability of the token's value in both the short and long term.

Environmental and energy concerns

While Proof of Burn (PoB) is considered energy-efficient, some coin burning methods may contribute to increased energy consumption, leading to environmental concerns. Critics argue that projects should be conscious of their environmental impact when implementing token burn practices.

Unintended consequences

In some cases, burning cryptocurrency might not yield the expected results of controlling inflation and supply. If overused or mismanaged, token burning can create market volatility, leading to unintended consequences for holders and the project as a whole.

Risks and benefits at a glance:

Potential Benefits | Key Risks and Challenges |

Controls token supply and inflation | Lack of transparency in burn schedules |

Creates scarcity and price support | Possible market manipulation |

Rewards long-term holders | No guaranteed impact on price |

Builds trust and community alignment | Environmental concerns in PoB systems |

Coin burning use cases and examples

Token burning has been implemented by various cryptocurrencies with some notable cases that have influenced tokenomics and market dynamics.

Coin burning in major cryptocurrencies

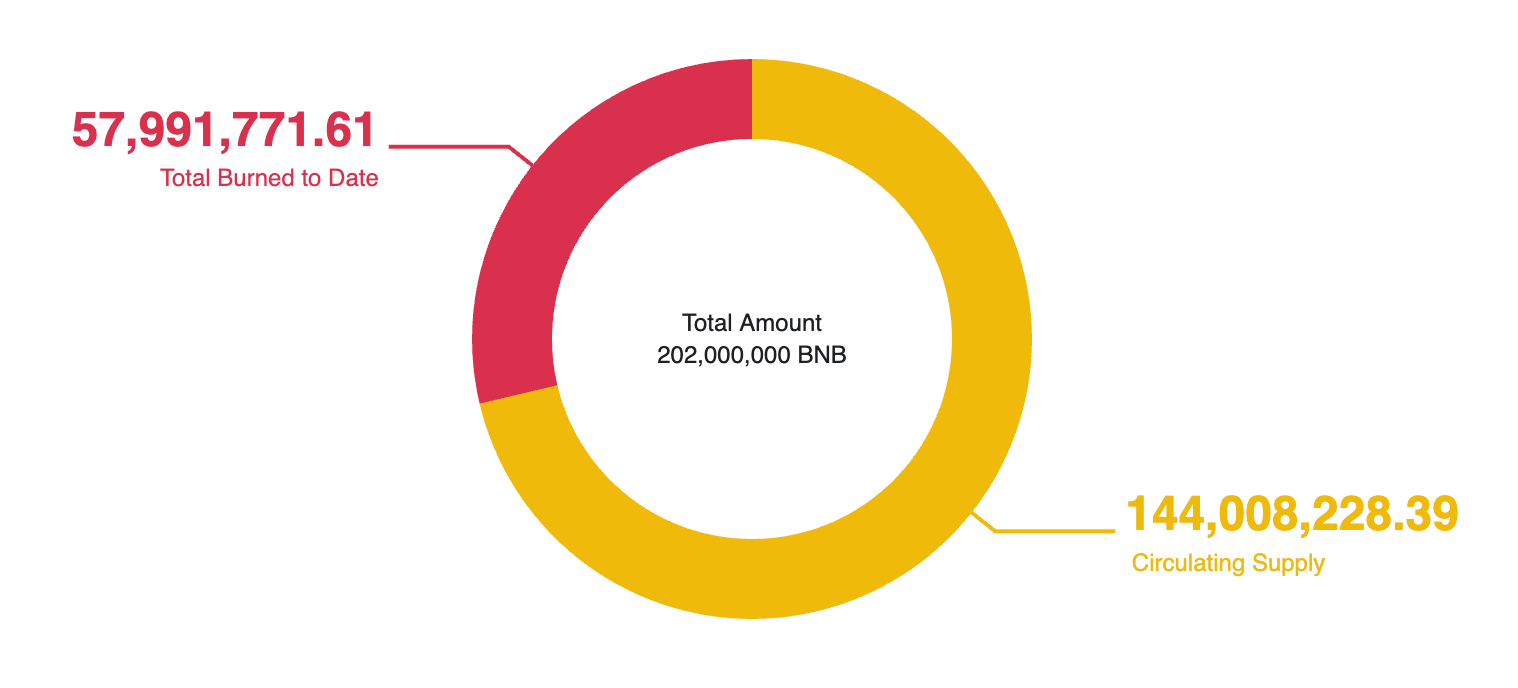

Cryptocurrencies like Binance Coin (BNB) and XRP (XRP) burn coins as part of their tokenomics strategies.

BNB regularly burns a portion of its tokens based on trading volume, gas fees, token price, and number of blocks produced. XRP too has a mechanism that destroys a small amount of tokens with each transaction, and has the option to burn millions of tokens held in escrow. Chiliz (CHZ), the native token of the Socios platform, also recently implemented a token burn mechanism with the aim of reducing inflation in the short and long terms.

Stablecoin providers like Circle (USDC) and Tether (USDT) have historically used token burning mechanisms to issue and redeem stablecoin tokens, while also using burning as an attempt to keep a stable and accurate backing ratio. Wrapped tokens like Wrapped Ethereum (WETH) and Wrapped Bitcoin (WBTC) also utilize token burning to lock up and redeem coins that can be used on different blockchains.

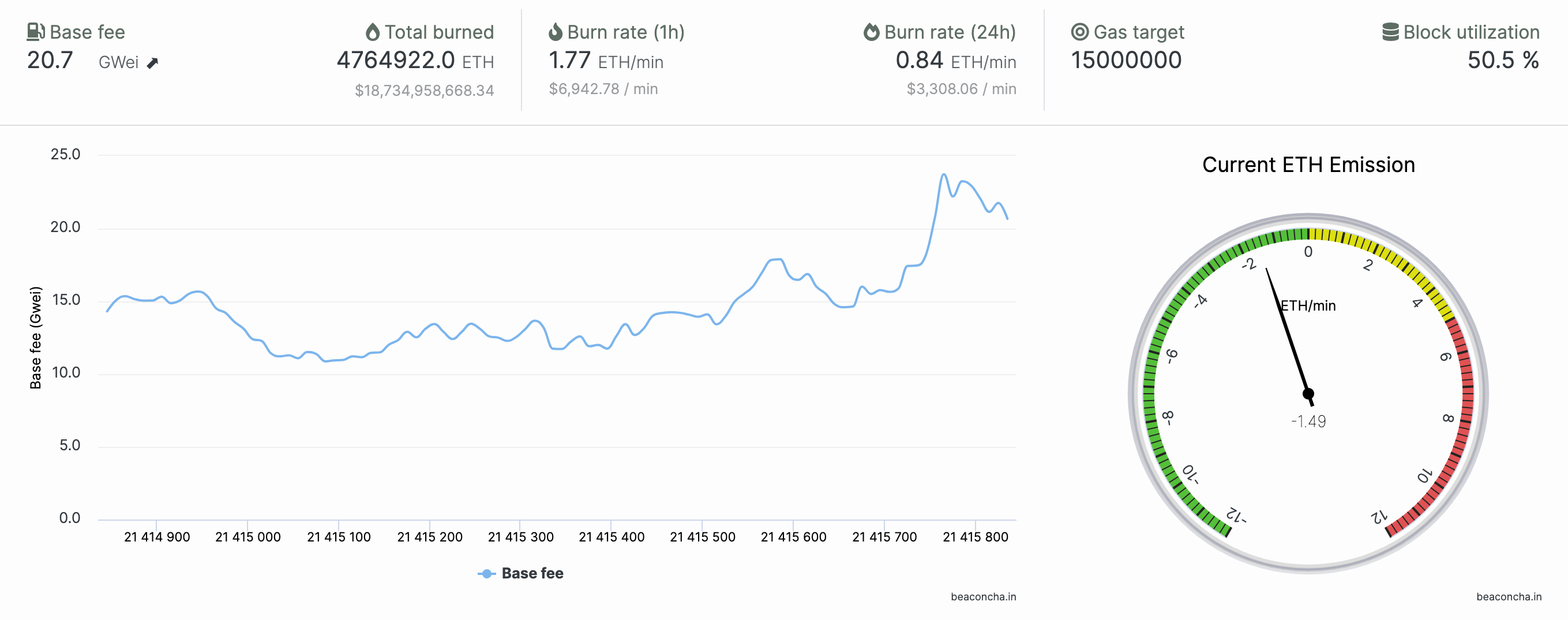

In 2021, the Ethereum London Hard Fork upgrade (EIP) 1559 introduced a mechanism to burn a portion of tokens used to pay transaction fees (Ethereum gas fees). To date, over 4.3 million ETH tokens have been burned since the implementation of EIP-1559.

Over the course of the next year, the Ethereum network is expected to burn over $10 billion worth of ETH tokens, in an effort to shrink the ETH supply to stabilize the cryptocurrency's tokenomics and potentially increase the Ethereum price.

Implementation strategies: Maker case study

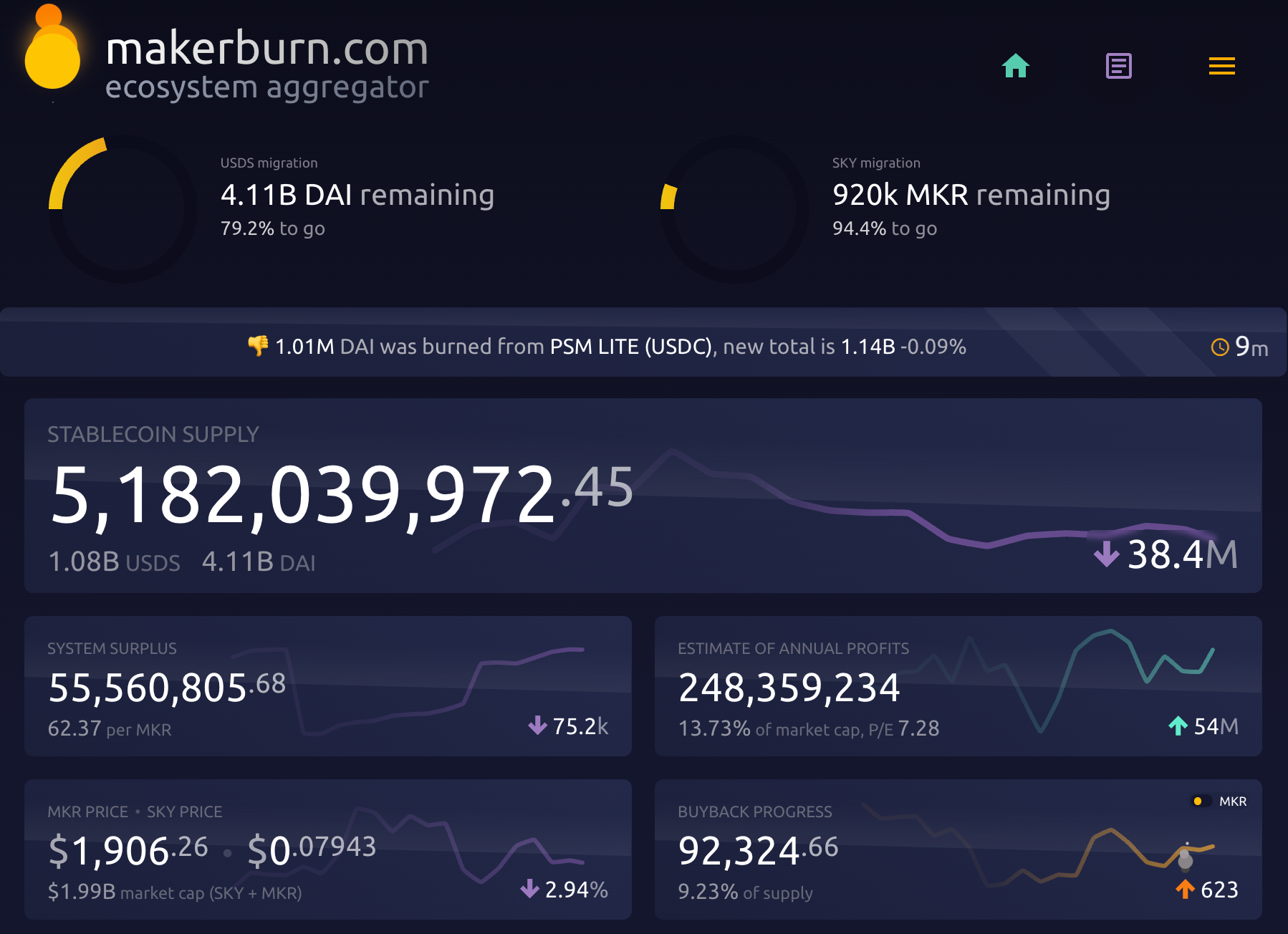

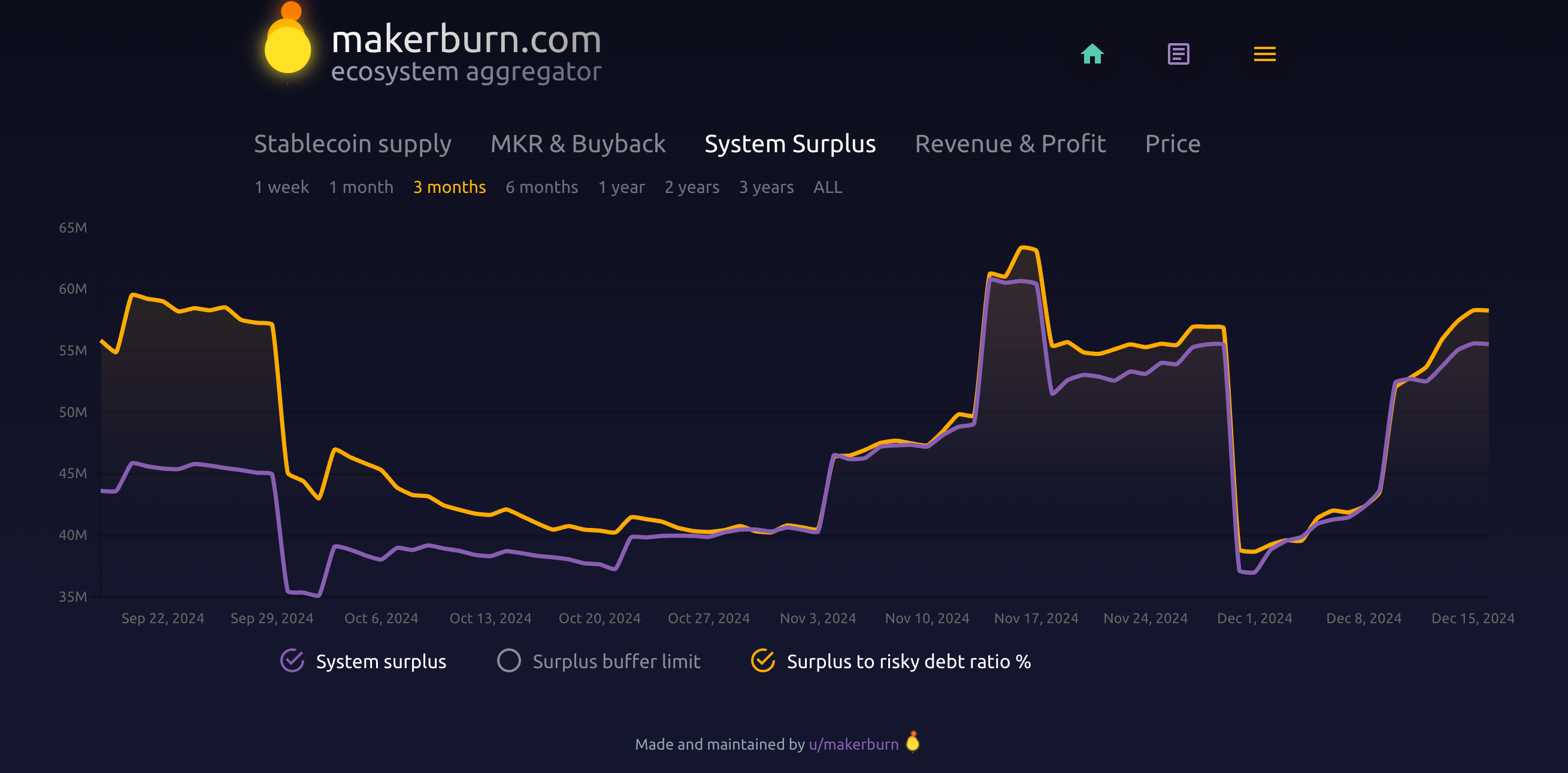

In July 2023, MakerDAO implemented a Smart Burn Engine (SBE) to manage the protocol's surplus of MKR tokens. This mechanism functions by automatically kicking in whenever there is a surplus exceeding $50 million in DAI tokens.

When this happens, the excess DAI is used to purchase MKR. This MKR is paired with more DAI to create liquidity provider (LP) tokens used in DAI-MKR liquidity pools on Uniswap. After providing liquidity, these LP tokens are then burned by sending them to a wallet owned by the MakerDAO protocol.

Since implementing SBE, thousands of MKR tokens have been bought back and burned by the protocol, while largely maintaining their desired surplus of 50 million DAI.

Maker (MKR) has a relatively low circulating supply of fewer than 1 million tokens, yet still frequently ranks in the top 50 of cryptocurrencies by market cap. For comparison, popular cryptocurrencies have much higher circulating supplies; there are more than 19.7 million Bitcoin (BTC) tokens in circulation, 120 million Ether (ETH), and 147 billion Dogecoin (DOGE).

Historical impact on tokenomics and market performance

Over time, coin burning has not definitively been shown to positively influence token economics and market performance one way or another.

While Maker (MKR) has largely seen price appreciation since implementing SBE, and XRP experienced a price surge during a period of increased burning in early 2024, it cannot be said if the burning itself had a direct impact on price increases. Additionally, cryptocurrencies like Ethereum, BNB, and MKR have all experienced historical price swings, even while employing token burning mechanisms.

At the same time, projects that consistently burn tokens could be seen to demonstrate a commitment to controlling supply and inflation, which may be preferable among some of their community members. Successful implementation strategies often involve transparent communication, clear burning schedules, and a focus on community engagement.

FAQs about coin burning

Is coin burning permanent?

Yes, cryptocurrency burning is a permanent process. Tokens are sent to a burn address that is purposely inaccessible to users and project owners alike. Coins burned in this way will be forever irretrievable.

Why do projects burn tokens?

Crypto projects burn tokens to make them more scarce, which can help boost (or sometimes stabilize) their value. It’s also a way to reward loyal holders or keep inflation in check within their ecosystem.

Can users burn their own tokens?

Yes, anyone can send tokens to a burn address, though it’s usually done by projects as part of official supply management strategies.

Which cryptocurrencies can you burn?

Some cryptocurrencies known to historically employ token burning mechanisms are:

Does token burning affect the price of a cryptocurrency?

Crypto projects may choose to implement token burning to reduce the circulating supply and create scarcity, potentially driving up the price (assuming demand stays the same or increases). However, there are many factors at play when it comes to price movements, and historical trends do not guarantee future performance.

How do you view a burn address?

Specific projects acting in full transparency should make the wallet address used for a coin burn available to all users on an official website, social media profile, or Discord community.

Once you have the burn address, you can use a blockchain explorer to view all activity involving the burn wallet. Block explorer options include Etherscan for Ethereum (ETH), BscScan for Binance Coin (BNB), and Solscan for Solana (SOL).

Gain exposure to crypto burns

Token burning is one of the most fascinating dynamics in crypto, and the good news is you can participate simply by holding or trading assets that use burn mechanisms.

MoonPay makes it easy to buy crypto suitable for burns, including Ether (ETH), Shiba Inu (SHIB), Binance Coin (BNB), XRP (XRP), wrapped tokens like Wrapped Ether (WETH) and Wrapped Bitcoin (WBTC), as well as stablecoins like USDC (USDC). Checkout in minutes using your preferred method like credit card, PayPal, bank transfer, Apple Pay, Google Pay, and more.

You can also start by adding funds to your wallet in euros, pounds, or dollars and use your MoonPay Balance to purchase crypto assets to be burned. Make your transactions smoother and more affordable, all with higher approval rates. And when cashing out, enjoy zero-fee withdrawals directly to your bank account.

.svg)

.png?w=3840&q=90)

.png?w=3840&q=90)