Bitcoin and Litecoin are two of the most well-known cryptocurrencies, often compared due to their similarities and shared origins.

Bitcoin, launched in 2009 by the pseudonymous Satoshi Nakamoto, is the first and most popular cryptocurrency. Offering a decentralized alternative to traditional currencies, Bitcoin operates on a peer-to-peer network, using blockchain technology to record transactions and maintain a transparent and immutable ledger.

Litecoin, introduced in 2011 by Charlie Lee, was designed to be a "lighter", faster version of Bitcoin, addressing some of the perceived limitations of its predecessor. Litecoin also operates on a blockchain and serves as a decentralized digital currency, but with added enhancements aimed at improving transaction speed and reducing fees.

While both crypto tokens were created to provide decentralized, peer-to-peer financial systems, they do differ in key areas such as technology, speed, and intended usage.

This article explores the differences between Bitcoin and Litecoin, helping you understand their unique features, tokenomics, and use cases.

Key differences between Litecoin and Bitcoin

While Bitcoin is the most popular and highly valued cryptocurrency, Litecoin offers faster transaction confirmation times due to its 2.5-minute block generation time (compared to 10 minutes for Bitcoin). Litecoin also used a Scrypt hashing algorithm, which is more energy-efficient than Bitcoin's resource-intensive SHA-256.

Here are some additional features that separate Litecoin vs Bitcoin:

Origin and purpose

Bitcoin: The first cryptocurrency

Bitcoin was created to offer a decentralized, digital alternative to traditional currencies, providing users with a way to transfer value without relying on third party intermediaries. Satoshi Nakamoto designed Bitcoin to address the inefficiencies and vulnerabilities of traditional financial systems, such as high fees, slow transactions, and centralization of control.

Litecoin: Micro-transactions

The Litecoin network was developed with the intent to improve upon Bitcoin’s technology, particularly in terms of transaction speed and scalability. Charlie Lee aimed to create a cryptocurrency that could handle transactions more efficiently while maintaining the key features of decentralization and security.

Algorithms and technology

Bitcoin's SHA-256

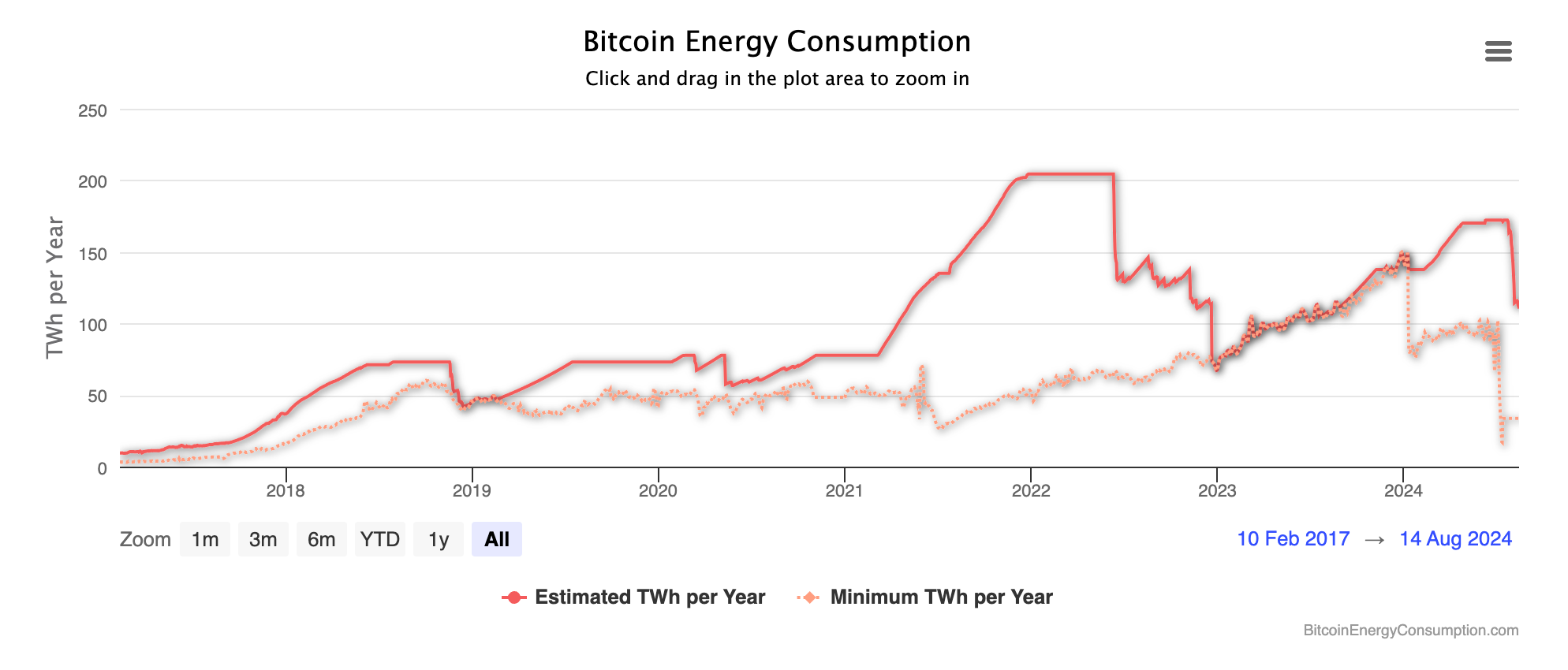

The Bitcoin blockchain uses SHA-256 (Secure Hash Algorithm 256-bit) for its Proof-of-Work (PoW) consensus mechanism. This algorithm requires significant computational power, making Bitcoin mining a resource-intensive process. Although SHA-256 is highly secure, it has often been criticized for its high energy consumption and subsequent environmental impacts.

Litecoin's Scrypt algorithm

The Litecoin blockchain employs the Scrypt algorithm, which is less computationally intensive than SHA-256. Scrypt was chosen to make crypto mining more accessible to average users and to reduce the advantage of specialized mining hardware (ASICs). This algorithm prioritizes memory over processing power, making it less energy-intensive than Bitcoin mining.

Transaction speed and block time

Block generation time

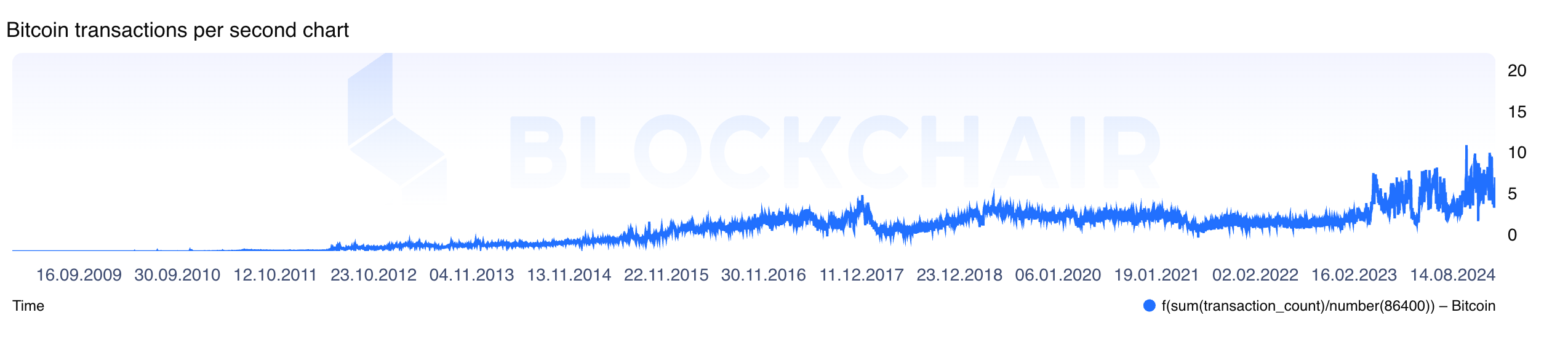

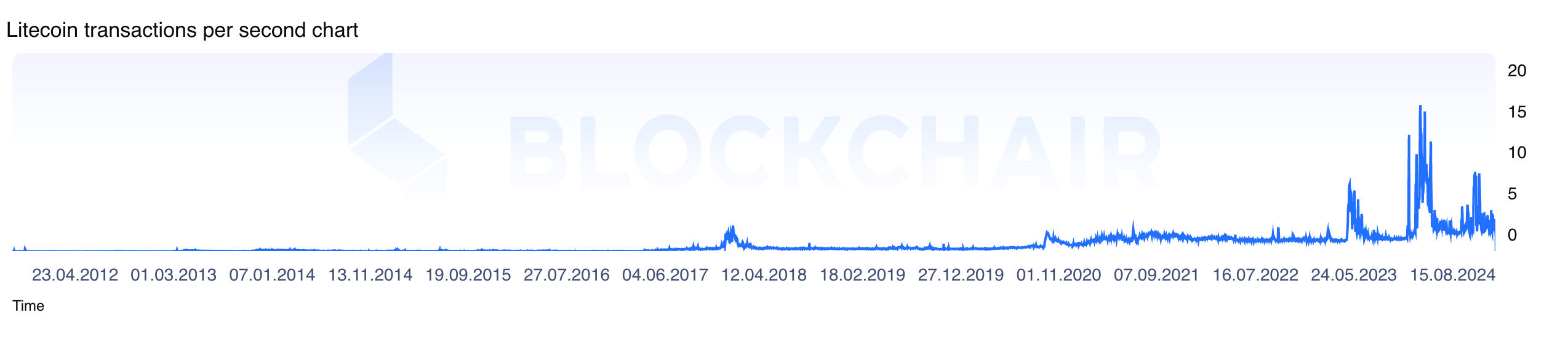

One of the key differences between Bitcoin and Litecoin is block generation time. Bitcoin's blockchain has a block generation time of approximately 10 minutes, while Litecoin generates new blocks every 2.5 minutes. This faster block time allows Litecoin to confirm transactions more quickly, with a maximum capacity of 56 transactions per second, compared to just 7 for Bitcoin.

Transaction speed and confirmation times

Due to its shorter block time, Litecoin transactions are typically confirmed faster than Bitcoin transactions. This makes Litecoin more suitable for smaller, everyday transactions, while Bitcoin’s slower confirmation times cater to larger, less frequent BTC transfers.

Supply and market cap

Bitcoin’s tokenomics

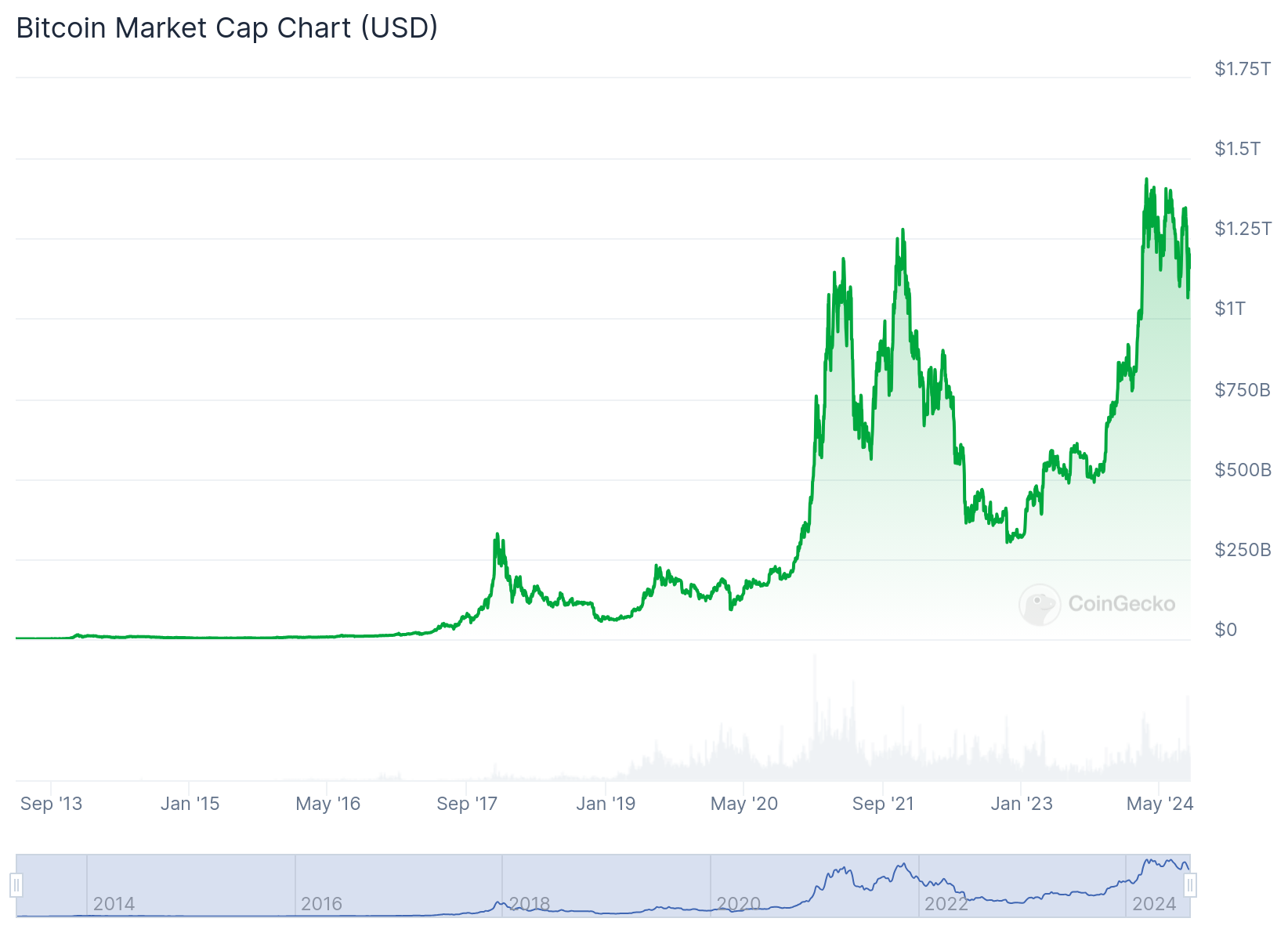

Bitcoin has a maximum supply of 21 million coins, with over 19.7 million currently in circulation. This capped supply, along with Bitcoin halving events, contribute to Bitcoin’s scarcity and value as a deflationary asset. Bitcoin's market capitalization of over $1.2 trillion is significantly higher than that of Litecoin, reflecting its dominance in the cryptocurrency market.

Litecoin’s tokenomics

Litecoin has a maximum supply of 84 million coins, four times that of Bitcoin, with nearly 75 million Litecoins in circulation. While Litecoin’s market cap of $4.7 billion is smaller than Bitcoin’s, it generally ranks in the top 20 of all cryptocurrencies.

Transaction fees

Average Bitcoin fees

Bitcoin transaction fees vary depending on network congestion, but they tend to be higher than Litecoin’s due to the longer block time and greater demand. As Bitcoin’s popularity grows, so does the competition for block space, potentially leading to higher fees.

Average Litecoin fees

Litecoin generally has lower transaction fees than Bitcoin. The faster block generation time and less congested network make Litecoin a cost-effective option for daily transactions, especially in smaller amounts.

Mining and security

Bitcoin mining

Bitcoin mining requires specialized equipment known as ASICs (Application-Specific Integrated Circuits), which are designed to perform SHA-256 calculations efficiently. Mining Bitcoin is highly competitive and energy-intensive, with miners needing substantial power resources to secure the network and earn their mining rewards.

Litecoin mining

Litecoin mining, while still competitive, is less resource-intensive than Bitcoin mining. It can be done using consumer-grade hardware like GPUs (Graphics Processing Units) due to the Scrypt algorithm’s memory-intensive nature. These factors help to make Litecoin mining more accessible to individual miners and less energy-taxing on the environment.

Market adoption and use cases

Bitcoin: Institutional adoption

Bitcoin has seen widespread adoption by institutions and merchants. Major companies and financial institutions have integrated Bitcoin into their systems and investment portfolios, with some recognizing its potential as “digital gold.” Additionally, the approval of Bitcoin Spot ETFs has helped to make BTC a more accessible investment to non-crypto users.

Litecoin: Moderate adoption

While Litecoin’s adoption is not as widespread as Bitcoin’s, it is still accepted by a number of merchants and institutions, particularly those looking for a faster, more cost-effective payment option. Litecoin has also been used as a testbed for Bitcoin’s new features due to its similar codebase.

Similarities between Litecoin and Bitcoin

Though they differ in areas like price, market capitalization, supply, and speed, both Litecoin and Bitcoin share much in common:

Decentralization

Bitcoin and Litecoin both operate on decentralized networks, meaning no single entity controls the blockchain. This decentralization is a core feature of both cryptocurrencies, meaning that transactions are secure, transparent, and resistant to censorship.

Peer-to-peer transfers

Both Litecoin and Bitcoin facilitate peer-to-peer transactions, allowing users to send and receive funds directly without the need for third party intermediaries. This enables faster, cheaper, and more private transactions.

Security features

Security is a top priority for both Bitcoin and Litecoin. They use cryptographic techniques and consensus mechanisms to validate transactions and secure their respective blockchains. Both blockchain networks have proven to be highly resilient to attacks, thanks in part to their decentralized nature and strong community support of users and developers.

Open-source nature

Bitcoin and Litecoin are both open-source projects, meaning their source code is publicly available and can be reviewed, modified, and distributed by anyone. This transparency raises trust and encourages community participation in the development and improvement of the networks.

Pros and cons of Bitcoin vs Litecoin

The advantages and limitations of both Litecoin and Bitcoin can be summarized in the following table:

Feature | Bitcoin | Litecoin |

Transaction Speed | Slower, with 10-minute block times | Faster, with 2.5-minute block times |

Transaction Fees | Generally higher, especially during network congestion | Lower, making it more suitable for small transactions |

Market Adoption | Widely adopted, recognized as "digital gold" | Less adopted, but used for faster transactions |

Mining | Energy-intensive, requires specialized ASIC hardware | Less energy-intensive, can use GPUs |

Supply | Capped at 21 million coins | Capped at 84 million coins |

Market Cap | Significantly higher, reflecting its dominant position | Smaller, but still significant in the crypto market |

Use cases: Bitcoin vs Litecoin

Bitcoin use cases

- Payment method: Bitcoin allows for direct, borderless transactions without the need for intermediaries. This use case is particularly popular for international transfers, remittances, and online payments.

- Digital gold: More than other cryptocurrencies, Bitcoin is often compared to gold, due to its scarcity and subsequent high market cap. However, its reputation as a store of value is highly debated.

- Trading: Both individual and institutional investors hold Bitcoin as part of their investment portfolios, and it is a popular asset for trading in the cryptocurrency market.

- DeFi: Thanks to features like wrapping, Bitcoin's utility can be extended to decentralized finance (DeFi) platforms, including lending and borrowing, and earning interest rewards.

Litecoin use cases

- Faster payments: Litecoin’s quicker block times make it ideal for everyday payments and microtransactions where speed is crucial.

- Digital currency: While not as widely accepted as Bitcoin, Litecoin is still used by some merchants for payments, thanks to its speed and low fees.

- Bitcoin testbed: Litecoin is often used to test new features (such as SegWit and the Lightning Network) before they are implemented on the Bitcoin network, due to its similar codebase.

Which is better: Bitcoin or Litecoin?

Whether Bitcoin or Litecoin is better depends on the user's specific needs. For example, Bitcoin is often chosen for long-term investment, large transactions, and security, while Litecoin is favored for faster, lower-cost transactions.

While it cannot be said 100% which is better, we can look at the historical price performance and future outlook of each token.

Historical price comparison

Bitcoin historical price performance

Bitcoin's price performance has been characterized by significant volatility and dramatic price swings.

Since its inception in 2009, Bitcoin started with virtually no value but began gaining attention in 2010 when it reached $0.08. It experienced its first major surge in 2013, rising from around $13 in January to over $1,000 by December. The price then fluctuated, reaching an all-time high of nearly $20,000 in December 2017 before dropping sharply in 2018. Amid growing institutional adoption and interest, Bitcoin saw another dramatic increase, surpassing $60,000 in 2021 (and later surpassed $73,000 in March, 2024).

Litecoin historical price performance

Litecoin's price performance has seen periods of rapid growth and sharp declines, reflecting broader cryptocurrency trends.

Launched in 2011, Litecoin initially traded for just a few cents. It saw its first major surge in late 2013, rising from around $4 to nearly $50. Another significant rally occurred in 2017, with Litecoin reaching an all-time high of about $375 in December, alongside Bitcoin's rise. After a market correction in 2018, Litecoin's price stabilized, with renewed interest in 2021 briefly pushing it to above $400.

Future developments

While both Bitcoin (BTC) and Litecoin (LTC) face scalability challenges, each network has been working on solutions. Bitcoin’s development is focused on Layer-2 solutions like the Lightning Network, which aims to increase transaction throughput. Litecoin is also exploring enhancements to improve scalability and maintain its position as a faster, lighter alternative to Bitcoin.

Where to buy Bitcoin and Litecoin

If you wish to experience Bitcoin or Litecoin further, it can be helpful to obtain the relevant cryptocurrency.

You can buy Bitcoin (BTC) and Litecoin (LTC) via MoonPay with a credit card, bank transfer, Apple Pay, Google Pay, and many other payment methods. MoonPay's on-ramp is compatible with the most popular Bitcoin and Litecoin wallets, like Ledger, Trust Wallet, and Exodus. Just enter the amount of BTC or LTC you wish to purchase and follow the steps to complete your order.

Users can also top up in euros, pounds, or dollars and use MoonPay Balance to buy cryptocurrencies like LTC and BTC. Once funded, use your balance for faster, cheaper transactions and higher approval rates. When you're ready to withdraw, enjoy zero-fee transfers straight to your bank account.

How to sell BTC and LTC

MoonPay also makes it easy to sell Bitcoin and Litecoin when you decide it's time to cash out your crypto.

Simply enter the amount of LTC or BTC to sell in the MoonPay widget and enter the details where you want to receive your funds.

.png?w=3840&q=90)

.png?w=3840&q=90)