The phrase "Proof of Reserves" (PoR) has recently become more commonplace in crypto discussions, and for good reason. Infamous collapses of major exchanges like FTX shook the digital asset world, dramatically eroding user trust and exposing serious gaps in accountability.

Suddenly, transparency and verifiability weren’t just buzzwords anymore, but lifelines for both crypto newcomers and seasoned traders. As the dust settled, it became clear that people wanted real proof that their funds were safe, actually present, and not being secretly loaned out or lost.

Regulators have begun stepping in, pushing for stricter requirements. Meanwhile, users have demanded on-chain evidence and the ability to independently verify exchange claims. This urgent call for greater transparency is why Proof of Reserves has become one of the hottest topics in the crypto space today.

In this guide, we break down what Proof of Reserves is, how it works, its benefits and limitations, how to verify it yourself, and why it matters for anyone engaging with crypto today.

What is a Proof of Reserves in Crypto?

Proof of Reserves (PoR) is a public demonstration that a crypto exchange actually holds the digital assets it claims to have on users’ behalf. This process uses cryptography and blockchain transparency to show that customer deposits are backed 1:1 by real, verifiable assets.

What does Proof of Reserves actually show?

A Proof of Reserves reveals how many cryptocurrency tokens the exchange holds in its wallets, usually compared against user deposits or liabilities. It provides a snapshot that aims to answer a critical question: if every user decided to withdraw their funds at once, would the exchange have enough liquidity to cover everyone?

How does Proof of Reserves offer protection for users?

While PoR is a powerful tool to enhance transparency, it is not a complete guarantee that user funds are safe. Although it confirms that, at the time of the snapshot, the exchange holds enough assets to match user deposits, it cannot prevent risks such as hacks, fraud, or mismanagement that occur after the snapshot.

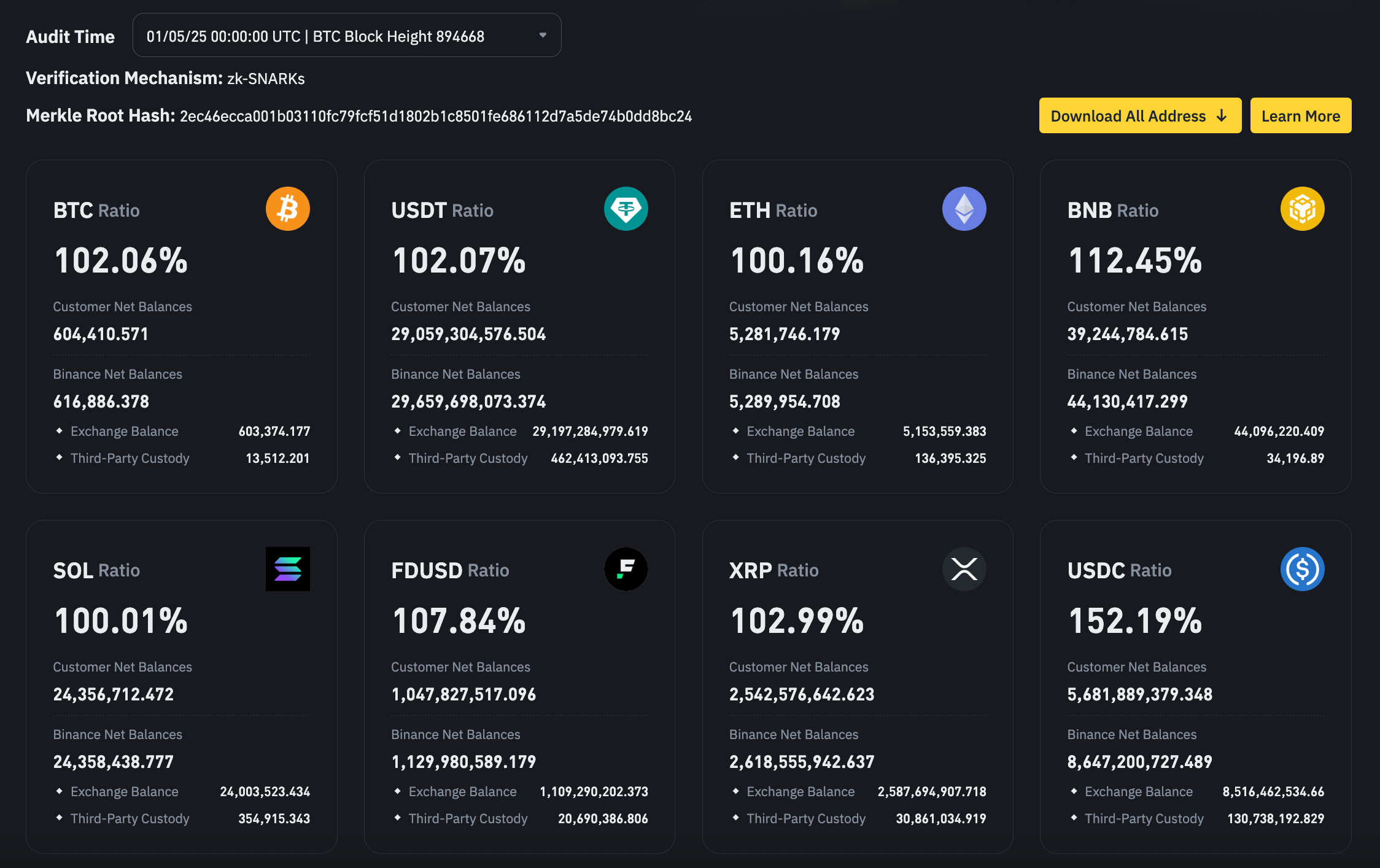

How often do exchanges publish PoR data?

The frequency with which exchanges publish PoR data can vary widely. Leading cryptocurrency exchanges may offer monthly or even real-time updates, while others only publish PoR after major events. The more frequently this information is published, the greater the level of transparency for users.

Can PoR be faked or manipulated?

However, PoR can be manipulated if not properly managed. For example, an exchange might temporarily borrow assets or use “flash loans” to artificially inflate reserves during the proof, only to return the borrowed assets later. This is why the process benefits from robust design and independent, third-party PoR verification.

What’s the difference between PoR and an audit?

While PoR serves as a real-time, on-chain proof of held reserves, it is not the same as traditional crypto audits. Firstly, regular financial audits are broader and typically conducted by external firms. They also encompass both assets and liabilities—on- and off-chain—for a fuller picture of an exchange’s financial health. Both methods offer value, but PoR focuses specifically to provide transparency through blockchain-based evidence.

How Proof of Reserves Works

The PoR process combines cryptography, transparency, and independent oversight.

Snapshot of exchange reserves

The first step in Proof of Reserves is for the crypto exchange to take a cryptographic snapshot of all the digital assets it claims to hold for users. At a specific point in time, the exchange records the balances of cryptocurrencies like Bitcoin, Ethereum, stablecoins, and others, directly from its wallets. Cryptographic hashes and blockchain data create a tamper-proof record of exchange holdings, laying the foundation for transparency and making future reserve claims easier to verify.

Public verification

Transparency comes next with public PoR verification. Exchanges publish wallet addresses or share cryptographic proofs—such as Merkle tree roots—that summarize the snapshot’s data. This enables anyone, from users to blockchain analysts, to independently confirm that the reserves exist on-chain, track asset movements, and ensure there's no double-counting.

User balance matching

A robust PoR process also demonstrates how reserves compare to user liabilities. The cryptocurrency exchange provides an anonymized list of user account balances (liabilities) in the snapshot and uses cryptographic methods like Merkle trees to protect privacy. Individual users can then verify their deposits are included, and outsiders can confirm that total liabilities do not exceed reserves.

Role of third-party auditors

Many exchanges strengthen trust by bringing in independent third-party auditors. These experts review the PoR process, validate cryptographic methods, and check for manipulation or hidden risks, such as encumbered reserves. Independent auditor involvement helps ensure PoR reports are technically correct, meet high standards for impartiality and compliance, and boost confidence that the exchange is operating transparently.

Benefits of Proof of Reserves

Proof of Reserve offers several clear advantages, bringing tangible benefits to users, exchanges, and the entire crypto ecosystem:

Increased transparency

Proof of Reserves allows users and the wider public to openly verify that a crypto exchange actually holds the cryptocurrency assets it claims. Greater visibility makes it much harder for bad actors to hide shortfalls or mismanage users' digital assets, raising the standard for honest business practices across the crypto industry.

Boosted trust

When users see that an exchange regularly publishes verifiable PoR data, it instills confidence that digital assets deposited are being managed responsibly. Publicly displaying accountability not only reassures individual customers but also helps build trust within the broader crypto ecosystem and with applicable regulators.

Reduced risk of fractional reserves

PoR makes it much more difficult for exchanges to secretly operate with less than full reserves or engage in risky practices like lending out customer funds without disclosure. PoR discourages the risky behaviors that led to major collapses in the past by requiring exchanges to maintain a 1:1 asset-backing standard.

Industry-wide confidence

The adoption of standardized, independently verified PoR reporting can raise the bar across the entire crypto market. A shared commitment to transparency and solvency helps repair reputational damage from past scandals while creating a safer environment for all users.

Drawbacks and Criticisms of PoR

Despite its strengths, Proof of Reserve has notable limitations and has faced several criticisms:

Timing issues

Proof of Reserves provides only a snapshot of an exchange’s assets at a single point in time. It does not guarantee that the reserves remain intact after the proof is published, so users could be misled by outdated data if reserves diminish or are misused after the snapshot.

Liabilities exclusion

Some PoR reports focus solely on assets and fail to provide a clear or complete picture of the exchange’s total liabilities. Without including all potential obligations to customers, a PoR might falsely suggest full solvency when, in reality, the exchange could still be overextended.

Potential for manipulation

There is a risk that exchanges could game the PoR process, such as by borrowing assets temporarily just to inflate reserves for a proof. If the process isn’t overseen by trustworthy third parties and designed with strong anti-manipulation safeguards, the credibility of the proof can be undermined.

Privacy concerns

Publicly sharing reserve and liability information must be balanced with the need to protect user privacy. Improper implementation of PoR could inadvertently expose sensitive customer info (like users' account balance data), or make individuals more vulnerable to targeted attacks.

Not a catch-all solution

Even with robust technical proofs, PoR cannot replace the need for good operational security, legal compliance, and risk management. It is just one piece of the puzzle for protecting user assets, and should be complemented by other best security practices.

Proof of Reserves vs. Proof of Solvency

While PoR checks what an exchange has, the Proof of Solvency model aims to show the exchange’s ability to pay all customers back in full by considering both assets (reserves) and liabilities.

Feature | Proof of Reserves | Proof of Solvency |

Verification Method | On-chain cryptographic proofs of assets | On-chain proofs and off-chain audits to verify both assets and liabilities |

Liabilities Inclusion | No | Yes |

Transparency Level | High for assets, limited overall | High (covers overall financial health) |

User Assurance | Confirms exchange controls sufficient assets | Confirms exchange can completely fulfill users' withdrawal requests |

Proof Method | Cryptographic snapshots, wallet publishing, Merkle trees | Cryptographic and/or traditional audit methods |

Key Limitations | May ignore debts or outstanding obligations | Relies on accurate, sometimes private, liability data |

Typical Frequency | Often real-time or regular intervals | Periodic, often less frequent (more complex) |

Best Used For | Transparency around customer assets held | Comprehensive solvency & risk management |

Or, more simply put:

- Proof of Reserves: Shows on-chain digital assets held.

- Proof of Solvency: Measures net solvency—assets minus all possible obligations.

In the name of true peace of mind for users, the crypto market is moving toward transparency over both reserves and liabilities. Other such models include Proof of Liabilities, Proof of Assets, and advanced hybrid systems that combine on-chain proofs with external crypto audits.

How to Verify Proof of Reserves as a User

Verifying reserves is easier than you think. Here’s how you can check an exchange’s PoR:

1) Check Exchange Websites

Begin by looking for a dedicated Proof of Reserves or audit report page on the exchange’s official website. Reputable platforms will make this information easy to find and update it regularly so users can easily access the latest reserve data.

2) Verify Public Wallets

Many exchanges will publish the addresses of their reserve wallets, which you can then check using a blockchain explorer. This allows anyone to independently confirm that the account balances in these wallets match what the exchange claims, providing extra reassurance that users' assets truly exist.

Some examples of popular blockchain explorers include:

3) Use Merkle Tree Tools

Advanced exchanges may offer Merkle tree proofs, which enable you to securely verify that your own account balance was included in the overall liabilities calculation. Merkle tree tools combine transparency with privacy, and let you check your inclusion without revealing your identity or full balance to anyone else.

4) Read the PoR Report

Take the time to review the full Proof of Reserve report to understand when it was last updated and whether it has been verified by a reputable, independent third party. Look for clear explanations of both assets and liabilities, and avoid platforms that provide vague or infrequent disclosures.

5) Be Cautious with Incomplete Information

If an exchange doesn’t consistently publish PoR information or only shares limited data, treat this as a red flag. It’s always safer to choose platforms that embrace transparency and provide tools to independently verify the safety of users' deposited assets.

Always be wary of exchanges that don’t publish transparency information.

Interact with Crypto Safely Today

With MoonPay, you don't have to worry about trusting your crypto to an exchange or third party.

As a non-custodial platform, we never hold your crypto. Instead, we source liquidity from trusted partners and send crypto directly to your secure self-custody wallet. You stay in full control, without having to rely on any single institution’s reserve reporting or stress about PoR audits.

Enjoy total peace of mind and buy crypto in just a few taps. Choose from popular tokens like Bitcoin, Ethereum, and Solana, and pay using your preferred method like credit/debit card, Apple Pay, PayPal, plus a variety of local payment options.

.png?w=3840&q=90)

.png?w=3840&q=90)