A traditional Web2 application like Twitter is run by a single entity with user data stored in centralized servers. Web2 apps therefore centralize control, which could give rise to related issues like censorship and unilateral control of personal data.

On the other hand, Web3 apps are permissionless and open-source protocols, with user data stored in a distributed manner across the network. Decentralized applications, or “dApps”, are thus censorship resistant and there is no single point of failure.

This article takes a closer look at dApps, explaining their use cases, advantages, and disadvantages.

What is a dApp (decentralized application)?

A decentralized application (dApp) is a type of open-source software program that runs on a distributed peer-to-peer (P2P) network, such as a blockchain. DApps are powered by smart contracts and are used in decentralized finance (DeFi) for purposes including finance, gaming, social media, advertising, and governance.

A 2014 paper titled “The General Theory of Decentralized Applications, Dapps” laid out the main criteria for dApps. According to the paper, a decentralized application must meet four main criteria:

- It must have open-source code and be operable without relying on a centralized network. Users must reach a consensus to implement changes to the app code.

- Data storage must occur cryptographically on public, distributed networks instead of a centralized server.

- A cryptographic token powers the decentralized application as app users, stakers, yield farmers, and miners earn tokens as rewards.

- The dApps rely on a consensus mechanism like Proof of Work (PoW) or Proof of Stake (PoS) for generating tokens.

The report also classifies decentralized applications into three categories depending on whether they have their own blockchain:

- dApps that have their own blockchain (Type I)

- dApps that rely on a Layer-1 blockchain (Type II)

- dApps that rely on a type II dApp (Type III)

The origins of dApps

In 2013, Daniel Larimer, founder of Bitshares, used the term Decentralized Autonomous Corporations (DAC) to refer to companies running on decentralized networks.

Bitshares was one of the earliest decentralized communities where token holders controlled the platform instead of a single authority. The term “corporation” was later dropped, however, and “decentralized applications” became the standard.

Blockchain-based decentralized apps became more popular with the emergence of the Ethereum blockchain.

In 2013, Vitalik Buterin and a team of developers conceptualized a blockchain system that went beyond simple Bitcoin transactions. The developers designed the smart contracts-powered Ethereum network empowering users to use decentralized apps.

Although it is difficult to trace the first dApp on the Ethereum blockchain, CryptoKitties was the first decentralized app to draw widespread attention. Dapper Labs launched CryptoKitties in November 2017 and by January 2018, the game had over 250,000 users.

The blockchain-based app became so famous that, at one point, the tokenized cats were trading for $200,000.

DApps use cases

Finance

In traditional financial institutions, users have to depend on a centralized single authority like a bank to mediate all financial transactions. However, in decentralized finance (DeFi), users do not have to rely on any centralized agency for managing their digital assets.

Since decentralized transactions happen on a peer-to-peer blockchain network, DeFi users only have to interact with each other through smart contract-enabled decentralized apps.

As of Q4 2023, Ethereum dApps control more than 56% of the total value locked (TVL) in DeFi, which has been a consistent figure over the years. Some of the most popular protocols by TVL include Lido, JustLend, and MakerDAO.

Aave is another popular protocol in the dApp ecosystem that offers lending-borrowing services for its users. Uniswap (UNI) also was the first smart contract-enabled decentralized exchange (DEX) on Ethereum to cross $1 trillion in total trading volume.

Gaming

According to a study by Global X, the gaming industry has generated $187.7 billion in revenue in 2023. Gamers, however, traditionally do not own their in-game assets. Blockchain-based games have stepped in to transform the gaming landscape by tokenizing assets and giving control back to gamers.

The emergence of NFT technology and Play-to-Earn (P2E) games like Axie Infinity have empowered gamers to immutably store their assets on a blockchain network. Players can now own and monetize in-game assets like racing cars, weapons, and avatar wearables. They can then trade these assets on secondary marketplaces, using them as collateral to take loans, or leverage them as derivatives.

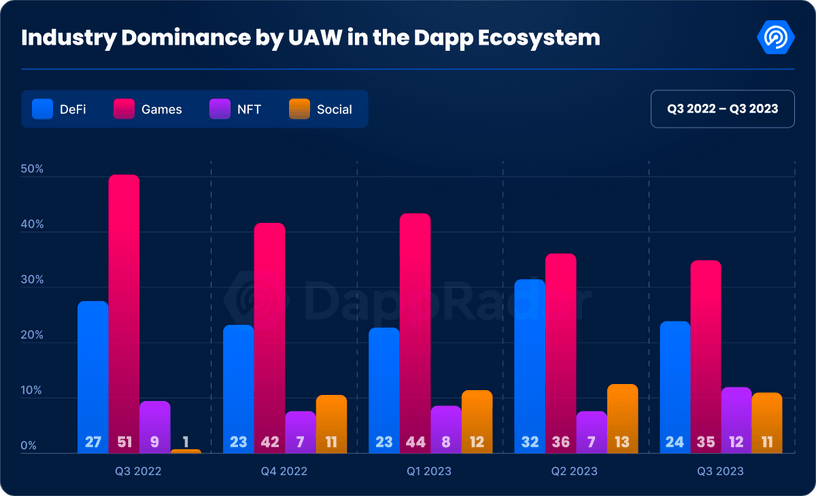

Despite being in its infancy, blockchain-based NFT games achieved sales of over $5.17 billion in 2021, accounting for 52% of activities across all blockchain networks. Gaming dApps have become immensely successful with over 1.22 million unique active wallets connecting to blockchain games in March 2022. By Q3 2023, this figure fell to around 787,000 unique active wallets, though this still represents an increase of 12% from Q2 2023.

Social media

Web2 social media platforms like Facebook, Instagram, and Twitter have certain disadvantages.

Firstly, the corporations control all user data and sometimes make the data accessible to third parties without consent from the user.

Secondly, content creators can get paid a tiny share of the revenue they believe they are entitled to as the Big Tech companies can set compensation levels.

Finally, company management controls access to user content, thereby making users dependent on the company for content.

Web3 social media dApps like CanCan, Canistore, and DSCVR offer unique solutions to these problems. On these apps, each user owns and can monetize their personal data. DApps run on a token economy and content creators can set up a direct payment network with their followers rather than sharing profits with a company.

Moreover, unlike applications that rely on centralized computers to store information, dApps immutably store data on a blockchain network. So once users create something like a public post, it is impossible to alter or delete it.

Advertising

Digital advertising is set to reach a high of $695 billion by 2025. However, traditional digital advertising methods have some disadvantages.

Companies may sell user data to advertisers without the user’s permission, and advertisers may target the wrong demographic. Many users therefore use ad blockers when they browse the web, leading to revenue loss for advertisers.

Many users are now using web browser dApps that give them greater autonomy over their data. Some of these browser dApps use an advertising model in which the user gets paid for watching ads.

Such a flexible platform creates a symbiotic relationship between the user and the advertising company. The company can target the right audience with its ads, thereby increasing revenue share. Users also have more autonomy to choose what they want to see and even get paid for viewing ads.

Governance

Companies can now use a special kind of dApp called Decentralized Autonomous Organizations (DAOs) to govern their company operations. The smart contract-enabled DAOs run on a decentralized network and automate the entire voting mechanism through a staking system.

DAO participants stake their money in the protocol to vote for upgrades and decide the organization’s future trajectory.

Staking helps to ensure that malicious actors do not take over a DAO during voting. DAOs also leverage distributed ledger technology to immutably store voting data on the blockchain, making it publicly available and difficult to alter.

Advantages of dApps

Enhanced user privacy

When users create a dApp account, they do not need to provide their personal information. They can interact with dApps through smart contracts without the need to reveal their identity.

Automating transactions between anonymous dApp users makes the protocols more secure from identity thefts and hacks because in many cases there is no personal information to access.

Censorship resistant

Since dApps store all information on-chain, no single entity can alter or delete it. This quality could make social media dApps a good alternative to existing Web2 platforms.

No downtime

Since dApps do not depend on centralized servers for their everyday operations, there is no single point of failure. A dApp should therefore not stop functioning due to an unexpected fire in the server room, technical glitches, or routine maintenance.

Since dApps rely on a decentralized network of computers, the protocols should continue to work even if any one computer malfunctions.

Disadvantages of dApps

Lack of scalability

Although dApps are still in their infancy, many find their inability to scale and the resultant network congestion concerning. Whenever a dApp requires more computation due to an influx of new users, it takes a long time to process data and execute transactions.

In 2017, for example, the CryptoKitties craze created massive congestion on Ethereum creating a backlog of almost 15,000 transactions. Ethereum has since attempted to tackle this scalability issue by upgrading to Ethereum 2.0.

Difficult user interface

Some dApps lack a user-friendly interface. Quality usually only improves when a dApp onboards more users onto the platform. Thus, dApps require a sizable amount of network participants along with nodes and validators to run smoothly.

In the initial stages when a dApp has few users, the end-user experience can be difficult to navigate and less than ideal.

Slower upgrades

Unlike Web2 apps, decentralized apps do not depend on a central entity for code modifications and updates. Rather, the community votes on upgrades and protocol changes and executes the decision only after achieving a majority consensus.

It therefore can take a while to update dApps, even for minor bugs or other security issues. And while the decentralized mechanism promotes community governance, it can sometimes delay crucial updates, potentially harming the dApp’s user experience.

Scams

Coding errors and other vulnerabilities in a dApp algorithm can make dApps susceptible to fraud.

Malicious actors can exploit faulty code to steal money from users’ wallets. In March 2023, for example, a hacker used a flash loan attack to steal $197 million from permissionless lending and borrowing protocol Euler Finance (though they later returned the funds).

Read our articles Crypto security basics: Staying safe in Web3 and How to spot and avoid crypto scams to learn about how to stay safe while investing in cryptocurrency.

The Future of dApps

In 2021, more than 2.7 million daily Anique Active Wallets (dUAWs) were interacting with dApps, a rise of 592% from 2020. Despite a bear market and turbulent global economy, 2.38 million unique user wallets interacted with decentralized apps in Q1 2022. As of Q4 2023, this number sits at around 2.2 million dUAW. Although this is down from the highs of 2021, this still represents a 15% increase from Q3 2023.

While dApp usage has fluctuated alongside the general crypto market, dApps need to address scalability challenges and work on developing better user interfaces for greater accessibility. The key to mass adoption likely lies in lowering entry barriers and enabling a smooth experience for users.

Buy crypto to access dApps

To get started with dApps and DeFi, simply buy cryptocurrency via MoonPay using your credit card or any other preferred payment method. MoonPay's simple widget allows you to easily buy Bitcoin, Ethereum, and more than 50 other cryptocurrencies.

MoonPay also makes it easy to sell crypto when you decide it's time to cash out. Simply enter the amount of the token you'd like to sell and enter the details where you want to receive your funds.

And if you have USDC (SOL) in your MoonPay Account, you can use it to access DeFi trading on MoonPay. Trade for Solana (SOL), meme coins like Bonk (BONK), dogwifhat (WIF), and OFFICIAL TRUMP, or other stablecoins like USDT (SOL) and PYUSD (SOL).

.png?w=3840&q=90)