Blockchain technology has been gaining popularity in recent years.

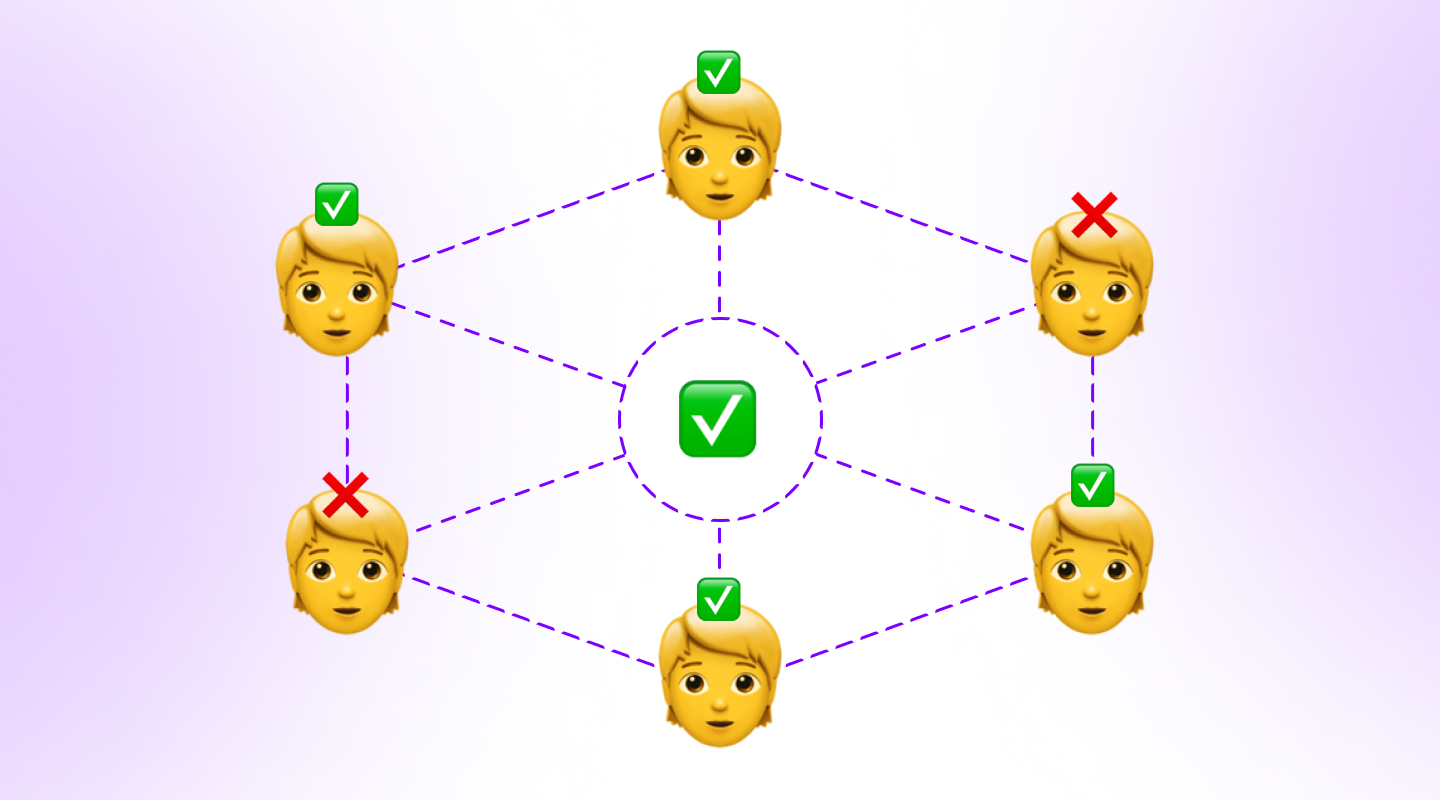

One of the key features that makes blockchain so appealing is its decentralized nature. Transactions on a blockchain are verified by a network of computers rather than by a central authority, which makes it difficult to manipulate or tamper with data.

But how does a blockchain network ensure that transactions are legitimate and prevent a fraudulent attack on the system as a whole? This is where consensus mechanisms like Proof of Work (PoW) and Proof of Stake (PoS) come in.

In this article, you will learn how Proof of Work and Proof of Stake function, as well as how they differ.

What is a consensus mechanism?

A consensus mechanism (a.k.a. consensus model) is a protocol that allows a decentralized network of computers to come to an agreement about the state of the system. This is necessary in order for the network to function properly.

Bitcoin | Test | Test | Test | |

Test | Test | Test | Test | Test |

Test | Test | Test | Test | |

Test | Test | Test | Test | |

Test | Test | Test |

In simpler terms, consensus mechanisms help validate and verify transactions.

There are two main types of consensus mechanisms: Proof of Work and Proof of Stake

What is Proof of Work?

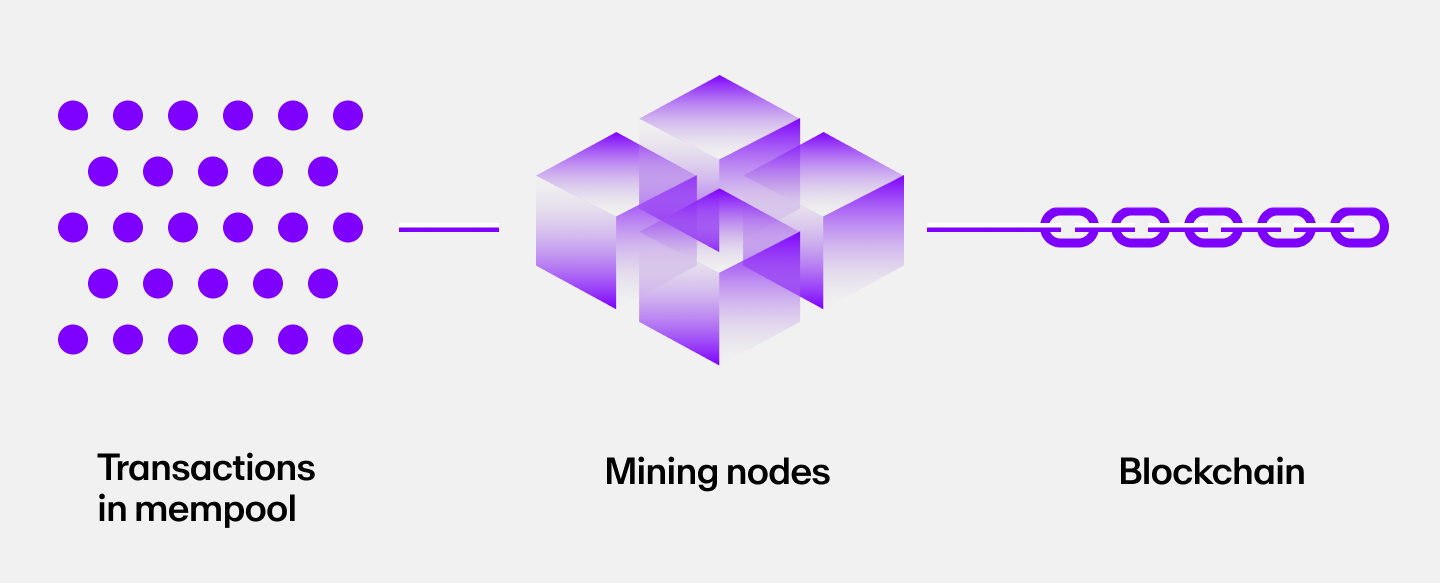

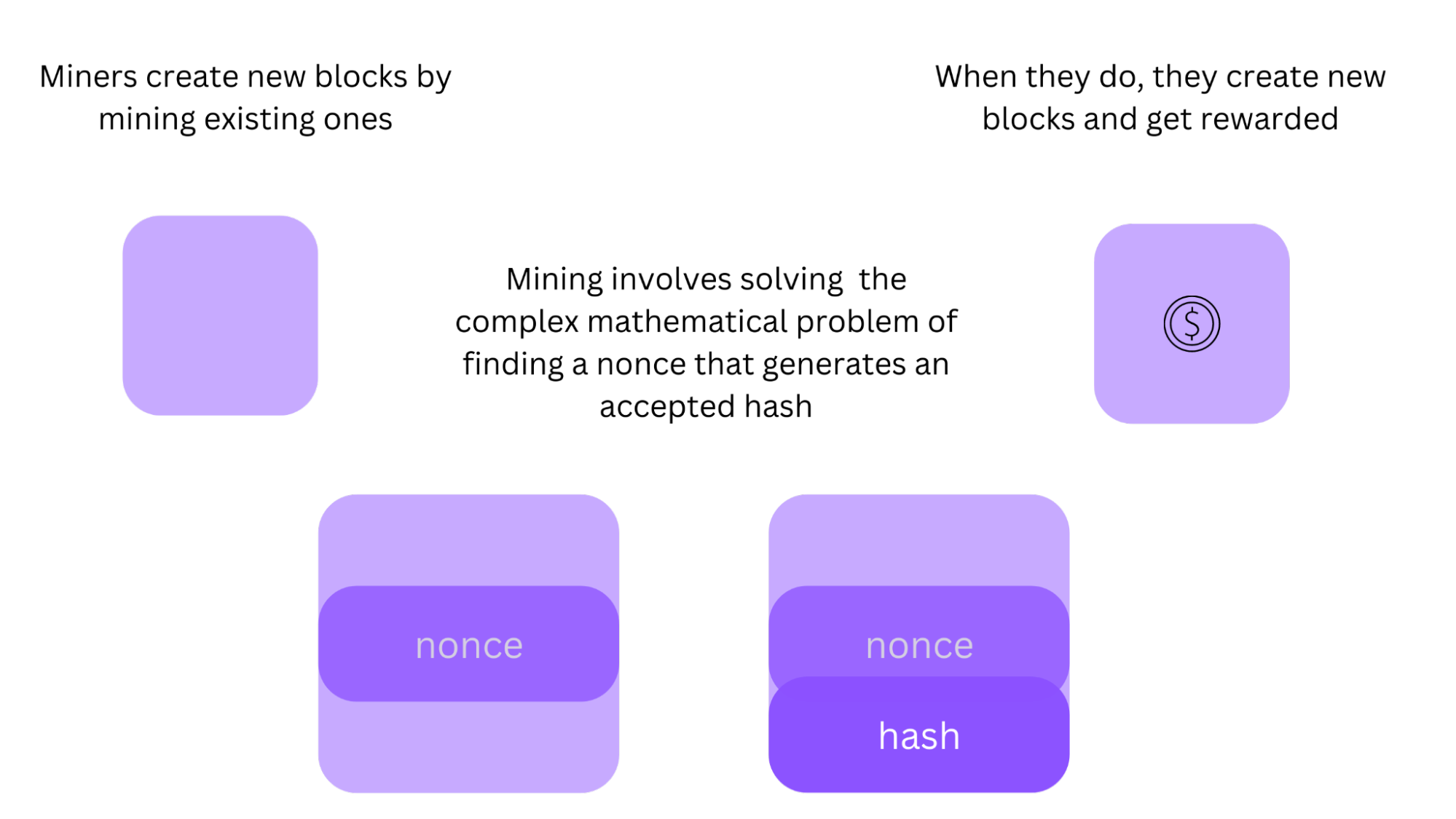

Proof of Work (PoW) is a consensus mechanism that is used to secure and validate transactions on a blockchain. The PoW mechanism works through a process called mining, in which transactions are validated by solving a complex mathematical problem known as a cryptographic hash function.

The people who solve these problems, miners, are rewarded with cryptocurrency. The more computing power miners can bring to bear on mining, the more likely they are to solve the hash function and earn rewards.

The reason for the high computational power requirement is that the hash value of data cannot be calculated by simply backtracking. The solution is the result of trial and error. If the miner can try out more solutions within a given period, the chances of succeeding are higher. This directly correlates to ‘operations per second' by the computer processor.

With PoW, miners compete against each other to validate transactions and add them to the blockchain. The first miner to add a block of transactions to the blockchain is rewarded with the chain's native cryptocurrency, such as Bitcoin.

The main advantage of Proof of Work is that it is very difficult to manipulate the data on a blockchain. This is because changing even a single transaction would require a huge amount of computing power to redo all the work done on previous blocks. This makes Proof of Work secure against “51% attacks”, which are when a group of miners control more than 50% of the total computing power on a network and can therefore manipulate the data.

However, there are also some disadvantages to using Proof of Work, which we will cover in later sections.

How Does Proof of Work function?

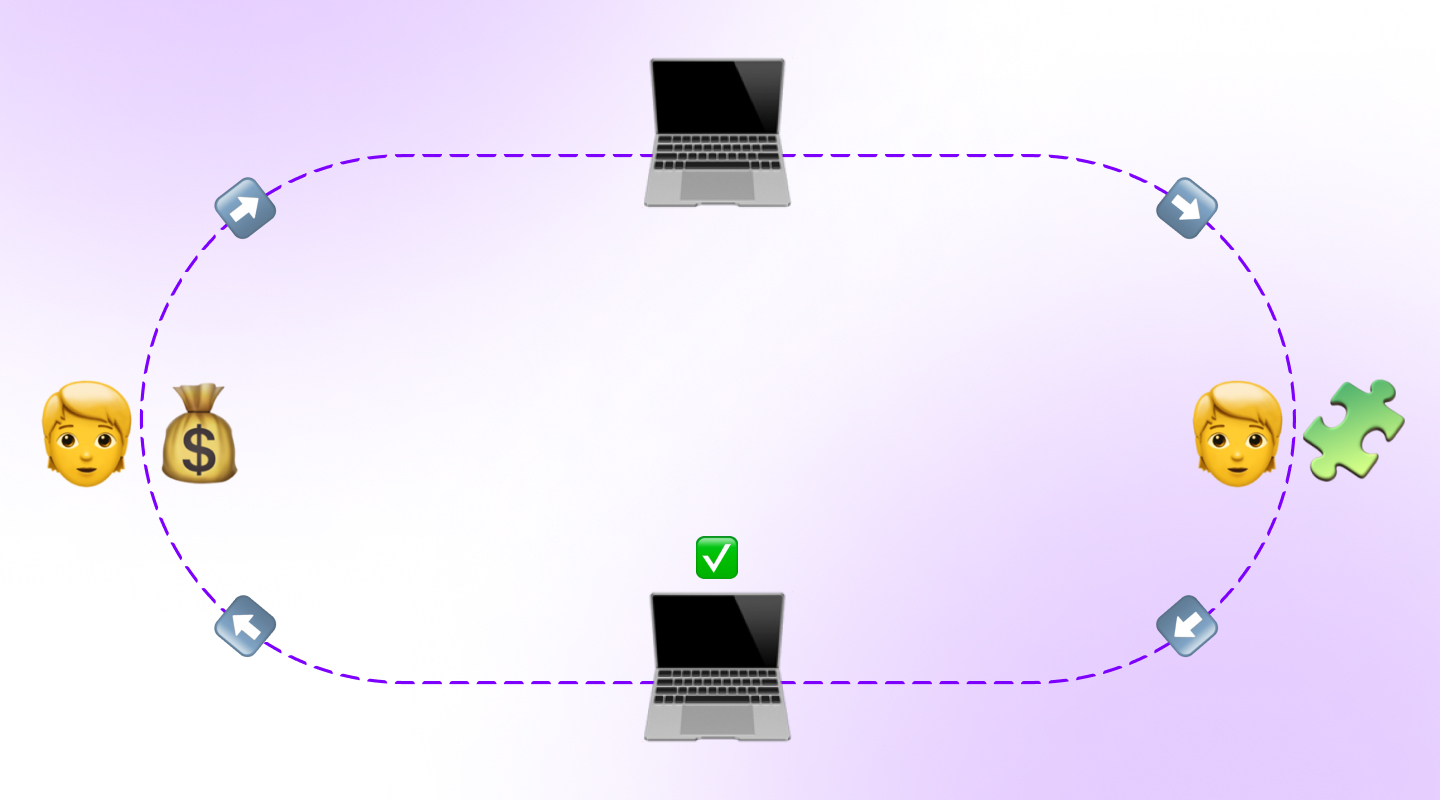

Suppose there is a transaction that needs to be added to the blockchain. This transaction will go into a pool of unconfirmed transactions called a mempool. Then, miners will pick up this transaction from the mempool and start working on it. They do this by using their computing power to solve complex mathematical problems.

The mathematical problem that is being referred to here is a hash. Since there is no way to reverse engineer a hash algorithmically, the only way to go about doing so is through a trial and error method.

Hence, the greater the processing power of the mining computer, the greater the likelihood of getting to the solution first.

The first miner who solves the problem adds the block of transactions to the blockchain and thus earns their block reward. The other miners then verify that the solution is correct and start working on the next block of new transactions.

What is Proof of Stake?

Proof of Stake (PoS) is a consensus model that is used to validate and secure transactions on a blockchain. It emerged as a solution to some of the drawbacks that PoW faces, particularly energy consumption.

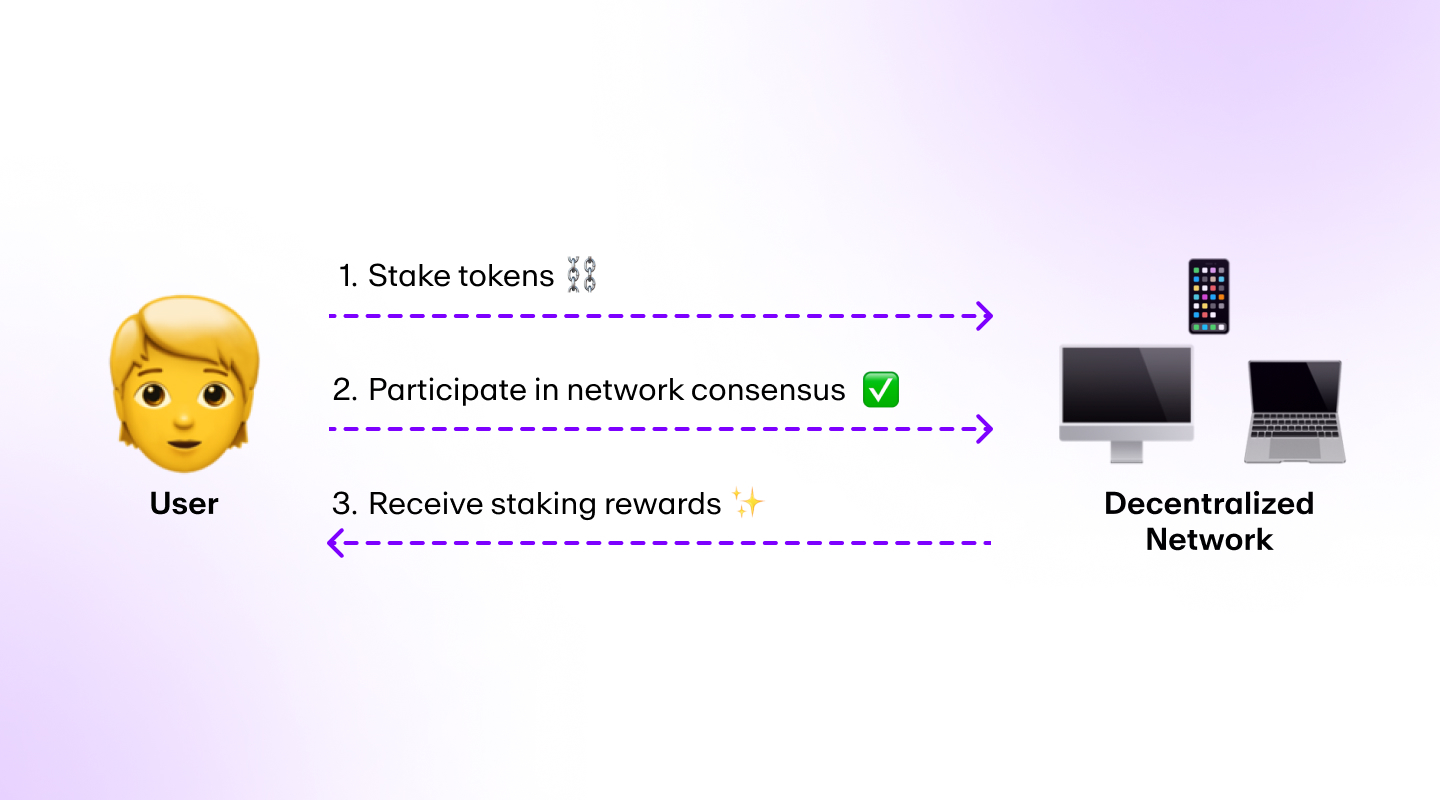

Unlike Proof of Work, the Proof of Stake consensus mechanism does not require all validators to rush to validate a single transaction. Instead, validators “stake” a certain amount of the network's native cryptocurrency. This ensures that the ones validating the transaction are financially invested in the project.

For instance, the Ethereum network recently migrated from a Proof of Work to a Proof of Stake system. Hence, to be a validator on this chain and earn ETH by validating transactions, you would have to stake a minimum of 32 ETH.

How Does Proof of Stake function?

Once you stake the minimum required amount of cryptocurrency on-chain, you are eligible to validate transactions.

The validators are chosen randomly to validate the next block of transactions. The more Proof of Stake cryptocurrency you stake (such as ETH), the greater your chances of being chosen as a validator.

Once a validator has been chosen, they validate the block of transactions and add it to the blockchain. They are then rewarded with cryptocurrency for their efforts.

Since a single validator produces blocks, how does the network ensure that the validator does not engage in nefarious activity for personal benefit?

This is where the concept of “slashing” comes in. Slashing is when a validator's stake is taken away as a punishment for engaging in malicious behavior.

For instance, if a validator tries to validate two different blocks at the same time, they will be caught and their stake will be slashed. This serves as a disincentive for validators to cheat PoS systems.

Proof of Work vs. Proof of Stake: Which is better?

Both consensus models have different benefits and drawbacks. Proof of Work is better suited for establishing trust in a distributed system, while Proof of Stake is better suited for reducing the cost of maintaining that trust.

However, in general, Proof of Work is better suited for situations where there is a need for security against attacks, while Proof of Stake is better suited for situations where there is a need for fast and efficient transactions.

Limitations of Proof of Work

Proof of Work was invented by Cynthia Dwork and Moni Naor in 1993 as a way to prevent DDoS (Distributed Denial of Service) attacks. It was only later that it was adapted for use as a cryptocurrency consensus mechanism.

Since it's a legacy consensus model, it has its fair share of shortcomings that need to be overcome in order to address the blockchain trilemma of decentralization, scalability, and security.

Energy-intensive

Proof of Work is very energy-intensive. This is not just because miners need to run powerful computers to validate transactions for the block rewards, but also because all miners have to run for all transactions even though only one of them is rewarded.

This renders a great amount of energy waste and also leaves a significant carbon footprint.

For example, Bitcoin alone consumes about 110 Terra-Watt hours of energy per year, which is more than the annual power consumption of countries like Finland, Norway, and Bangladesh. Some estimates even put this figure at up to 150 Terra-Watt hours per year, as much energy consumption as the entire country of Argentina.

Low throughput

The Proof of Work system also suffers from low transaction throughput. This is because the time it takes to mine a new block and add it to the blockchain is fixed.

For Bitcoin, this time is roughly fixed at 10 minutes. This means that the network can only process a maximum of 7 transactions per second. In comparison, Visa processes about 1,700 transactions per second (with some figures estimated at up to 65,000 transactions per second).

Expensive

Another drawback of Proof of Work blockchains is that they require high computational power to participate in the mining process. This creates a barrier to entry for most people and also centralizes power among those who can afford expensive computers capable of delivering such power.

The high cost of entry also leads to the centralization of power among miners, which goes against the decentralized nature of blockchain technology.

Limitations of Proof of Stake

Scott Nadal and Sunny King are the two developers who invented Proof of Stake. According to them, the Proof of Work consensus mechanism used by the Bitcoin network and its forks are detrimental to the environment and present scalability issues that would hinder the mass adoption of cryptocurrency as a payment system.

Proof of Stake was therefore developed to be more energy-efficient and overcome the obvious challenges posed by Proof of Work.

But Proof of Stake also has limitations.

“Nothing at stake” problem

The “nothing at stake” problem is a challenge inherent in Proof of Stake where an attacker can easily fork the blockchain and create two different versions of the truth. This is because there is no incentive for validators to stay loyal to one chain as they can verify transactions on both chains and get rewards from both.

The nothing at stake problem was first proposed by Ethereum co-founder Vitalik Buterin in 2014 and is still a challenge that needs to be addressed by developers.

High stake requirement

Another limitation of Proof of Stake is that it requires validators to have a high stake in the network. This is because validators would only be motivated to act in the best interest of the network if they have a lot to lose.

While this may seem like a good thing, it actually centralizes power among those who can afford to buy a lot of tokens.

For instance, to become a validator on the Ethereum 2.0 network, you would need to stake a minimum of 32 ETH. This is a large sum for the average investor and tech enthusiast.

Less secure

The Proof of Stake consensus algorithm is also more vulnerable to 51% attacks. This is because it would only require an attacker to control more than 50% of the stake in the network to fork the blockchain.

In essence, a “whale”, or somebody with enough capital to have a noticeable impact on the market through large trades, can potentially become a validator and have a significantly greater influence on verifying transactions.

The Future of Proof of Work vs. Proof of Stake

The battle between Proof of Work and Proof of Stake will continue as both models have their pros and cons.

It is important to note that both mechanisms are still in their early stages and have not been fully tested. As such, it is hard to say which one is better.

What we do know for sure is that blockchain technology will continue to evolve regardless of which consensus algorithm eventually prevails.

In short, both Proof of Work and Proof of Stake have their advantages and disadvantages, but it's ultimately up to project developers to decide which is more suitable for their needs.

Buy Proof of Stake and Proof of Work cryptocurrencies

You don't need to purchase expensive mining equipment or 32 ETH to gain exposure to Proof of Work and Proof of Stake cryptocurrency.

MoonPay makes it easy to buy Bitcoin (BTC) and Ethereum (ETH) instantly with a credit or debit card, bank transfer, Apple Pay, Google Pay, and more.

Buy as much as you need, for as little as $35 worth of BTC or ETH.

.png?w=3840&q=90)