The Ethereum Merge has finally happened. After years of hard work by developers, much speculation by the ETH community, and great interest worldwide, the biggest milestone in crypto history was reached on September 15, 2022.

Ethereum (ETH), the second-largest blockchain network, has distinguished itself from competitors by being the first to enable decentralized applications (dApps). ETH users can implement smart contracts, buy NFTs, and interact with thousands of decentralized applications (dApps), all within the Ethereum ecosystem.

While these use cases have caused Ethereum to explode in popularity and market cap, there were concerns regarding energy consumption and high gas fees associated with elevated network activity.

The solution to address some of these shortcomings has rolled out in what is known as “the Merge”. Formerly known as ETH2 or ETH 2.0, this event transitioned Ethereum from the mining-intensive Proof of Work (PoW) consensus mechanism to the more energy-efficient Proof of Stake (PoS) mechanism.

This article explains what the Merge is, outlines its features and roadmap, and details why it matters for the future of crypto.

What Is Ethereum 2.0?

Ethereum 2.0 (also called ETH2 or ETH 2.0) is the name previously used to describe the Ethereum Merge. The “Ethereum 2.0” moniker was done away with to prevent confusion among users who may have mistakenly thought that post-Merge Ethereum would gain a new ETH2 ticker. It hasn't.

Another reason for the switch away from the ETH 2.0 naming was to prevent users from getting tricked into swapping to fictitious ETH2 tokens from scammers.

Ethereum vs Ethereum 2.0: What will change?

The average Ethereum user initially didn't experience a significant change.

ETH holders didn't need to do anything to convert their existing tokens, and they were still able to send and receive Ethereum as they did pre-Merge. And until sharding (more on that below) is implemented, users can still expect to pay occasionally high gas fees during periods of network congestion.

For network validators—and the planet itself—however, the difference is night and day. Instead of creating new ETH tokens and validating transactions via the energy-intensive Proof of Work consensus mechanism, this process will now be done through the much more efficient Proof of Stake model.

Proof of Work blockchain networks consist of miners competing to solve a cryptographic hash function by using increasing levels of computing power in order to earn block rewards.

With Proof of Stake blockchains, however, the network is secured via validators that “stake” a certain amount of their cryptocurrency holdings and use those to validate transactions.

What is the Ethereum Merge?

The Ethereum Merge is the transition to a new Proof of Stake network from the old Proof of Work mainnet. In order to safely transition the current Ethereum blockchain network, the plans for the Merge were rolled out in phases.

Some of the phases have already been completed in the past few years, while others are subject to change. The ultimate goal was to complete The Merge by September 15th, which was successful.

The three principal upgrades are the Proof of Stake Beacon Chain, the Merge itself, and the scalability-enablement called Danksharding (previously named Sharding).

The Beacon Chain

The Beacon Chain was the first phase of rollout and one that formally brought Proof of Stake to Ethereum. On December 1, 2020, an initial threshold was reached of 16,000 validators to deposit the required 32 ETH to stake. Since that date, the Proof of Stake Beacon Chain has been running parallel to Ethereum’s Proof of Work consensus layer.

The Beacon Chain boosts the security of the network by randomly assigning validators in order to prevent dishonest actors from attacking the system. In addition, malicious validators are punished for harmful actions by having their staked ETH slashed.

The Merge

The Merge itself refers to the joining of the current Ethereum mainnet with the Beacon Chain. In preparation for the Merge, several testnets were merged with the Ethereum mainnet. The purpose of these testnets was for developers to safely test features of the Proof of Stake network without the risk of losing real ETH.

Ropsten, the oldest such Ethereum test network that dates back to 2016, completed its transition to the Beacon Chain and Proof of Stake in June 2022. This was followed by the successful Merge of the Sepolia testnet in July 2022, which was completed ahead of schedule. The final test Merge occurred in August 2022, when the Goerli testnet joined Prater, its counterpart on the Beacon Chain.

Sharding

While the initial Merge didn’t do much to lower gas fees, Danksharding (previously just called Sharding) should help in this regard.

Broadly speaking, sharding is when an entire dataset is split into portions that represent the whole. With the Merge, the current Ethereum chain became a shard of the whole, in a chain of 64 parallel chains.

Danksharding will serve to greatly improve the scalability of the network, since each sharded chain will spread out the data storage functionality of the current Ethereum chain, simultaneously spreading out the data processing burden across the nodes.

Although it was originally planned for 2022, the current estimate is for danksharding to be rolled out in 2024. When it is released, sharding will be able to accommodate Layer-2 roll ups like zkSync and Immutable X that can process bulk Ethereum transactions off-chain at higher speeds and lower costs.

What are the impacts of the Ethereum Merge?

These phased steps, along with the principal change from a Proof of Work to a Proof of Stake model aimed to address the three main shortcomings of the current Ethereum network: security, scalability, and sustainability.

Security

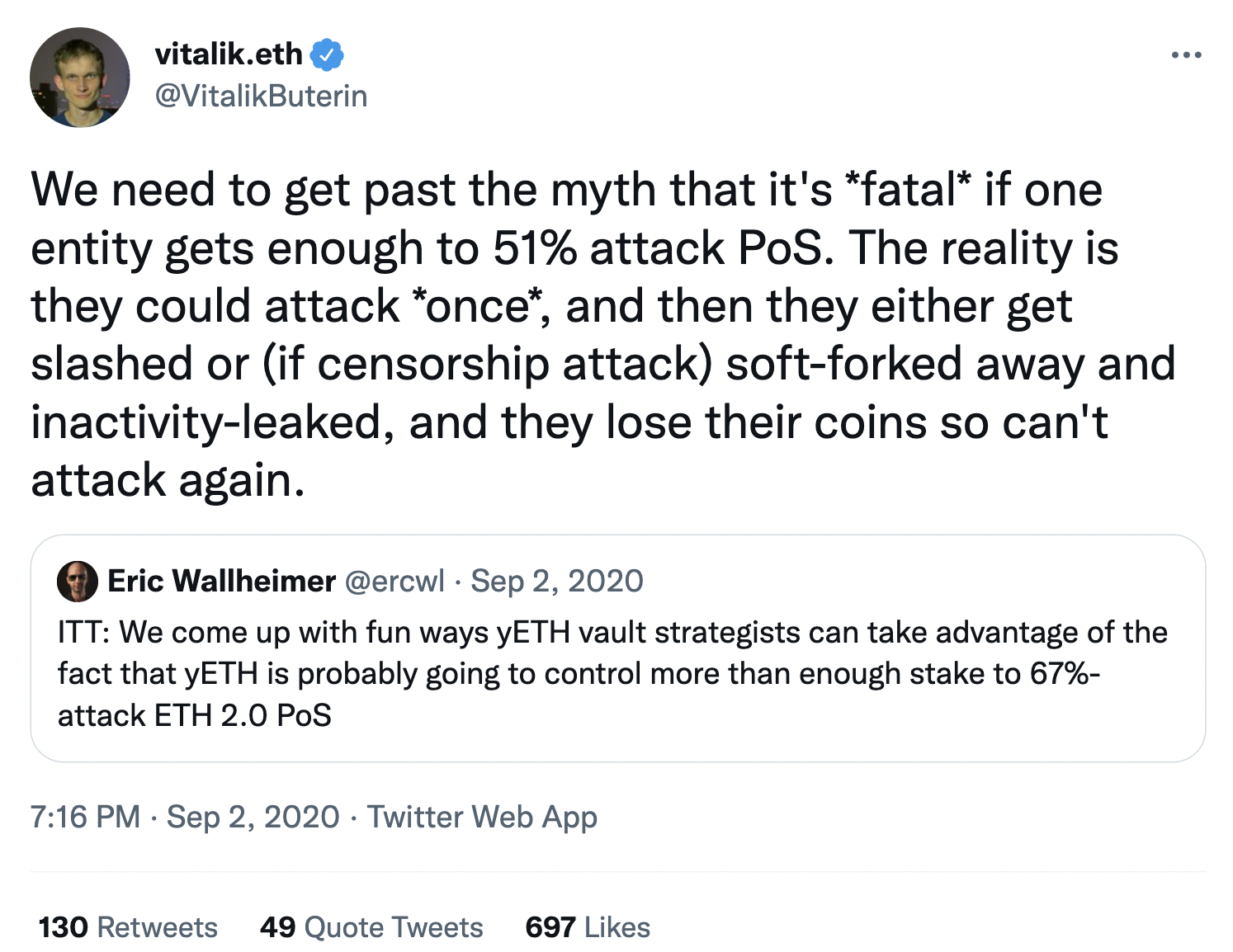

The Merge added measures against malicious actors that try to attack the Ethereum network. Slashing is that new penalty system that punishes malicious validators and would-be attackers by inflicting penalties such as slashing, which causes the affected validators to lose ETH.

Slashing penalties can vary, though rule violators may be fined up to 18 staked ETH and even face removal from the network. With Proof of Stake, validators are encouraged to perform honest validations, and through validator shuffling, the chances of a successful attack can be minimized.

No system is completely immune from bad actors however so it is important to always be vigilant.

So even if someone is able to successfully execute an attack, slashing is a preventative measure that will cause the attacker to lose their stolen ETH.

Scalability

Through sharding and Proof of Stake, Ethereum will be able to process anywhere from 20,000 to 100,000 transactions per second. Though it may take a few years to reach this maximum capacity, this represents a speed increase of up to 999,900% from the current rate of 20-30 transactions per second. These exponential increases in speed should help clear up network congestion and keep gas fees low.

On the previous Proof of Work Ethereum network, between 15 and 30 transactions could be processed per second. To give an idea of how this compares to traditional finance networks, Visa claims they can handle up to 24,000 transactions per second at max capacity.

As network activity increased on the pre-Merge Ethereum blockchain, users reported waiting longer for transactions to be confirmed and paying higher fees while doing so. Additionally, under heavy usage, some users lost their gas fees despite the transaction failing to execute.

The balance here lies in exponentially increasing the processing capacity of the network while still incentivizing validators to carry on validating. With Proof of Stake, validators will continue to receive the block rewards and transaction fees under the current system, depending on the amount of ETH staked by the individual.

Sustainability

The transition away from Proof of Work has also gone a long way to solve the cryptocurrency energy problem by massively cutting costs and reducing the environmental impact associated with validating the Ethereum network.

While still requiring significantly lower energy levels than Bitcoin, Ethereum hasn’t escaped scrutiny for the high energy costs under its previous Proof of Work model.

In a Proof of Work consensus model, blocks of Ethereum or Bitcoin are validated through a process that secures the network by miners physically proving the computational work done to validate the chain. This process uses a significant amount of energy, which can lead to high costs for those who wish to serve as miners or validators.

The good news is that the Merge drastically reduced the energy consumption of the current network. Carl Beekhuizen, a researcher at the Ethereum Foundation, predicted that the Merge would reduce Ethereum’s energy expenditure by 99.95%. And according to a report by CCRI (Crypto Carbon Ratings Institute), he is correct so far.

Transaction fees

Unfortunately (but not surprisingly), an increase in Ethereum’s adoption and transaction volume, has also led to higher fees. Transaction costs on the Ethereum network, also known as gas fees, are paid using Ethereum’s native token, Ether. Gas is the fuel that powers everything on the Ethereum blockchain, from validating transactions to activating smart contracts.

Since transaction completion time depends on network congestion levels, this presents an issue: as the number of ETH holders continues to grow, gas fees rise as well. When miners select transactions to validate, they will naturally pick the ones with the highest transaction fees to include in blocks.

This is because the rewards for Ethereum mining come in the form of transaction fees, so when there is more traffic, miners will select blocks that pay higher returns for the same amount of work. In especially high-traffic situations, users looking to pay lower gas fees may be stuck waiting for their transactions to be validated.

When did the Ethereum update take place?

The final completion date for the Ethereum Merge was originally set for September 19, 2022. With all the moving parts that a massive undertaking like the Merge encompasses, the expected completion date was delayed a few times.

So it was quite the achievement when the Merge was actually completed a few days sooner than expected, on September 15, 2022.

What are the next steps for Ethereum?

As Ethereum co-founder Vitalik Buterin points out, there are additional upgrades happening concurrently with the Merge.

These are the Surge, which will enhance scalability via sharding; the Verge, which introduces Verkle trees as an upgrade to Merkle Proofs; the Purge, which will improve network congestion by reducing the hard drive space needed by validators; and the Splurge, which will include additional enhancements to maintain network performance.

Since the Merge was successfully completed by its September 2022 deadline, the subsequent roadmap will remain the same. Namely, the next major milestone will be the introduction of danksharding at some point in 2024.

The latest major development, called the Shanghai and Capella (Shapella) upgrades, was activated on April 12, 2023. This long-awaited upgrade allowed users to withdraw staked ETH and staking rewards that were previously locked up during the transition.

Etherem Merge Frequently Asked Questions (FAQ)

Did ETH holders need to do anything with their Ethereum to prepare for the Merge?

No, ETH holders did not need to do anything. Their stored or staked Ether was automatically converted from ETH to ETH2 post-Merge. ETH also maintains the same ticker symbol.

What will happen to staked ETH?

Stakers were unable to make withdrawals on their staked ETH for several months after the Merge. In what was known as the Shanghai upgrade, users were able to withdraw staked ETH starting on April 12, 2023, with a daily withdrawal limit of 40,000 ETH per day (out of ~13 million staked).

Validators, however, will be able to receive liquid ETH rewards from network validation. Although they were unable to withdraw until the Shanghai upgrade, validators were issued a unique wallet address that contained their staked ETH and network rewards verified by the Beacon Chain.

Why stake ETH?

By staking ETH, you can earn rewards from validating transactions. This is made possible without energy-intensive equipment required for Proof of Work mining.

You can stake ETH using a smartphone or home computer to start participating in the Ethereum Proof of Stake network. As more users stake their ETH, the more secure the network becomes, making it more difficult for attackers to control the majority of validators.

Buy Ethereum via MoonPay

You can still participate in the Ethereum blockchain without acquiring the necessary 32 ETH to become a network validator.

You can buy Ethereum (ETH) and Ethereum Classic (ETC) via MoonPay with a credit or debit card, bank transfer, Apple Pay, Google Pay, and more preferred payment methods.

Sell Ethereum via MoonPay

MoonPay also makes it easy to sell Ethereum when you decide it's time to cash out. Simply enter the amount of ETH you'd like to sell and enter the details where you want to receive your funds.

Swap Ethereum for other crypto

Want to exchange Ethereum for more cryptocurrencies like Bitcoin? MoonPay allows you to swap crypto cross-chain with competitive rates, directly from your non-custodial wallet.

.png?w=3840&q=90)

.png?w=3840&q=90)