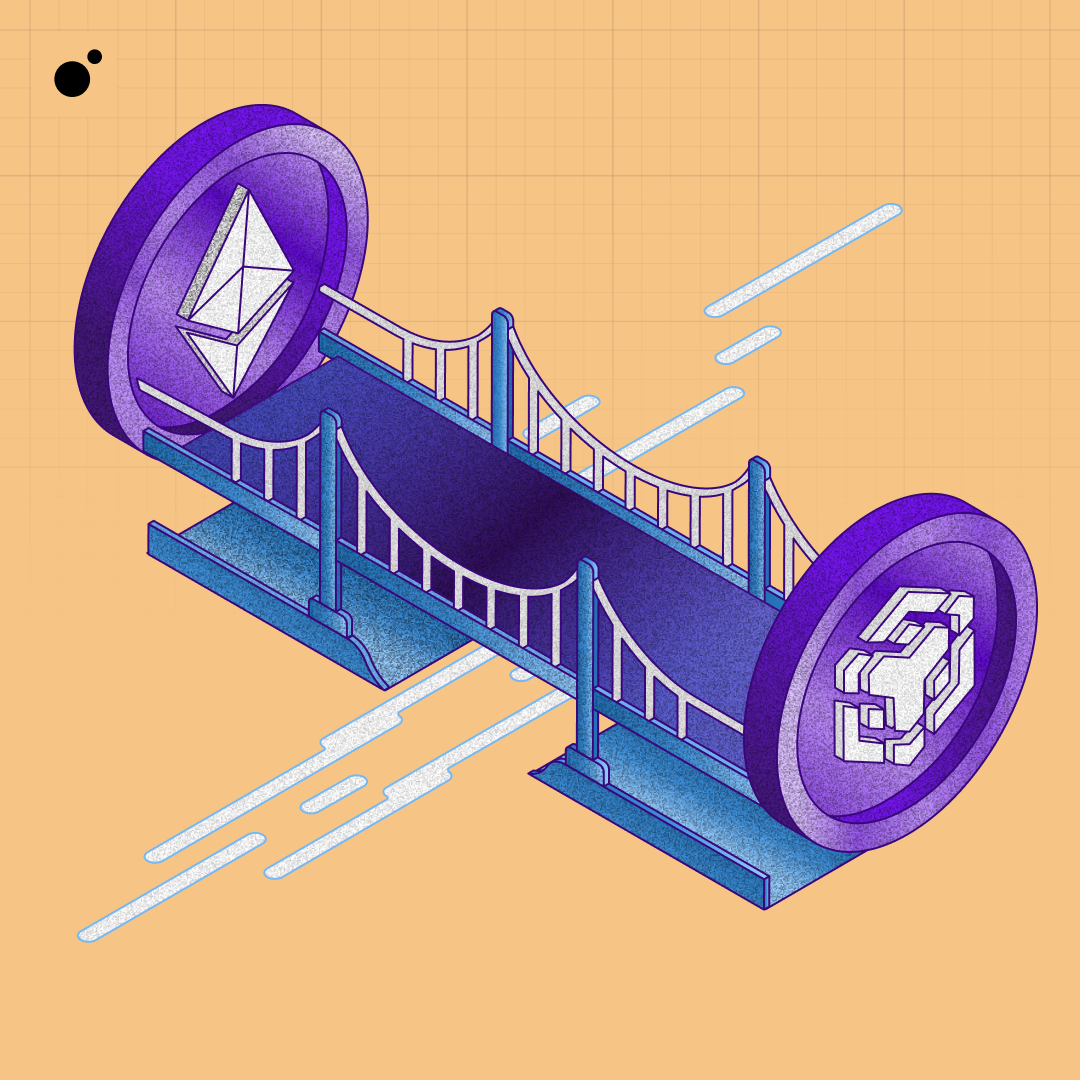

Interoperability isn’t just a buzzword; it’s a necessity in today’s landscape of blockchain ecosystems. As the number of blockchain networks grows, the need for clear communication and smooth asset transfer among them has become more evident.

Cross-chain bridges meet this need by providing users with a means to move cryptocurrency assets cross-chain. In the process, they can also increase liquidity and open up new possibilities for users to diversify their digital portfolios.

In this article, we dissect what crypto bridges are, how they function, as well as some advantages and precautions that come with them.

What is a cross-chain bridge?

A cross-chain bridge is an application that facilitates the transfer of digital assets between two different blockchain networks. Cross-chain bridges operate via smart contracts and function as a cross-chain messaging protocol that enables blockchain interoperability.

For example, let's say you want to transfer Ethereum-based ERC-20 tokens to the Binance Smart Chain (BSC) in order to use a BSC decentralized application (dApp).

To do this, you could use a cross-chain bridge to initiate a cross-chain transfer. This involves locking up your tokens on the Ethereum network and minting equivalent tokens on the Binance Smart Chain. Once the tokens are successfully transferred, you can freely use them within the BSC ecosystem. Similarly, this process can be reversed to transfer tokens back from BSC to Ethereum.

Why does interoperability matter in crypto?

Without crypto bridges, it would be difficult to transfer assets between different blockchain networks, leading to inefficient transactions and increased time and costs associated with transfers.

Additionally, as the Web3 ecosystem evolves, it becomes necessary to build bridges between existing Web2 infrastructures and forthcoming Web3 services.

How do cross-chain bridges work?

Cross-chain bridges work by utilizing different techniques and protocols to enable interoperability between blockchains. These bridges typically involve a set of smart contracts, decentralized applications (dApps), or centralized entities that manage the transfer of assets between the participating blockchains.

When you deposit an asset for transfer, the bridge's smart contracts lock up this asset and release an equivalent wrapped asset on the destination blockchain. This procedure, known as the lock-and-mint model, is the bedrock of blockchain bridges. Let's examine its workings further.

Lock-and-mint model

With lock-and-mint bridges, users deposit crypto assets for transfer and the smart contract on the source chain locks the tokens. You can think of this like putting your assets into a vault.

Then, an equivalent digital asset is minted on the destination blockchain, allowing the locked assets to be utilized in the new blockchain ecosystem.

This procedure relies on a backend communication system that monitors the locking and triggers minting on the corresponding destination blockchain.

Other mechanism models

There are some additional mechanisms that cross-chain bridge models use:

Burn-and-mint

With burn-and-mint bridges, users must burn tokens on the source chain, permanently removing them from the circulating supply. New tokens are then minted and re-issued on the destination chain.

Lock-and-unlock

With lock-and-unlock bridges, users must lock tokens on the source chain. New tokens can then be unlocked on the destination chain from a liquidity pool.

Cross-chain bridge security

Maintaining the integrity and security of cross-chain bridges is a task of utmost importance and complexity, since each blockchain network has its unique programming and virtual environment.

The heroes of this process are the validators, who ensure the integrity of transactions by verifying and validating the locked and minted assets.

In an attempt to safeguard user funds, cross-chain bridges employ a host of security measures such as:

- Multi-signature schemes

- Cryptographic techniques

- Time locks

- Intrusion detection systems

- Continuous monitoring

- Incident response plans

Validation methods

In addition to security mechanisms, bridges employ various validation processes to minimize trust, such as native verification by validators of the destination blockchain and external verification with additional security measures.

There are several validation structures that blockchain bridges may employ:

- Federated bridges are centralized bridges that are structured like a private network. They rely on a select group of trusted validators to facilitate cross-chain transactions.

- Trustless bridges are decentralized and facilitate the asset transfer process without the need for a central authority or intermediary.

Cross-chain bridge examples

The blockchain world is rich with cross-chain bridge solutions, each boasting a unique set of features and benefits. Some cross-chain platforms include:

- Near Rainbow Bridge: The Near Rainbow Bridge is a cross-chain bridge protocol that facilitates the seamless transfer of assets between the NEAR Protocol and other blockchain networks.

- Avalanche Bridge: The Avalanche bridge allows for the transfer of assets between the Avalanche and Ethereum networks.

- Polygon Portal (Polygon Bridge): The Polygon to Ethereum bridge enables seamless interoperability between the Polygon and Ethereum networks.

- Binance Bridge: The Ethereum to Binance Smart Chain bridge facilitates the transfer of assets between the Ethereum and Binance Smart Chain networks.

Additional blockchain bridges include Multichain, Poly Network, Hop Exchange, Axelar, and Connext.

*These platforms are provided only as examples and should not be viewed as an endorsement or recommendation by MoonPay.

Applications such as these enable the transfer of digital assets like ERC-20 tokens and NFTs between a wide range of blockchain networks, providing flexibility and connectivity for users transferring assets.

Advantages of cross-chain bridges

Cross-chain bridges are more than just technological achievements; they present tangible advantages to users. Here are a few:

Enhanced liquidity

Cross-chain bridges enable greater liquidity by enabling the transfer of assets between different blockchain networks, unlocking new opportunities for users to access and utilize their crypto assets.

Cross-chain liquidity also helps to prevent economic silos, with increased token utility helping to broaden the scope of economic activities within the decentralized finance (DeFi) space.

Access to multiple ecosystems

Cross-chain bridges serve as passports to multiple blockchain ecosystems. They open up a world of decentralized applications (dApps) across different blockchains, enabling user interaction with multiple ecosystems.

They allow users to leverage the unique features and strengths of different blockchain platforms, enhancing their overall experience and encouraging a more interconnected Web3 ecosystem.

Cost and speed benefits

Cross-chain bridges offer more than just connectivity; they also bring efficiency and scalability. Bridges can provide faster transaction speeds by enabling the use of more efficient blockchains and bypassing the need to use multiple crypto exchanges to swap between assets.

Bridges can improve scalability by distributing transaction loads and improving processing times. Bridges that serve Ethereum Layer-2 scaling solutions can also provide an economical option compared to transactions on high-cost networks like the Ethereum mainnet.

No dependency on a single chain

Cross-chain bridges can help mitigate risks associated with single-chain dependence by enabling diversification and asset allocation across multiple blockchain networks.

Diversifying among several chains could be particularly handy in the event of network outages, which are known to occur on blockchains like Solana.

Risks of cross-chain bridges

Similar to all Web3 technologies, cross-chain bridges also carry their own set of risks and challenges. Here are some worth keeping in mind:

Centralization risks

With crypto bridges, the balance between centralization and decentralization is a key trade-off.

While centralized bridges offer efficiency by relying on the speed of centralized structures, they also come with significant security risks as they require users to place trust in a centralized authority. As the central custodian that stores large amounts of funds that back cross-chain transfers, centralized bridges have been the targets of many attacks in the past. In 2022 alone, bridge hacks resulted in over $2.7 billion in financial losses.

Decentralized bridges, on the other hand, disperse trust across the network, which can enhance security by making it more challenging for malicious attacks to succeed. However, that doesn't make them impervious to hacks, and users should always research any decentralized application (dApp) before depositing crypto assets.

Read our article How to spot and avoid crypto scams to learn all about the most common scams and how to spot them.

Smart contract vulnerabilities

The smart contracts that form the backbone of crypto bridges are susceptible to vulnerabilities. These risks can manifest as logical flaws or technical mismatches, which attackers can exploit to make unauthorized withdrawals or execute other malicious activities.

Addressing these vulnerabilities requires rigorous smart contract audits and ongoing security updates to both centralized and decentralized bridges. External audits by third-party security firms can help uncover and address weaknesses in smart contract code, thus mitigating the risks of exploitation.

Other bridge risks

Liquidity risks

Liquidity risks within cross-chain bridges refer to the potential challenges associated with maintaining sufficient liquidity for assets being transferred between different blockchain networks. These risks can arise due to various factors such as imbalance in supply and demand, price discrepancies, market volatility, and slippage.

Regulatory and compliance changes

Blockchain bridges may face regulatory challenges and compliance requirements, particularly regarding the transfer of assets between different blockchain networks and jurisdictions.

Network congestion

Crypto bridges may contribute to network congestion and scalability issues, especially during periods of high transaction volume or activity. The Ethereum network in particular is known for having high transaction (gas) fees and slow processing speeds during periods of increased activity.

Frequently Asked Questions about blockchain bridges

Are cross-chain bridges safe?

Ensuring the security of cross-chain bridges involves balancing security, trust, and flexibility. For example, some cross-chain solutions may implement rate limits on token transfers to cap the amount of value that can be transferred over a given time period as a preventive measure against potential security breaches.

Safe navigation of cross-chain bridges necessitates vigilance and caution.

Always verify and ensure that the bridge application being used is the authentic platform and not a phishing attempt. Always conduct thorough research of the platform’s security features to understand all potential risks before using a cross-chain bridge.

What are wrapped tokens?

Wrapped tokens are tokens that exist on one blockchain but represent assets from another blockchain. For example, wrapped Bitcoin (WBTC) represents Bitcoin on the Ethereum blockchain.

What are multi-signature wallets?

Multi-signature wallets are cryptocurrency wallets that require multiple signatures or approvals before a transaction can be executed. These wallets are often used in cross-chain bridges in an attempt to increase security and mitigate risks.

How to bridge fiat to crypto?

MoonPay offers an easy and fast way to bridge the gap between fiat and crypto, enabling users to buy, sell, and manage cryptocurrencies with fiat money.

To get started, just top up your wallet in euros, pounds, or dollars and use your MoonPay Balance to purchase crypto like Bitcoin (BTC) and Ethereum (ETH). Then, simply transact for cheaper and faster transactions with higher approval rates. Plus, enjoy zero-fee withdrawals directly to your bank account when you decide to cash out.

Concluding thoughts on cross-chain bridges

In an expanding Web3 ecosystem, cross-chain bridges are the digital connectors that facilitate interoperability between disparate blockchain networks. They're essential for building advanced decentralized applications (dApps) for purposes like seamless token swaps, staking, and providing liquidity. Although they may seem mundane, they're key to making digital assets more accessible and expanding the capabilities of Web 3.0.

MoonPay Swaps: Tapping into cross-chain interoperability

MoonPay Swaps is a new example of cross-chain interoperability, offering users a seamless platform for swapping digital assets across multiple blockchain networks.

With its user-friendly interface and extensive support for many cryptocurrency tokens and blockchains, MoonPay Swaps provides users with the best aspects of cross-chain functionality and interoperability.

.png?w=3840&q=90)