If you’ve ever dabbled with Proof-of-Stake (PoS) cryptocurrencies like Solana and Ethereum, chances are you've encountered crypto staking. In the traditional staking setup, you lock up your tokens with a validator to help secure the network and earn rewards.

While regular staking can generate passive income (while also securing the blockchain network), it also means your crypto are usually tied up and unavailable for other financial activities. What many users don’t realize is that there’s now an alternative approach to staking designed to offer much greater flexibility and more ways to participate in DeFi.

Enter liquid staking.

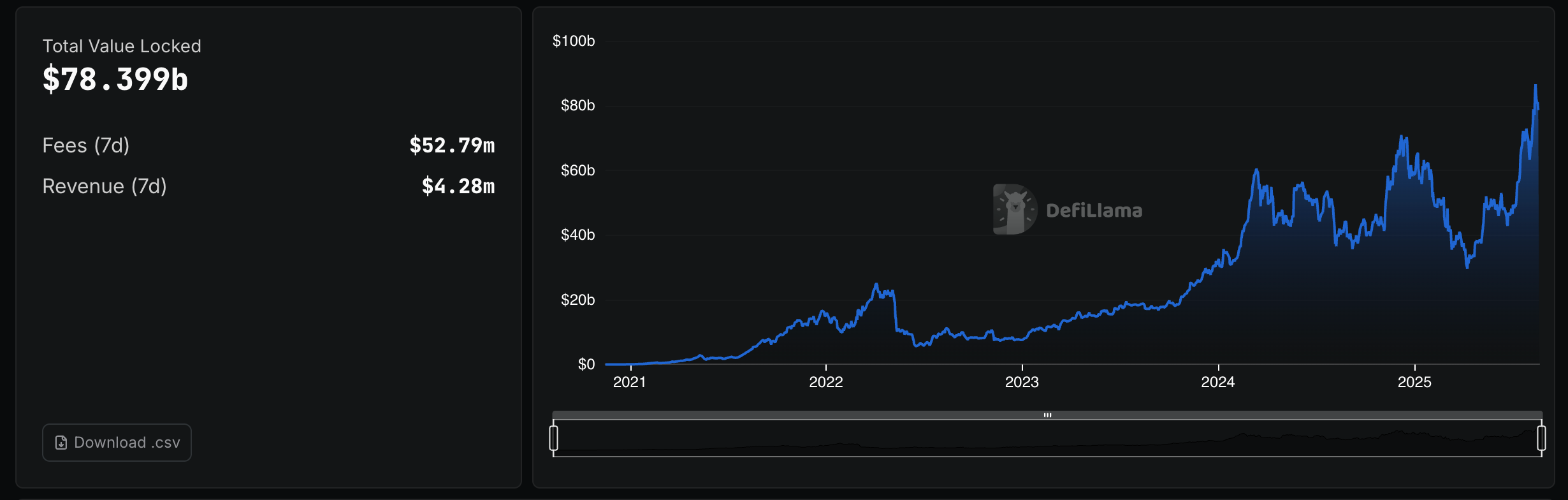

With over $78 billion in total value locked (TVL), this advanced form of crypto staking is quickly changing the way people interact with Proof-of-Stake blockchains, providing new opportunities to earn rewards, secure the PoS network, and unlock extra value from digital assets.

But what is liquid staking, and how does it work?

In this guide, you’ll learn what liquid staking is, how it can open up new ways to use your crypto, what to watch out for, and practical steps to start staking today.

What is Liquid Staking?

Liquid staking is a type of staking that allows users to stake cryptocurrency tokens to secure a Proof-of-Stake blockchain network and earn rewards. Unlike traditional staking methods, users receive a liquid staking token (LST) that can be traded, transferred, and used in DeFi protocols.

While the tokens are staked, they are “locked up” with a validator and are not liquid until unstaked, which can take some time depending on the protocol.

LSTs represent the token holder's staked assets and rewards that those assets accrue. The underlying staked asset continues to earn staking rewards normally, even as the LST is used elsewhere in the DeFi ecosystem.

For example, you can deposit these tokens on DeFi lending platforms like Aave or Solend to lend them out or borrow stablecoins. You can also add them to liquidity pools on Curve or Raydium to collect trading fees and yield farming rewards.*

Many liquid staking tokens can also be traded on decentralized exchanges (DEXs), making it simple to exchange them for other assets or just manage your entire DeFi portfolio in one place.

*These activities carry different risks than liquid staking. DeFi protocols may offer extra value, but they also increase your exposure to risks like price volatility, liquidation, and potential smart contract failures, so they are best suited for experienced users only. Nothing in this article should be construed as a recommendation or endorsement of any investment strategy.

How Does Liquid Staking Work?

Here is how liquid staking works:

The underlying mechanism

When you participate in liquid staking, you deposit your crypto assets (for example, ETH or SOL) into a liquid staking protocol (ex., Sanctum) instead of staking directly with a validator node.

The protocol then stakes your tokens with a validator and issues you a liquid staking token that represents your staked balance and accrues staking rewards over time. The LSTs remain in your wallet and can be used throughout DeFi, even as your underlying assets remain staked.

Examples of liquid staking tokens

Some well-known liquid staking tokens include stETH (Lido Staked ETH), mSOL (Marinade Staked SOL JITOSOL (Jito Staked SOL), PSOL (Phantom Staked SOL), and mpSOL (MoonPay Staked SOL)

Each token is unique and has its own features, perks, and drawbacks. Staking yields may also vary over time and from token to token.

While most tokens are accepted on decentralized exchanges, lending platforms, and yield farming protocols, exact usage is limited to the specific token issuer and its integrations with such decentralized applications (dApps).

Role of smart contracts & validators

Smart contracts are used in liquid staking protocols to automate the entire process, including staking, distributing rewards, and issuing LSTs. With smart contracts handling these operations, users generally do not need to manage manual claims or track rewards themselves.

Validators are responsible for securing the Proof-of-Stake blockchain network and generating staking rewards. Token holders typically delegate their LSTs to pools managed by the protocol, which then distributes them across trusted validator nodes.

Disclaimer: Do your own research and evaluate the third-party service providers (ex., smart contract issuers and validators) associated with any liquid staking token to help protect your staked assets.

Re-staking potential

Many ecosystems now allow for "re-staking," where your LSTs can be staked again in additional DeFi protocols for additional rewards. For example, you could stake Solana, receive mSOL in exchange, and then provide mSOL as collateral in a lending protocol, thereby earning multiple streams of yield from the same underlying asset.*

*Using your liquid staking tokens in additional protocols (such as lending platforms) increases your exposure to smart contract vulnerabilities, price volatility, and potential liquidation risk. Always research liquid staking providers carefully and be sure you understand the risks before participating.

Liquid Staking vs. Traditional Staking

Liquid staking and traditional staking both help secure blockchains and pay out staking rewards, but there are some important differences to consider:

Feature | Liquid Staking | Traditional Staking |

Liquidity | Tokens remain tradable and usable in DeFi | Tokens are locked and cannot be traded |

Flexibility | Can move, trade, or use liquid staking tokens (LSTs) | Assets are inaccessible until unstaking period ends |

Yield Opportunities | Access to additional DeFi yields* | Earn base staking rewards only |

Security and Risks | Same risks as traditional staking, plus additional smart contract risks and price risk of the LST itself against underlying asset | Slashing, validator reliability, and price risks |

DeFi Participation | Can use tokens in DeFi lending, farming, or trading | Cannot use staked tokens in DeFi |

The difference: Liquid staking provides far greater flexibility and utility for crypto assets, but also introduces added risks like smart contract risk, impermanent loss, as well as price volatility of the liquid staking tokens themselves.

*Users should understand the tradeoffs of liquid staking protocols before staking. Always do your research before committing assets.

Benefits of Liquid Staking

Liquid staking enables users to achieve greater access and flexibility in DeFi. Here are some of the most compelling advantages it brings to token holders:

Earning staking rewards without locking crypto assets

With liquid staking, you continue to receive rewards just as you would with traditional staking services. However, in the liquid version, you are not forced to lock up your tokens, giving you greater ownership over how you deploy your assets.

Participating in DeFi with staked assets

LSTs allow users to access liquidity across a wide range of DeFi protocols.* You might lend your stETH on a lending platform to earn more returns, deposit mSOL into a liquidity pool for yield farming, or use these assets in other decentralized applications.

For example, stETH can be supplied as collateral on Aave, while mSOL can be used in Solana DeFi protocols such as Raydium or Solend.

*Liquid staking introduces additional smart contract, liquidity, and price risks. Only use reputable protocols and never invest more than you can afford to lose.

Diversifying portfolios

Liquid staking may make it easier to diversify your income streams, as you can use your staked assets in multiple DeFi activities. This flexibility lets users build more creative and potentially more profitable strategies, all while participating in network security.

Risks of Liquid Staking

No decentralized finance product comes without risks. Here are some to be aware of when considering liquid staking:

Smart contract risks

Because liquid staking relies on complex smart contracts, any bugs or vulnerabilities could lead to lost funds or unexpected behavior. Always assess the reputation of the protocol and whether it has undergone external smart contract audits.

Price volatility of liquid staking tokens

LSTs are designed to track the value of the underlying asset, but during periods of intense market volatility or low liquidity, they can trade at a depressed price relative to the original token.

Slashing risks & validator reliability

Even though the liquid staking protocol manages validator delegation for you, if a validator misbehaves, it can be penalized (via slashing) and your returns may decrease.

Regulatory uncertainty

The rules and regulations around liquid staking and DeFi are still evolving in many countries. Changes in the regulatory landscape could potentially impact access to these services or the value and liquidity of the tokens involved.

Popular Liquid Staking Protocols

With liquid staking becoming increasingly mainstream, several popular protocols have emerged on various blockchains.

Lido

Lido is the leading liquid staking protocol by TVL, issuing liquid stETH via thousands of global node operators. Users can stake ETH to receive stETH, which earns rewards and can be further used in with over 100 DeFi platforms for trading, lending, and collateral.

Lido previously supported both the Solana (stSOL) and Polygon (stMATIC) networks, though now focuses exclusively on Ethereum. The platform is non-custodial and governed by the Lido DAO.

Lido TVL: > $38 billion

Rocket Pool

Rocket Pool is a decentralized liquid staking protocol for Ethereum, allowing users to stake as little as 0.01 ETH and receive rETH. This token earns yield and can be traded, used in DeFi, or unstaked at any time. With thousands of node operators worldwide, Rocket Pool also offers the option to run your own validator with as little as 4 ETH.

Rocket Pool: > $2.8 billion

Jito

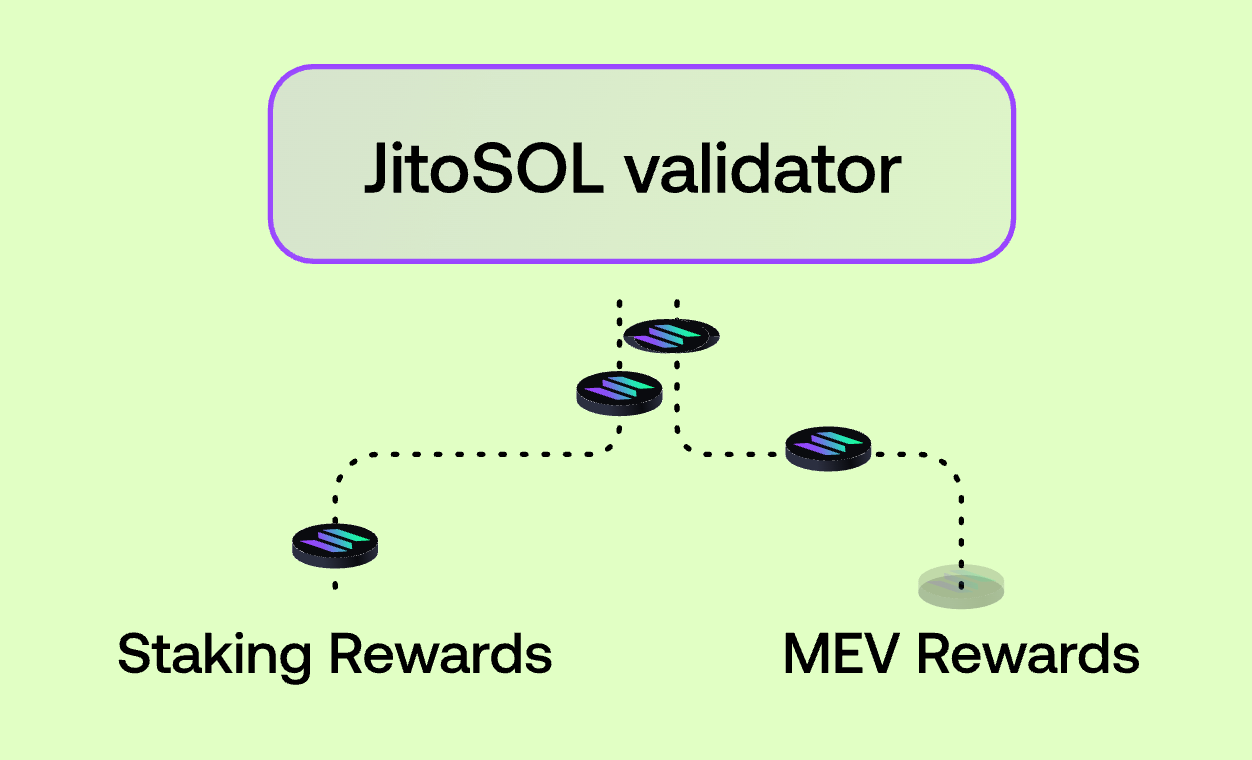

Jito is a Solana liquid staking protocol that gives users JitoSOL tokens in return for staking SOL. The Jito Staked SOL token automatically grows in value by accruing both staking and MEV (maximal extractable value) rewards.

JitoSOL can be used across Solana DeFi, and when you unstake, you receive more SOL than you initially deposited (provided that JitoSOL continues to appreciate over time vs Solana).

Jito TVL: > $2.8 billion

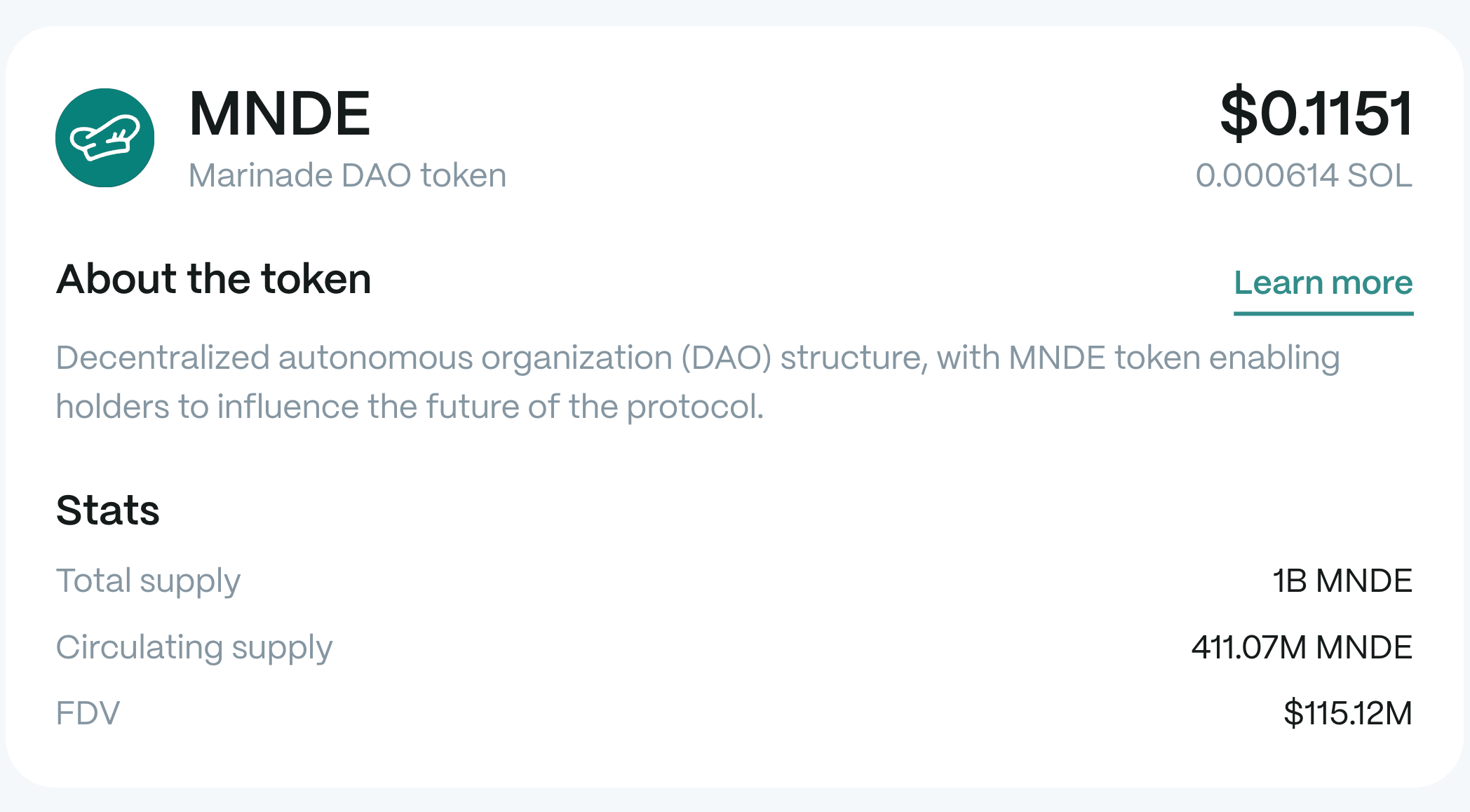

Marinade Finance

Marinade is a Solana-based liquid staking protocol that lets users stake SOL to receive mSOL in return. These tokens earn staking rewards and can be freely traded or integrated across the Solana DeFi ecosystem.

Users can take advantage of mSOL on platforms like Kamino or marginFi to earn interest, or provide liquidity on exchanges such as Orca, Meteora, or Raydium to earn yield from transaction fees.

Marinade TVL: > $862 million

Ankr

Ankr is a multi-chain liquid staking protocol supporting blockchain networks like Ethereum, Binance Smart Chain, Polygon, Avalanche, and more. Its Ankr Bridge lets users move liquid staking tokens cross-chain for greater liquidity and additional earning opportunities. Token holders can provide liquidity, earn trading fees, or use their LSTs in a variety of DeFi strategies to boost returns.

Ankr TVL: > $62 million

Disclaimer: Each protocol’s token (e.g., stETH, rETH, mSOL) may have different features, fees, and DeFi integrations, so users should compare each liquid staking provider's benefits and risks before choosing where to stake.

How to Get Started with Liquid Staking

Getting started with liquid staking is straightforward, especially if you've staked crypto normally before. Here’s a step-by-step overview, using Phantom wallet as the liquid staking provider of choice.

1. Choose a staking platform

Select a reputable platform or wallet that supports liquid staking, such as Phantom for Solana, Lido or Rocket Pool for Ethereum, or Ankr for multiple blockchains.

For the purposes of this walkthrough, simply download Phantom in the app store on your mobile device, or as a desktop plugin on browsers like Chrome, Brave, and FireFox.

2. Add tokens to your wallet

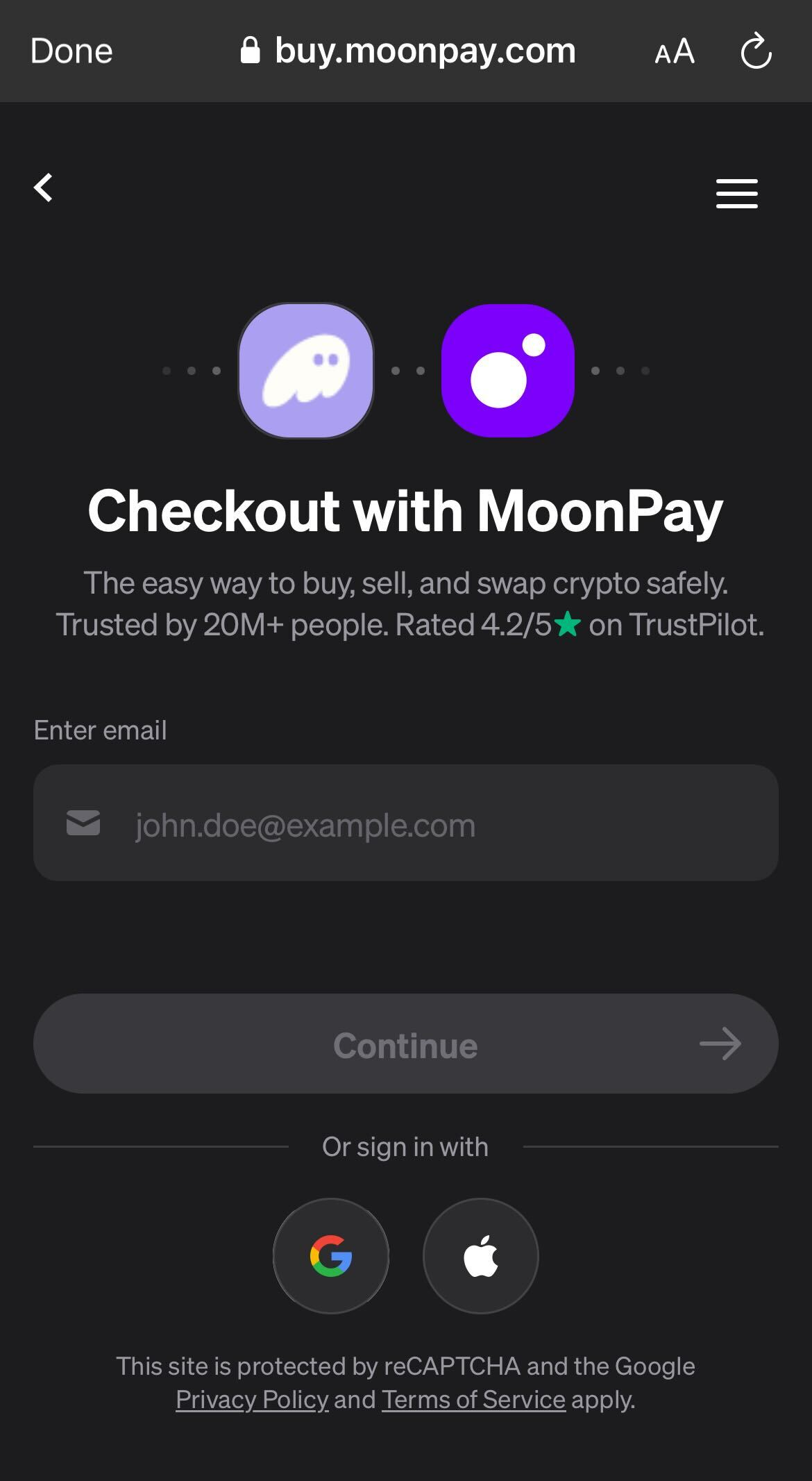

Top up your wallet by buying crypto through an on-ramp provider like MoonPay.

You can easily buy Solana (SOL) for staking directly in your Phantom wallet, using preferred payment methods like credit/debit cards, PayPal, Apple Pay, and more.

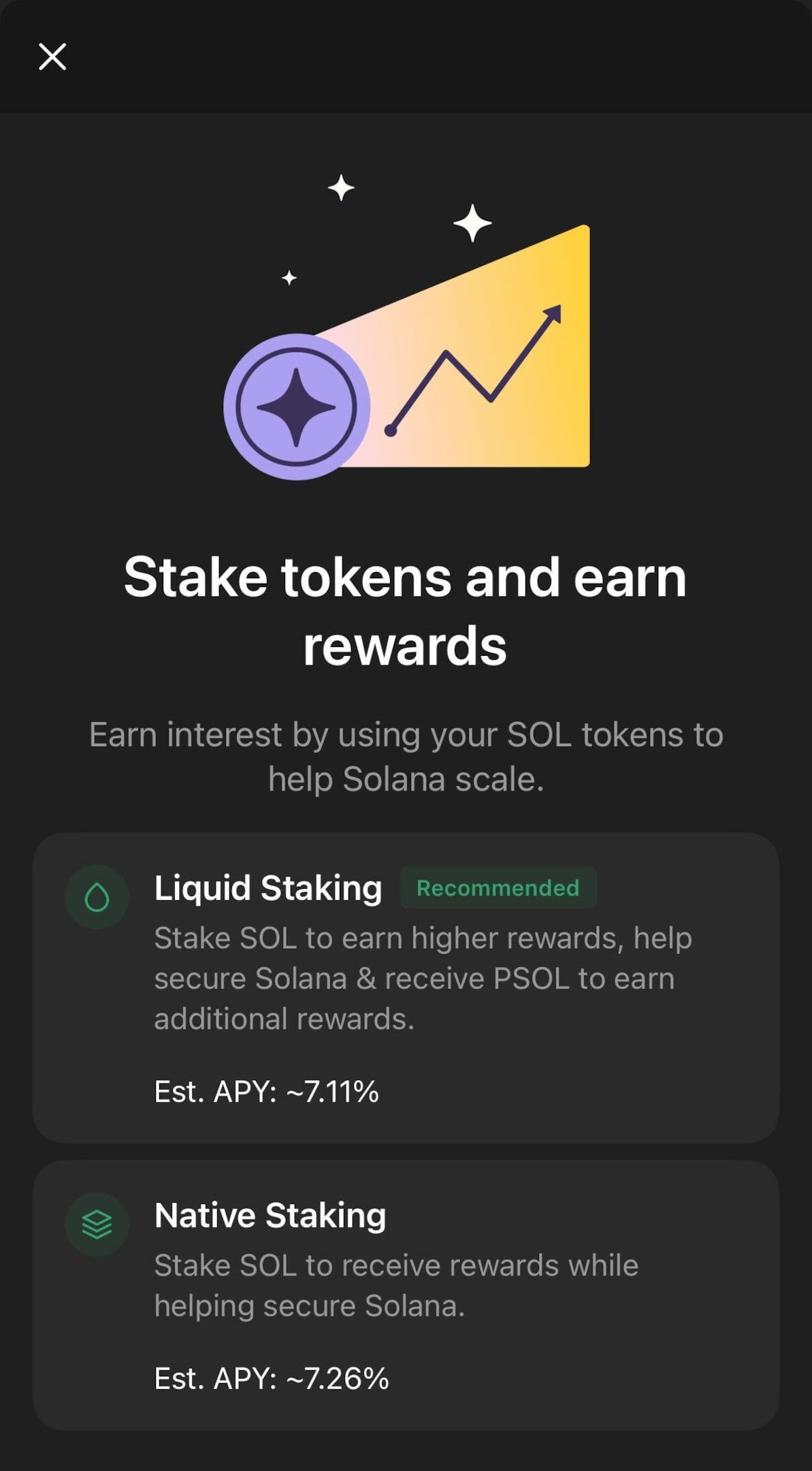

3. Choose the liquid staking option

Once you have Solana in your wallet, click the Stake SOL button and choose liquid staking over native staking.

4. Stake tokens and receive liquid tokens

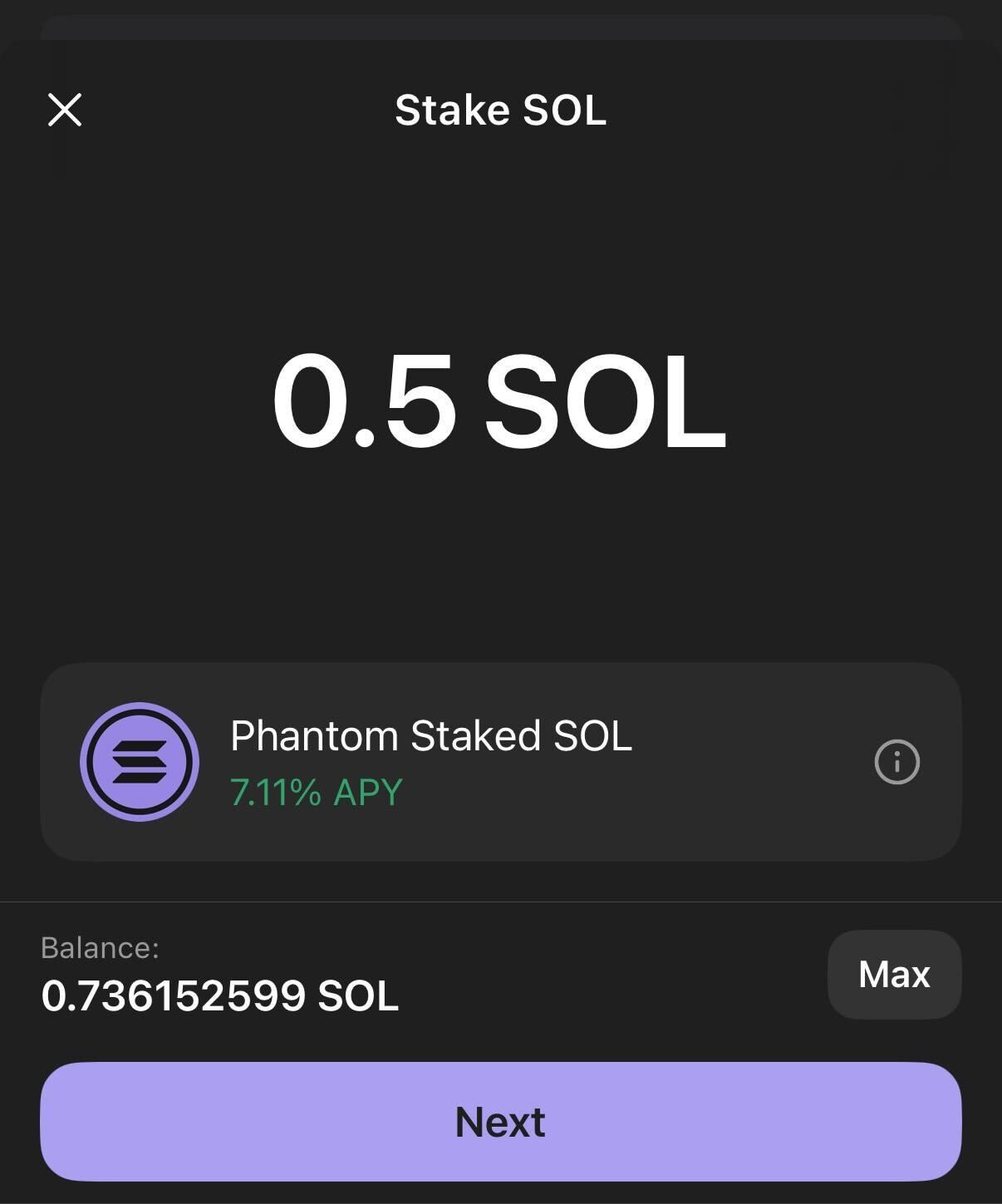

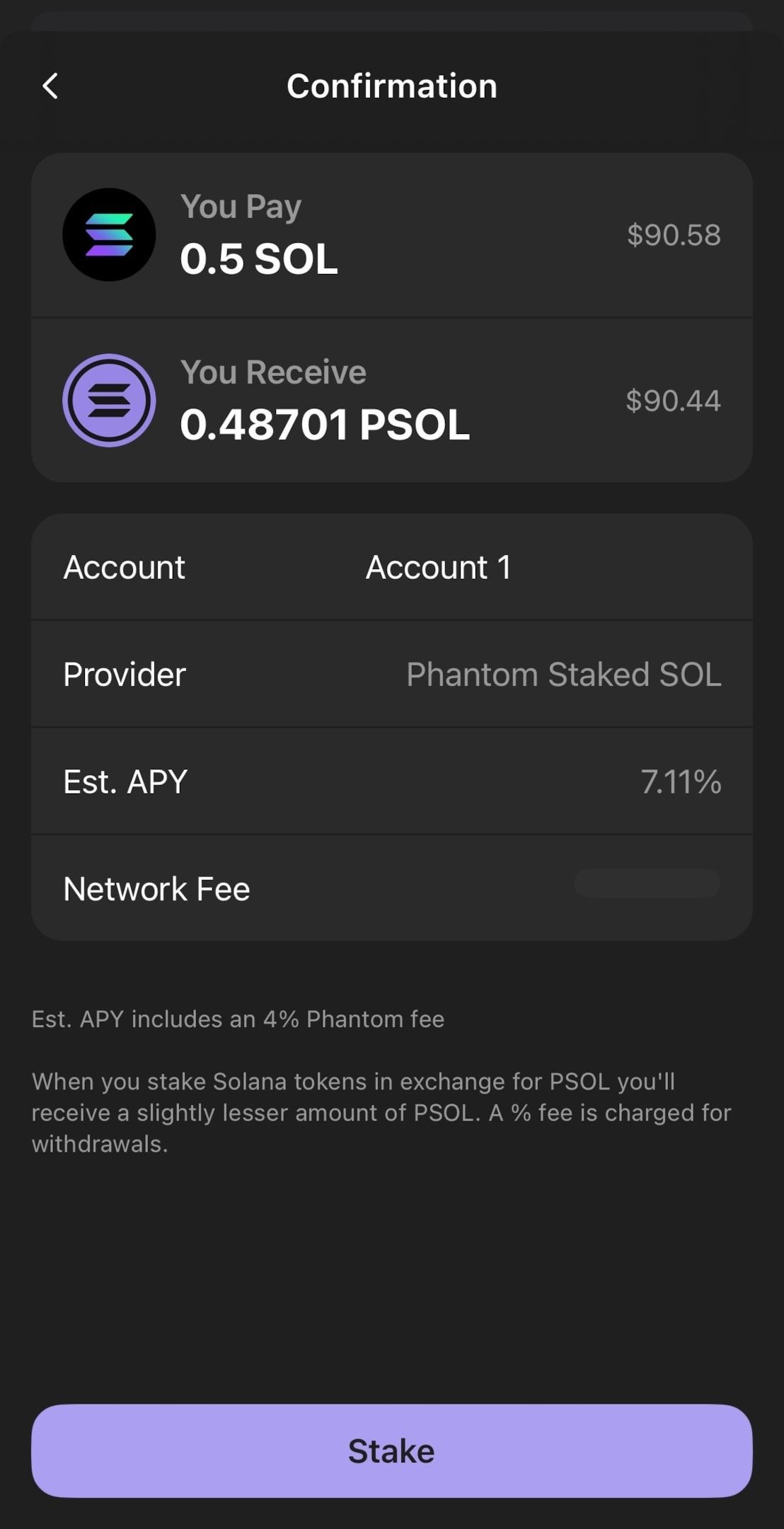

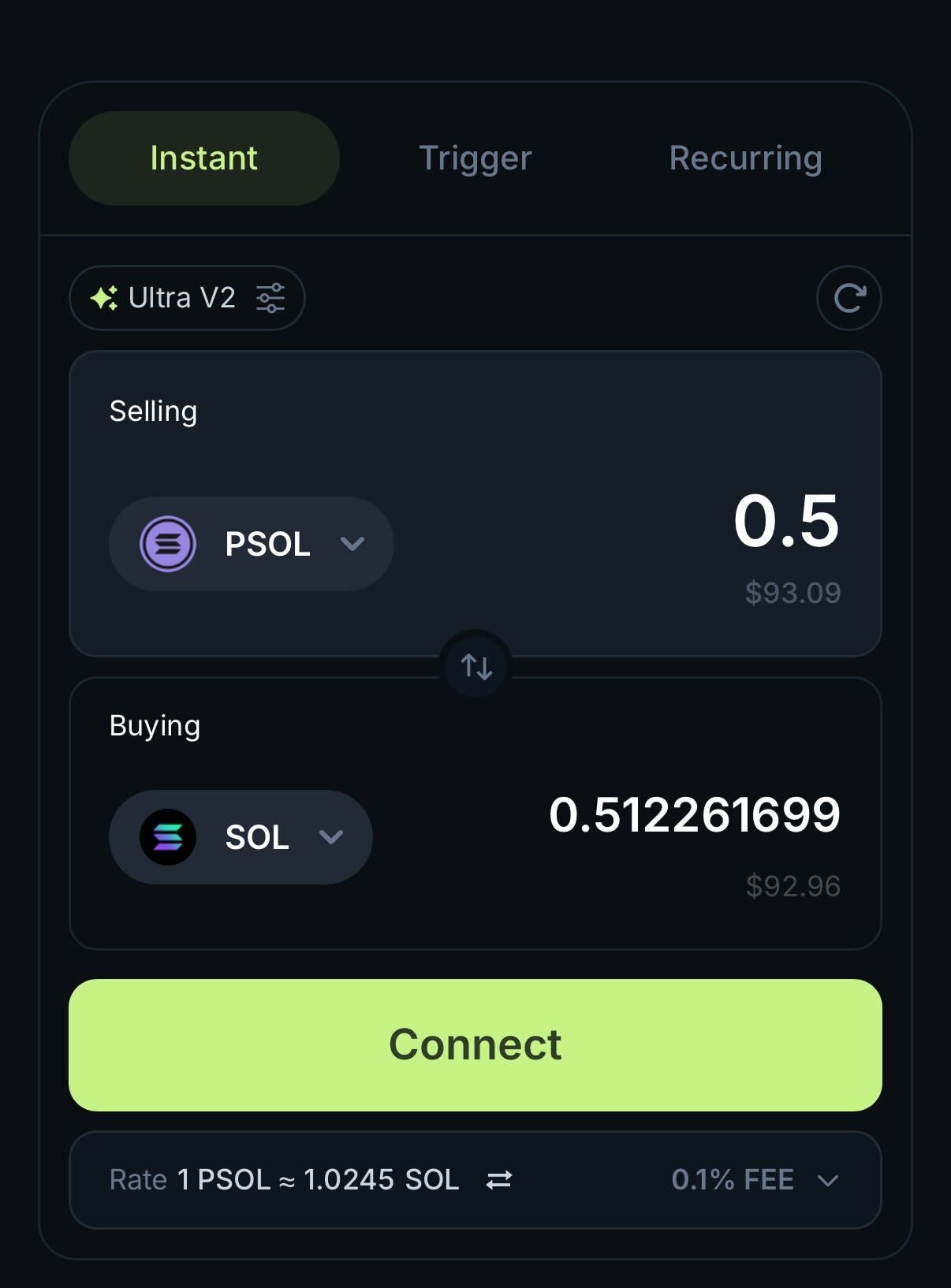

If you choose the liquid option, you'll also be able to select between receiving Jito Staked SOL (JITOSOL) and Phantom Staked SOL (PSOL). For the purposes of this guide, we'll be going with PSOL.

Enter the amount of Solana (SOL) you wish to stake for PSOL and click Next to review the potential APY and fees.

5. Use your liquid tokens in DeFi

That's it! After clicking Stake, you'll receive your Phantom Staked SOL tokens in your wallet, representing your staked position.

You're now free to use them as you wish to explore Solana DeFi protocols compatible with your new PSOL tokens. You can lend, farm, or trade them for other coins to earn yield and increase token flexibility, all while still collecting Solana staking rewards.

6. Unstake tokens

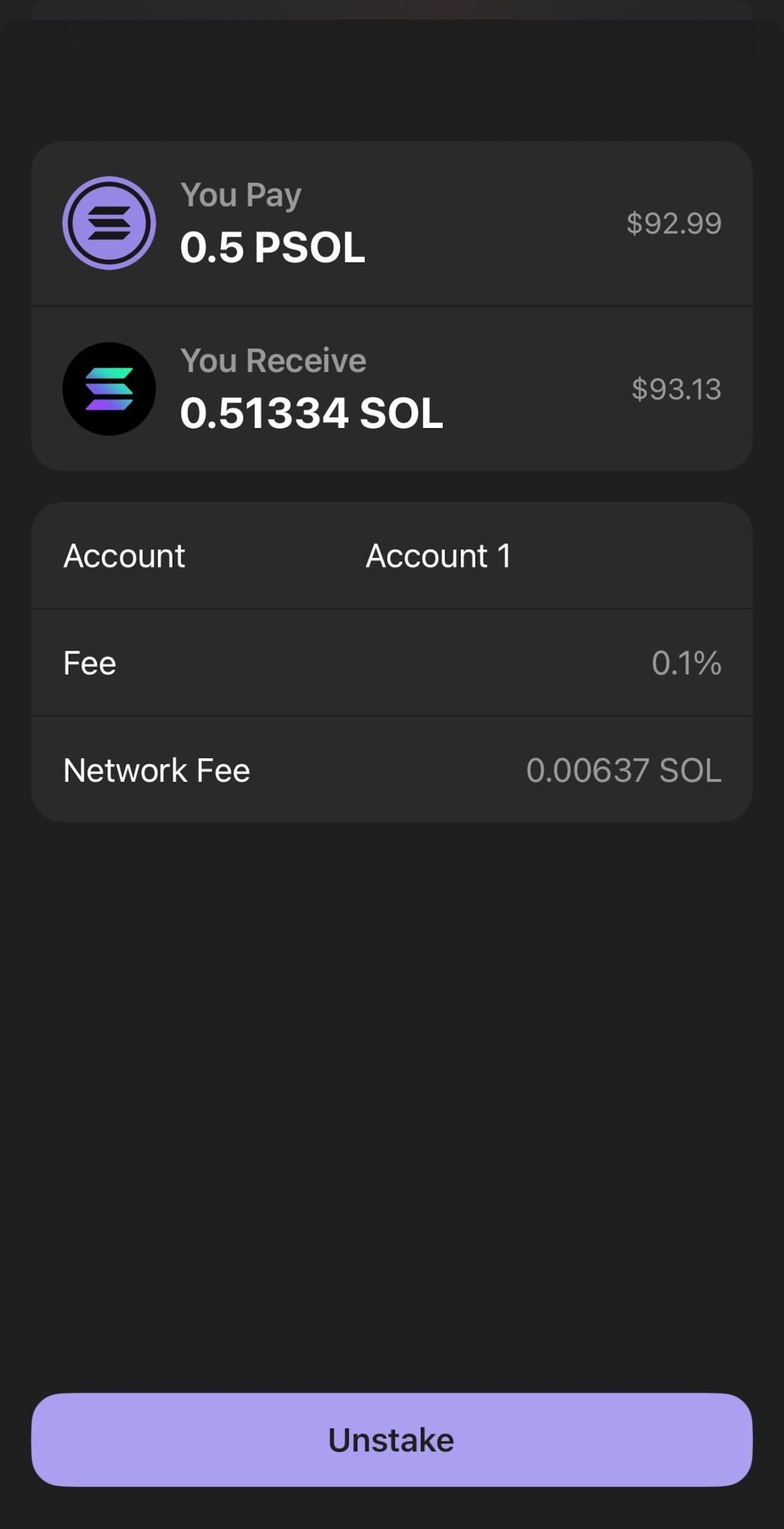

When you want to withdraw back to Solana, you can initiate an unstake transaction at any time.*

You can unstake your entire position, or as little as 0.000000001 PSOL at a time (bearing in mind that there are transaction fees for each withdrawal).

And, just like when you stake, be sure to confirm the fees before confirming and clicking the Unstake button.

*Transaction completion time may range from a few seconds to several minutes, depending on Solana network factors such as congestion.

Pro tip: You can check the status of your unstaking transaction on Solscan, the Solana block explorer.

.png)

.png?w=3840&q=90)