As the digital asset industry continues to evolve, U.S. lawmakers are stepping up to define how cryptocurrencies and blockchain technologies will be regulated.

One of the most significant developments is the Market Structure Bill, formally known as the Financial Innovation and Technology for the 21st Century Act (FIT21). This bipartisan legislation aims to create a clear, coordinated, and innovation-friendly regulatory framework for digital assets.

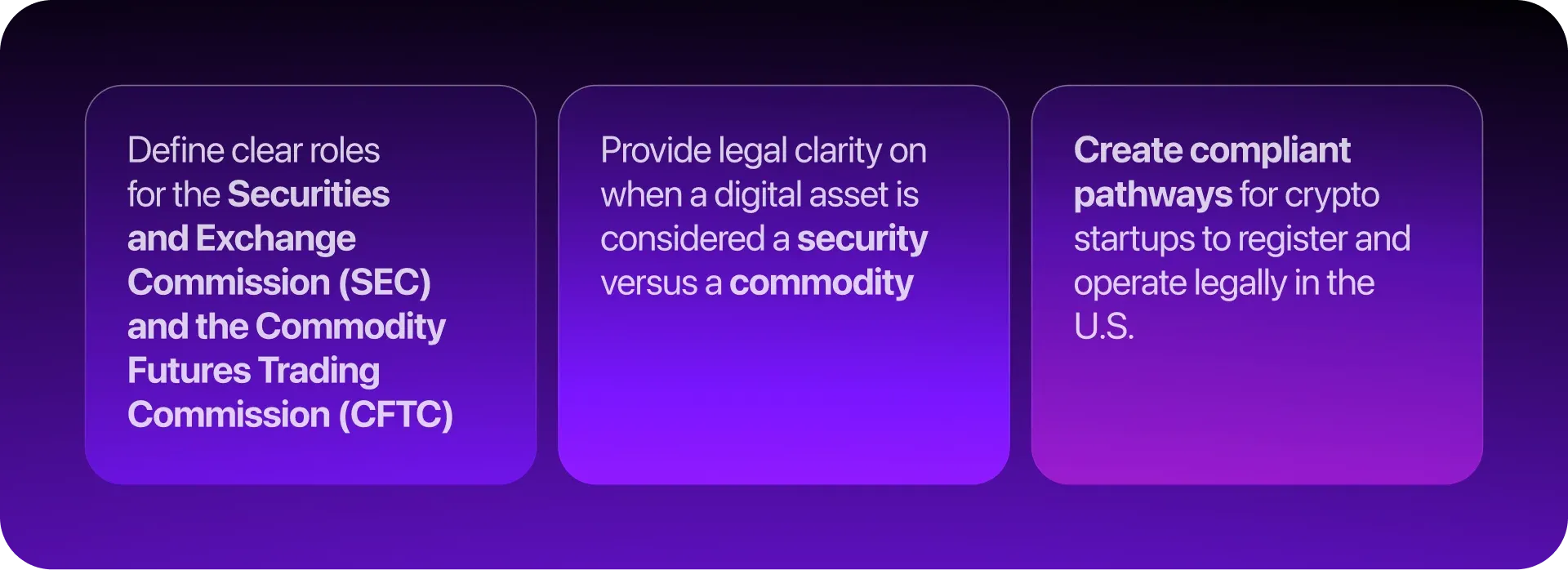

The bill is designed to:

Its core objective: reduce legal uncertainty that has historically stifled U.S.-based innovation and pushed crypto activity offshore.

Connecting the Market Structure Bill and the GENIUS Act

The recently passed GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) complements the Market Structure Bill by establishing a robust federal framework for funding and scaling emerging technologies—including AI, blockchain, and decentralized internet infrastructure.

Together, the bills form a coordinated legislative strategy:

This alignment signals a structural shift: the U.S. is not only regulating digital assets—it’s investing in their future, positioning itself as a global leader in the digital economy.

Senate Endorsement: Policy Principles for Market Structure

In June 2025, Senators Tim Scott, Cynthia Lummis, Thom Tillis, and Bill Hagerty released a unified set of principles that reinforce the bill’s goals. Their framework emphasizes:

This cross-senate endorsement adds legislative momentum and affirms the need for a smart, balanced approach to crypto regulation.

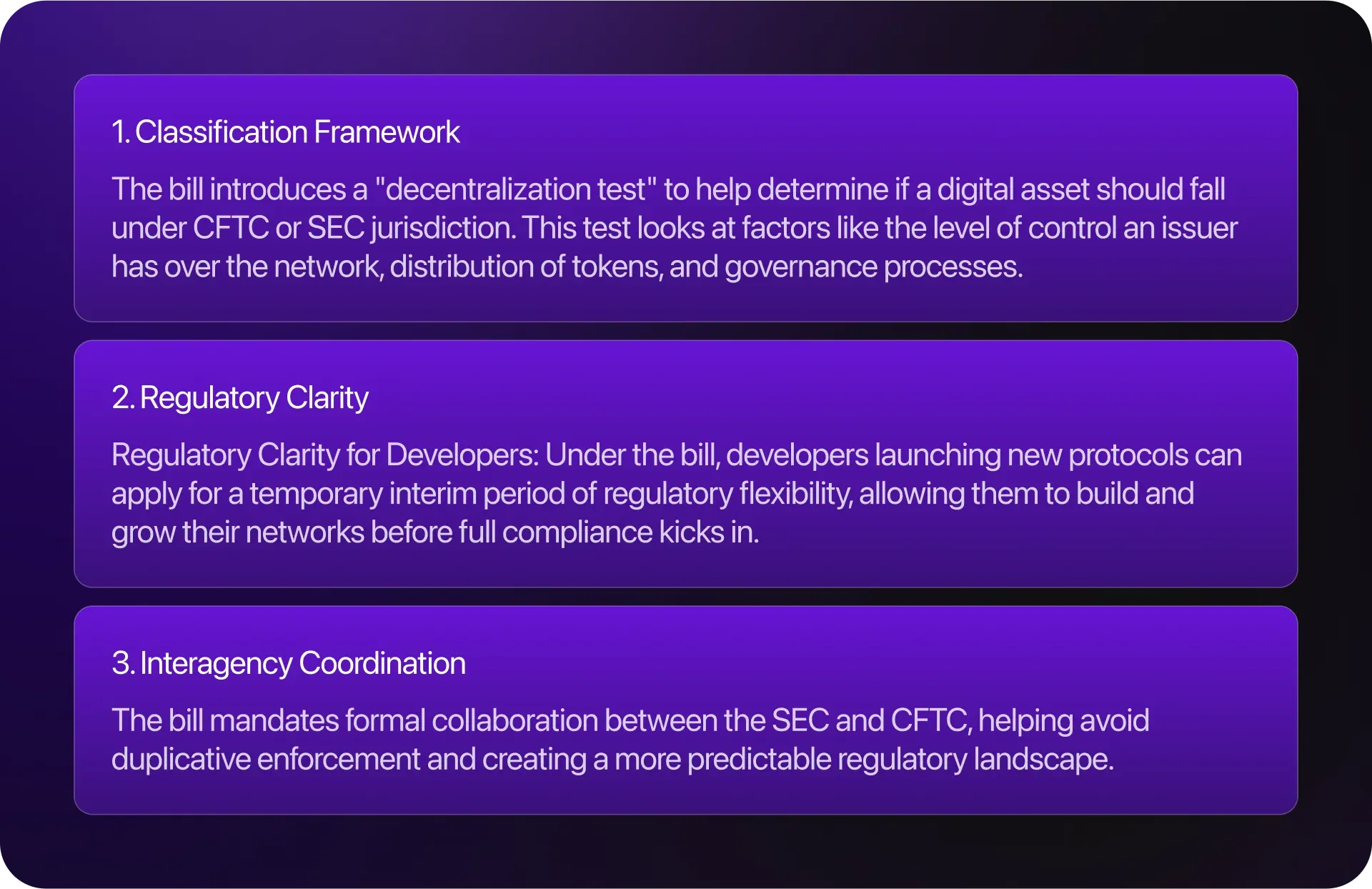

Key Highlights of the Bill

Potential Impact on the Crypto Ecosystem

If passed, the U.S. Market Structure Bill could reshape the perception of the U.S. as a hostile environment for digital assets. Here’s what it could mean:

Critics caution that more safeguards are needed for DeFi protocols and small-scale builders to ensure the framework supports innovation at all levels. Even still, the US Market Structure bill is a step in the right direction towards a more transparent, inclusive, and innovation-forward regulatory landscape—one that enables responsible growth while preserving the core values of decentralization, user ownership, and financial access.