What Is Reputational Risk—And Why It Matters

For years, U.S. bank regulators used a broad concept called "reputational risk" to guide which customers banks should serve—and which they might avoid. If a business was seen as controversial or politically sensitive, banks could drop them even if the company had done nothing wrong legally. Crypto companies, cannabis firms, and adult content platforms often found themselves caught in this gray area.

We've seen firsthand how this affected access to banking services, especially in the early days of crypto adoption. But the landscape is changing—and fast.

Regulators Are Recalibrating

In a notable shift, key U.S. financial regulators—the Federal Reserve, the Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC)—are scaling back how they apply reputational risk in bank supervision.

Here’s what’s changed:

The goal is to ensure that banks assess customers fairly—based on facts, not fear.

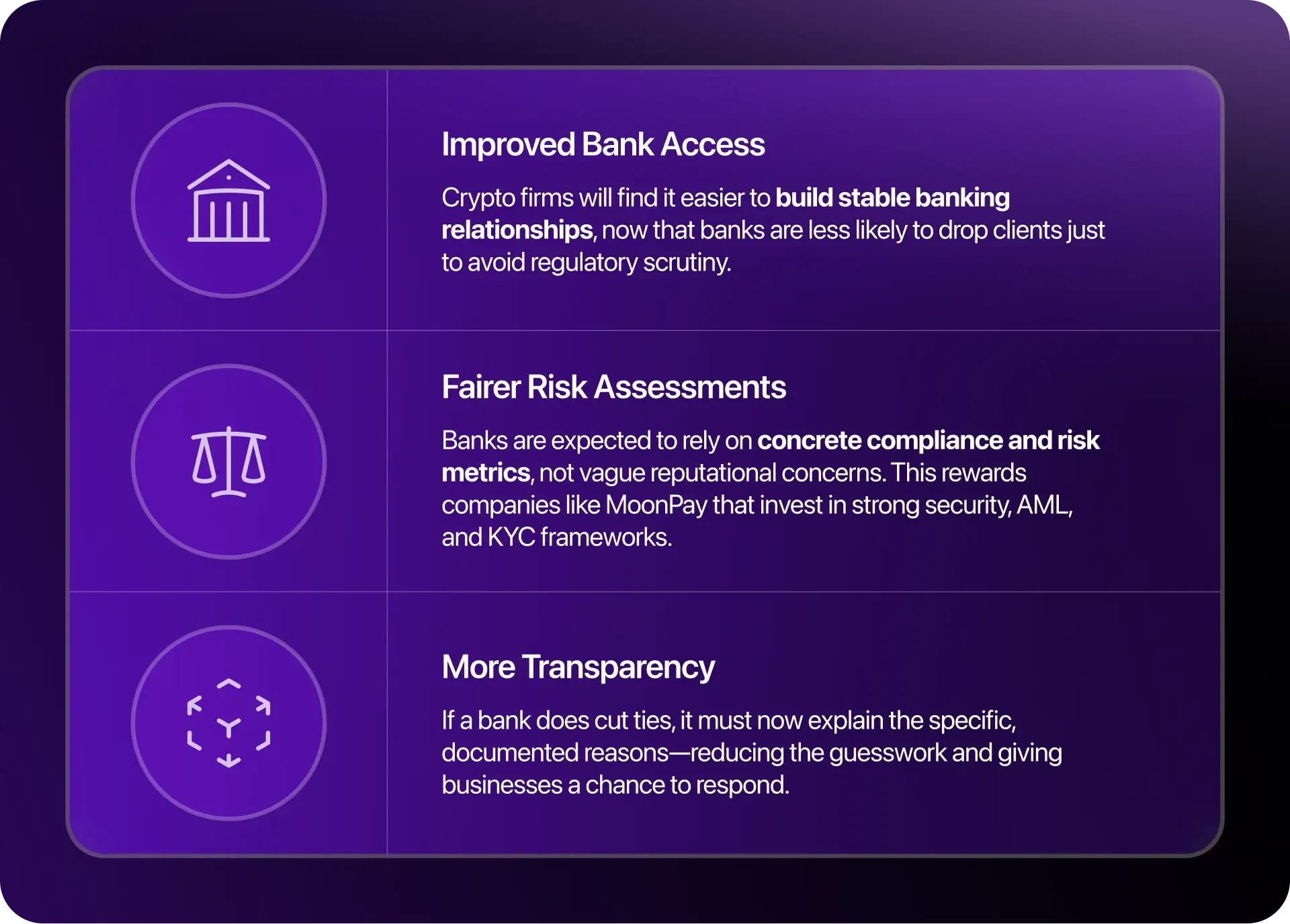

What This Means for Crypto

This shift is a positive step forward for MoonPay and the broader crypto ecosystem.

Here's why:

Why This Shift Matters Beyond Crypto

This isn’t just a crypto story—it’s about equal access to financial services. Whether you're a startup innovating at the edge of Web3 or a business in a regulated but stigmatized sector, the new rules encourage a more level playing field.