Decentralized Prediction Markets

Prediction markets let people put their money where their opinions are. They allow users to trade on the outcomes of future events, from elections and sports to crypto prices and pop culture moments. Decentralized prediction markets take this concept on-chain, removing middlemen and letting code handle the odds.

What are Decentralized Prediction Markets?

At their core, prediction markets are platforms where people can buy and sell shares that represent the outcome of an event. Each share’s price reflects the market’s collective belief about how likely something is to happen.

In traditional prediction markets, a central operator runs the show and holds custody of funds. Decentralized prediction markets replace that operator with smart contracts on a blockchain. Instead of trusting a company to settle outcomes, users rely on open-source code and on-chain data feeds.

How They Work

Imagine a market that lets people predict whether Bitcoin will go above $150,000 by the end of the year. There are two tokens: “Yes” and “No.” If most traders believe there is a 40 percent chance it will happen, the “Yes” token might trade for about 40 cents.

When the event ends, a decentralized oracle checks the final result and records it on the blockchain. Smart contracts then pay out automatically to holders of the winning outcome. No manual settlement. No withdrawal delays. Just code doing its job.

Many decentralized prediction markets use automated market makers (AMMs) to price outcomes. This keeps trading continuous, allowing people to enter or exit positions at any time before the event closes.

How People Use Them

Prediction markets go beyond simple bets. They turn collective opinion into measurable data, offering a live picture of how people expect events to unfold.

Traders use them to hedge or speculate. Researchers track them to gauge crowd sentiment. Some users simply enjoy the social and competitive aspect of being right about what comes next.

In crypto, these markets also highlight the potential of trustless finance by showing how real-world forecasts can exist without a bookmaker or a bank.

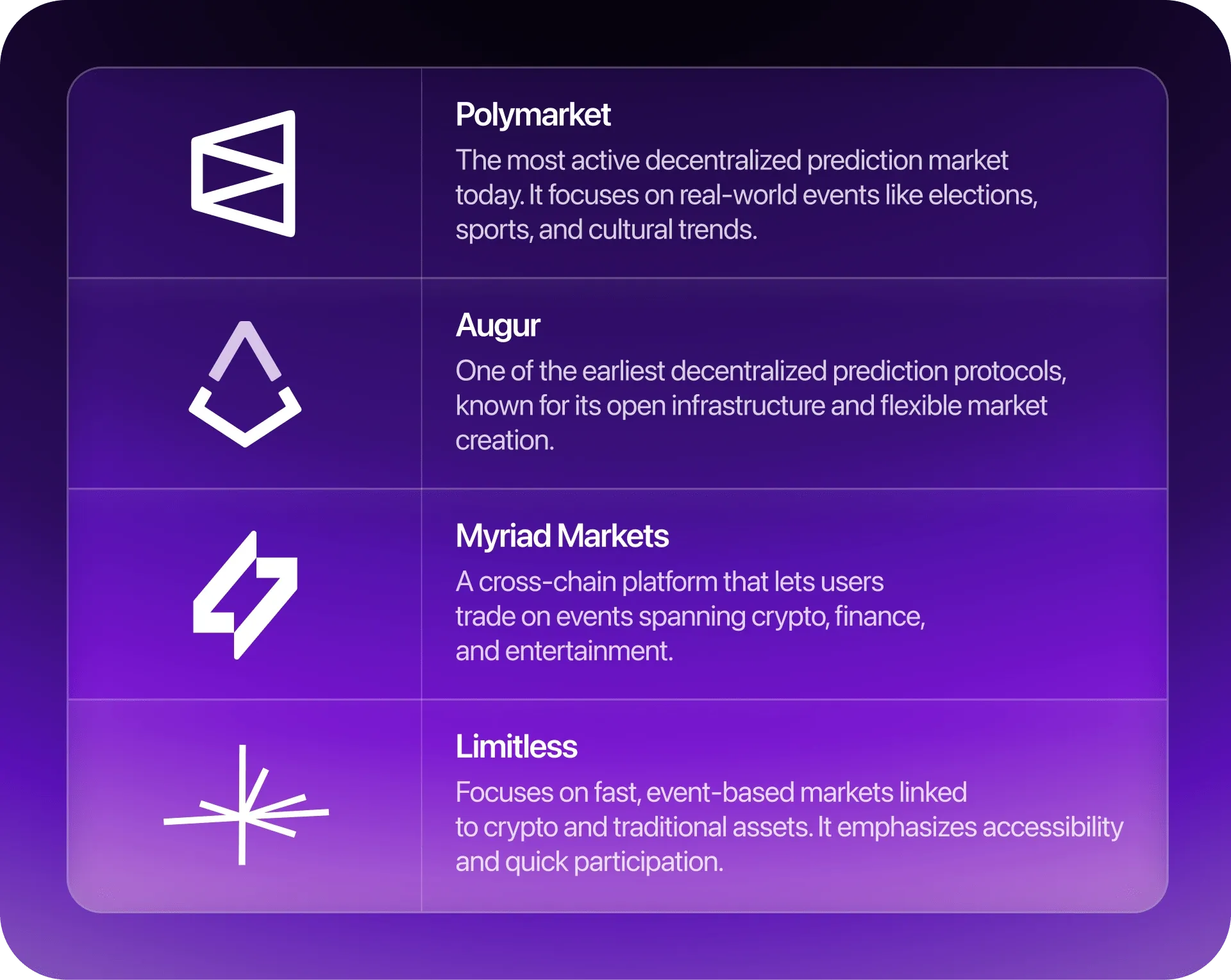

Popular Decentralized Prediction Markets

Decentralized prediction markets continue to evolve, with platforms like Polymarket and Myriad Markets each serving different needs, from real-world event trading to community forecasting.

Spotlight: Polymarket

Polymarket has helped bring prediction markets mainstream. Instead of focusing on niche crypto topics, it turned everyday events into tradable questions that anyone can understand.

Users can buy and sell shares on outcomes like “Will a major tech company launch an AI product this year?” or “Will a certain team win the championship?” The platform uses simple yes or no markets and USDC-based trading on Polygon, designed to make participation straightforward for users.

An oracle verifies each result and triggers payouts automatically, ensuring the process runs reliably and without intermediaries. The interface is designed to be approachable and easy to navigate, attracting both experienced users and those new to prediction markets.

The platform’s rapid rise has also drawn attention from established players. In 2025, Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, announced an investment of up to $2B in Polymarket, underscoring growing institutional interest in decentralized prediction markets.

The Bigger Picture

Decentralized prediction markets aren’t just about betting on the news. They’re a glimpse into how collective intelligence can shape prices in an open financial system.

If information really is the world’s most valuable commodity, these markets might be one of the purest ways to measure it.