Cold storage refers to keeping your cryptocurrency private keys completely offline, disconnected from the internet.

Think:

- A hardware wallet stored in a drawer

- A USB drive that never touches WiFi

- Even a piece of paper with a handwritten seed phrase

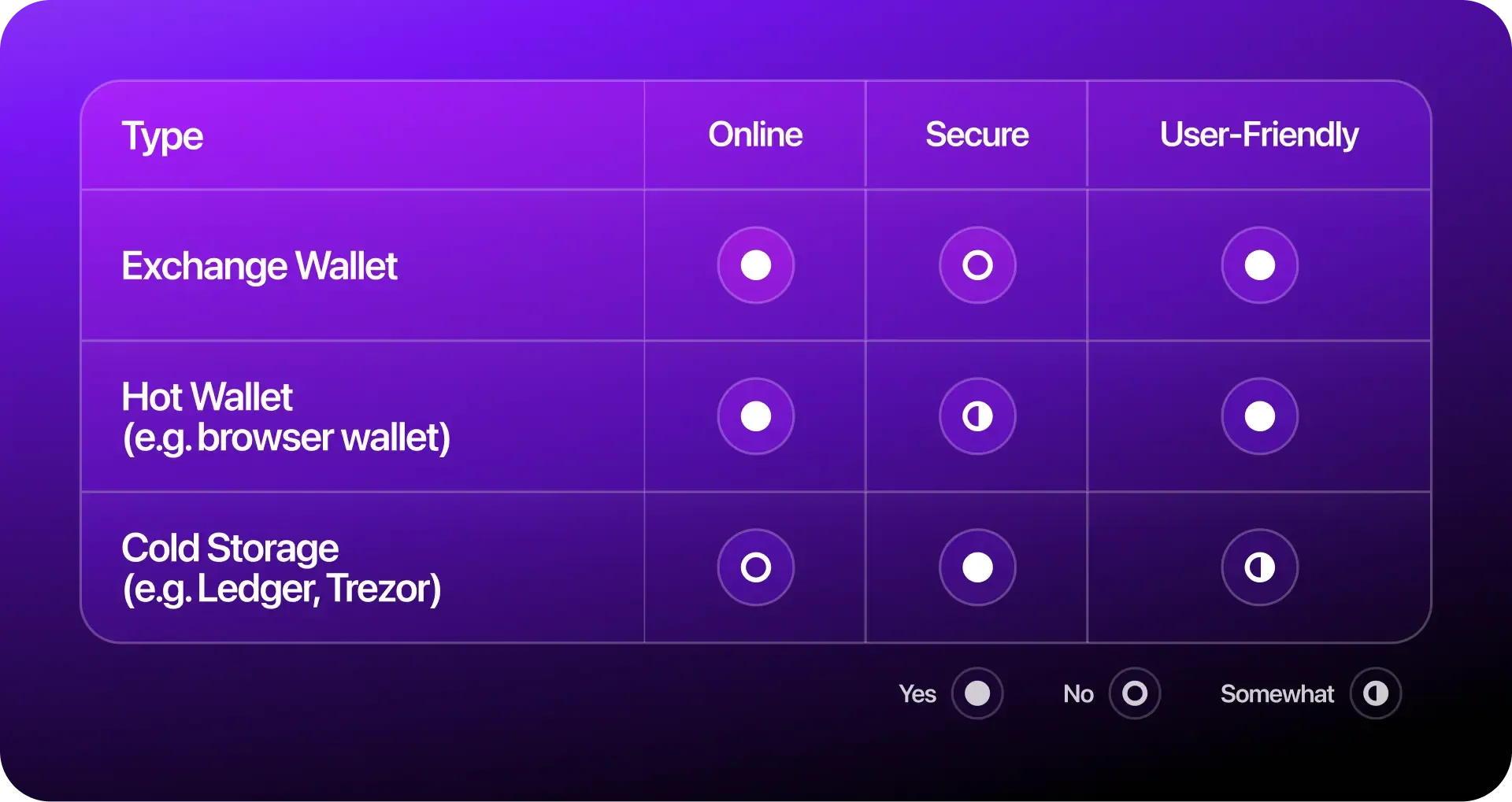

It’s the opposite of hot wallets, which are connected to the internet (like wallets on exchanges). Cold storage isn’t always convenient—but that’s the point. It’s not supposed to be fast. It’s supposed to be safe.

Why cold = safe

Crypto ownership is defined by private keys. If someone else gets access to yours, they can drain your wallet in seconds—and there’s no “forgot password” button.

So by keeping those keys offline, cold storage adds a physical layer of defense. Hackers can’t phish what they can’t reach.

Let’s break it down:

Hardware wallets: the gold standard

The most popular form of cold storage is a hardware wallet—a small device (like a USB stick) that stores your private keys securely.

Names you might’ve heard:

These devices sign transactions internally, meaning your private keys never leave the wallet—even when it’s plugged in. That’s the magic: you can interact with crypto without exposing your keys to the internet.

The risks (yes, there are a few)

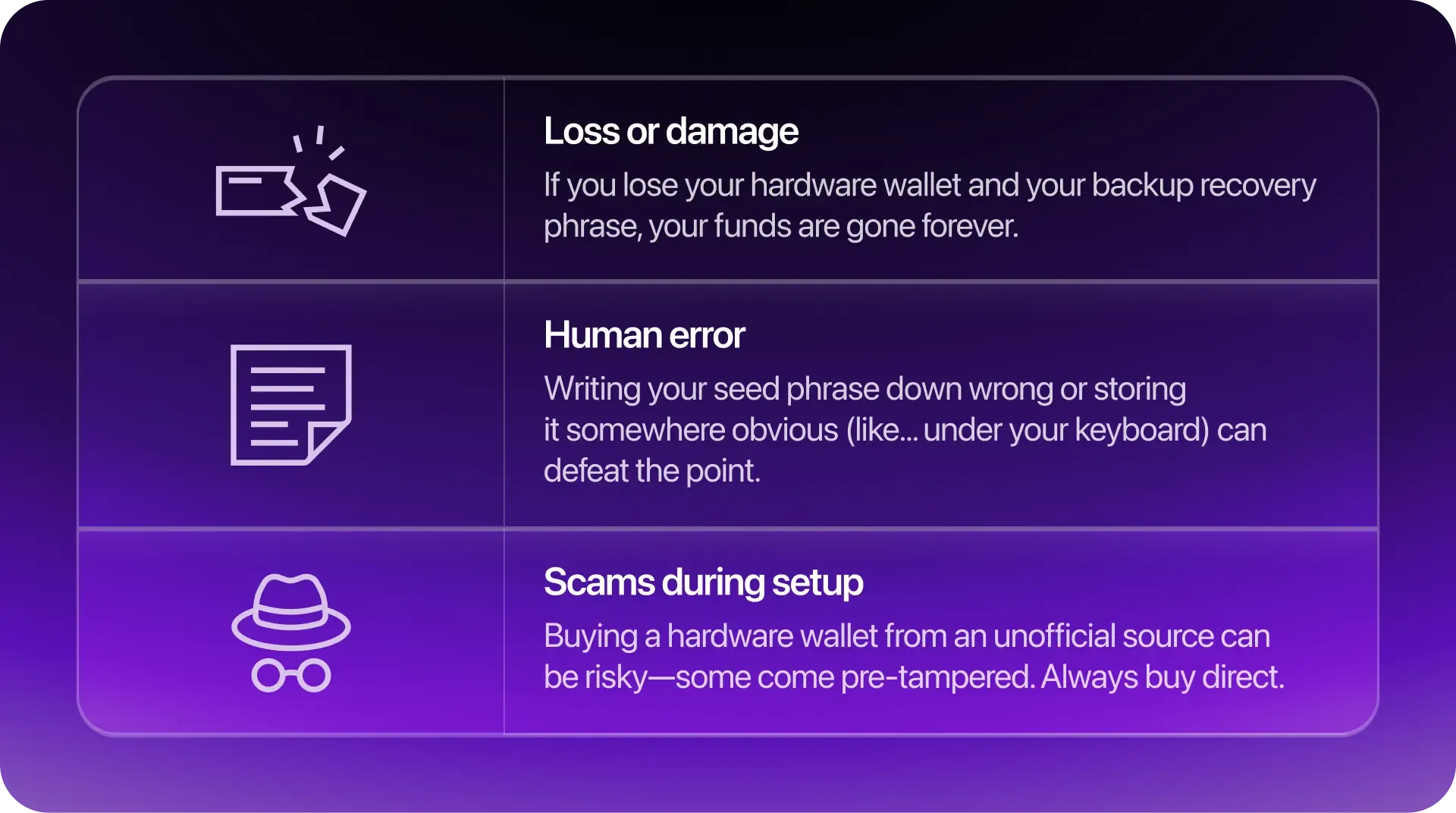

Cold storage is extremely secure, but it’s not foolproof. Common pitfalls include:

Who should use cold storage?

Cold storage isn’t necessary for everyone. If you’re casually trading small amounts, a secure hot wallet might be enough.

But if you hold significant value in crypto—or simply sleep better knowing no one can touch your coins without physical access—cold storage is essential.

Sign up to our weekly MoonPay Minute newsletter