Stablecoins - cryptocurrencies whose value is pegged to another asset like the U.S. dollar or euro - are one of the most hotly-discussed innovations in the industry because of their promise to reshape global finance.

While stablecoins have been adopted all over the world (especially by countries seeking safe harbor in the dollar), the U.S. has been the focal point of this evolving market.

Sign up to our weekly MoonPay Minute newsletter

What’s the big deal?

Stablecoins are significant in the U.S. for numerous reasons:

- By far the two biggest stablecoins are USDT and USDC, both pegged to the U.S. dollar.

- The dollar is itself the world’s primary reserve currency.

- The U.S. already has robust financial infrastructure (e.g. credit cards, PayPal) making it easy for stablecoin providers to plug into these systems.

The stablecoin market is also growing globally, which has piqued the interest of American leaders from the banking sector to Capitol Hill:

Size

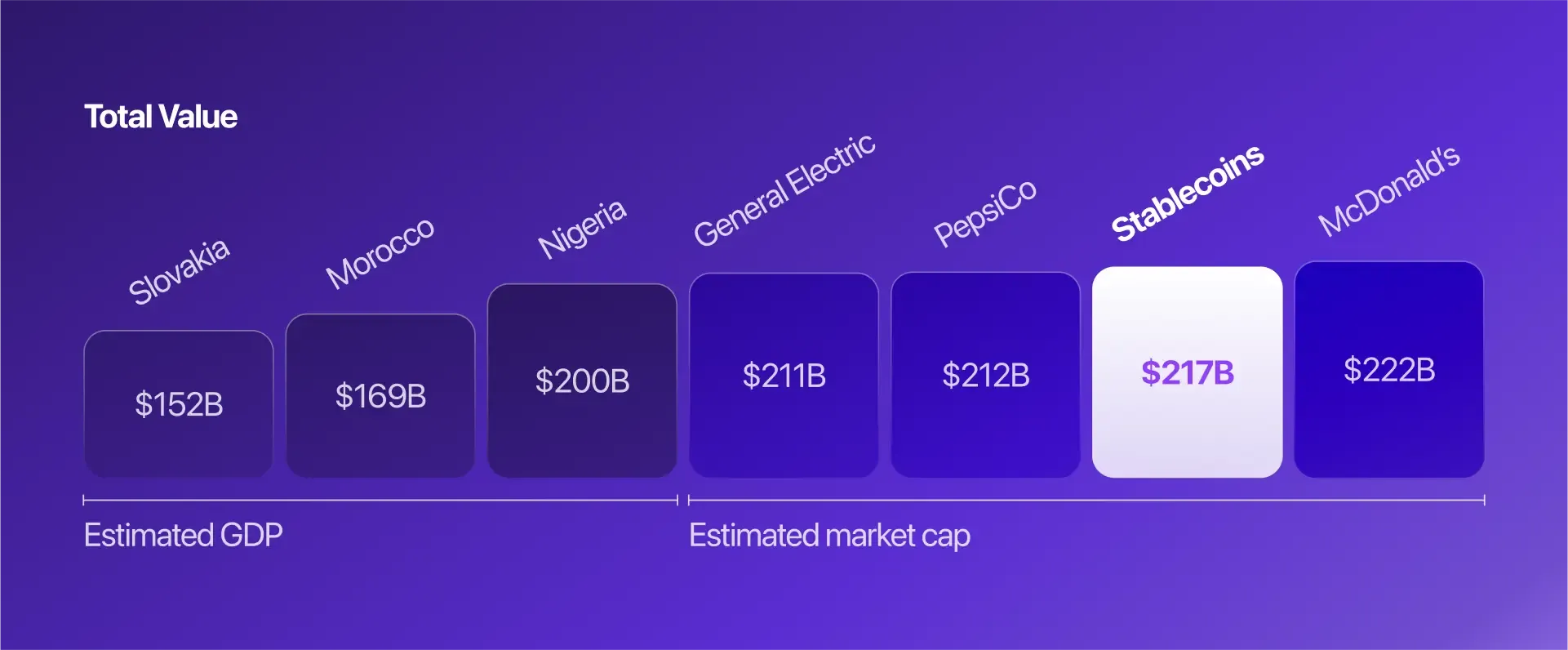

The stablecoin market is enormous, currently valued around $217B. For context, that’s roughly the market capitalization of General Electric and exceeds the GDP of countries like Nigeria, Slovakia, and Morocco.

Growth

People are using stablecoins more and more. Last year annual transfer volume ($27.6T) surpassed the combined volumes of Visa and Mastercard. In countries where currency is devalued by governments, stablecoin adoption has grown. In Ethiopia, for example, stablecoin transfers grew 180% year-over-year as a direct result of the birr being devalued 30%.

Adoption

Stablecoins have real-world impact and are already being used extensively for things like cross-border remittances and humanitarian aid. In regions like Sub-Saharan Africa, where banking infrastructure is limited, stablecoins are allowing people to store and transfer value using just their phone.

A stroke of GENIUS

In February, Senator Bill Hagerty (R-TN) introduced a bill entitled “Guiding and Establishing National Innovation in U.S. Stablecoins” (GENIUS), which proposes a new regulatory framework that will “unleash innovation”. The GENIUS Act:

Defines

A stablecoin is “a digital asset used for payment or settlement that is pegged to a fixed monetary value.”

Clarifies

Clear guidance for organizations that want licenses to issue their own stablecoins.

Regulates

Issuers of $10B+ stablecoin market caps need to follow the Federal Reserve’s regulatory framework.

Allows

Issuers below the $10B threshold can opt to follow state-level regulations.

Other lawmakers have also proposed stablecoin legislation, most notably Kirsten Gillibrand (D-NY) and Cynthia Lummis (R-WY)—both vocal champions of fair crypto regulations.

Subscribe to our newsletter!

Did you like this article? Sign up to our weekly MoonPay Minute newsletter to get similar content delivered directly to your inbox.