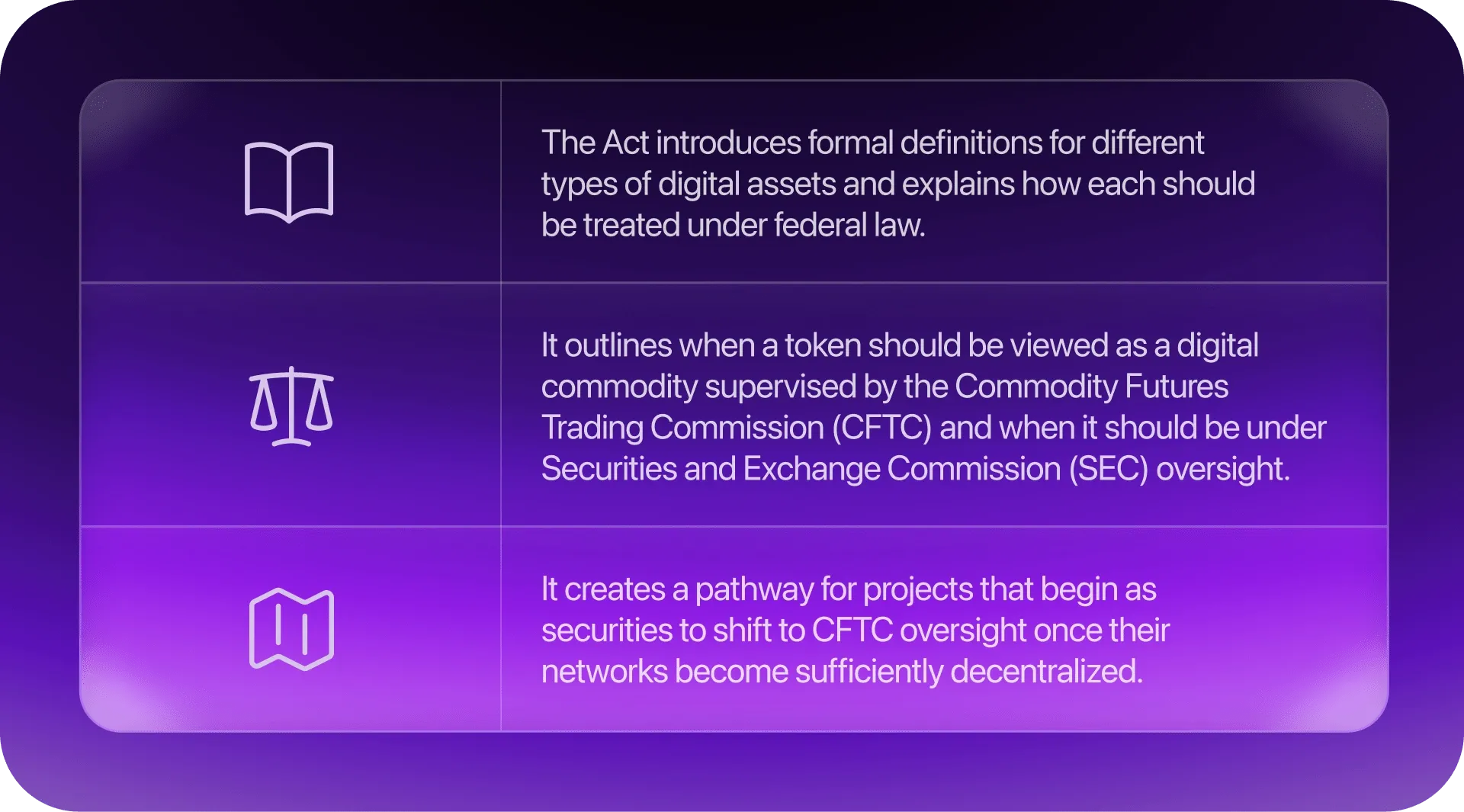

The Digital Asset Market Clarity Act of 2025, known simply as the CLARITY Act, is one of the most significant attempts by Congress to create a clear legal framework for digital assets in the United States.

After years of uncertainty about which regulator oversees different parts of the crypto market, lawmakers are now trying to build a coordinated structure that helps developers, platforms, and users understand the rules of the road.

Core ideas of the CLARITY Act

Rules for trading platforms

Trading platforms are an important section of the proposal. The Act sets out clearer requirements for how exchanges, brokers, and custodians should operate. It highlights transparency, record keeping, and consumer protection.

Many of these expectations mirror rules in traditional financial markets. Supporters argue that this creates a fairer and safer environment for both builders and users.

Why the Act matters

The promise of the CLARITY Act has generated excitement across much of the industry because it offers the possibility of predictable rules instead of enforcement-driven policymaking. Clear classifications could make it easier for startups to build responsibly, for institutions to participate with confidence, and for users to understand how their assets are treated under the law.

At the same time, some critics note that important questions remain about how these rules would apply to decentralized finance, where traditional intermediaries do not exist.

What comes next

The Act passed the House of Representatives earlier this year. Its future now depends on the Senate, where lawmakers are still reviewing the proposal and considering possible revisions.

The Senate has also drafted its own market structure bills, which seem more likely for the Senate to pass into law rather than simply adopting CLARITY wholesale.

Even when a market structure bill passes, regulators will need to translate the text of the bill into practical rules. That process could take time, and the final shape of the framework will depend heavily on how agencies interpret concepts such as decentralization, token taxonomy, and how intermediaries are classified.

The bottom line

For now, the CLARITY Act signals that Congress is moving closer to a unified approach to digital assets. If a market structure bill becomes law and is implemented effectively, it could provide the structure needed for responsible growth, stronger consumer protections, and a more competitive environment for US crypto innovation.