Perpetual Futures, or Perps, are one of the most popular and active trading instruments in crypto today. They are a type of crypto derivative that lets traders bet on whether a token will go up or down without actually owning it. They work similarly to placing a bet on a race with no finish line. You can enter or exit your position anytime, making Perps flexible and fast-moving.

Perps let you speculate on whether a token's price will rise or fall. Unlike traditional futures, they never expire. You can hold a position indefinitely, provided you maintain enough margin.

As the most widely traded crypto derivatives, Perps offer deep liquidity, high leverage, and round-the-clock action.

So how do Perps actually work?

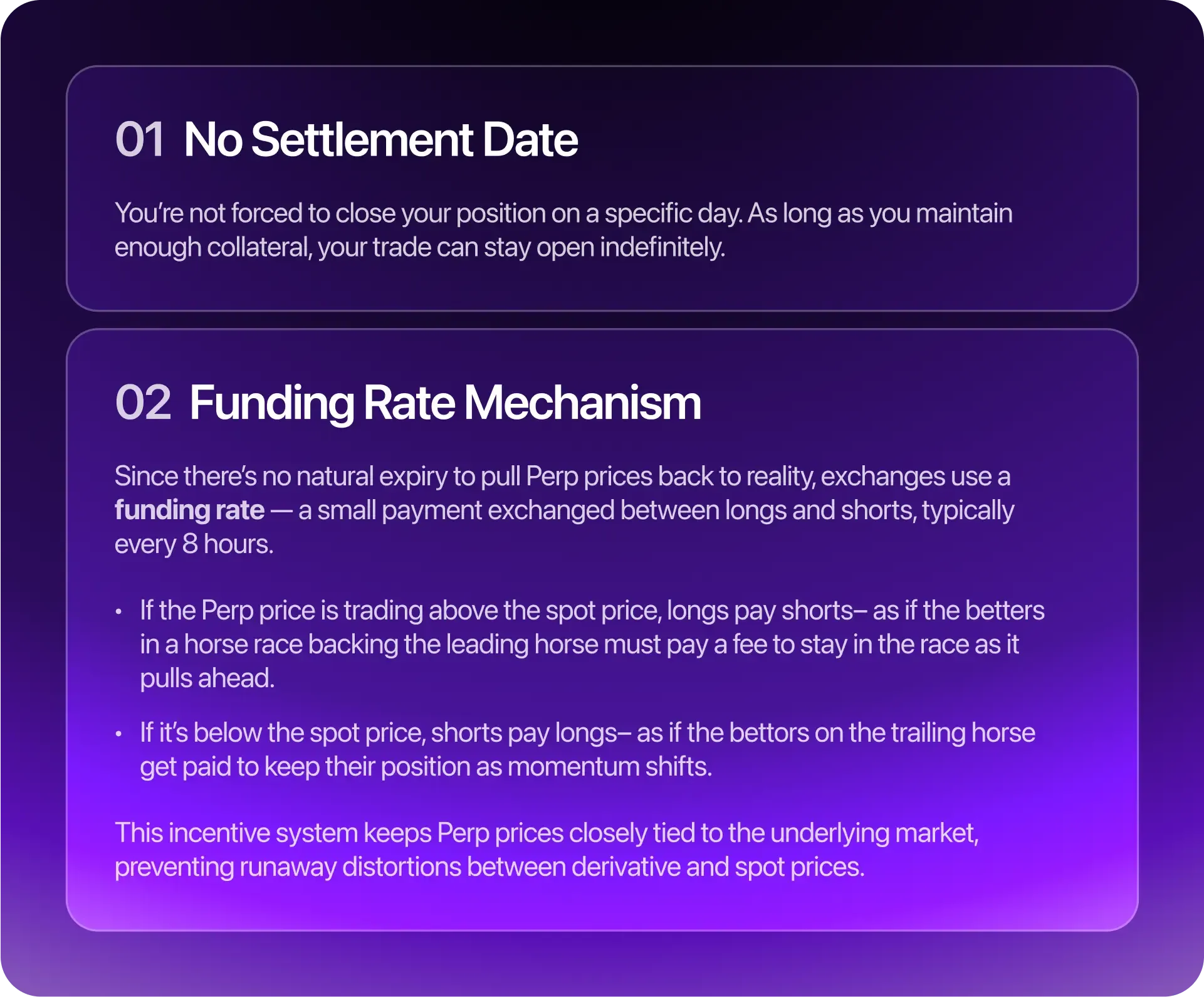

Perps mimic traditional futures but come with two key features that make them uniquely suited to crypto:

Where can you trade Perps?

Crypto-native platforms have made perps a cornerstone of their offering:

Centralized exchanges like Binance, Bybit, and OKX also offer robust perp markets with deep liquidity and high leverage – some up to 100x (though that’s extremely risky).

By the numbers

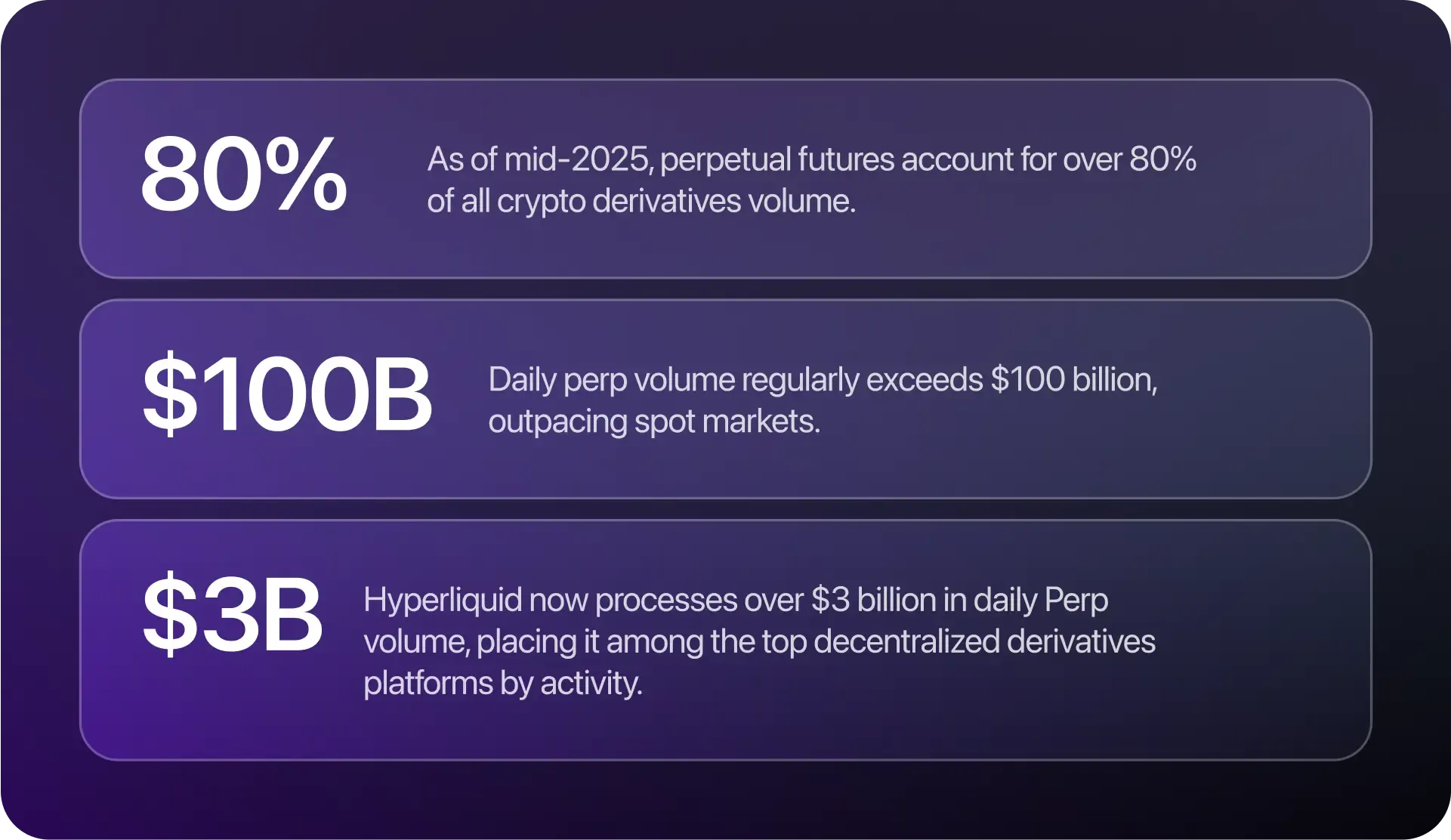

Perps dominate the crypto derivatives space:

But remember: with great power comes great risk. High leverage can wipe out positions quickly, especially in volatile markets. Perps are best used by informed traders who understand the mechanics, and the stakes.

Whether you’re a DeFi native or just perp-curious, the future of trading is here — and it’s perpetual.