The European Union’s Markets in Crypto Assets Regulation (MiCA) is a comprehensive regulatory licensing framework for cryptocurrencies designed to protect consumers and enhance market stability.

Approved by the European Parliament in April 2023, MiCA will be gradually rolled out in phases with an optional “grandfathering” period allowing certain companies to operate as late as July 2026 without a license.

Sign up to our weekly MoonPay Minute newsletter

Why it’s important

Large scope

- Europe is the world’s second-largest crypto economy behind North America

- Nearly a fifth of global crypto transaction volume is driven by Europeans

- Euro-denominated cryptocurrencies are the world’s second most popular stablecoins (cryptocurrencies whose price is pegged to another asset)

Industry milestone

- First set of uniform rules to be enforced across a large geography

- Provides legal clarity for a wide range of crypto assets

- Paves the way for more institutional investment

- Legitimizes crypto for wary customers

Further reading: How do stablecoins work? A guide to stablecoin cryptocurrencies

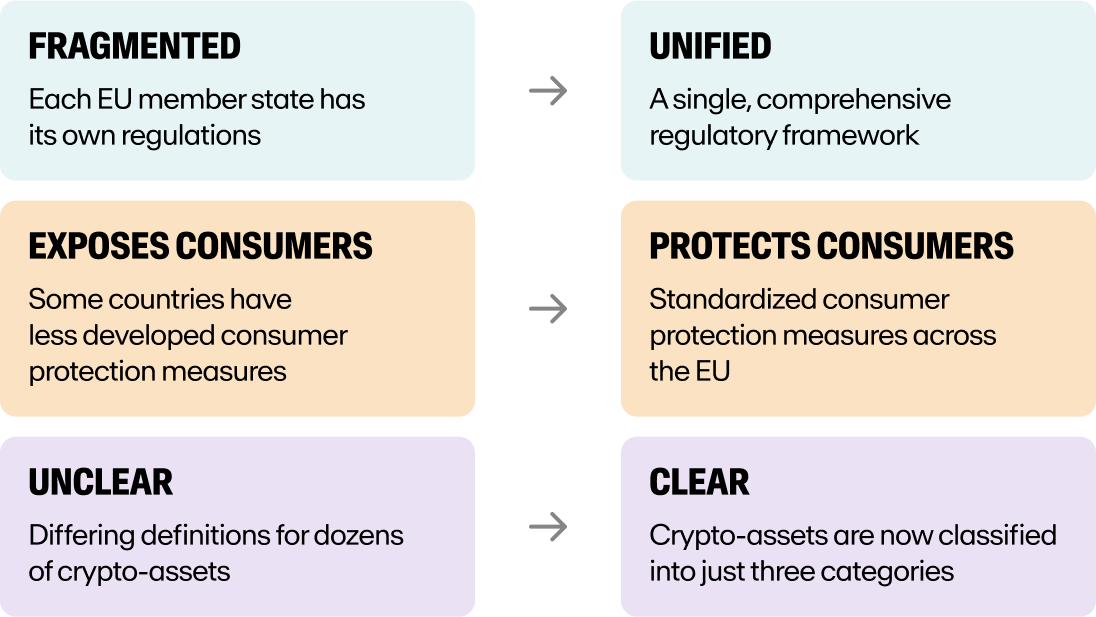

Before and after

The three categories of crypto-asset

MiCA defines a “crypto-asset” as any digital asset that can be transferred or stored using blockchain. These are:

- Asset-Referenced Tokens: Stablecoins whose price is pegged to a combination of commodities and / or currencies

- E-Money Tokens: Stablecoins backed by a single currency (e.g. the euro)

- “Other Tokens”: Anything not currently covered by EU law, like utility tokens (cryptocurrencies that give access to products or services in a blockchain ecosystem)

Many digital assets won’t be regulated by MiCA. For example, anything that’s “unique and not fungible” (NFTs) is excluded, so is any cryptocurrency provided in “a fully decentralized manner” without the use of a centralized intermediary.

Subscribe to our newsletter!

Did you like this article? Sign up to our weekly MoonPay Minute newsletter to get similar content delivered directly to your inbox.