Hyperliquid is rewriting what a decentralized exchange can be – a lightning-fast, gas-free, fully decentralized trading platform – powered by its own custom Layer-1 blockchain.

Not your usual DEX

Most decentralized exchanges use automated market makers (AMM) – a clever but blunt tool that pools assets and sets prices using formulas.

Hyperliquid takes a different approach by using an order book system – the same kind used by centralized exchanges like Coinbase and Binance.

Order books let traders set specific prices and sizes for their orders.

This means:

And the best part? It all still runs without gas fees.

The Hyperliquidity Provider (HLP)

Hyperliquid’s Hyperliquidity Provider (HLP) is a pooled liquidity mechanism that backs leveraged perpetual trades on the platform. (Perpetual trades are derivatives that let traders speculate on asset prices without expiration– kind of like betting on a horse race that never ends, where you can jump in or out whenever you want.)

It’s a completely new take on DEX liquidity – built specifically for perpetual futures – and it forms the backbone of Hyperliquid’s deep, fast markets.

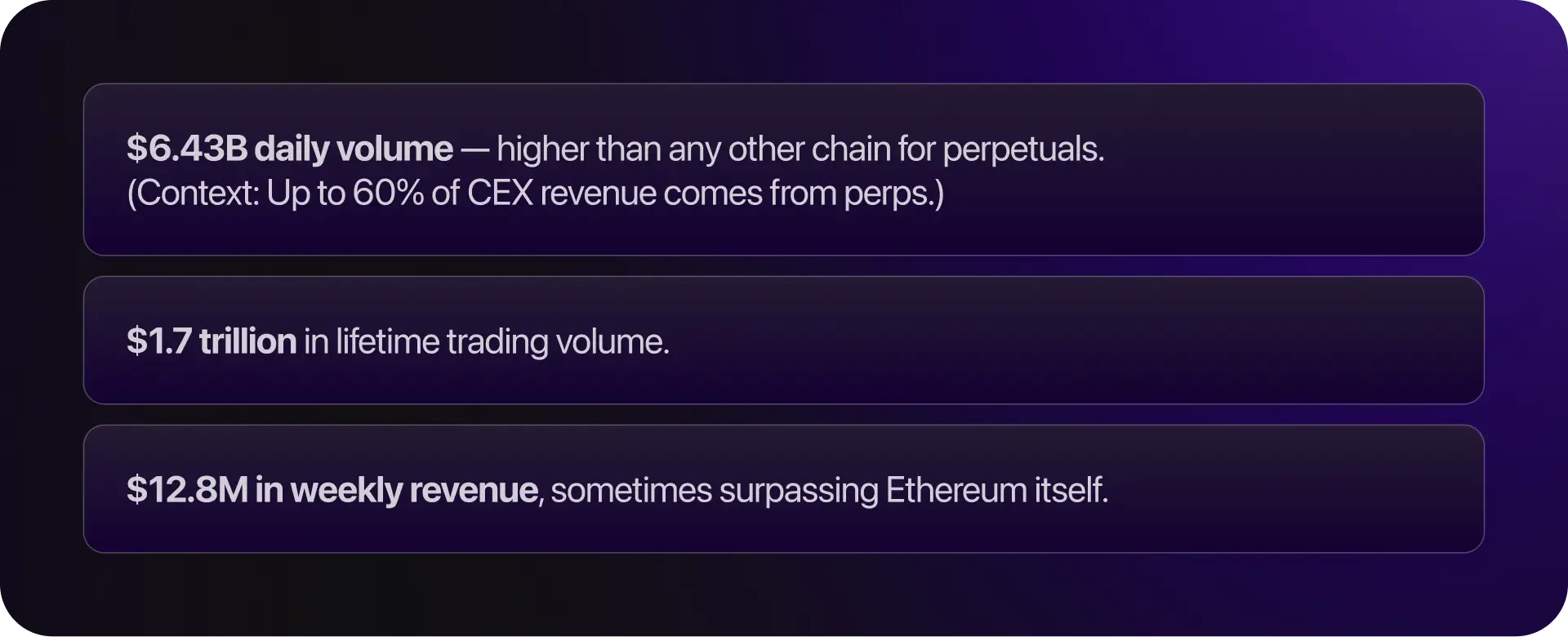

Real Volume. Real Revenue. Real Disruption.

This isn’t just DeFi noise. It’s a performance benchmark for on-chain markets.

Custom Layer-1, Not Just Another Rollup

Despite being a standalone chain, Hyperliquid is far from isolated. It recently added support for Ethereum-based apps, making it easy for developers to bring over existing projects. Users can move money between the two parts of the platform quickly and safely thanks to a built-in bridge. The platform also lets people deposit and withdraw Bitcoin (BTC) and Ethereum (ETH) directly—no need for complicated steps or special versions of the tokens. And, support for Solana (SOL) is coming soon, too.

The HYPE machine

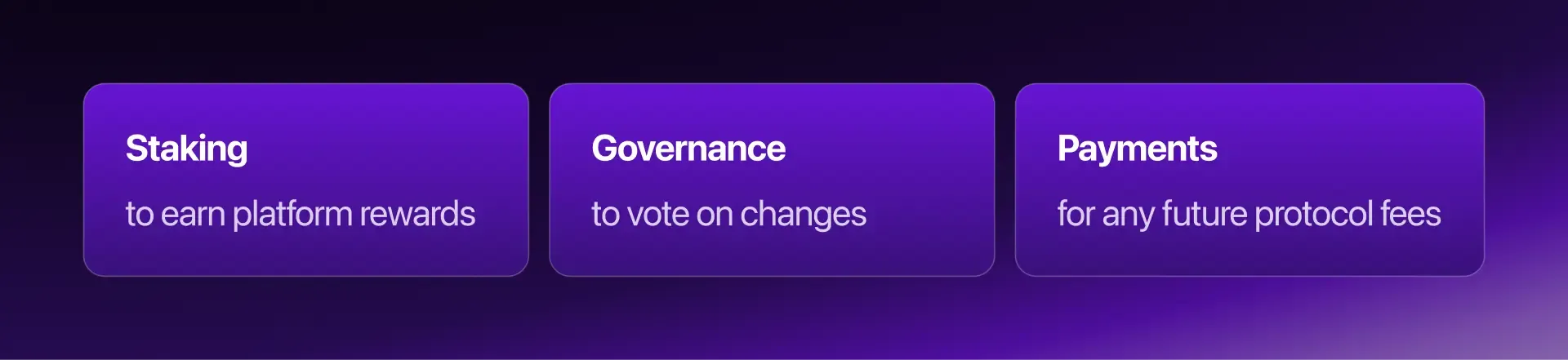

Launched in late 2024, Hyperliquid’s governance token – HYPE – powers everything behind the scenes.

It’s used for:

Unlike many crypto projects, Hyperliquid didn’t raise money from venture capital firms, which means no big unlocks looming over the token. It also didn’t sell a portion of its supply to insiders. That’s led some to call it one of the most community-driven launches of the last cycle.

Vaults: Create Your Own Hedge Fund

Hyperliquid also gives users tools to grow their money in more creative ways.

One of the most powerful tools is Vaults – a feature that lets anyone create their own hedge-fund-style investment portfolios. Users can design strategies around specific assets or themes, and other users can invest in them directly.

It’s permissionless, transparent, and offers an entirely new way to build and manage structured products – no institutions required.

The new frontier: Pre-Markets

One of Hyperliquid’s most intriguing features is Pre-Markets – a system that lets users trade tokens before they officially launch.

Think of it like speculative futures trading for tokens still in stealth. Recent examples include LayerZero (ZRO) and EigenLayer (EIGEN), both traded as synthetic versions before they hit the market.

It’s a new way to drive price discovery – and, arguably, to democratize access to early price action that’s usually reserved for insiders.

Hyperliquid is the first fully on-chain exchange to truly match centralized exchanges (CEXs) in both performance and experience.

And it’s fully permissionless—anyone can plug in, build, or trade. No gatekeepers. No middlemen.