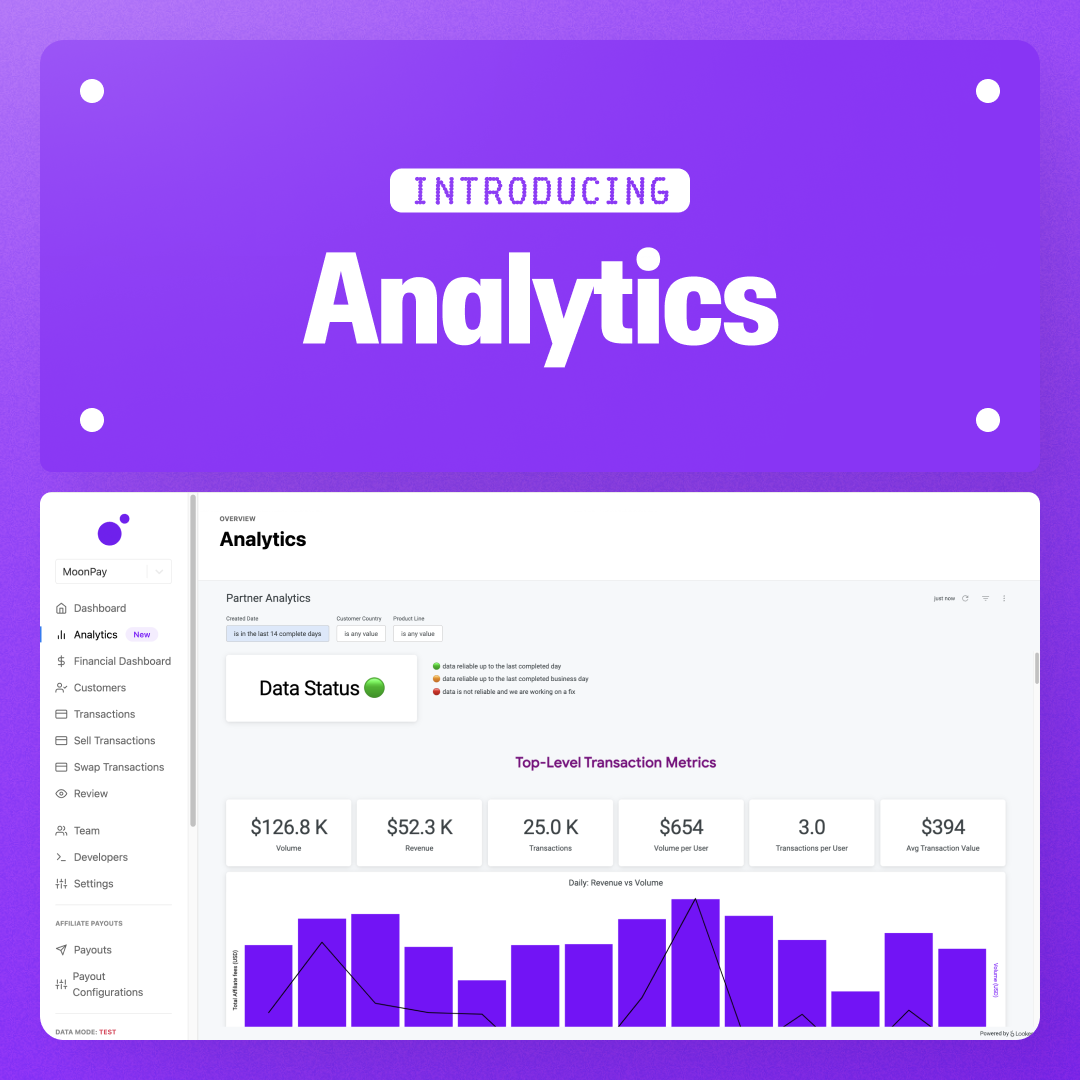

We’re excited to announce the release of Analytics, our latest Dashboard feature designed to elevate the analytical capabilities of our partners.

Analytics provides partners with a comprehensive view of data related to customer engagement as well as business-critical metrics such as volume and revenue—all within the MoonPay Dashboard!

The new tool empowers partners to analyze these metrics and customize time filters according to their specific needs, allowing them to make informed decisions and drive business success.

Features and benefits

Comprehensive business metrics: Access rich and up-to-date transactional metrics (e.g. volume, revenue, etc.) directly from your MoonPay dashboard.

Customer insights: Understand customer behavior and preferences to optimize user experience and drive engagement.

Cross-product analysis: Examine user-level data for all your MoonPay products, including Buy, Sell, and Swaps.

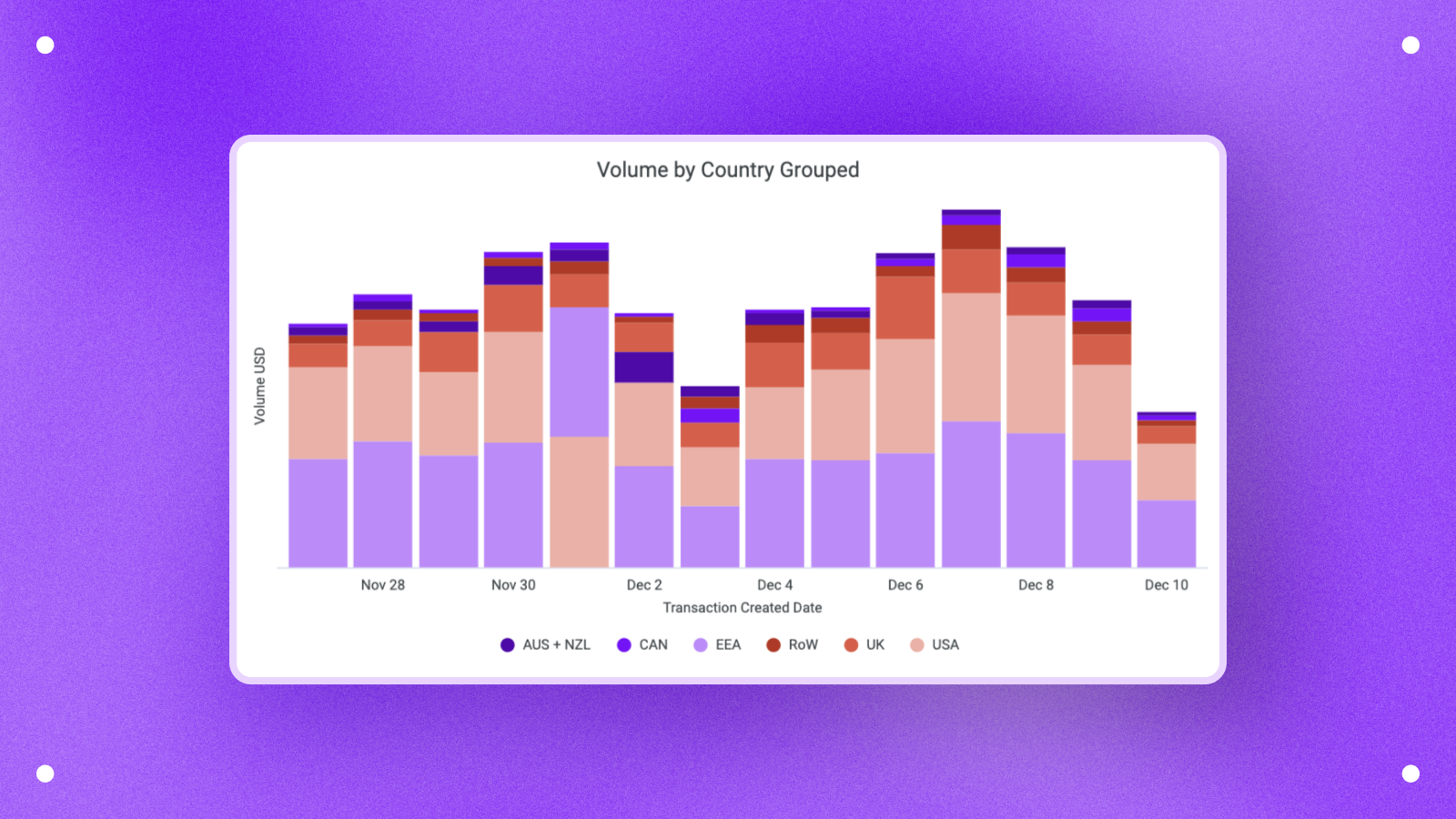

Geographical split: Get insights into transaction volumes and user demographics in specific geographical areas to tailor your strategies and expand your reach.

Custom time filters: Understand detailed trends of key customer and transaction-level metrics across flexible timeframes

User-centric interface: Explore data and derive actionable insights through our intuitive user interface.

How to get started with Analytics

Analytics is now live!

If you’re an existing partner, get in touch with your Partner Success Manager and we can help you get started. Alternatively, you can find Analytics under the “Analytics” tab within the MoonPay Dashboard.

If you’re not an existing partner with us, click here to learn more and get started today. Our On-Ramp integration gives you global coverage, seamless revenue sharing, and zero risk of fraud or chargebacks—all in a few lines of code.