If you’ve been in this space long enough you’ll undoubtedly have come across the argument that cryptocurrencies will help solve some of the problems around cross-border remittance payments.

But how exactly?

We take a closer look at remittances and where crypto might play a useful role.

What are remittances?

From the Latin remittere "send back”, a remittance is a non-commercial payment made by someone living abroad to family in his or her home country.

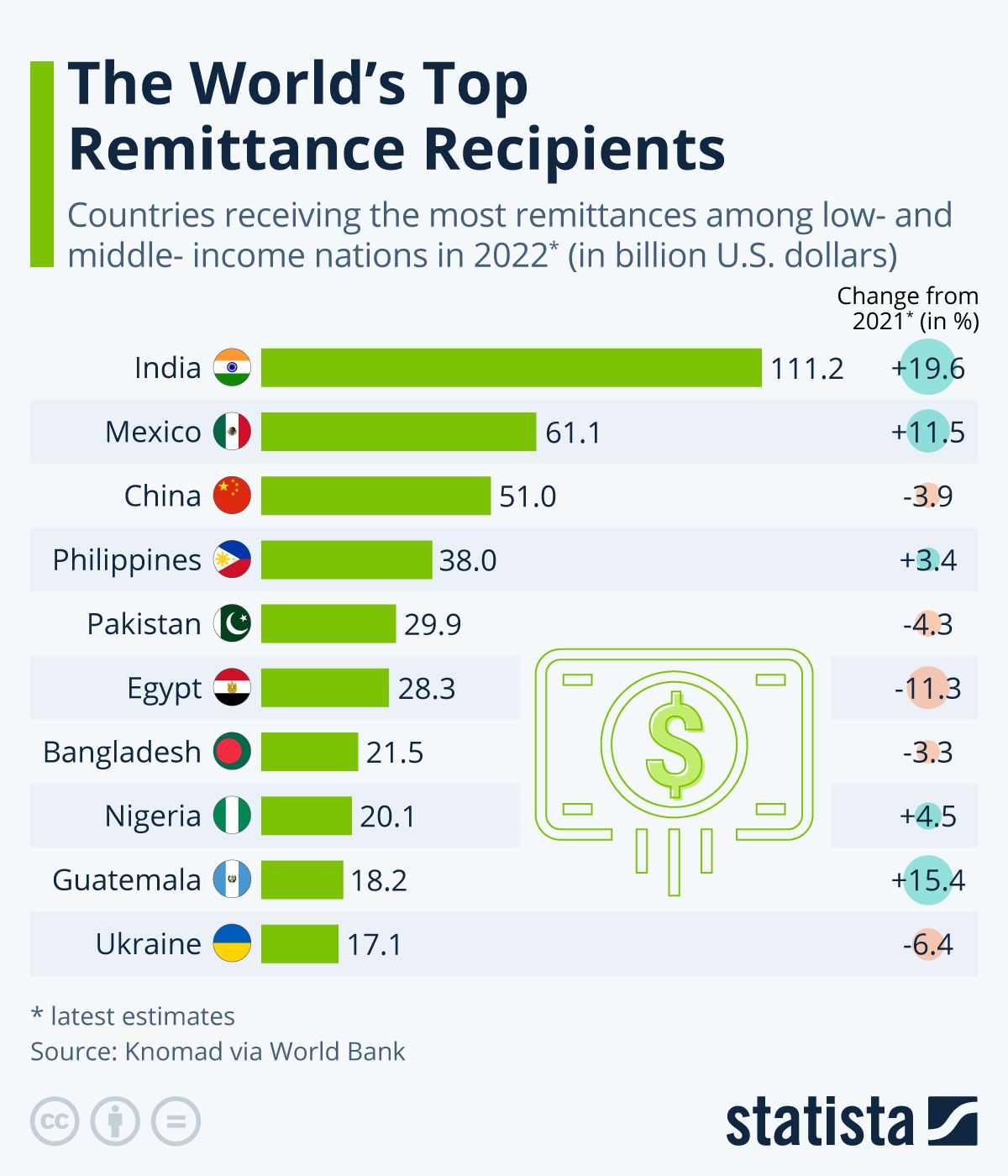

In countries like the US and UK, there are few incoming remittances since these rich countries are often the source of such payments. But in developing countries, such as India, Lebanon, and Nigeria, remittances make up a sizeable portion of GDP.

In Somalia, for example, remittances account for over a third of the country’s income, and in Tonga, four of five households receive remittances from abroad. So while most people living in developed countries pay little mind to remittances, globally they’re a major source of income.

In fact, according to the International Fund for Agricultural Development (IFAD), over 70 countries rely on remittances for more than 4 per cent of their GDP. The IFAD also found that over half the world’s remittances are sent to rural households where 75 per cent of the world's poor and food-insecure live.

This goes to show that not only is the scale of global remittance payments noteworthy, so too is the fact that they remain a crucial lifeline for millions of people.

How international remittances work

Remittances are typically paid in a local currency to what’s called a Money Transfer Operator (MTO). The MTO then tells its agent in the recipient country to deliver the funds, which the payee collects in his or her home country currency.

For example, a Malaysian in New York City might pay an MTO $200 (according to the UN, the average remittance payment is $200-$300 every two months), which will then instruct its agent in Kuala Lumpur to deliver the funds in Malaysian ringgit.

But here’s the rub: the payee won’t actually receive $200 worth of Malaysian ringgit.

MTOs will charge a fee, typically to the sender, averaging 5.2% of the transaction. And then there’s also a currency-conversion fee, and, for some operators, a fee for the recipient. Add to this the exchange rate margin, and the payee is left with 7% shaved off the initial payment.

In practice, then, global remittances can more accurately be described as payments made by someone living abroad for which the recipient gets only a portion.

Crypto and remittances

One of the most notable features of cryptocurrency is that it cuts out the middleman. Crypto can be freely transferred without the need for a bank or other third party intermediary, which in the case of remittances are not only the MTOs facilitating (and profiting from) payments, but also the software providers through which they operate.

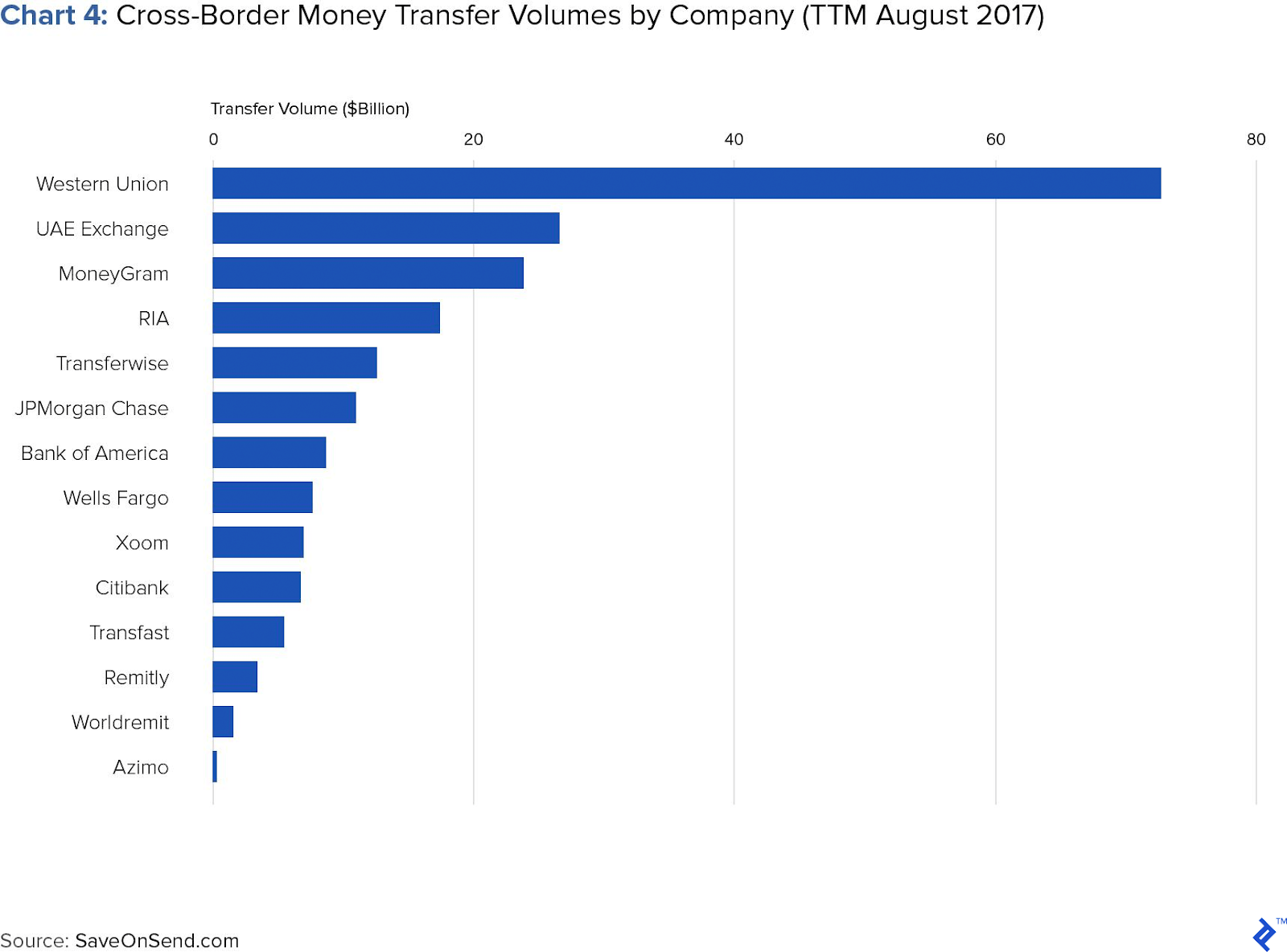

Of these providers, Western Union dominates the market. The Abu Dhabi-based UAE Exchange is a distant second, accounting for about a third of the Western Union’s cross-border transfer volumes (see chart).

With such few players commanding the space, any decisions from on high can have enormous consequences. In 2020, for example, Western Union shut the doors of its 407 locations across Cuba in the wake of President Trump’s sanctions on the country.

“The problem is not the closure of Western Union,” said director of the Center for Migration and Economic Stabilization at Creative Associates International, Manuel Orozco, to NBC News, “but that Western Union is practically the only U.S.-to-Cuba provider of remittance payments.”

In August 2021, Western Union also decided to suspend services in Afghanistan until the political turbulence there subsided, cutting off remittance flows when they were desperately needed.

And who could forget Venezuela, where remittance payments have boomed as a result of people fleeing the Maduro regime? Had software providers and MTOs decided to suspend operations, this would have pulled the rug out from under 28 million Venezuelans.

Crypto is arguably the best alternative to financial institutions that are subject to disruptions in the face of political turmoil.

Banking the unbanked

It’s also an attractive option to people who don’t have bank accounts. It’s estimated that 1.7 billion adults (over a fifth of the world’s population) are unbanked. Crypto won’t be the only solution to this problem, as there are many factors that account for it, but it has the potential to be the greatest driver of financial inclusion the world has ever seen. In the case of remittances, it will allow people who previously had no financial presence online to send and receive payments anywhere in the world.

José Rafael Peña Gholam, who covers cryptocurrencies in Venezuela, writes that sending crypto abroad is a simpler process than working through traditional MTOs. “I’ve sent [crypto] from Venezuela to family members in Colombia and Spain,” he writes. “These transactions are often faster and cheaper than their traditional finance counterparts, with fewer steps to send money, at least if you know how to take advantage of the platform.”

The good news is Venezuelans are catching on: Bloomberg recently reported that Venezuelan migrants sent $5B in remittances in 2023 (6% of the country's GDP), nearly a tenth of which was paid in crypto.

If crypto can provide easy access to remittances and be simpler and cheaper than MTOs, then it’s hard to imagine this emerging technology not playing a major role in future cross-border payments.

Closing thoughts on crypto remittances

Crypto might play such a big role that the very idea of a remittance will become an anachronism. As former Coinbase UK CEO and MoonPay’s Chief Growth Officer Zeeshan Feroz argues, remittances are an “artefact of our current financial system.”

“They divide payments into domestic vs. cross border,” he says. “Crypto transfers do away with this two-tier system as all transfers are executed at the same speed and cost, regardless of the recipient’s location.”

In other words, crypto might not only disrupt remittances, it could replace them.

Did you know? You can pay with crypto

Buy crypto for remittances

With MoonPay, cryptocurrency for remittances can be purchased in minutes, not days.

Buy Bitcoin, Ethereum, or your preferred crypto and send it at a fraction of the cost of money transfer services using our simple widget. Just select the cryptocurrency you wish to purchase from the dropdown menu and enter the amount. Then follow the steps to complete your order.

You can also top up your wallet in euros, pounds, or dollars and use your MoonPay Balance to purchase crypto like Bitcoin (BTC) and Ethereum (ETH). Then, simply transact for cheaper and faster transactions with higher approval rates. Plus, enjoy zero-fee withdrawals directly to your bank account when you decide to cash out.

MoonPay also allows you to easily sell crypto when it's time to cash out. Simply choose the cryptocurrency you want to sell and enter the details where you want to receive your funds.

.png?w=3840&q=90)