SWIFT is an interbank messaging service primarily used for cross-border payments. It’s a way for Bank 1 to tell Bank 2 “pay so-and-so this amount”—kind of like an email system for banks.

While it has served an important purpose, SWIFT is often considered outdated and inferior to blockchain as a way to move money.

Sign up to our weekly MoonPay Minute newsletter

What problem did SWIFT solve?

Banks need to talk to each other. If Joe (who belongs to Bank 1) wants to pay Jane (who belongs to Bank 2), the two banks need to communicate in order to properly debit / credit Joe’s and Jane’s accounts. Here’s where SWIFT comes in:

- The Society for Worldwide Interbank Financial Telecommunication (SWIFT) was founded in 1973 to replace the slow, error-prone system of interbank communication that had existed since the 30s.

- That old system, called Telex, relied on text messages sent over phone lines using teleprinters (basically typewriters that can send and receive messages).

- SWIFT disrupted this by introducing computers that send secure, standardized messages. Its key innovations were digitization and standardization.

How does it work?

SWIFT doesn’t technically move money–it’s just the messenger. It’s a way for banks to send payment instructions.

The 11K+ banks in the SWIFT network are essentially sending each other notes like “Bob pays Jane $200” and “Viktor pays Mario €450”. These notes are secure (using advanced encryption) and standardized (using strict formats so instructions are clear and consistent).

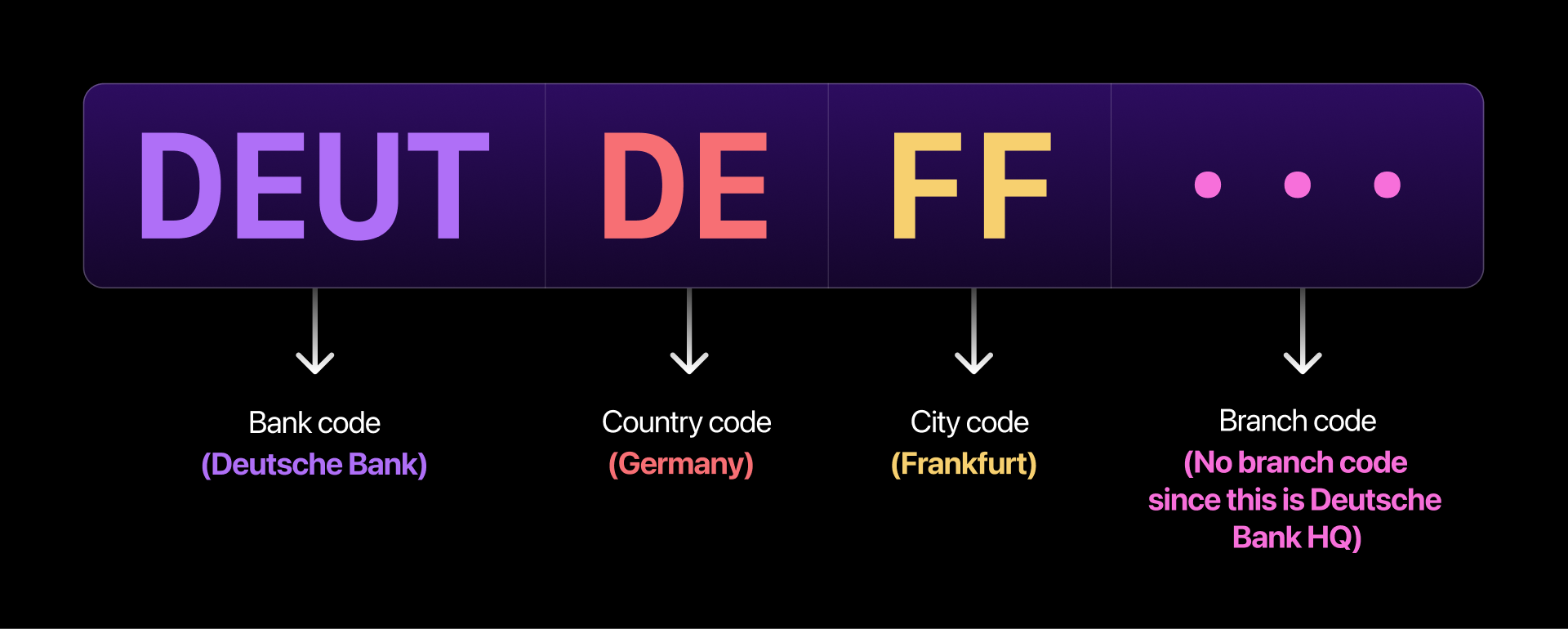

An example of standardization is the SWIFT code (aka a Bank Identifier Code), a string of 8-11 characters assigned to each bank. For example:

Why blockchain is better

Imagine you’re at a cocktail party and are confronted by someone who is radically pro-SWIFT. Here’s how you might engage in an argument:

"SWIFT has been around for 50+ years and is trusted by banks worldwide.”

"Banks are clinging to what they know. Blockchain will replace this slow and outdated technology.”

“SWIFT is not slow! It can move $5T a day.”

"Blockchains like XRP Ledger can move 1,500 transactions per second. Plus SWIFT payments can take 1-5 days to process.”

“What about security? SWIFT is a closed network so isn’t prone to hacks.”

"Try again…it was hacked in 2015. Blockchains are immutable.”

“Those hackers breached the banks, not SWIFT itself. Our core tech is safe."

“If blockchain was used you’d see every move—no hiding vulnerabilities, no weak links. SWIFT doesn’t have that transparency.”

“Well it’s still better off as a closed system that’s protected from bad actors.”

“You mean a closed system that locks out small players? Blockchain lets fintechs and startups participate, which is a good thing. Plus it’s cheaper.”

“SWIFT is cheap too. $20-$50 fees are nothing for moving millions."

"Blockchain slashes that to cents per transfer. It’s cheap for any amount of money, not just huge sums.”

Subscribe to our newsletter!

Did you like this article? Sign up to our weekly MoonPay Minute newsletter to get similar content delivered directly to your inbox.