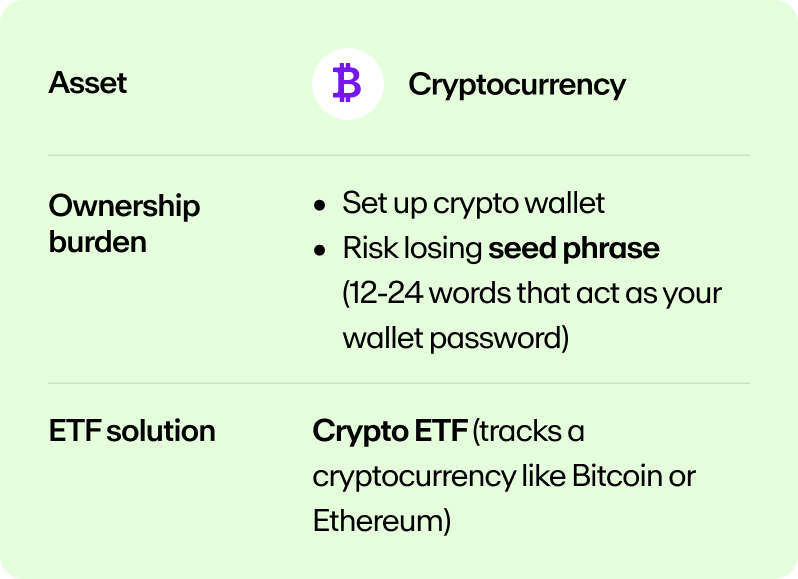

A crypto exchange-traded fund (ETF) is a type of investment that can be bought and sold through traditional financial brokers. It allows people to invest in cryptocurrencies without actually owning them. Crypto ETFs are significant because they:

- Simplify access to cryptocurrency markets

- Don’t require any technical knowledge

- Legitimize cryptocurrencies as an asset class

Sign up to our weekly MoonPay Minute newsletter

Investment, not ownership

ETFs work by pooling together a bunch of investment products and tracking their average market value. Part of their appeal is that they can be designed to track almost anything.

ProShares Pet Care ETF, for example, tracks dozens of companies that sell pet products. There are nearly 12,000 ETFs globally that track everything from coffee and batteries to telemedicine and African markets.

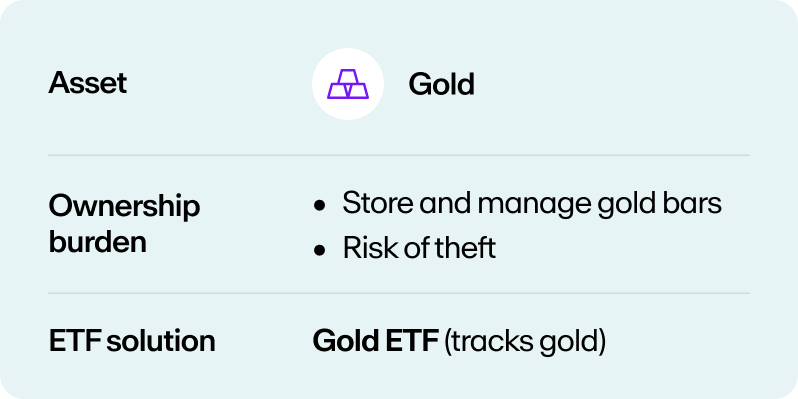

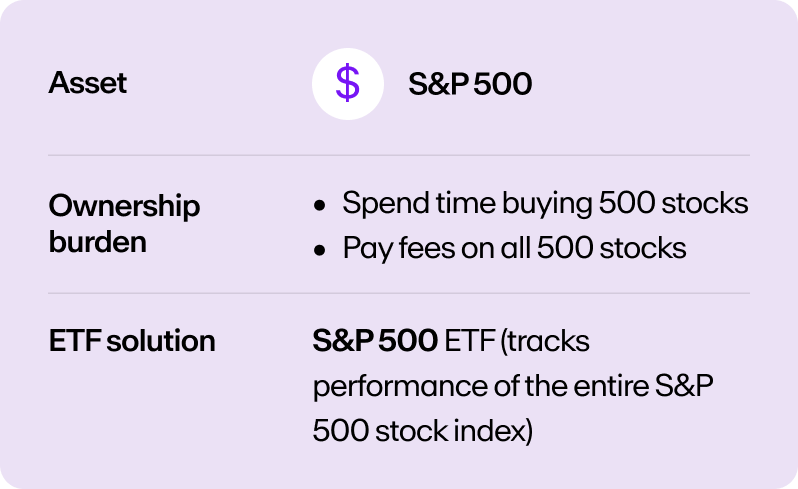

In each case, ETFs allow people to invest in assets without the burden of owning them—a dichotomy that can help us better understand crypto ETFs.

The two main types of crypto ETFs

In January, the Securities and Exchange Commission (the US agency that regulates financial markets) approved 11 Bitcoin ETFs.

This was widely hailed as a watershed moment for the industry, not because it was the first time crypto ETFs began trading in the US, but because it was the first time “spot” crypto ETFs began trading–a type of ETF that many consider to be superior for its ability to track crypto prices directly:

Timeline

Subscribe to our newsletter!

Did you like this article? Sign up to our weekly MoonPay Minute newsletter to get similar content delivered directly to your inbox.