Decentralized finance (DeFi) refers to blockchain-based financial applications that are peer-to-peer, meaning users can engage directly with one another without intermediaries like banks and brokers.

Many see DeFi as a major challenge to institutional finance. Robert Leshner, founder of DeFi protocol Compound, says it is providing the opportunity to “reimagine the financial system on a blockchain.”

Others see it as a complimentary counterbalance to the existing centralized financial ecosystem.

Further reading: What is DeFi? An introduction to decentralized finance

Marking DeFi’s borders

DeFi is one of those broad terms that is best understood by defining what it is not. Usually DeFi is differentiated from:

- TradFi (“traditional finance”): Mainstream financial institutions like banks and brokers

- CeFi (“centralized finance”): Centralized crypto platforms, also known as centralized exchanges (CEXs)

All three - DeFi, TradFi, and CeFi - offer financial services, but they differ in important ways.

Why it’s important

DeFi aims to address three main issues with centralized financial services:

* A crypto wallet is a tool that lets people send and receive cryptocurrencies.

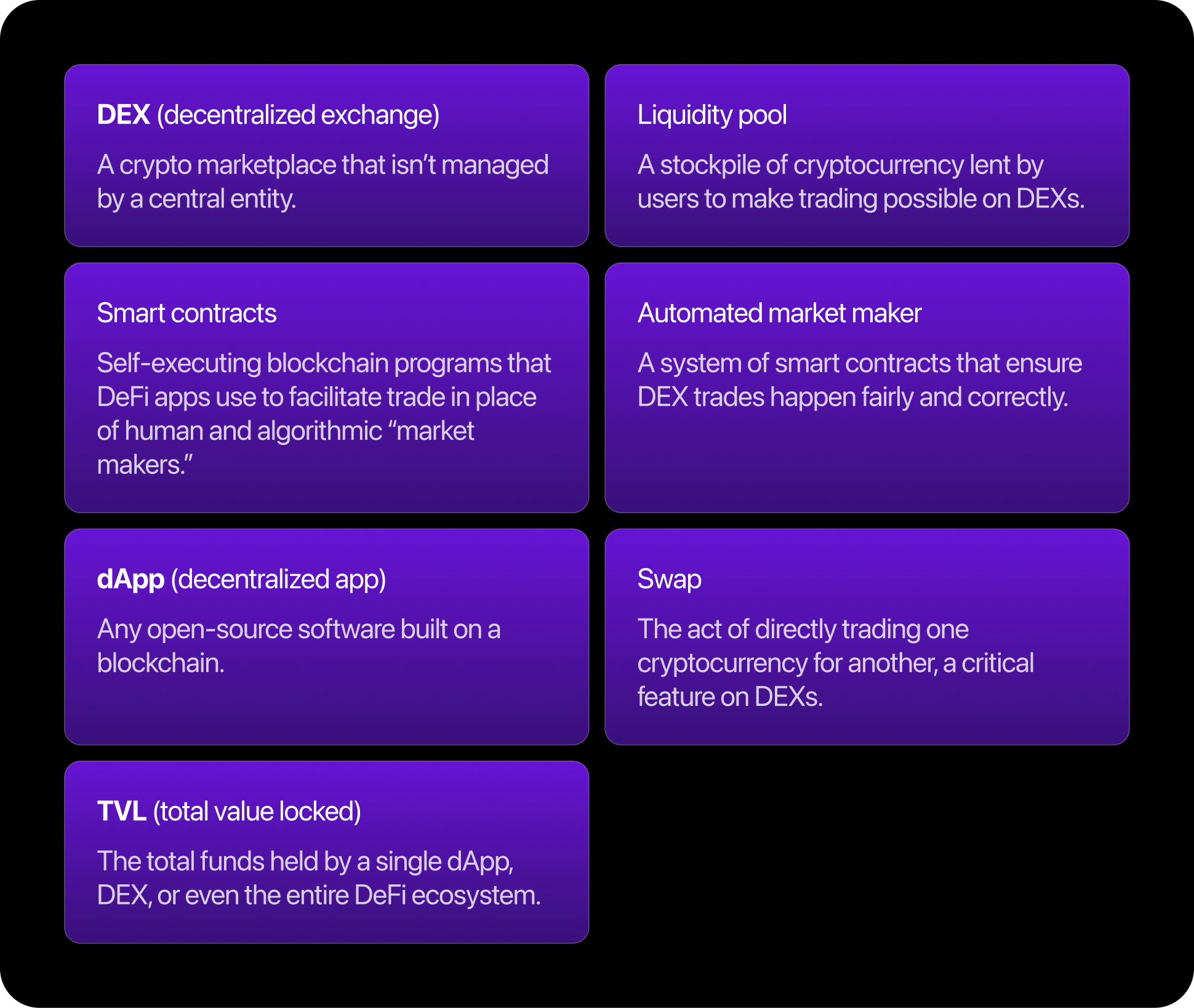

Terms you should know

DeFi has its own jargon that can be daunting for newcomers, but if you master these seven terms you can navigate the DeFi ecosystem with ease:

Subscribe to our newsletter!

Did you like this article? Sign up to our weekly MoonPay Minute newsletter to get similar content delivered directly to your inbox.