Blockchain technology has transformed everything from finance to art, giving us decentralized currencies, NFTs, crypto games, and borderless payments.

But behind the rapid innovation, blockchain networks continue to grapple with a fundamental challenge: how to unlock their full potential while dealing with trade-offs that can limit user experience and network performance.

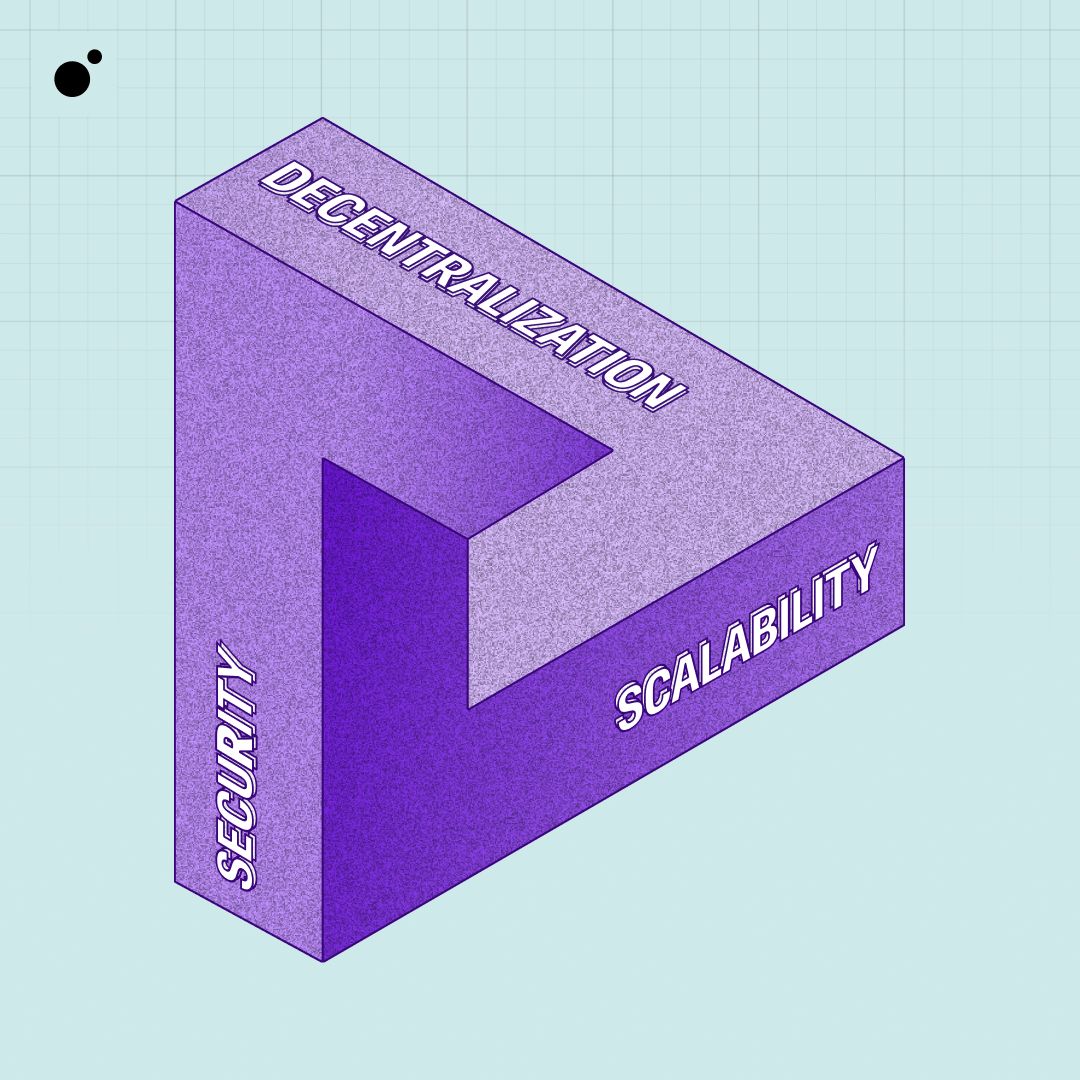

This underlying issue, known as the blockchain trilemma, has become a defining force in the evolution of leading cryptocurrencies and is steering the development of the next generation of blockchain protocols.

In this guide, we’ll break down what the Blockchain Trilemma is, why it matters, how leading projects address it, and what solutions are emerging to overcome it.

What is the Blockchain Trilemma?

The blockchain trilemma refers to the technical puzzle of achieving blockchain decentralization, security, and scalability. Most public blockchain networks struggle to optimize all three pillars together, since enhancing one often means making sacrifices with the others.

Ethereum founder Vitalik Buterin coined the phrase after noticing that blockchains could typically excel at two of these aspects but would struggle with the third. For example, a network maximizing decentralization and security (like Bitcoin) often sacrificed scalability, while one optimized for scalability (Solana) might compromise on decentralization or blockchain security.

.png)

Let’s explore each core element of the blockchain trilemma:

1. Decentralization

Decentralization lies at the heart of blockchain technology. In a decentralized blockchain, power is distributed: control over the network, transaction validation, and updating the ledger happen through a broad community of participants rather than a single entity. Anyone can join as a validator, node operator, or miner, making the network open and censorship-resistant.

Some examples of highly decentralized networks include:

- Bitcoin: The Bitcoin blockchain is governed and maintained by tens of thousands of nodes run independently worldwide. The Bitcoin network's vast distribution keeps it censorship-resistant and true to the original vision of Satoshi Nakamoto.

- Ethereum: The Ethereum blockchain is built on decentralization, with a large, globally dispersed network of validators after its transition to Proof of Stake. This makes it difficult for any one actor to take over or manipulate the Ethereum network.

2. Security

Security forms the foundation of trust in blockchain technology. Every transaction is securely encoded and added to a permanent record, making the entire history transparent and tamper-proof. Through this design, altering past data would require an unrealistic amount of computational power, effectively protecting users’ assets and sensitive information.

Security mechanisms vary by blockchain, though they all share similar characteristics:

- Proof of Work (PoW): In PoW networks like Bitcoin, miners compete to solve increasingly complex puzzles, a process that requires significant resources and makes it extremely costly for attackers to compromise the system.

- Proof of Stake (PoS): Used by many blockchain networks (including post-Merge Ethereum), the PoS system requires validators to lock up (stake) tokens as collateral, incentivizing honest behavior while penalizing malicious actions.

- Cryptography: Across all blockchain platforms, different and sophisticated cryptographic techniques (like hash functions and digital signatures) aim to ensure that transactions are authentic and tamper-proof.

3. Scalability

Scalability is what enables blockchain networks to grow and serve millions, or even billions, of users, without becoming slow or expensive. Highly scalable blockchains can process thousands of transactions per second with minimal fees and delays, allowing real-world, mass-market adoption.

Some real-world use cases that require highly scalable blockchains include:

- Finance: Decentralized exchanges (DEXs) and payment platforms require fast, inexpensive settlements.

- Gaming: Popular blockchain games need to process many microtransactions simultaneously.

- NFTs: Huge surges of demand, like NFT drops, can clog up less scalable networks, leading to high gas fees and network congestion.

Why the Blockchain Trilemma Is a Challenge

Now that we understand the three elements at play, it’s clearer why striking a perfect balance is so difficult for blockchain developers. The very features that make a blockchain strong in one area can undermine it in another:

- Decentralization vs. Scalability: When anyone can participate (max decentralization), validation slows down, and more communication is required between nodes, limiting throughput.

- Scalability vs. Security: Speeding up transactions may lead to shortcuts that reduce blockchain security and open up attack vectors.

- Security vs. Decentralization: Overly complex network security mechanisms might centralize control to a handful of well-resourced players.

The requirements for decentralization, scalability, and security sometimes pull in opposite directions, forcing the need for compromise. A blockchain that increases its block size to handle more transactions, for example, can make it harder for individuals to run nodes and participate, thus inadvertently centralizing the network.

Alternatively, projects that focus on keeping transaction costs low may do so by limiting who can validate transactions, weakening both the system’s resilience and its openness.

A useful analogy is to imagine someone trying to juggle three balls, while also walking a tightrope. If you put too much focus on one element, you risk dropping another, or even falling off the wire. In the same way, blockchains almost always face trade-offs; leaning into one strength means making concessions elsewhere.

No design is perfect, and the path each project takes to manage these trade-offs ultimately shapes its priorities, performance, and potential.

But how do specific blockchain projects attempt to balance each element?

How Different Blockchains Address the Trilemma

Every blockchain project takes a different approach to this puzzle, prioritizing some features while accepting trade-offs in others. Here are some of the biggest blockchains and how they attempt to solve the puzzle:

Bitcoin (BTC)

Bitcoin (BTC), the original blockchain, maximizes decentralization and security, relying on thousands of independent miners and an immutable Proof of Work protocol. However, its transaction throughput remains limited (around 5-7 transactions per second), leading to slow confirmations and high fees during congestion.

Ethereum (ETH)

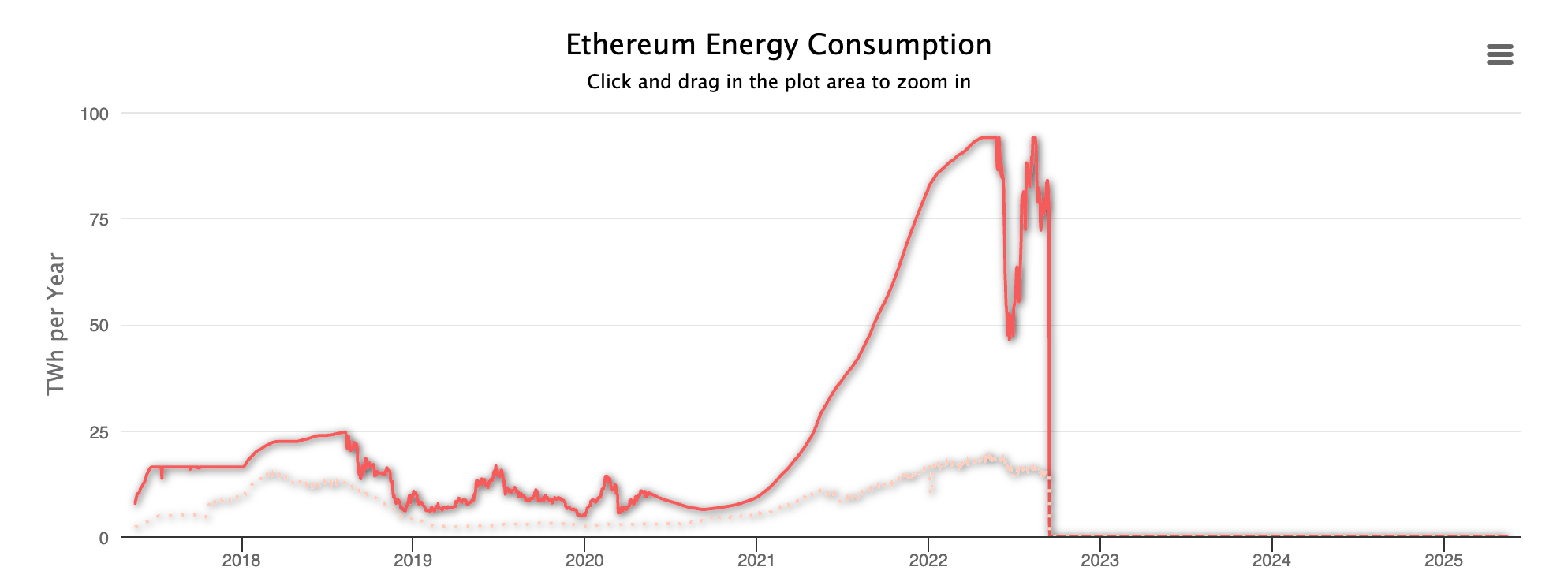

Ethereum (ETH) originally focused on decentralization and security but encountered scalability challenges as it became more popular. With the Merge, it transitioned to a Proof of Stake mechanism, reducing energy consumption and laying the groundwork for future scaling upgrades (like sharding and Layer 2 solutions).

Solana (SOL)

Solana (SOL) puts scalability front and center, making it one of the fastest blockchains for throughput and speed. Its focus on performance has attracted many DeFi, NFT, and gaming applications, but its validator structure has resulted in occasional outages, as well as ongoing debates about whether it is as decentralized as other blockchains.

Polkadot (DOT) & Cosmos (ATOM)

Polkadot (DOT) and Cosmos (ATOM) take modular, interoperability-focused approaches to solving the blockchain trilemma. Both connect multiple smaller chains—parachains in Polkadot, and zones in Cosmos—via a secure blockchain hub, increasing scalability and flexibility while attempting to maintain a high level of baseline security. These platforms enable several blockchains to communicate and scale outwards without sacrificing every aspect of the blockchain trilemma.

Other blockchains: Avalanche, Near, and Algorand

The next-generation blockchains of Avalanche (AVAX), Near Protocol (NEAR), and Algorand (ALGO) represent another wave of innovation, each using unique consensus algorithms or sharding strategies. Avalanche’s consensus protocol enables parallel chains and rapid finality; Near splits its workload across shards; Algorand’s Pure Proof of Stake selects validators through verifiable randomization, all in pursuit of scalability without undermining decentralization or security.

Solutions and Innovations Aimed at Solving the Trilemma

To move beyond the limitations of the trilemma, blockchain developers have begun introducing creative new technologies and design approaches. Below are some of the most promising innovations shaping the future of decentralized networks.

Layer 2 Solutions

Layer 2 solutions have emerged as a game-changer, building blockchain protocols on top of existing Layer 1 mainnets to handle transactions off the main chain and then settle them in batches. This approach massively increases throughput and decreases transaction costs, all while maintaining the foundational security of the Layer 1 base chain.

Blockchain rollups such as Arbitrum and Optimism package thousands of transactions together, posting just a single proof back to Ethereum. State channels similarly enable participants to transact instantly and privately off-chain, only broadcasting the final state to the blockchain.

Sharding

Sharding offers another powerful solution that divides a blockchain’s database into smaller, parallel sections called shards, with each shard capable of processing its own transactions and data. This innovation allows networks to operate far more efficiently, as many transactions can be processed simultaneously rather than one at a time.

Thanks to sharding parallelization, participants only need to validate the information in their designated shard, making it feasible for more users to contribute while keeping a decentralized ecosystem as it scales. Looking ahead, sharding (now called "Danksharding") has been a central pillar of Ethereum’s roadmap to support decentralized applications (dApps) on a truly global scale.

Consensus Mechanism Evolution

As the demands on blockchains continue to grow, consensus mechanisms have evolved to balance efficiency, accessibility, and security. Initially, systems like Bitcoin and Ethereum relied on Proof of Work, but today’s blockchain technology is increasingly gravitating toward more efficient models.

The shift from energy-intensive Proof of Work to Proof of Stake, for instance, has reduced energy consumption dramatically while also making it easier for more people to become validators. Newer models like Delegated Proof of Stake and Byzantine Fault Tolerance push these advancements even further by improving confirmation times, lowering costs, and maintaining resilience against attacks.

Ethereum’s much-anticipated Merge showcased just how upgrading consensus protocols could open up new possibilities for both scalability and decentralization, providing a model for the industry at large.

Modular Blockchains

A significant trend in recent blockchain architecture is the rise of modular blockchains, which break apart the network’s core functions. Features like smart contract execution, consensus about transaction order, and long-term data storage are separated into distinct, specialized layers.

This separation enables each component to focus on its strength, improving both efficiency and the ability to scale. Projects like Celestia provide dedicated data availability layers, while frameworks such as Cosmos bring together entire decentralized ecosystems of specialized, interconnecting chains.

Modular architecture provides blockchains with the flexibility and performance needed to balance scalability, security, and decentralization, and is widely seen as the innovative solution that could finally overcome the blockchain trilemma and usher in a new era of decentralized technology.

Access Blockchain Scalability Today

Want to tap into the power of blockchains that offer robust security, fast transaction speeds, and growing decentralization? MoonPay simplifies access to leading blockchain networks, supporting everything from DeFi and NFTs to gaming and real-world payments.

To get started, simply download the MoonPay app and buy crypto in just a few taps. Choose from popular tokens like Bitcoin, Ethereum, and Solana, and pay using your preferred method such as cards, Apple Pay, PayPal, or a variety of local payment options.

.png?w=3840&q=90)

.png?w=3840&q=90)

.png?w=3840&q=90)