Table of Contents

NFTs have a lot more value than meets the eye.

To some they may appear to just be JPEGs, but these digital assets have the potential to transform every industry, from event ticketing to digital art and "phygital" goods.

The hidden value of NFTs lies beneath the surface, in their utility. That’s something that can't be captured with a screenshot.

Another thing that most people don't know about NFTs is that they have the ability to generate passive rewards.

Many collections allow users to stake NFTs to earn rewards. There are also NFT staking platforms designed to enable NFT holders and non-holders alike to make the most of these digital assets.

In this article we'll look at several NFT staking opportunities and the ability to earn passive income via NFT staking rewards.

What is NFT staking?

NFT staking refers to an NFT owner locking up their digital asset for a certain period of time, earning rewards in the form of cryptocurrency while doing so. Some collections allow owners to stake an NFT for an indefinite lockup period, while others have strict limits for how long NFTs must be staked.

To facilitate this, there are dedicated, collection-agnostic staking platforms that reward NFT collectors with tokens in exchange for staking NFTs from multiple projects and blockchains. But more on those later.

How does NFT staking work?

Staking is a key feature of many different blockchains. With NFTs, staking is the action of depositing your digital asset onto a secure platform that will earn yield in the form of cryptocurrency. The longer you lock up your NFT, the more rewards you will earn. Many NFT platforms encourage staking to incentivize long-term hodling and reward holders with a token specific to the community.

Traditional cryptocurrencies like Ethereum implement a Proof of Stake (PoS) mechanism that secures the blockchain via validators having their vote weighed in accordance with how many tokens they have staked. Some NFT collections may follow a similar process, as an incentive for holders to stake multiple NFTs at once.

The good news is that staking is also available for NFTs from many different collections.

You can earn passive returns from certain NFTs by staking them on a compatible platform. This can be a beneficial tool for long-term NFT holders, who can generate passive income from their assets instead of simply holding them in a cryptocurrency wallet.

How are NFT staking rewards calculated?

Every collection that offers staking will have its own rewards rate, which incentivizes NFT holders to lock up their assets for as long as possible.

Just as you can view the annual percentage yield (APY) on traditional cryptocurrency staking platforms, so too can you preview returns on NFT staking sites. However, not every site will show an exact APY, but instead may display the expected token rewards (e.g. 10 tokens per day) that can be earned during the staking period.

But please bear in mind that actual returns may differ from expected token rewards and you should always conduct your own research into any staking platforms.

Again, the exact reward value will vary by NFT, but the common factor uniting most projects is that they will compensate users that stake NFTs by rewarding them with a utility token.

This token may have additional perks such as voting or governance in a decentralized autonomous organization (DAO). Some NFT collections will even let you stake these earned tokens.

Is NFT staking right for me?

NFT staking can be a worthwhile endeavor given the right conditions. Before staking an NFT however there are several factors you should consider.

1) Annual NFT staking yield/APY

The first question a potential NFT staker may ask themselves is: what are the expected staking returns of the project? Some NFT collections may promise high returns. While this may be tempting initially, you should be cautious of returns that appear too good to be true. These rates can fluctuate drastically and often won't hold up for very long.

Some projects will increase APY rewards for staking multiple NFTs or NFTs with a higher rarity score. If you're planning to hold more than one NFT from the same collection, then you can check to see if it's worthwhile to stake multiple NFTs for better interest rates.

2) NFT collection price

Experienced NFT traders believe they know when to hold and when to sell. If you plan on flipping an NFT, it may be better to sell than stake, especially if the collection has seen recent price volatility. In fact, staking may prevent you from selling an NFT if there is a lengthy lock up period.

While staking can be a good hedge against short term price movement, in some cases higher returns can be achieved simply by selling when the floor rises. Timing this perfectly, however, is very difficult, and even the most seasoned traders will have difficulty getting this timing right.

3) Cryptocurrency price movement

Besides the floor price of the NFT collection itself, you should also keep in mind that the cryptocurrencies associated with NFTs are volatile as well. For example, if you buy an NFT for 1 ETH when the price of Ethereum is $3,000, and sell for 1.1 ETH when Ethereum is $2500, you'll actually be selling at a loss (of $250).

4) Percentage of total NFTs staked

If you're hesitant to stake an eligible NFT, you can take a look at the project's website to see the percentage of all NFTs that are staked. A higher number may be a signal that NFT owners are holding their NFTs for the long run.

Although not a guarantee, there may be a lower chance of a mass sell and price dump if a large percentage of total NFTs are staked—especially if there is a longer required lockup period.

5) Lock up period

There may be strict lock up period rules, depending on the NFT collection or staking platform used. If you prefer to have quick access to your NFT, then it's best to choose an NFT staking option that carries a shorter lock-up period; anything from hours to days is preferable to a lock-up period that lasts up to weeks.

NFT staking platforms

If you own an NFT eligible for staking, you can check the official collection website for complete instructions on where and how to stake it.

There are also collection-agnostic platforms built to allow users to stake NFTs from multiple NFT projects.

Here are some of staking platforms that are currently available:

LooksRare

LooksRare is an NFT marketplace that doubles as a staking service. During its launch in January 2022, LooksRare airdropped 120 million of its native $LOOKS token to entice NFT traders to use its platform. All users that had made a certain amount of trades (in excess of 3 ETH) on OpenSea were eligible to claim the airdrop.

Rewarding traders continues to be an integral part of LooksRare's functionality. Users can earn more $LOOKS tokens just by buying and selling NFTs on the marketplace. $LOOKS can then be staked directly on the platform to earn more $LOOKS tokens and wrapped Ethereum (WETH).

Though the incentive to earn $LOOKS is mainly for users that trade NFTs, the token is also available on decentralized exchanges like Uniswap.

Shortly after launch, the annual percentage yield for staking $LOOKS rose as high as 9000% APY, though it eventually leveled off at just under 200%. Currently, the APY sits around 9.24%, though it's always subject to change based on volume and market dynamics.

WhenStaking

WhenStaking is a staking platform for NFTs on Onessus, the WAX-based decentralized application (dApp) development studio that has created NFT play-to-earn games such as HodlGod and NiftyVille.

NFT assets from these games can be staked on WhenStaking to earn returns in the form of $VOID, the native token for Onessus that powers current and future projects on the platform. For fans of popular blockchain games on the WAX blockchain, both Onesssus and WhenStaking are conveniently integrated with WAX Cloud Wallet.

Rewards on WhenStaking vary by NFT rarity, collection value, and the platform's unique level system. On WhenStaking, users can earn more rewards over time, with NFTs leveling up and increasing APY the longer they are staked. Stakers can also rest assured that they will still be able to use their NFTs as an asset in the game of their choice, through a leased version of the staked token.

Additional NFT staking platforms

This list is by no means exhaustive, and in the quickly-evolving NFT space, you can expect that many more will emerge. Other platforms built for NFT staking include:

NFT collections available for staking

Disclaimer: This is not an endorsement to buy or invest money into any of the listed NFT projects. Users should always do their own research before making any financial decision.

The Sandbox

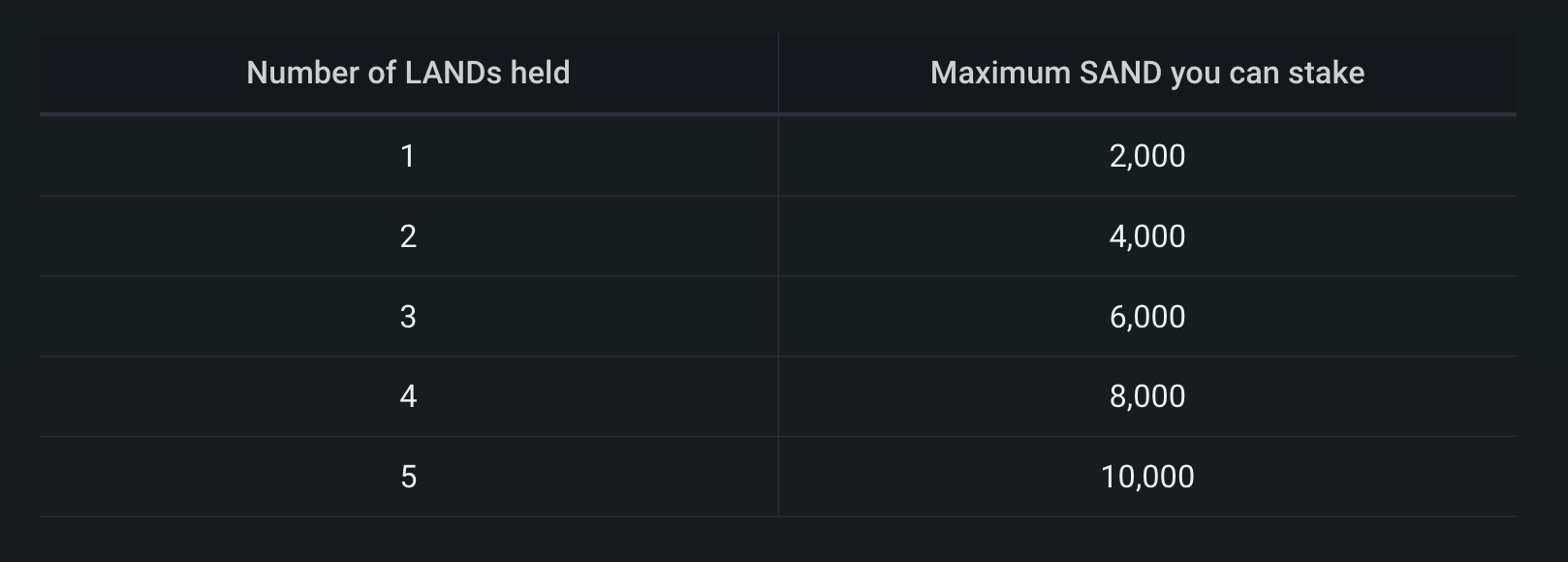

The Sandbox is a popular metaverse platform built on the Ethereum blockchain. This blockchain-based game allows cryptocurrency staking for holders of its native $SAND token that vary based on how many LAND NFTs a user holds.

For example, users that hold up to 5 LAND NFTs can stake a maximum of 10,000 SAND tokens using the Polygon (MATIC) blockchain. Throughout 2023 one SAND token has ranged between approximately $0.28 and $0.90, meaning that users could stake from $2800 to $9000 worth of cryptocurrency during this year.

The Sandbox is available on OpenSea, and other in-game items can be purchased on the platform's official NFT marketplace. SAND tokens are available for purchase using a card via MoonPay.

Axie Infinity

Axie Infinity is one of the most popular blockchain-based games, with over 2.8 million daily users at its peak in 2021. Axie users collect avatar NFTs (Axies) to battle against other players to earn rewards in the form of Axie Infinity Shards (AXS) tokens.

The native token allows holders to make in-game purchases in the Axie Infinity Marketplace, such as more Axies, accessories, Lands, and Land items.

Axie Infinity supports multiple versions of staking:

Cryptocurrency staking: Users can stake AXS tokens to earn rewards in the form of more Axie Infinity Shards.

NFT staking: Axie Infinity has a second staking system, where Land NFT holders can stake their plots to earn additional Axie Infinity Shards. The rarer your Land NFT is, the more AXS tokens you earn per day.

CyberKongz

CyberKongz is one of the original NFT staking collections that pays out in its native cryptocurrency $BANANA. Owners of the original 1,000 Genesis CyberKongz earn 10 tokens per day for each first-gen NFT they hold, until the year 2031.

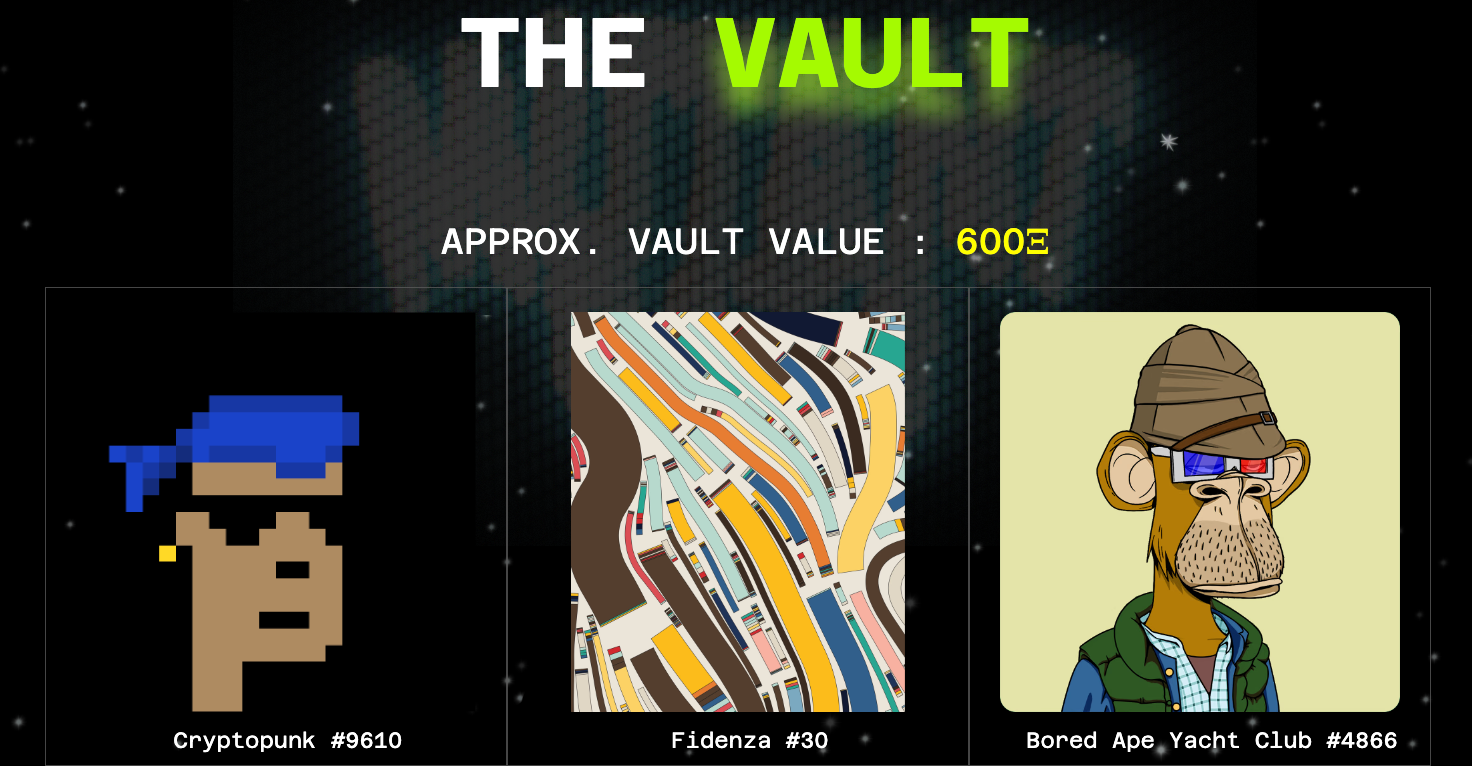

Mutant Cats

Mutant Cats is a collection of 9,999 feline avatars built on the Ethereum blockchain. Holders can stake their Mutant Cats to earn $FISH, the native utility token of the project. $FISH tokens pay out at 10 per day for each staked cat, and represent fractionalized ownership of its vault assets.

Mutant Cats are available on OpenSea. The current staking rate yields 10 $FISH per day.

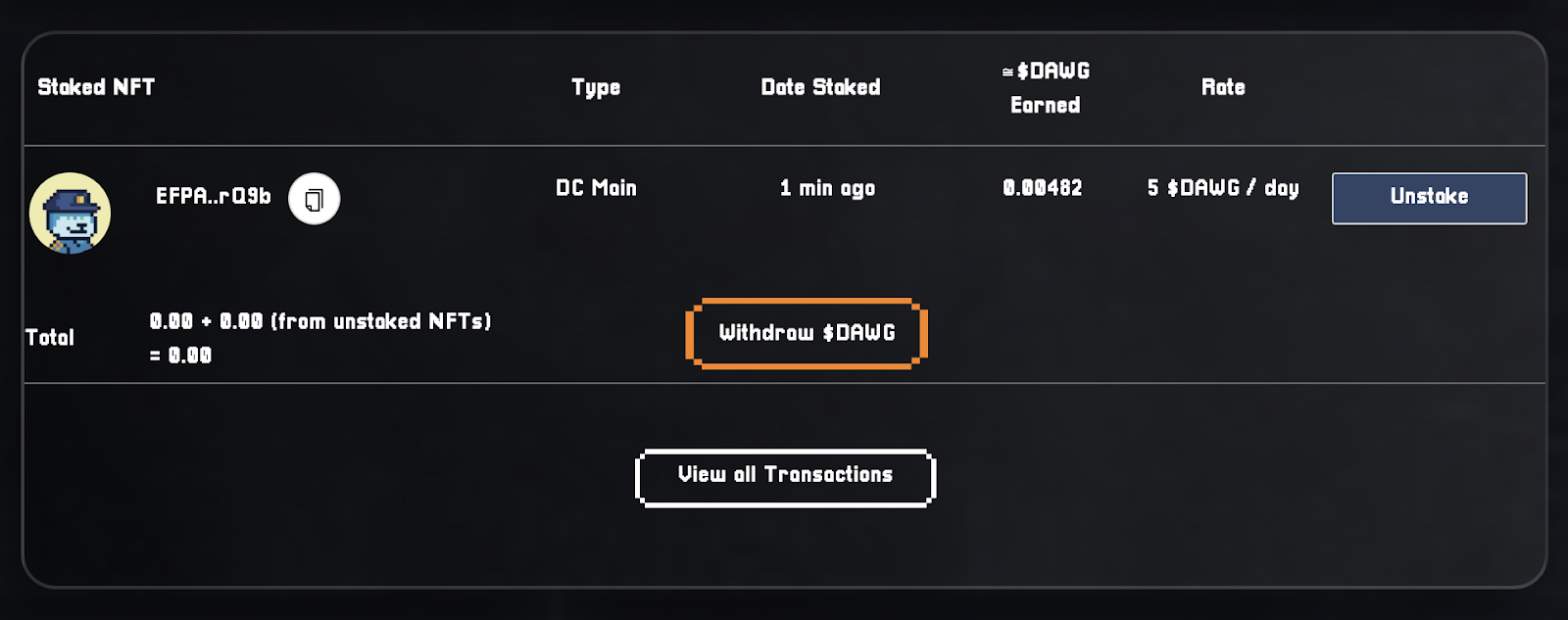

Doge Capital

Doge Capital is an NFT collection on the Solana blockchain consisting of 5,000 pixelated avatars of the Dogecoin dog mascot.

The NFT collection allows holders to stake their NFTs to earn $DAWG tokens, which can also be acquired on Solana decentralized exchanges (DEXs) such as Raydium and Dexlab.

Just like the cryptocurrency it was inspired by, Doge Capital's native cryptocurrency token $DAWG is also a meme coin. According to the Doge Capital website, “$DAWG is a meme token with utility.” As the native utility token of the NFT project, $DAWG powers the Doge Capital ecosystem.

Doge Capital NFTs are available on Magic Eden. The current staking rate yields 5 $DAWG per day.

Additional NFT staking collections

Should I stake my NFTs?

Before deciding whether staking your NFTs is the right move, you should consider the pros and cons of staking:

NFT staking pros

Passive income

If you plan to hold your NFT long term, you can generate returns passively by staking your NFT.

Community participation

Staking reward tokens are not just crypto assets to be flipped for a quick profit. As in many of the NFT collections outlined above, native cryptocurrency utility tokens carry additional perks such as voting power and governance in the future direction of the project.

NFT staking cons

Price volatility

While staked, your NFT could see a significant rise or drop in value. If you stake an NFT that has a long lockup period then you'll be unable to sell for quite some time. However, if holding your NFT long-term has always been your intention, you can worry less about temporary peaks and dips as you generate returns on your NFT holdings.

Rugging

While your NFT is staked there are always risks of rugging. This occurs if and when the founders or developers leave the project. Sometimes they leave it in the hands of the community, while other projects disappear completely, leaving holders with worthless NFTs.

Frequently Asked Questions (FAQs) about NFT staking

How much does it cost to stake an NFT?

When staking your NFT you'll need to account for any network or transaction fees, which will vary by blockchain. For example, Ethereum NFTs generally carry higher gas fees than networks like Solana.

On most blockchain networks, transaction costs also depend on how busy the network is at any given point. This variable could increase gas fees anywhere from a few dollars to several thousand.

For Ethereum, you can check current transaction fees at Etherscan's Ethereum Gas Tracker.

On other blockchains like Solana, however, transaction fees are usually low, sometimes as low as fractions of a cent. If you plan on staking and unstaking frequently, then you may want to use a cheaper blockchain that has lower gas fees.

No matter which blockchain your NFT is on, you'll always need to leave some extra crypto in your wallet to account for transaction fees, as they are always paid in the blockchain's native token (ETH, SOL, etc).

How do you earn money from NFTs?

Besides staking, there are other ways to earn money from NFTs, and not just for the buyer. Artists can sell their work as NFTs to ensure they get their fair share of royalties from sales and proceeds.

There are also NFT traders who buy NFTs to flip them for a profit. However, it is somewhat of a risky venture because NFTs are a highly illiquid asset that may have volatile pricing and can be difficult to sell, especially when compared to traditional cryptocurrencies.

For example, if you want to cash out your crypto, you can head to a cryptocurrency exchange or fiat off-ramp to swap cryptocurrency for fiat currency or stablecoins. With NFTs, however, the only guarantee that they will sell is if a buyer wishes to make a purchase.

Can you claim rewards before your NFT is unstaked?

The staking rewards and lockup period will depend on the NFT project you choose. Some NFT collections may reward users with a constant flow of rewards during the entire staking period, while others may only release rewards when the NFT is unstaked.

Where can you buy NFTs to stake?

You can mint NFTs directly on the project's official website, or buy on secondary NFT marketplaces like OpenSea, LooksRare, Magic Eden, and SuperRare.

Be sure to only mint, buy, and sell NFTs on legitimate, official websites only. It's easy to fall prey to NFT and crypto scams.

Buy NFTs for staking

Whether you want to stake, hold, or flip NFTs, the Moonpay Checkout solution makes it easier than ever to buy NFTs directly using a credit card.

We've removed excessive steps in the purchasing process, including needing to acquire the necessary crypto first and transfer between multiple exchanges and wallets.

Just choose the NFT you wish to purchase and enter your card details to complete your transaction.